piranka

By Jeff Spiegel and Adrienne Healey

The Start Of A Global Infrastructure Renaissance

Decades of underinvestment, continued population growth, rapid urbanization, and extreme weather events have placed immense stress on global infrastructure systems. Gridlocked superhighways and rolling blackouts have become all too common. But trillions of dollars should be on their way to help address these challenges. A flood of funding from both public and private sources may reach as much as $130 trillion over the next five years, spurring an unprecedented global effort to modernize infrastructure.1

- In the U.S., President Biden signed the bipartisan Infrastructure Investment and Jobs Act (IIJA) into law in November 2021, cementing the single largest infrastructure investment in U.S. history, allocating $1.2 trillion of spending (including $550 billion of new spending) over the next decade.2

- The European Union announced its Global Gateway initiative, which seeks to direct over EUR 300 billion to transport, clean energy, and other infrastructure projects of partner countries.3

- “Dry powder” funding for infrastructure, capital raised in the private sector but not yet utilized, is estimated at over $200 billion.4

Modern Infrastructure Prioritizes Environmental Solutions

Infrastructure and what it means to communities has changed throughout history. Large scale projects throughout U.S. history, like building the Erie Canal, Transcontinental Railroad, and the Interstate Highway System, established basic connectivity across the country to facilitate the movement of people, goods, and services. Today, infrastructure projects are not just focused on the “what” — continuing to meet the transportation, power, and resource needs of a growing and changing population — but also, the “how” by increasingly seeking to reduce environmental impact, achieve greater resilience, and enhance the safety of communities.

Government policies around the world have incorporated environmental considerations into their infrastructure rebuilding plans. The IIJA in the U.S., for example, includes $65 billion to upgrade power grids, $55 billion to improve water infrastructure, $5 billion for clean school buses, $47 billion for resilient infrastructure, and $21 billion to clean up legacy pollution.5 Similarly, the EU’s stated goal of its EUR 300 billion Global Gateway initiative is “infrastructure development that is clean, resilient and consistent with a net-zero future.”6

In our view, the focus on the intersection of the environment and infrastructure makes sense. Transportation and electric power generation jointly account for 40% of global greenhouse gas (GHG) emissions.7 A significant portion of this is concentrated in the world’s cities, which occupy just three percent of all land but are responsible for 60-80% of energy consumption and 75% of GHG emissions.8 Over the next decade, an estimated $32 trillion may be required for environmental infrastructure and related sectors, creating opportunities for companies leading this transformation.9

