Oat_Phawat/iStock via Getty Images

Investment Thesis

1 – Presentation

The Canada-based GCM Mining (OTCQX: TPRFF) is a gold and silver exploration, development, and production company mainly focusing on Colombia. The wholly-owned Segovia operations in Colombia are the company’s principal producing asset. The company is also involved in Guyana with the Toroparu Project.

2 – 4Q21 and full-year 2021 Snapshot and commentary

The company reported its fourth-quarter 2021 results on March 31, 2022.

Gran Colombia achieved its production guidance in 2021 with 208,817 ounces of gold produced at Segovia, driven by the Maria Dama plant expansion completed by mid-2022. The company has raised its 2022 annual guidance, now expected to be 210K to 225K ounces of gold.

An essential element of Gran Colombia’s 2021 action plans was the drilling program at Segovia. The company completed 97,000 meters of drilling, with 81,000 meters at the four operating mines and 16,000 meters of high-priority brownfield targets. It resulted in an increase of 18% in reserves or 745K ounces.

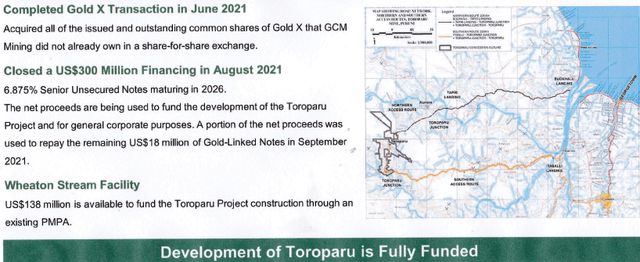

3 – The Toroparu Project

On December 1, 2022, GCM completed an updated mineral resource estimate and PEA for the Toroparu Project after acquiring the project in June 2021.

TPRFF: Toroparu Project Presentation (Gran Colombia)

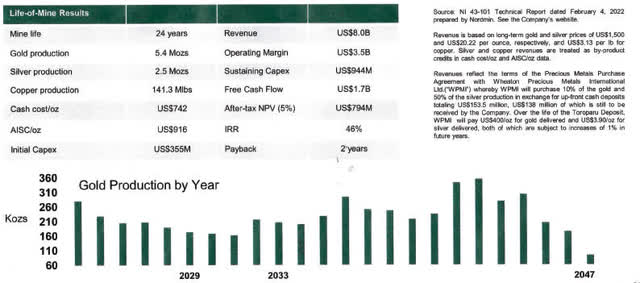

TPRFF: Toroparu Project details (Gran Colombia)

The estimate showed a 15% increase in measured and indicated resources to 8.4 million ounces of gold. Toroparu is one of the largest undeveloped gold deposits in the Americas.

- Updated Mineral Resource Estimate of 8.4 Mozs Measured and Indicated Gold Resource at 1.42 g/t and 396 Mlbs

- Measured and Indicated Copper Resource at 0.1% in 185 million tonnes of rock Preliminary Economic Assessment estimates:

- 280,000 ozs of gold production in the first year of operation in 2024;

- 5.4 Mozs of gold, 2.5 Mozs of silver and 141.3 Mlbs of copper produced over a 24-year mine life;

- US$8.0 billion total revenue, US$3.5 billion operating margin and US$1.7 billion after-tax Free Cash Flow at a US$1,500/oz gold price; and, After-tax net present value (5%) of US$794 million with an after-tax IRR of 46% and two-year payback.

- Initial US$355 Million capex to construct the Toroparu Project is fully funded.

Gran Colombia has already started pre-construction activities on the camp, airstrip, and an access road, carrying out additional infill drilling.

Finally, GCM added revenue diversification at Segovia Operations through a new polymetallic recovery plant that will recover commercial quantities of zinc, lead, gold, and silver into concentrate from our tailings.

