LukaTDB/E+ via Getty Images

Investment Thesis

Pioneer Natural Resources (NYSE:PXD) is a dividend yield story. For anyone that believes that oil prices are likely to stay around $100 WTI or higher, they would do well to consider this stock.

There’s a lot to like here, from a very clean balance sheet to a low valuation. But ultimately, what attracts me most is its 13% combined yield via dividends and buybacks.

I rate the stock a buy.

Impressive Capital Return Program

Before getting stuck into Pioneer’s capital return program, let’s in the first instance take a step back and come to terms with its financial position.

As of Q1 2022, it has net debt of $3.3 billion. However, for a business that just reported $2.3 billion of free cash flow in a single quarter, clearly, its balance sheet is in a strong position.

Indeed, looking ahead to year-end, Pioneer declares that it can get its net debt to net to EBITDAX to approximately 0.1x.

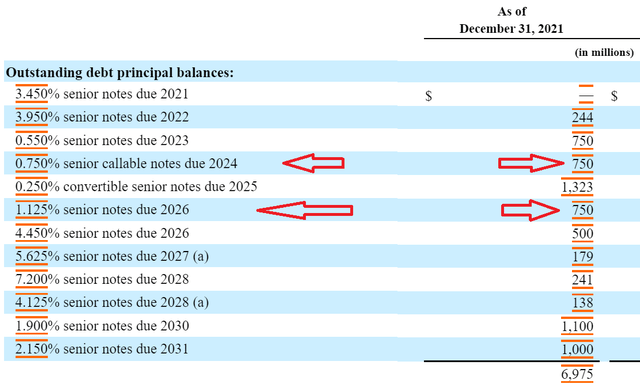

Indeed, as you can see below, Pioneer hasn’t got any near-term debt maturities.

In fact, given that Pioneer has recently retired its 2024 and 2026 senior notes, this only further strengthens its balance sheet and interest payment.

Put another way, there’s very little doubt that Pioneer’s balance sheet is now strong enough to withstand an oil downturn.

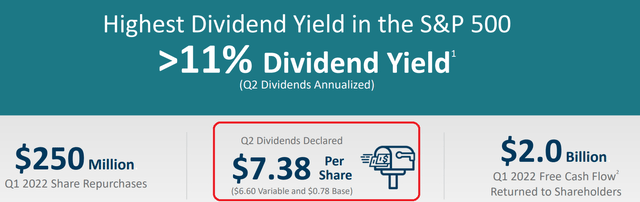

Along these lines, a 3.2% quarterly yield is to be paid in Q2. For context, this is annualized at 12.8%.

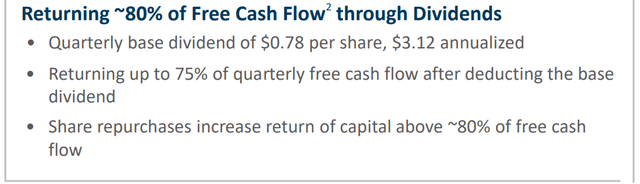

This base dividend plus special dividend combined amounts to $1.9 billion. This combined dividend amounts to 83% of its total free cash flow returning to shareholders:

Here are some assumptions. Pioneer is likely to generate circa $2.5 billion during Q2, so this very high dividend yield is well covered.

Yet, as you know, that dividend has already been paid out. The big question is whether there will be similarly large dividend payouts in the coming quarters?

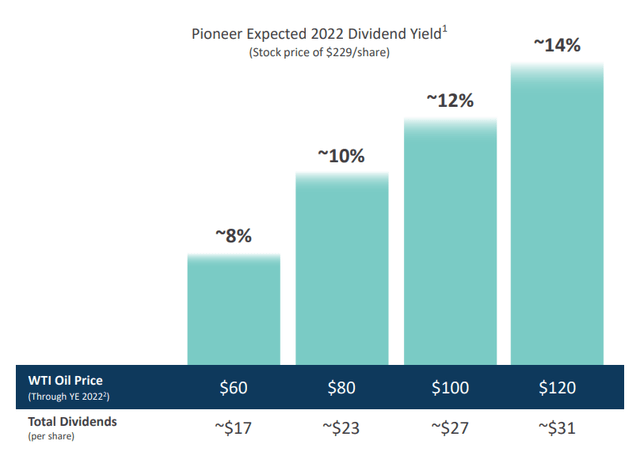

To help us answer that question, Pioneer highlights this graphic. It shows that with increasing WTI prices, the level of dividend yield that shareholders can expect.

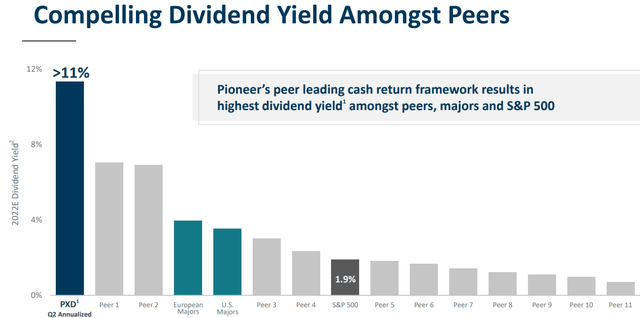

There’s really no ambiguity on where Pioneers’ focus is. Pioneer is intent on having the highest dividend yield amongst its peers.

Now, let’s turn our focus to Pioneer’s share repurchase program. This was $250 million in Q1. And if we annualized this sum it comes to a 1.8% total return via buybacks.

Consequently, dividends and buybacks drive a combined shareholder yield closer to 15%.

PXD Stock Valuation: Priced At 6x Free Cash Flow

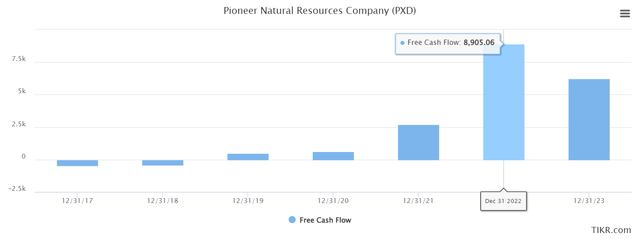

Pioneer reported $2.3 billion of free cash flow in Q1. It looks very likely that when Pioneer reports Q2 it will probably report very similar levels, if not slightly higher, perhaps reaching close to $2.8 billion.

Hence, H1 2022 will probably see around $5.1 billion of free cash flow. If we assume that oil prices remain relatively stable at around $100 to $105 in 2022, that would mean that Pioneer would see around $10 billion of free cash flow.

Needless to say that nobody can accurately predict oil prices, so this assumption is a wild guess. However, we must start somewhere.

For their part, analysts following the stock are expecting that Pioneer’s 2022 free cash flow reaches around $8.9 billion, slightly lower than my own estimate.

Nevertheless, even using analysts’ estimates, that puts Pioneer priced at 6x free cash flow.

This multiple is perhaps one turn higher on the free cash flow multiple than many of its peers. However, one also should remember that unlike many of its peers, Pioneer has a very clear and committed shareholder return strategy.

The Bottom Line

If one assumes that oil prices are inherently volatile and one is going to embrace the ”risk” of volatile oil prices, I believe that a prudent course of action is either to go for the lowest free cash flow multiple oil companies or chose companies with the strong shareholder returns.

Along these lines, I believe that Pioneer makes the cut. If one is bullish on oil, an investment in Pioneer makes a lot of sense.

Be the first to comment