ArtemisDiana

In this modern era, it has become necessary to work with large amounts of data in order to gather insights for the purpose of optimizing financial performance. And given how advanced technology has become, utilizing artificial intelligence for the purpose of collecting and analyzing the data in question has gone from being something of science fiction to being real. Any sort of company that operates in this space, particularly the smaller firms, should be growing at a rather rapid pace. After all, the opportunity for data analysis utilizing artificial intelligence is already large, but it continues to grow at a nice pace as well.

Unfortunately, this does come with a downside that many other small and rapidly growing companies face. And that is that rapid growth often comes with high costs, not only because of the cutting-edge work that’s done, but also because of the expense of scaling any enterprise. As a value-oriented investor, I tend to stay away from companies like this. But every so often, I will come across a prospect that is not only growing nicely but also does not require an unreasonable amount of profitability to be a worthwhile investment. One great candidate that fits these criteria is Veritone (NASDAQ:VERI), and artificial intelligence computing solutions and services firm that has a rather small market capitalization of less than $250 million. Although the company’s financial performance is not yet robust enough to warrant a bullish rating, I do believe that it does make for a decent ‘hold’ for growth-oriented investors who don’t mind some risk.

A niche software play

As I mentioned already, Veritone operates as a provider of artificial intelligence computing solutions and services. Through the company’s AI operating system, called aiWARE, the firm uses machine learning algorithms, combined with a suite of powerful applications, to reveal valuable insights from large amounts of structured and unstructured data. This platform offers capabilities to its customers that mimic human cognitive functions like perception, prediction, and problem-solving. In theory, this should empower users to quickly and efficiently, not to mention cost-effectively, transform unstructured data into structured data. It should also give them the ability to analyze and optimize data in order to drive business processes and insights.

The company also offers other solutions to its customers. For instance, it provides cloud-native digital content management solutions and content licensing services. These are largely focused on customers and the media and entertainment space. The company’s full-service advertising agency leverages its aiWARE system in order to provide differentiated managed services to its customers. For context, the advertising services are not restricted only to this. They provide a wide array of functions, such as advertisement buying and placement, campaign messaging, custom analytics, and more. This also includes the company’s VeriAds Network, which is comprised of programs that enable broadcasters, podcasters, and social media influencers to get additional advertising revenue. In 2021, the company also acquired PandoLogic. Based in Israel, PandoLogic operates as a leading provider of intelligent hiring solutions that utilizes its own proprietary platform to accelerate the time and improve the efficiency in the process for employers that are hiring at scale and hiring difficult-to-source candidates.

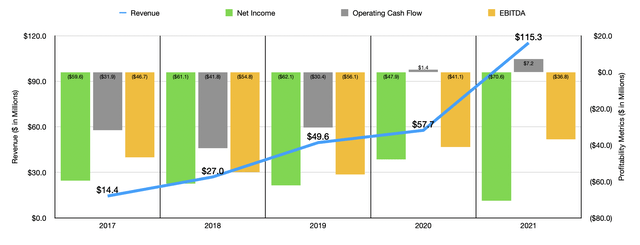

Over the past few years, the management team at Veritone has done a fantastic job growing the company’s revenue. Revenue went from $14.4 million in 2017 to $57.7 million in 2020. Then, in 2021, revenue approximately doubled, hitting $115.3 million. There have been a couple of drivers behind the company’s revenue expansion. For instance, under the Software Products and Services category, the number of customers has grown remarkably. By the end of 2021, the firm had 529 customers in this niche. That’s up from the 360 that it had the same time one year earlier. And under the Managed Services portion of the firm, average Billings per active client expanded from $545,000 in the final quarter of 2020 to $625,000 at the same time last year. The biggest driver behind its growth recently though seems to have been its acquisition of PandoLogic in September of 2021.

Ideally, you would like to see revenue growth accompanied by improved profits. But this has not been exactly the case. Between 2017 and 2019, the company’s net loss increased modestly, growing from $59.6 million to $62.1 million. In 2020, the loss narrowed to $47.9 million before spiking to $70.6 million in 2021. Other profitability metrics have been less than pleasant. Operating cash flow was consistently negative between 2017 and 2019. In 2020, it turned positive to the tune of $1.4 million before turning positive to the tune of $7.2 million last year. Unfortunately, that’s the only profitability metric that turned that way. The other main one, EBITDA has been consistently negative over the past five years. Having said that, after bottoming out at negative $56.1 million and 2019, it has improved year over year, eventually turning negative to the tune of $36.8 million last year.