Three Segments In Environmental Infrastructure

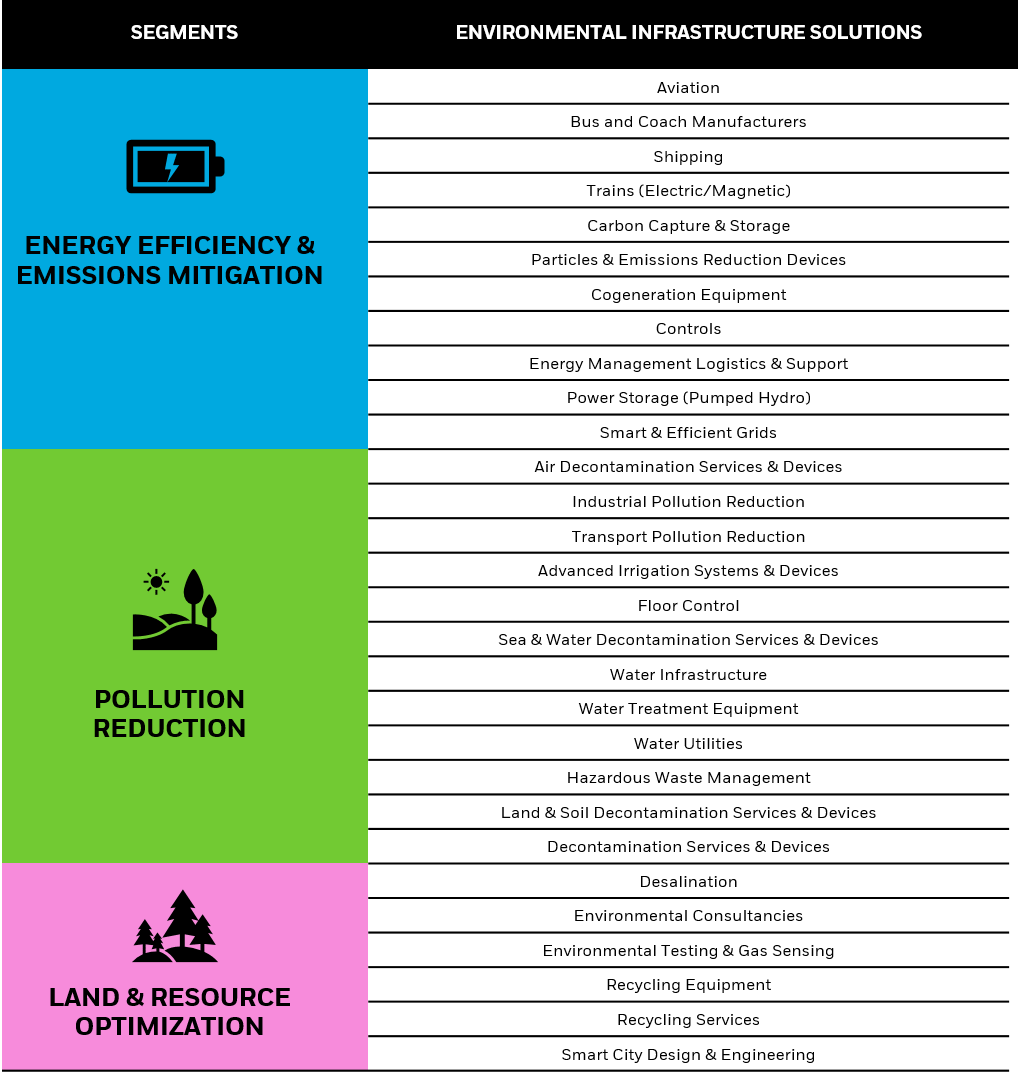

As trillions are spent to modernize infrastructure, a significant portion may be channeled towards environmental infrastructure objectives — a wide range of products and services spanning 1) improving energy efficiency and emissions mitigation; 2) reducing pollution; and/or 3) optimizing the use of our limited resources.

1. Energy efficiency and emissions mitigation

Electric power is responsible for 27% of GHG emissions worldwide.10 While renewable energy sources like wind and solar are growing their market share, reliance on fossils fuels continues. In the U.S., for example, around 60% of electricity comes from fossils fuels, mostly coal and natural gas.11 Additionally, our energy infrastructure is overextended and outdated, struggling to meet challenges like growing demand and renewable power generation.

Infrastructure solutions for improving energy efficiency span how one lives, gets around, and connects with their communities. Zero-emissions transit has been on the rise, as electric trains, electric buses, and innovations in shipping and aviation harness low-carbon technology. Further, buildings are being retrofitted to be more energy efficient, energy storage developments are lengthening battery lifecycles, and smart grid technology, explored in greater detail below, is more common than ever before.

2. Pollution reduction

The world continues to face challenges from pollution: 99% of people worldwide breathe polluted air according to World Health Organization guidelines,12 accounting for an estimated seven million premature deaths each year.13 Over 2.4 billion tons of waste is generated annually,14 and at least 33% is not managed in an environmentally safe manner through open dumping or burning.15

Pollution reduction efforts are working to improve the environment. Decontamination technology is designed to get rid of contaminants in the soil, sky, and sea. Advancements in storm water and wastewater infrastructure can potentially treat water for reuse, reduce floods in cities, and improve public health. Safer hazardous waste removal and treatment can help protect the soil and filtration technology can reduce the amount of soot released into the atmosphere from shipping and other heavy transport.

3. Land and resource optimization

Resource scarcity is one of the world’s greatest challenges. Access to clean water and depletion of nonrenewable resources are two concerns. One in every three people worldwide lacks access to safe drinking water.16

Cutting-edge recycling technology is changing the approach to resource management. Copper, aluminum, and steel can be transformed from scrap metal into new building materials. E-waste recycling can help prevent toxic chemicals in laptops and cell phones from leaching into the soil and give those raw materials a new life. Desalination plants can produce fresh water from the ocean.

A Closer Look: Smart Grids

Since environmental infrastructure solutions touch a wide range of areas, let’s dive deeper into one key segment: smart grids.

