photobyphm

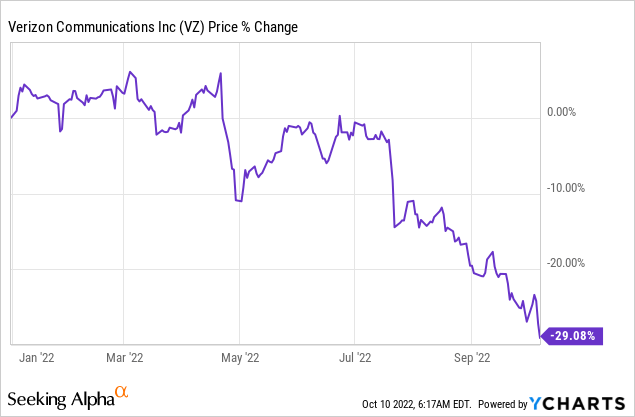

Shares of Verizon (NYSE:VZ) skidded to a depressing 1-year low last Friday, just two weeks before the company is due to release results for the third-quarter. While I can understand some reservations investors have regarding the telecom, I think that Verizon offers investors deep value based off of free cash flow. I believe the drop is a buying opportunity for investors that want to own Verizon for its potential in the broadband market and its attractive dividend income.

Aggressive broadband growth strategy

Telecoms like Verizon and AT&T (T) have muted top line growth prospects because they operate in very saturated markets where almost every consumer already owns a smartphone and has access to the internet. Consensus top line estimates are calling for just 2.1% revenue growth in FY 2022 and 1.4% in FY 2023.

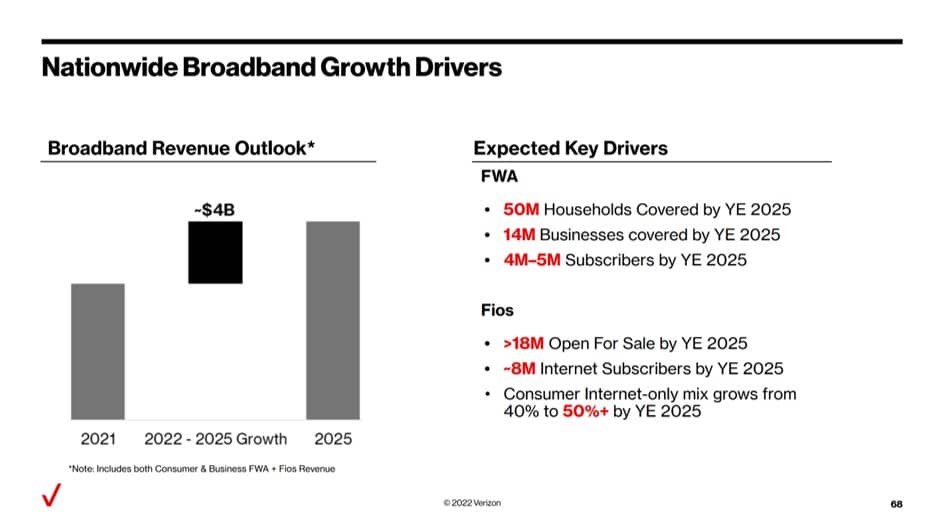

Despite low rates of expected revenue growth, I believe Verizon is creating the foundation for long term growth through its aggressive investments in 5G and especially the broadband sector. According to Verizon’s long term growth plan and capital allocation framework, the company plans to cover 50M households with fixed wireless access by FY 2025 which could lead to additional revenues in the amount of $4.0B.