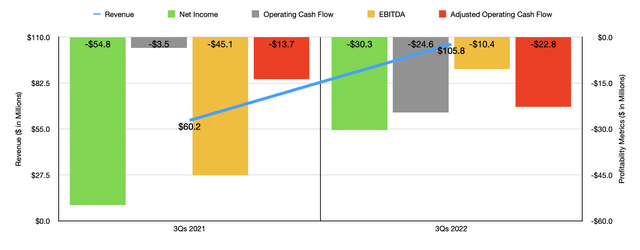

When it comes to the 2022 fiscal year, the company has seen some nice improvements. For instance, revenue in the first nine months of the year came in at $105.8 million. That dwarfs the $60.2 million reported the same time last year. The greatest growth here came from the Software Products & Services portion of the company, with revenue spiking from $19.29 million to $57.36 million year over year. During this window of time, PandoLogic contributed an extra $36.4 million to the company’s growth. The company has also been working hard to continue to innovate. For instance, in October of this year, it introduced a new AI-powered video forensics solution called Veritone Tracker. This was followed up later that month by the company’s launch of SPORT X, an AI-driven, short-form sports video licensing marketplace.

When it comes to profitability though, things have still been rather mixed. For instance, the firm’s net loss did improve, going from $54.8 million to $30.3 million. On the other hand, operating cash flow worsened from negative $3.5 million to negative $24.6 million, while the adjusted figure for this went from negative $13.7 million to negative $22.8 million. Besides net income, the only profitability metric that improved year over year was EBITDA, which went from negative $45.1 million to negative $10.4 million.

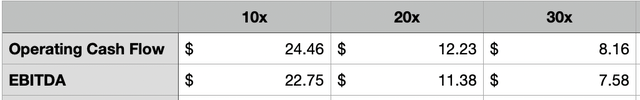

Truth be told, it’s really more or less impossible to really value a company that’s generating negative results across the bottom line. But what we can do is instead ask ourselves what it would require for the company to be at least fairly valued and then ask ourselves if that is reasonable based on where the firm is today. In the table above, for instance, you can see hypothetical multiples for the operating cash flow and the EBITDA of the company, starting at 10 and moving up to 30. You can see how much of each of those metrics the company would need to generate to be fairly valued. It is a rapidly growing enterprise, so a multiple near the higher end of this range is probably not unrealistic. When you look at a scenario where a multiple of 30 is appropriate, the firm would only need to generate about $8.2 million in operating cash flow and $7.6 million in EBITDA to be fairly valued. This year, management is forecasting revenue of between $150 million and $152 million, which compares to the $115.3 million achieved last year. Yes, the net loss for the company should be $14.5 million. This dwarfs the $6.8 million loss generated last year. But for a company growing this rapidly, an eventual slowdown in growth that might result in less spending could very well generate the kind of cash flow figures we are looking at.

Generally speaking, I also stay away from companies that use cash in weird ways. For instance, a firm that’s growing this fast and that has profitability issues would likely be benefiting shareholders the most by focusing on furthering growth and reducing cash outlays instead of paying down low-interest debt. But in the particular case of Veritone, the move the firm announced on November 30th is very logical. The firm is basically buying back $60 million worth of its 1.75% convertible senior notes in exchange for a price of approximately $38 million. Such a discount on debt when the company already has cash in excess of debt seems like a good long-term move for a management team that is bullish about the company’s future.

Takeaway

Based on the data we have today, I will say that I still would not purchase shares of Veritone personally. As a value investor, I like to find companies that are trading on the cheap. But given the company’s rapid growth and the moves being made recently, I don’t think it’s unreasonable to expect the firm to eventually grow into its valuation. This will require continued growth and a disciplined capital strategy. But it’s likely to take place eventually. Because of this, I have no issue rating the company a solid ‘hold’ at this time, though I could understand why somebody might pull the trigger and purchase shares.

Be the first to comment