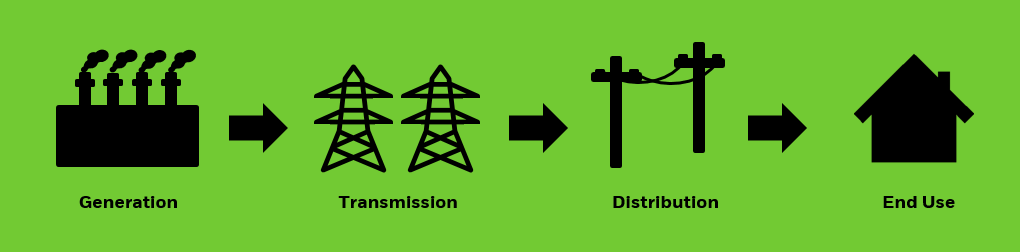

Alexander Graham Bell might look at a touchscreen smartphone and wonder “what is this?” Thomas Edison, on the other hand, might look at our power lines and feel quite at home. Traditional electric grids still operate largely the same way as they did in the 1890s. When we turn on a light switch, energy flows in one direction: from power plants to customers (Figure 1).

Figure 1. Traditional “one-way” electric flow

Chart description: Graphic illustrating traditional “one-way” electric flow. This graphic show the way in which energy flows from generation to transmission to distribution to end users. (Source: Imagery from BlackRock based on energy flow information from DOE, Quadrennial Energy Review Report: An Integrated Study of the U.S. Electricity System, January 2017.)

For illustrative purposes only.

While this one-way energy flow was an extremely effective system for decades, it is being significantly enhanced by smart grid technology which can optimize energy efficiency and incorporate renewables and energy storage into the grid.

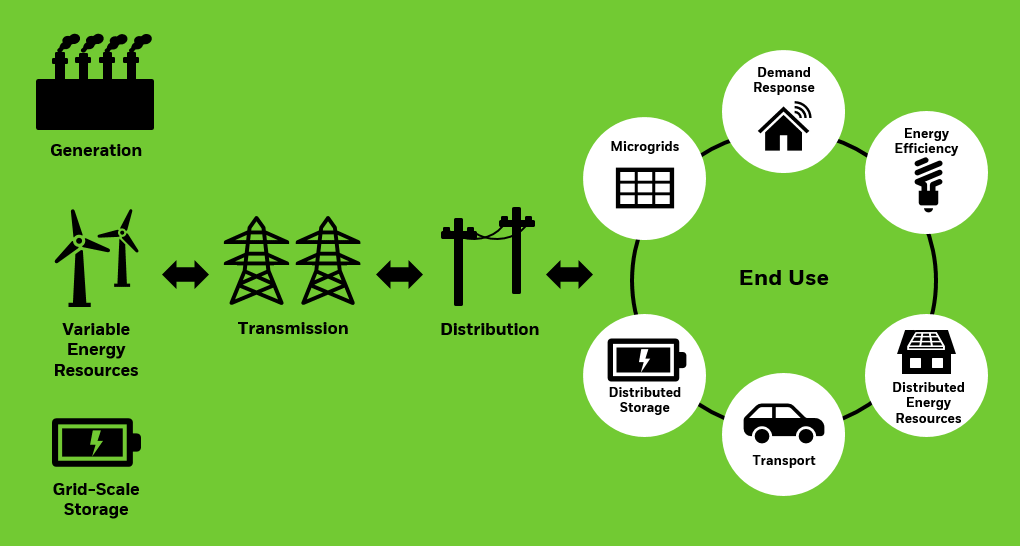

A smart grid enables two-way flow between consumers and utilities and consists of several components that are designed to work together to improve the efficiency of energy.

Figure 2. Emerging “Two-Way” Electric Grid

Chart description: Graphic illustrating the emerging “two-way” electric grid. This graphic shows the two-way flow of energy between utilities and consumers, and the innovations that enable this. (Source: Imagery from BlackRock based on energy flow information from DOE, Quadrennial Energy Review Report: An Integrated Study of the U.S. Electricity System, January 2017.)

For illustrative purposes only.

These technologies can help operators predict and prevent outages, provide utilities with information about electricity usage, and potentially lower energy costs for consumers by, for example, communicating price signals so consumers can use power when prices are lowest.

Smart grid technology can also communicate with smart appliances. A smart dishwasher, for example, could run off-peak energy hours. An electric vehicle (EV) could charge at night when energy usage tends to be the lowest. Conversely, an EV could share energy with the grid to help avoid brownouts or blackouts during times of energy need.

