RiverNorthPhotography

Verizon Communications (NYSE:VZ) is a great dividend idea hiding in plain sight. The stock price is down almost 26% in 2022, worse than the Dow 30 and S&P 500 Index. The bears will rightly point out that the company is struggling to grow its postpaid cellular subscribers while its competitors are doing so. On the other hand, Verizon is known for its high-quality service. Moreover, the drop in stock price has caused the valuation to plunge to the lowest in a decade while the dividend yield has simultaneously surged to nearly 7%. Verizon should reignite subscriber growth as it ramps up C-Band 5G cellular service, but in the meantime, the stock is a buy.

Overview of Verizon

Verizon is a telecommunications company founded in 2000. Between 1984 and 2000, the company was known as Bell Atlantic after being spun off from the original AT&T (T). In 2000, Bell Atlantic merged its wireless operations with Vodafone AirTouch creating Verizon Wireless. In the same year, it joined with GTE creating Verizon Communications. Later the company acquired MCI WorldCom and Alltel. The company sold its AOL and Yahoo businesses in 2021, exiting the content business. Additionally, in 2021, Verizon acquired TracFone Wireless for about $6.9 billion, adding ~20 million prepaid customers.

Today, the company reports in three segments: Mobility, Broadband, and Value Market.

In total, at the end of Q3 2022, Verizon had about 114.6 million wireless retail connections, including 91.5 million postpaid and 23.1 million prepaid customers. The company also serves ~7.6 million broadband connections; of that, about 6.7 million are FiOS. On the business side, it has approximately 29.6 million postpaid wireless connections and ~0.9 million broadband connections.

Total revenue was $133,613 million in 2021, and in the past 12 months, making Verizon the No. 2 telecommunications company by revenue after AT&T.

Q3 2022 Results

Verizon reported decent third-quarter results, but the stock price sank anyway because of poor consumer cellular subscriber numbers. As a result, the stock price hit a 12-year low. Still, Verizon grew revenue by 4% and beat earnings per share estimates.

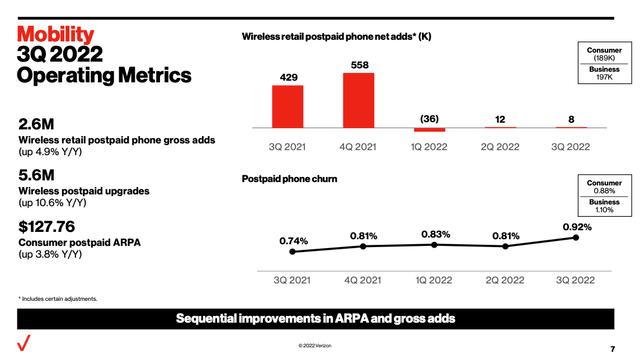

However, the problem was retail wireless net adds were flat at ~8k in the quarter, and growth in business adds was offset by a drop in consumer adds. A third consecutive quarter of flat consolidated growth punished the stock. Also, the churn rate has inched up in the past five quarters to 0.92%

Verizon Q3 2022 Investor Presentation

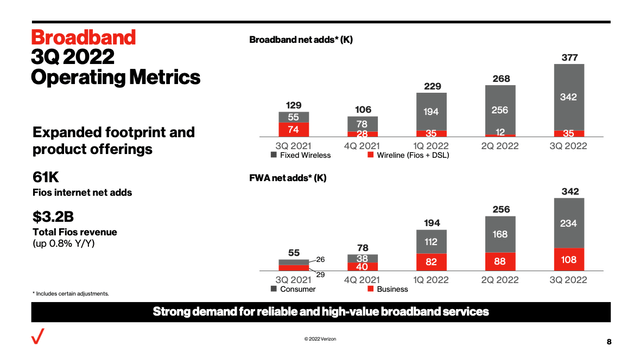

On the other hand, the Broadband segment saw accelerating growth in fixed wireless access and wireline (FiOS and DSL). Also, the Value Market segment reversed four straight quarters of losses with a net gain.

Verizon Q3 2022 Investor Presentation

Verizon maintained guidance even with weak cellular growth because it successfully increased prices and moved customers to higher-priced plans.

Growth and Risks

Verizon already has the highest revenue per customer, making growth in this way more challenging. Hence, the strategy of acquiring TracFone to bulk up its value offering and probably migrate connections to postpaid plans is smart.

