Justin Sullivan/Getty Images News

Investment Thesis

As Warren Buffett sold off his entire Verizon (NYSE:VZ) position in Q1, 2022, investors have been left wondering, “What now?” In this article, we will breakdown the risk and reward.

Verizon is a utility at scale serving American families a near essential service. The risks are not all in plain sight. But, to the insightful investor, we believe VZ is offering a long-term return of 11% per annum.

A Utility At Scale

Verizon’s business is a utility at scale. The company provides wireless and wireline services to families and businesses throughout the United States. Almost everyone needs the utilities Verizon provides: WiFi, cell service, and data. These are an essential part of our modern lives. Because of this, Verizon benefits from what is known as inelastic demand. If the price of wireless increases across the board, consumers have no choice but to pay up; they need WiFi and cell service. Also, if there is a recession, Verizon and other providers do not have to decrease their price. Verizon’s product, like food at the grocery store, is not economically sensitive.

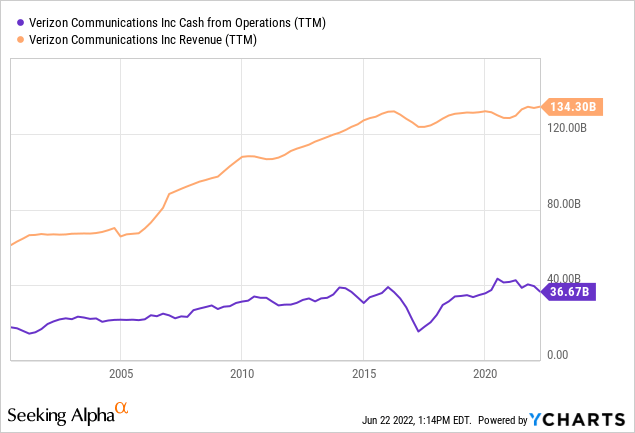

Verizon’s revenue and cash flow continued to grow through the global financial crisis of 2008:

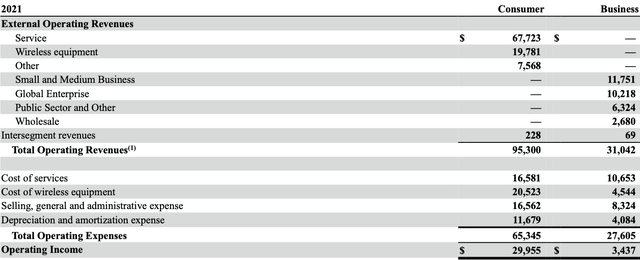

Verizon serves individuals and families (consumers), as well as businesses. But the company makes most of its money in the consumer segment.

Verizon’s operating income by segment:

Verizon’s Operating Income (Annual Report)

Risks

Verizon operates in a world of constant technological change. The landline telephone has basically disappeared. Along with that goes all of the money Verizon invested over the decades to install that service. Now Verizon is investing in 5G to the tune of $45 billion in 2021 alone. Nobody knows how long 5G will be relevant for. Meanwhile, SpaceX’s Starlink is aiming to provide satellite internet across the globe. To counter this threat, Verizon has chosen to partner with Amazon to provide a similar service. As you can see, this a complicated puzzle.

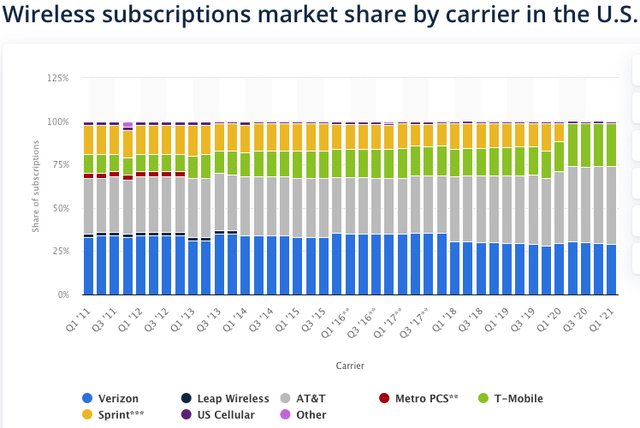

Verizon also faces competition from competitors. Although, it appears the industry is consolidating into three major players: Verizon, AT&T (T), and T-Mobile (TMUS). Verizon’s market share in wireless has decreased in recent years:

Market Share By Wireless Subscriptions (Statista)

There are smaller players, providing a cheaper service than the big three, such as Ryan Reynolds’ Mint Mobile. However, from our understanding, Verizon offers better coverage and higher quality plans.