Smart grid tech gets the investment boost

Smart grid technology has been gaining traction. The IIJA is intended to fund $65 billion to improve power grid infrastructure, including smart grid technologies.17 Investment in smart grid technology has steadily climbed, reaching $55.7 billion in 2021.18 The smart meter market alone is projected to reach $54.35 billion globally by 2030, estimated to grow over 10% annually from 2021 to 2030.19 From smart meters to automation to transformers, companies across this value-chain may benefit from investment and tailwind.

How To Invest In Environmental Infrastructure

Investors looking for exposure to environmental infrastructure solutions may consider looking at ETFs targeting companies that have significant exposure to the following areas:

Chart description: Table mapping FTSE Green Revenues Classification System micro-sectors identified as relevant to three environmental solutions segments: energy efficiency and emissions mitigation, pollution reduction, and land and resource optimization. (Source: FTSE Russell, BlackRock, November 2022.)

Conclusion

As both the public and private sectors pour trillions into new infrastructure spending, the companies providing the critical goods and services to modernize infrastructure with greater consideration for the environment may be better-positioned to benefit. Those looking to invest in environmental infrastructure solutions may want to consider ETFs that provide exposure to stocks across the theme’s ecosystem.

© 2022 BlackRock, Inc. All rights reserved.

1 McKinsey & Company, “Here comes the 21st century’s first big investment wave. Is your capital strategy ready?” March 18, 2022. Forward looking estimates may not come to pass.

2 EY, “Infrastructure Bill,” Accessed on October 27, 2022.

3 European Commission, “Global Gateway,” December 1, 2021.

4 WSJ, “The Price of Inertia,” October 19, 2022. Forward looking estimates may not come to pass.

5 U.S. Senate, “Bipartisan Infrastructure Investment and Jobs Act Summary: A Road to Stronger Economic Growth,” 2021.

6 European Commission, “Global Gateway,” December 1, 2021.

7 Breakthrough Energy, Five Grand Challenges, 2022.

8 UN Sustainable Development Goals, “Goal 11: Make cities inclusive, safe, resilient, and sustainable,” Accessed on October 19, 2022.

9 BlackRock Investment Institute, “Managing the net-zero transition,” February 2022. Forward looking estimates may not come to pass.

10 Breakthrough Energy, Five Grand Challenges, 2022.

11 EPA, “Sources of Greenhouse Gas Emissions,” August 5, 2022.

12 UNEP, “Collective action needed to improve quality of the air we share,” August 3, 2022.

13 UNEP, Air Pollution Note – Data you need to know, August 2022. Forward looking estimates may not come to pass.

14 The World Bank, “Solid Waste Management,” February 11, 2022.

15 The World Bank, “What a Waste 2.0,” 2022.

16 World Economic Forum, “Low-income communities lack access to clean water. It’s time to change,” August 2, 2022.

17 U.S. Senate, “Bipartisan Infrastructure Investment and Jobs Act Summary: A Road to Stronger Economic Growth,” 2021.

18 IEA, “Smart Grids,” September 2022.

19 Allied Market Research, “Smart Meter Market by Product (Smart Electricity Meter, Smart Gas Meter, and Smart Water Meter) and End Use (Residential, Commercial and Industrial): Global Opportunity Analysis and Industry Forecast, 2021 – 2030, December 2021. Forward looking estimates may not come to pass.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

The Fund’s environmental, social and governance (“ESG”) investment strategy limits the types and number of investment opportunities available to the Fund and, as a result, the Fund may underperform other funds that do not have an ESG focus. The Fund’s ESG investment strategy may result in the Fund investing in securities or industry sectors that underperform the market as a whole or underperform other funds screened for ESG standards. In addition, companies selected by the index provider may not exhibit positive or favorable ESG characteristics.

Companies that provide infrastructure and industrials solutions follow certain environmentally-related themes and include companies from the basic materials, industrials, and utilities industries. These companies may be subject to a variety of factors that could adversely affect their business or operations, including the effects of climate change, high costs to develop or deploy products or services, costs associated with governmental, environmental and other regulations, the levels of government and private spending on environmental and infrastructure projects, and other factors. In addition, such companies may not derive their revenues entirely from providing infrastructure and industrials solutions, but may be exposed to the market and business risks of other business models, industries or sectors, and the Fund may be adversely affected by negative developments impacting those other business models, industries and sectors.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH1122U/S-2554798

This post originally appeared on the iShares Market Insights.

Be the first to comment