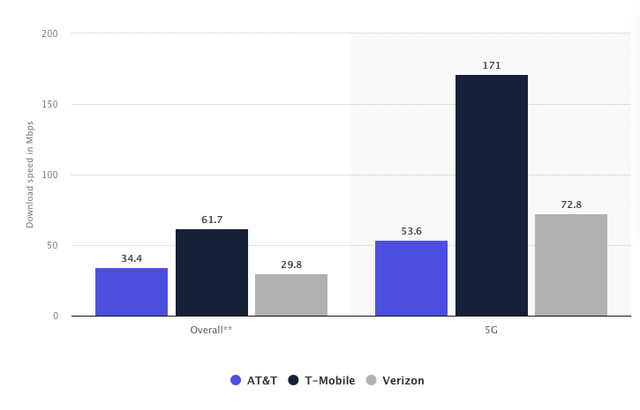

But the core problem is that T-Mobile is executing well, adding customers at a rapid clip and successfully pushing subscribers to higher plans. The company has the advantage of faster 5G download and upload speeds compared to Verizon and AT&T. For example, in download speeds, T-Mobile is more than twice as fast as Verizon because of its speedier mid-band and low-band 5G speeds. T-Mobile leveraged the Sprint acquisition to expand its 5G coverage and faster speeds. Verizon’s speeds are slower because it combines 4G and 5G together to a greater extent than other carriers.

Statista

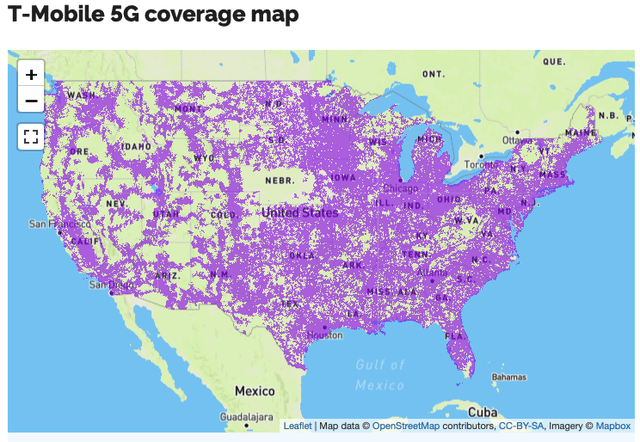

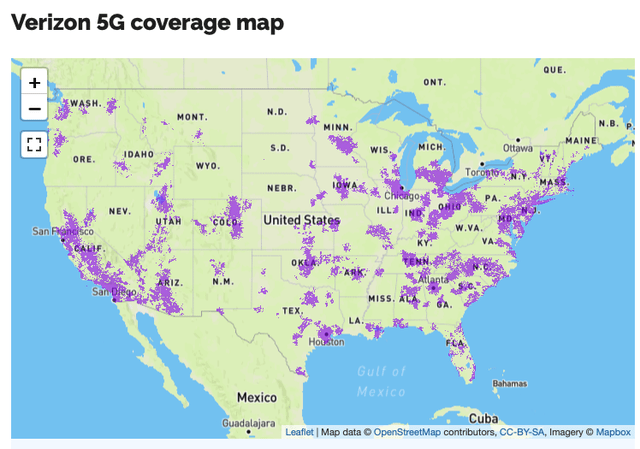

Furthermore, T-Mobile has much greater 5G coverage than Verizon, even though the latter started earlier with its high-band 5G ultra-wideband millimeter wave (mmWave) network. As of early October, T-Mobile 5G service covered ~53.8%, AT&T covered ~29%, and Verizon covered a paltry ~12.8% of the United States.

whistleOut

whistleOut

Second, AT&T has restructured by divesting Warner Media and DirectTV. It still has ownership stakes, but they are now operated as a joint venture. The newly focused firm is gaining customers, too, on the strength of faster speeds and greater 5G coverage than Verizon.

Verizon is attempting to solve the problem with C-band 5G. The firm spent $52.9 billion to acquire the C-band spectrum, which operates in the midband. It is reportedly faster than low-band networks with greater coverage than millimeter-wave 5G. Notably, Verizon uses millimeter-wave 5G with theoretical speeds up to 1 GB per second, but it is only available in limited areas in certain cities.

Verizon is pricing this faster 5G service as a premium one, which should help drive growth.

Although total debt has risen because of the spectrum purchases, the firm still retains a solid investment-grade credit rating and is reducing total and long-term debt. Total debt peaked at $158,502 million in Q3 2021 and is now $147,907 million. Similarly, long-term debt peaked at $148,700 in Q3 2021 and is now $132,912 million.

