MF3d

It’s unfortunate that my decision is a pass, because there really is a lot to like about small-cap pharmaceutical company Vericel Corporation (NASDAQ:VCEL), a leader in advanced therapies for the sports medicine and severe burn care sectors.

Balance Sheet

First and foremost is the balance sheet. The public markets are littered with companies of all sizes that have drowned themselves in debt, with interest payments that eat up an ever-growing portion of their operating income that could be flowing to shareholders. However, when VCEL announced 2Q22 results on August 3, the debt on their balance sheet was showing zero, as it has been ever since I started following this company two years ago. This is one of the few companies that I can name that has zero debt. Add to that the $131M in cash and you have a very strong balance sheet, with a very low need for any sort of anti-dilutive capital raise. Management should be commended for being able to commercialize their health care offerings without ruining shareholder value in the process.

MACI

Cell therapy treatments are treatments that involve placing new or modified cells back into a patient’s body. At the moment, VCEL has two advanced cell therapy products on the market: MACI and Epicel.

Their flagship product is MACI (matrix-induced autologous chondrocyte implantation), which is approved for knee cartilage repair in adults. MACI was approved in December 2016 and replaced Carticel (the company’s prior cartilage repair product), which was approved in 1997 and was marketed until 2Q17 (see 2021 10-K, pg 7).

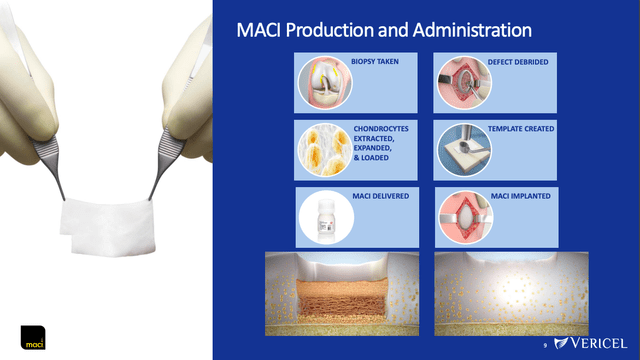

The MACI implantation procedure first begins with an orthopedic surgeon performing a cartilage biopsy on the patient’s knee. The sample is then sent to VCEL’s lab facilities, where the chondrocytes (the cells that produce cartilage) are extracted, expanded, and then reloaded onto a resorbable collagen membrane, which is then sent back to the surgeon for implantation.

August 2022 presentation, slide 9

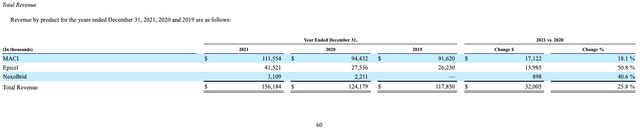

Relative to Carticel, MACI involves a much simpler and shorter surgical procedure and results in a much more precise fit, all while continuing to be highly effective. This positive differentiation has expanded the addressable market size, as can be seen in the sales figures between the two products. For the final 3 full years that it was on the market, Carticel had 2014, 2015, and 2016 annual sales of $22M, $35M, and $39M, respectively (see 2016 10-K, pg 52). Contrast that with these past 3 full years, where MACI has had 2019, 2020, and 2021 annual sales of $92M, $94M, and $112M, respectively.

The overwhelming success of the procedure has led to news stories popping up around the country (see here and here) documenting the satisfaction of patients. Some patients are even so satisfied that they have elected to have MACI done on their other knee as well. Given the commercial successful that VCEL has seen in the US, it’s difficult to reconcile that with the disappointing sales in the EU. Commercially available in Europe since 2001, and finally receiving marketing authorization in 2013, VCEL suspended the marketing of MACI in Europe in September 2014. Management attributes the primary reason as an “unfavorable pricing environment”.

It is true that health care regulators are much more cost-conscious in the EU compared to the US. Priced at $40,000 per procedure in the US, it seems that the pricing ability constraint of MACI in the EU made it simply not worth the hassle. At any rate, the treatment continues to do very well in America.

Patients in need of knee cartilage repair do have other treatment options such as microfracture and osteochondral allograft. Microfracture consists of making tiny fractures in the underlying bone, thus allowing bone marrow to enter the defect. The procedure is minimally invasive, but does form a weaker form of cartilage that offers shorter-term relief but is at a much higher risk of not being effective in larger defects.