CFO Mike Davies said in the conference call:

2021 was a successful year for GCM Mining. We accomplished what we set out to do. We completed 97,000 meters of drilling at Segovia, our biggest year yet, numerous high-grade intercepts led to successful increases in resources and reserves. It was our sixth year of meeting guidance. We returned $17 million to shareholders, $11.5 million through our monthly dividends and $5.5 million through our normal course issuer bids.

4 – Investment Thesis

GCM Mining is another solid gold miner with good growth potential. One weakness in the business model is that the company relies heavily on one single mine in Colombia. However, this weakness attached to the lack of diversity is solved with the Toroparu completed.

Furthermore, The company is net-debt-free and has secured enough cash to develop the Toroparu project without external financing.

Hence, I recommend trading LIFO short-term with about 50% of your position to reduce your risk exposure until the Toroparu project is completed (2024) and keep only a core long-term position.

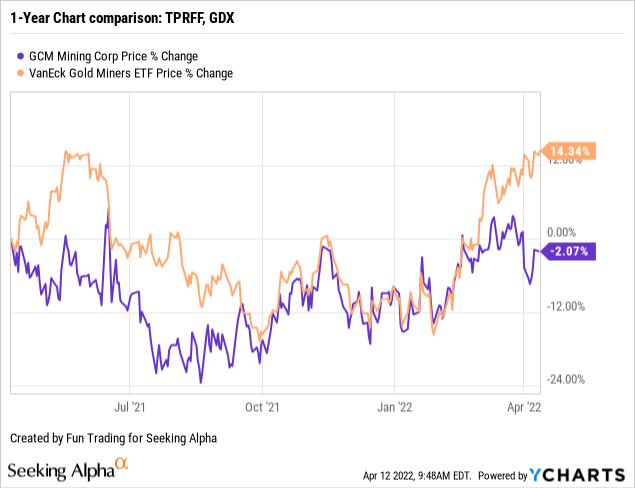

5 – Stock Performance

TPRFF has underperformed the VanEck Vectors Gold Miners ETF (NYSEARCA: GDX) and is down 2% on a one-year basis.

GCM Mining – Financial Snapshot 4Q21 – The Raw Numbers

| Gran Colombia | 4Q20 | 1Q21 | 2Q21 | 3Q21 | 4Q21 |

| Total Revenues In $ Million | 99.67 | 101.92 | 96.35 | 90.72 | 93.62 |

| Net Income in $ Million | -36.53 | 124.56 | 29.80 | 25.26 | 6.61 |

| EBITDA $ Million | -17.61 | 143.45 | 53.69 | 50.90 | 32.14* |

| EPS diluted in $/share | -0.61 | 1.28 | 0.28 | 0.20 | 0.07 |

| Operating Cash flow in $ Million | 30.42 | 13.62 | 12.79 | 26.74 | 27.41 |

| Capital Expenditure in $ Million | 23.67 | 11.12 | 15.77 | 14.61 | 21.97 |

| Free Cash Flow in $ Million | 6.76 | 2.50 | -2.98 | 12.13 | 5.44** |

| Total Cash $ Million | 122.51 | 73.71 | 57.80 | 331.31 | 328.04 |

| Total Long term Debt (incl. current) In $ Million | 140.21 | 57.00 | 40.86 | 307.67 | 314.27 |

| Shares outstanding -(diluted) in Million | 61.67 | 73.99 |

83.90 |

109.35 |

109.95*** |

| The dividend is paid per month now/ Quarterly dividend in $/share. |

0.034 |

0.034 |

0.034 |

0.034 |

0.034 |

Data Source: Company release. (More data available for subscribers only).

* Indicated by the company ** Estimated by Fun Trading

*** In the conference call, CFO Mike Davies said:

We currently have 97.9 million shares issued and outstanding and at yesterday’s close, that translates to a market cap of $572 million, up 73% from 1 year ago. Our fully diluted share count is now 131.7 million. And we have an ongoing normal course issuer bid, under which we purchased 1.3 million shares last year at a cost of about $5.5 million.