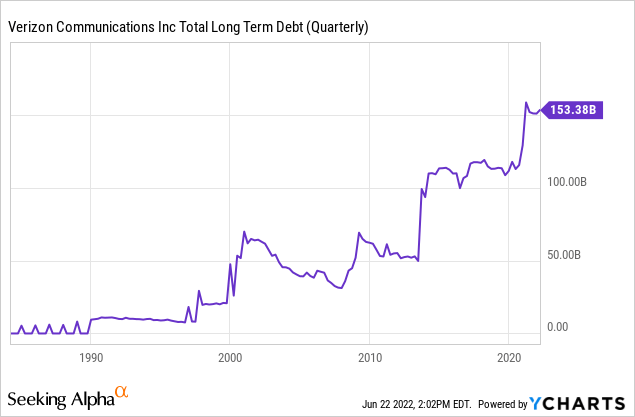

Finally, we have the debt. Along with all of Verizon’s investments, comes a pile of debt amounting to $157 billion. This is not great timing as interest rates are on the rise. With negative working capital, rising interest expense, and a 5% dividend, there is a world where Verizon starts to feel the squeeze.

As for now, we think Verizon’s financials are manageable, with predictable net income of $21.4 billion covering the dividends of $10.5 billion. But the company needs to improve its balance sheet. We are not impressed with management in this regard. As the debt is reduced in the years ahead, we do not see many share buybacks coming investors’ way.

Valuation

Verizon’s net income is a more accurate reflection of the company’s earnings than its free cash flow. Verizon’s CapEx is overstated due to the company investing in its future. As the CapEx normalizes, free cash flow will jump. For now, let’s use EPS.

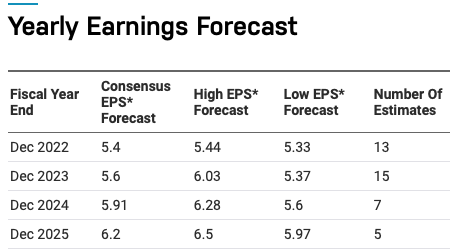

Analysts have earnings per share (EPS) growing at 4.8% per annum over the next few years:

Verizon EPS Estimates (Nasdaq)

Going forward, we believe Verizon’s recent investments will protect it from competition. With consolidation in the industry, inelastic demand for its products, and inflation on the rise, we believe Verizon can grow at 4% per annum over the decade ahead. The dividend and the debt put a ceiling on Verizon’s growth. The company will need to continue making these payments year after year.

Our 2032 price target for Verizon is $95 per share, implying a return of 11% per annum with dividends reinvested. Verizon has a 5% dividend yield.

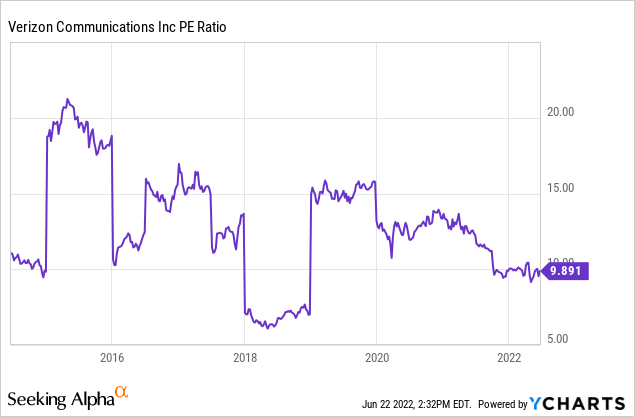

- This is the result of growing the company’s EPS at 4% per annum, resulting in 2032 earnings of $7.61 per share. We’ve applied a terminal multiple of 12.5 for a business that faces constant technological change but should have an improved balance sheet in a decade’s time. A terminal multiple of 12.5 is both appropriate for this level of growth, and relevant on a historical basis:

Conclusion

Verizon appears to be offering a long-term return of 11% per annum, but risks lurk around every corner. Verizon should benefit from inflation, inelastic demand, and industry consolidation. On the other hand, management’s capital allocation has been questionable, and the balance sheet is a risk. Telecommunications is an industry in a constant state of flux as new competitors like SpaceX and Mint Mobile chip away at the walls of Verizon’s castle. For knowledgeable investors, who believe they have an insight into Verizon’s future, outsized returns may await. We believe the risks are fully discounted and have a “buy” rating on VZ.

Be the first to comment