An osteochondral allograft involves taking tissue containing both bone and cartilage from a deceased donor and implanting it into the patient. Complications involve a higher rate of graft rejection, disease transmission from the deceased donor, and low availability of fresh donor specimens with the required cartilage thickness.

Needless to say, other pharmaceutical companies, such as Anika Therapeutics (ANIK), CartiHeal, and Aesculap Biologics are running trials for knee cartilage repair technologies. However, at the moment, MACI is the only FDA-approved ACI product on the market in the US. It continues to sell well, and it’s not a stretch to assume that peak sales could be multiples higher than the $100M+ that it’s doing right now.

Epicel

VCEL’s other approved cell therapy product is Epicel, a cultured epidermal autograft (CEA). Epicel is a skin graft grown from a patient’s own skin, and is FDA-approved for patients suffering from deep dermal or full thickness burns covering a total body surface area (TBSA) of at least 30%.

Back in 1998, Epicel was designated as a Humanitarian Use Device (HUD), which is a device or treatment that is intended for an affected population of not more than 8K patients per year in the US. The following year, a Humanitarian Device Exemption (HDE) application was submitted. This application is essentially a way for a company to request approval of a treatment that is exempt from the normal FDA efficacy requirements. This pathway does impose profit limitations, however, and limits the selling price to an amount that does not exceed the cost of R&D. To get around this profit restriction, a company must obtain a label for pediatric patients as well, which is what VCEL ended up doing.

In February 2016, the FDA agreed to revise Epicel’s label to include pediatric patients. The new label also mentions the probable survival benefit, demonstrated via two Epicel clinical experience databases, as well as a physician-sponsored study comparing survival outcomes in massive burn patients treated with Epicel compared to standard care.

Management feels that relative to the clinical need, Epicel has been underutilized by burn centers due to “the lack of a consistent promotional effort prior to 2015.” Since 2014, when there was a single sales representative supporting the product (see 2017 10-K, pg 7), the sales team has been expanded to 13 representatives. As you can see below, revenues have certainly picked up over the past few years.

What remains a bit unclear is how much higher they can go. Management feels that the total addressable market size is $200M, so based off of 2021’s figure of $42M, they have captured about 19% of that. If we take their 2022 total revenue guidance of $184M, subtract out MACI revenue guidance of $137M, and subtract out another $4M of NexoBrid revenue (my estimate for the next treatment we will discuss), that implies Epicel revenues of $43M. So very minimal growth over last year’s total.

Epicel, like MACI, is also a great product, but it’s not clear how much higher its sales will go.

NexoBrid

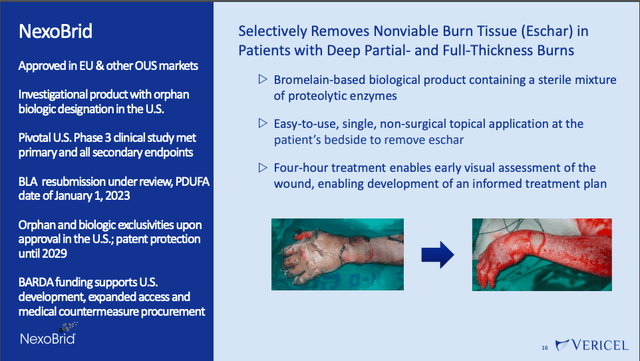

VCEL’s final pipeline asset is NexoBrid, which is a topically-administered biological product that works via enzymes to remove nonviable burn tissue (called “eschar”) in patients with deep partial and full-thickness thermal burns.

August 2022 presentation, slide 16

VCEL acquired the North American rights to NexoBrid from MediWound on May 7, 2019. The upfront payment was $17.5M, with an additional $7.5M to be paid upon FDA approval. The terms also include sales milestone payments to MediWound of up to $125M, with the first milestone payment of $7.5M being triggered when annual net sales in North America cross the $75M threshold. On top of this, VCEL will pay tiered royalties on net sales ranging from single-digit to low double-digit percentages.