Analysis: Revenues, Earnings Details, Free Cash Flow, Debt, And Gold Production

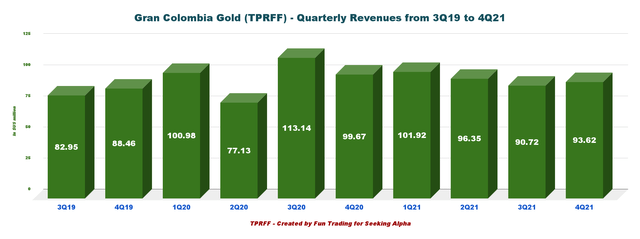

1 – Total Revenues and others were $93.62 million in 4Q21

TPRFF: Chart Quarterly Revenues history (Fun Trading)

The company announced fourth-quarter revenues of $93.62 million, down 6.1% from the same quarter a year ago and up 3.2% sequentially. The company posted a net income of $6.61 million compared to a loss of $36.53 million last year.

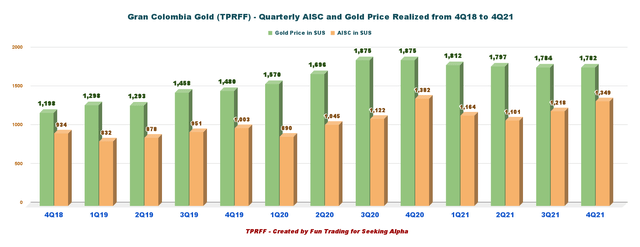

The spot gold price in the fourth quarter of 2021 was lower than the same quarter a year ago, decreasing the Company’s realized gold price by 6% to an average of $1,782 per ounce sold in the fourth quarter of 2021 compared with an average of $1,875 per ounce sold in the fourth quarter last year.

The fourth-quarter adjusted EBITDA was $37.37 million compared to $43.08 million in 4Q20.

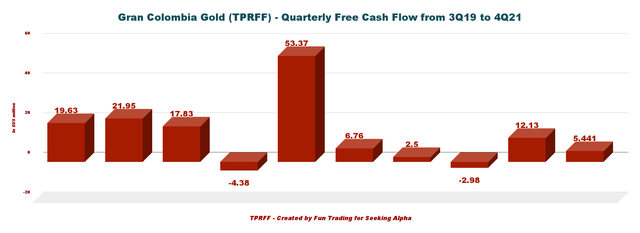

2 – Free cash flow was a loss of $5.44 million in 4Q21

TPRFF: Chart Quarterly Free cash flow history (Fun Trading)

Note: Generic free cash flow is cash flow from operations minus CapEx.

The trailing 12-month free cash flow TTM is now $17.09 million, with free cash flow in 4Q21 of $5.44 million.

As of December 31, 2021, the company’s investments in associates totaled $18.51 million, which represents GoldX primarily.

The company also repurchased 702,000 shares for cancellation for $3.2 million.

Note: After December 31, 2021, the Board of Directors declared monthly dividends on January 17, 2022, February 15, 2022, and March 15, 2022, of CA$0.015 per common share.

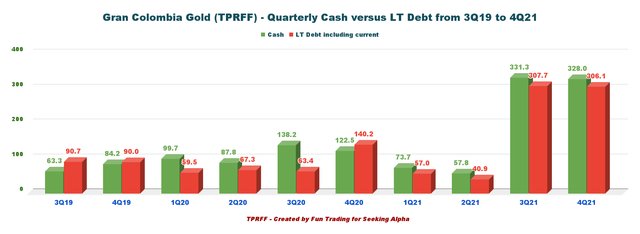

3 – Gran Colombia was net debt-free at the end of the 4Q21

TPRFF: Chart Quarterly Cash versus Debt history (Fun Trading)

At the end of December 2021, GCM Mining had a cash position of approximately $328.04 million, and the total debt was $306.1 million. Lease obligations totaled $3.81 million.