Verizon: Broadband Strategy

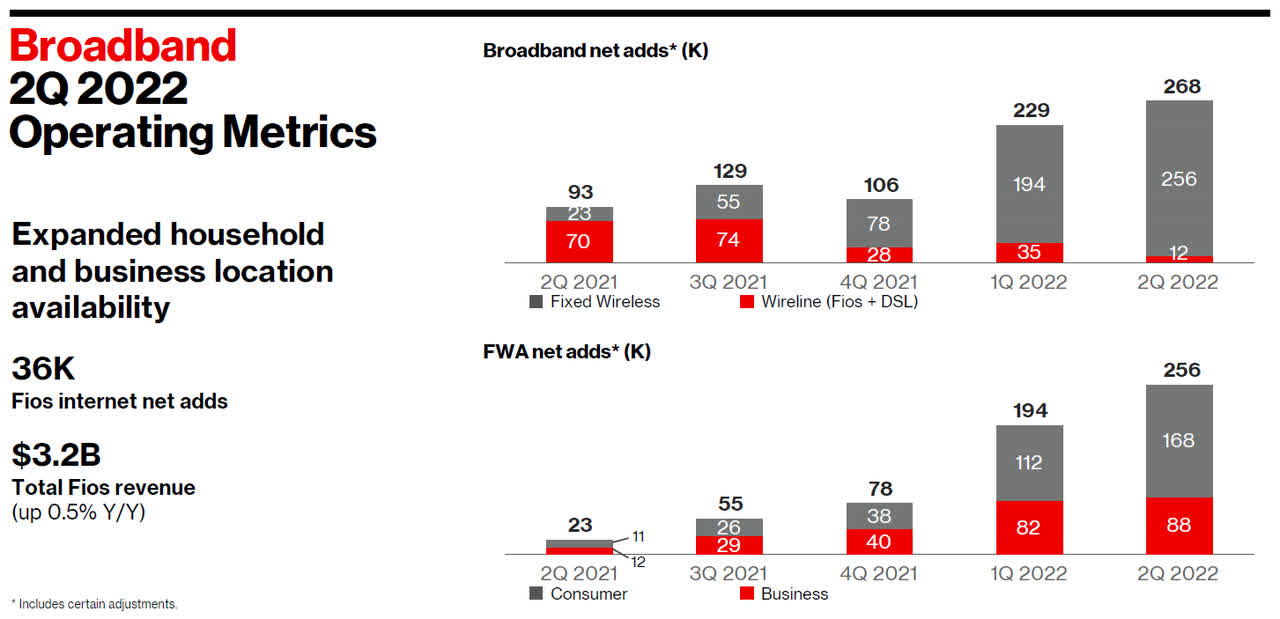

In the second-quarter, Verizon posted strong results from its broadband business as it added 268 thousand new accounts. Additionally, growth in fixed wireless net-adds has been accelerating due to robust adoption especially in the consumer business: fixed wireless consumer net-adds soared to 168 thousand in Q2’22, up from just 38 thousand in Q4’21 due to Verizon’s growing footprint. For the third-quarter, I expect Verizon to reveal between 190-200 thousand consumer fixed wireless net-adds as the company executes well on its roll-out and continues to cover more and more locations.

Verizon: Broadband Q2’22 Results

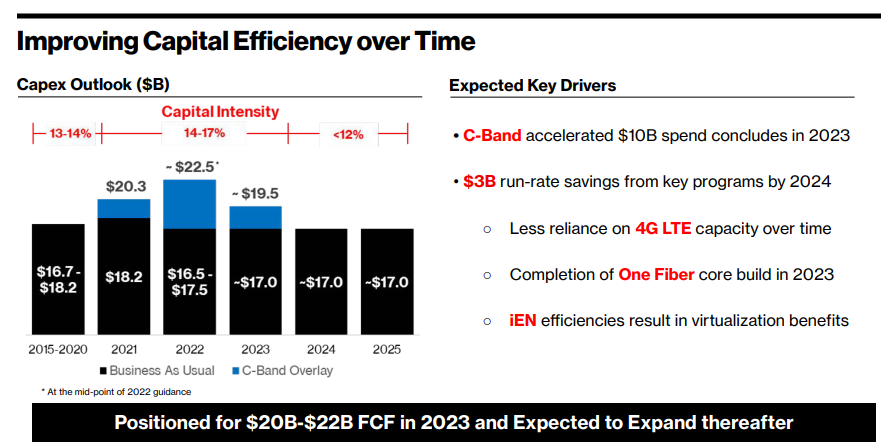

Capital allocation framework

The expansion of Verizon’s broadband network and heavy investments in the roll-out of 5G are going to cost the company a lot of money. Verizon’s capital framework lays out approximately $17B in annual capital costs until FY 2025. In its investor presentation (released in Q1’22) Verizon said that it expects $20-22B in free cash flow in FY 2023 as some of its 5G and broadband investments are already expected to make positive contributions through broadband segment revenue growth, higher market penetration, rising product adoption and cost savings.

Verizon: Capital Plan

Worst-case free cash flow scenario for Verizon

In July, I assumed baseline free cash flow of $22B and after making some adjustments for Verizon’s growing free cash flow risks — since it is taking customers longer to pay their bills — I arrived at a realistic free cash flow range of $17.6-18.7B.

However, in a worst-case scenario, Verizon could see an even larger draw-down in the telecom’s free cash flow. Verizon generated $7.2B in free cash flow in the first six months of FY 2022, which was down 38% year over year. If more customers were to run into solvency issues due to roaring inflation, then Verizon may experience a steeper than expected drop-off in free cash flow this year and next year.