The other intriguing component about the NexoBrid agreement is the interest from the US Biomedical Advanced Research and Development Authority (BARDA). BARDA provided $56M in funding to support the trials that were needed for submission of the US Biologics License Application (BLA), and committed to an initial procurement of $16.5M (with the first delivery occurring in August 2020). Aside from that, BARDA has also awarded a separate contract to MediWound for the development of NexoBrid as a debridement product in patients suffering from sulfur mustard injuries. This contract includes up to $43M in development aid.

The phase 3 DETECT study that BARDA helped pay for was a success, with topline results announced in January 2019. Unfortunately, the FDA declined to approve it, instead issuing a CRL in June 2021, and citing the following reasons as needing further review: 1) issues relating to Chemistry, Manufacturing, and Controls (CMC); 2) inability to perform inspections of manufacturing facilities in Israel and Taiwan due to COVID-related travel restrictions; 3) observations that were made during good clinical practice (GCP) inspections related to the DETECT study and requested that MediWound address questions regarding the impact of the observations on the study’s efficacy findings; and 4) provide a safety update as part of the BLA resubmission.

All in all, the issues raised in the CRL do not seem like red flags. Manufacturing-related issues usually just require additional time to prepare/inspect the facilities, and have nothing to do with the efficacy or safety of the drug. And given that NexoBrid has been approved and utilized in Europe since 2012, it’s unlikely that some new efficacy or safety issues popped up during the DETECT trial.

The NexoBrid BLA resubmission was accepted for review on August 3, 2022, and the FDA is expected to make a final decision by January 1, 2023. The main question for me is not whether it will be approved or not (I think it will), but how high sales might be if it eventually is.

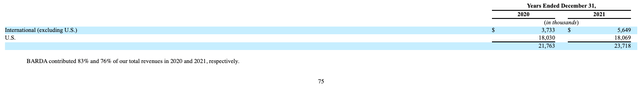

MediWound’s revenues are largely derived from sales of NexoBrid, and as you can see below, total company revenues for 2020 and 2021 were only $22M and $24M, respectively, with BARDA accounting for over 75% of total revenues in both years.

Just because a treatment does not do well overseas does not mean that it won’t do much better in the US. This company is proof of that, as MACI has done very well in the US, even though marketing has been discontinued in Europe after very lackluster sales.

This article discusses some reasons why NexoBrid might do better on US soil. One reason given is that the US burn market is more focused, with about 75% of patients treated at specialized burn care facilities, compared with only 33% in Europe. A second reason given is that surgical debridement is much more expensive in the US, which should justify using a cheaper alternative such as NexoBrid first. Lastly, there is now additional clinical data showing the benefits of NexoBrid—data that was not available when NexoBrid first launched overseas.

Management thinks the addressable market size for NexoBrid is also $200M+ in the US (as it is for Epicel), and EvaluatePharma thinks it will do $71M in sales by 2024. However, even if it does $50M+, I’m not sure it would be enough to change my overall thinking on this company.

Valuation

It’s tempting to try and make the case that VCEL should be a Buy simply by looking at the stock chart. The company reported a quick return to the strong MACI sales that had been seen prior to the COVID pandemic of 2020 and 2021. This news was largely responsible for pushing the price up to $60+/share, before the NexoBrid CRL started the descent back down.

However, it’s not enough to make investment decisions based solely off the expectation that a stock that has come down a lot will eventually go back up. There needs to be a justified valuation to support a thesis that a stock will return to prior highs. Even after losing over 60% of its value, VCEL still has a market cap of over $1B. Even if we assume MACI peak sales of $500M (maybe even a bit higher depending on what you think ankle cartilage repair will contribute, if eventually approved for this), and Epicel and NexoBrid peak sales of $60M each, it’s tough to make the case that this stock is undervalued.

VCEL is a great company with 3 very novel products and a very strong balance sheet. However, it’s no longer a microcap biotech, with the market now valuing them at $1B+ (and justifiably so). The stock might go up 30%+ from here, as in the short term things don’t always trade based on their fundamentals. But it’s just not clear that this stock is mis-priced.

If it goes down for some unexplained reason, then this name would be at the top of my Buy list. But as of right now, I think this is, unfortunately, a Pass.

Be the first to comment