Dividend Analysis

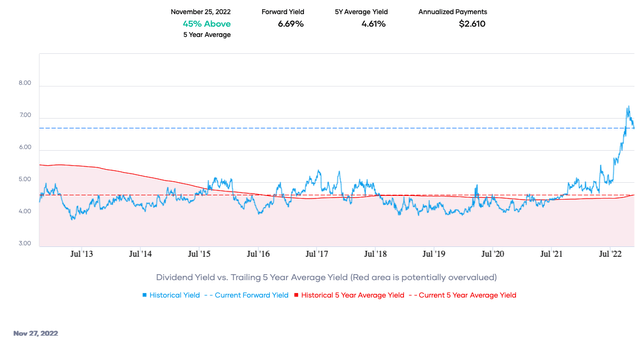

Verizon’s dividend yield is 6.69%, based on a forward dividend rate of $2.61. The yield is nearly two full percentage points greater than the 5-year average. It is also just below the decade high of ~7.16%. Additionally, the dividend yield is several times the average of the S&P 500 Index at 1.62%.

Portfolio Insight

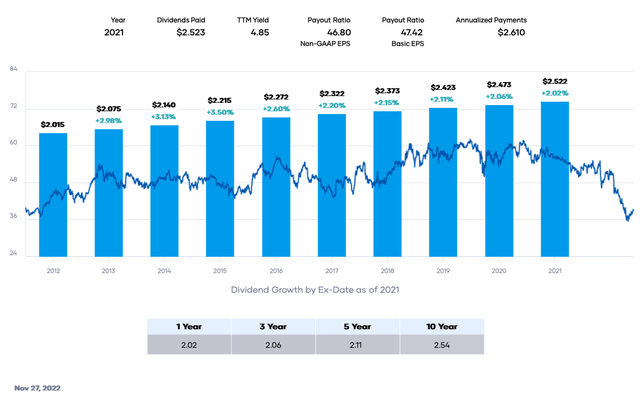

Verizon has increased the annual dividend for 18 consecutive years, making the stock a Dividend Contender. The rate of increase is almost 2% per annum. The last quarterly dividend increase was to a value of $0.6525 per share from $0.64 per share. Moreover, the relatively conservative payout ratio provides some confidence about dividend safety.

Portfolio Insight

Verizon has acceptable dividend safety from the view of EPS, FCF, and the balance sheet.

Consensus estimates for the fiscal year 2022 are $5.17 per share, and the dividend rate is $2.61 per share. These quantities result in a forward payout ratio of ~50%. Our payout ratio cutoff is 65%, suggesting the dividend is safe with a moderate cushion and room for growth.

Verizon had approximately $14,340 million in FCF in the last twelve months. The dividend needed about $10,714 million, giving a dividend-to-FCF ratio of ~75%. This value is above our limit of 70%, signifying some risk to the dividend based on FCF. However, Verizon is spending more on the C-band 5G rollout, so capital expenditures are elevated now, depressing FCF.

Verizon has $2,082 million in total cash and short-term investments versus $14,995 million in current debt and $132,912 in long-term debt. Interest coverage is ~8.3X, and the leverage ratio is ~3.6X. The company has a BBB+/Baa1 lower-medium investment grade credit rating from S&P Global and Moody’s. Debt is not concerning for dividend safety because the firm should be able to refinance debt.

Valuation

Verizon’s stock price is down because of the bear market and company-specific travails. The year-to-date total return is roughly (-25.6%), and the 1-year return is nearly the same. However, the stock is valued at a P/E ratio of practically 7.6X, well below its span in the trailing five and ten years.

The consensus analyst earnings estimates are now $5.17 per share for 2022. So next, we will use 11X as a conservative value for earnings, multiple accounting for competition and current challenges. Hence, our fair value estimate is $56.87. The current stock price is ~$39.02, suggesting that Verizon is very undervalued based on consensus fiscal 2022 earnings.

Applying a sensitivity calculation using PE ratios between 10X and 12X, we obtain a fair value range from $51.70 to $62.04. Hence, the stock price is approximately 63% to 75% of the fair value estimate.

Estimated Current Valuation Based On P/E Ratio

|

P/E Ratio |

|||

|

10 |

11 |

12 |

|

|

Estimated Value |

$51.70 |

$56.87 |

$62.04 |

|

% of Estimated Value at Current Stock Price |

75% |

69% |

63% |

Source: dividendpower.org Calculations

How does this calculation compare to other valuation models? An EV/EBITDA multiple analysis from finbox gives a fair value estimate of $43.40 per share. The model assumes a forward multiple of 7.4X. Portfolio Insight’s blended fair value model combining the P/E ratio and dividend yield gives a fair value of $68.40 per share. Finally, the Gordon Growth Model gives $43.50, assuming a 2% dividend growth rate and an 8% desired rate of return.

The four-model average is ~$53.02, signifying Verizon is significantly undervalued at the current price.

Final Thoughts

Verizon is undervalued and near a record-high dividend yield. Current operational weakness relative to its competitors has made it challenging to grow consumer wireless connections. Consequently, the market has punished the stock. But at the current dividend yield and low valuation, patient investors should be rewarded as Verizon rolls out faster C-band 5G. As a result, I view Verizon as a long-term buy.

Be the first to comment