Assuming that Verizon’s free cash flow declined 30% year over year in FY 2022 due to customers struggling with their bills, then Verizon would generate much less in free cash flow, around $13.5B. However, even in this worst-case scenario, Verizon would be able to easily pay its dividend which costs the company $2.7B quarterly and $10.8B annually. Based off of this calculation, Verizon would pay out about 80% of its free cash flow.

Why Verizon is unlikely to cut its dividend

Besides covering its dividend with free cash flow, Verizon raised its dividend 2% in Q3’22 to $0.6525 per-share. Companies don’t raise their dividends if management believes the dividend could be under pressure in the short term due to falling free cash flow. Companies raise their dividends when they believe they can afford to pay them which clearly is the case with Verizon.

Super attractive valuation

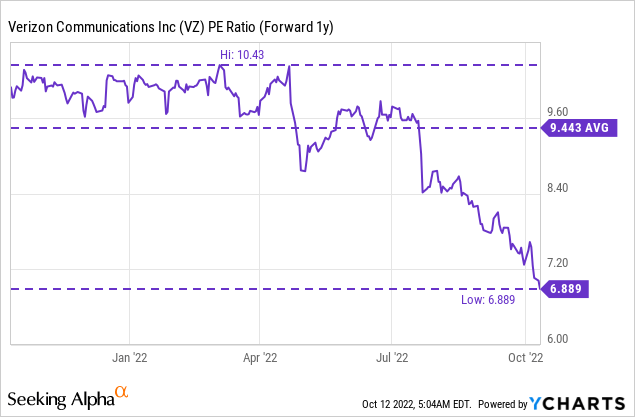

Based off of $13.5B in free cash flow — my worst-case estimate — shares of Verizon trade at 11.5 X free cash flow. Based off of my previous free cash flow estimate of $17.6-18.7B — which assumed a 15-20% draw-down — Verizon’s has a P-FCF ratio of 8.5 X. In both cases, Verizon’s valuation is very attractive. Based off of earnings for next year, Verizon has a P-E ratio of 6.9 X which is significantly below the firm’s 1-year average P-E ratio of 9.4 X.

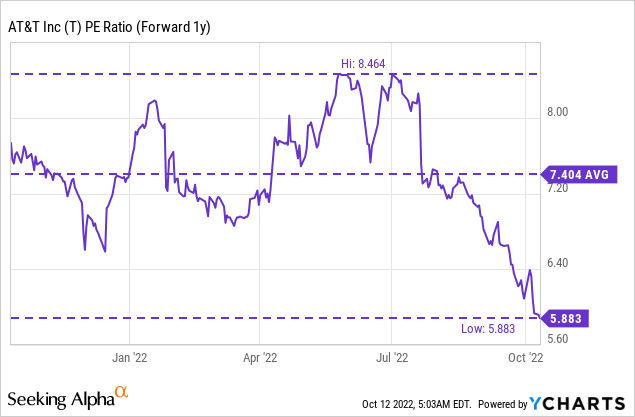

AT&T has also suffered from the same sell-off pressures as Verizon in recent weeks, indicating that the slide in valuations in the telecom sector is not company-specific. I said here — AT&T: General Buying Opportunity — that AT&T’s dividend is also supported by free cash flow and that AT&T’s valuation is very attractive right now. The P-E ratio for AT&T is 5.9 X and also significantly below the 1-year average.

Risks with Verizon

There are a couple of risks with Verizon, some of which I already mentioned. The market right now is concerned about whether or not Verizon’s free cash flow guidance will be down-graded in FY 2023 which some investors fear may lead to a dividend cut. I don’t see this happening because even in the case of a very significant free cash flow draw-down, Verizon would be able to cover its dividend with free cash flow. What would change my mind about Verizon is if the company saw a deceleration of growth in its important broadband segment.

Final thoughts

Verizon’s low-growth, high-FCF stock is out of favor with investors. The result is a super-low valuation based off of free cash flow/earnings and a 7.1% dividend yield.

Investors are currently consumed by worries over Verizon’s free cash flow prospects in a high-inflation world and the sustainability of the dividend. I believe the dividend remains safe heading into earnings and even if bill collection issues remained in 3Q-22, Verizon’s free cash flow should be sufficient to cover the dividend.

The best reason to buy Verizon right now is the heavily discounted valuation based off of both free cash flow and earnings, the irresistible 7.1% dividend yield as well as the aggressive growth plan laid out for the broadband market!

Be the first to comment