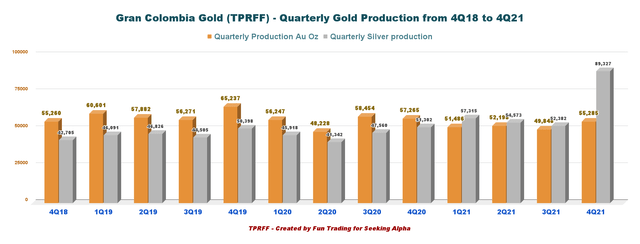

4 – Production was 55,285 Au Oz and 89,327 Ag Oz in 4Q21.

4.1 – Gold and Silver production: Historical chart

TPRFF: Chart Quarterly gold and silver (Fun Trading)

Production comes from Segovia operations mainly. Segovia operations include:

- Sandra K mine – 7,797 Oz

- Providencia mine – 17,094 Oz

- El Silencio mine – 18,720 Oz

- Carla is a potential with a probable reserve of 33K Au Oz – 1,027 Oz

With Maria Dama Processing Plant and “El Chocho” Tailings Storage.

The Segovia operations processed 1,557 tonnes per day (“TPD”) in the fourth quarter of 2021, with an average head grade of 13.4 g/t. GCM is showing an exceptional average head grade.

4.2 – Quarterly AISC (consolidated) and the gold price received: Chart history

TPRFF: Chart Quarterly AISC and gold price history (Fun Trading)

The AISC increased sequentially to $1,349 per ounce, uncomfortably high.

4.3 – Great Pipeline projects

- Zancudo Project – Colombia 100%

- Juby Project – Ontario, Canada, with Caldas Gold

- Toroparu Project – Guyana to be 100%

- Meadowbank – Nunavut 26%

Technical analysis (short term) and commentary

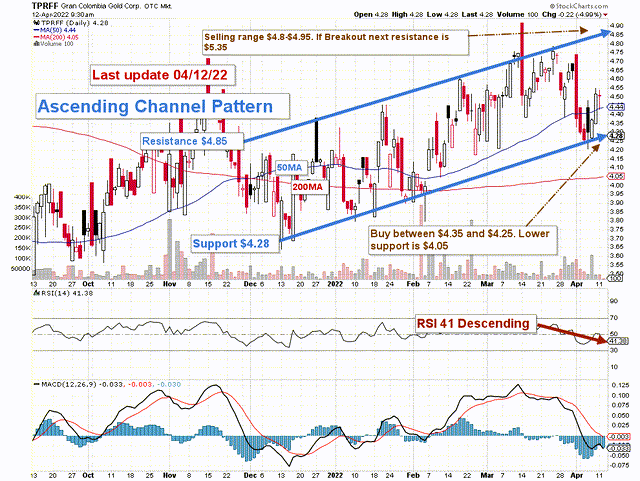

TPRFF: TA Chart short-term (Fun Trading)

TPRFF forms an ascending channel pattern with resistance at $4.85 and support at $4.28. The trading strategy is to sell about 30% between $4.8 and $4.95 and accumulate between $4.35 and $4.25.

For those who have decided to keep a long-term position, I recommend strongly trading LIFO while holding a core long-term position for a potential test of $5s or higher.

The gold sector is highly volatile and could suffer if the FED turns more hawkish due to inflation being out of control. While inflation is generally bullish for gold, as we can experience now, the FED action could reverse this effect and push the gold sector into a bearish trend. Also, it seems that the war in Ukraine is also helping gold.

In a bearish case, TPRFF could cross the support and drop at or below $4 or even $3.

Conversely, if the FED adopts a more dovish attitude to please the market and avoid a crisis, gold could retest $2,000 per ounce. In this scenario, I see TPRFF trading between $5.75 and $6.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks!

Be the first to comment