chonticha wat

The Direxion Daily Junior Gold Miners Index Bear 2X Shares (NYSEARCA:JDST) gives you daily leverage on the prices of a basket of gold mining stocks. Gold mining stocks trade pretty closely with prices of gold and gold indices, so JDST gives you a bear bet on the price of gold, which has been paying out a little over the last year. Gold is broadly speaking at high levels, having plateaued for over a year now quite a margin above pre-COVID levels. There is a bet to be made against gold at this point as speculative factors begin to point against it. However, the bet is ambiguous and therefore an aggressive position like JDST only introduces volatility to a portfolio rather than giving conviction to a thesis. Best passed on.

Thinking About Gold

Gold had a rise on the basis that the US manufacturing data might have been pointing towards lower employment figures later in that week. Manufacturing data showed that orders were down, and other potential drivers of employment were in some sort of decline. Indices were still above pre-COVID levels however, and ultimately employment remained high in the employment report. The reason speculators were buying gold is because the prospect of hikes ending would be a benefit for non-yielding assets like gold whose proposition improves relative to cash that could be invested in treasuries. With the high employment rates signaling that so far inflation is not stopping, gold has recently fallen on that account, since cash invested in treasuries or other government bonds will likely command better and better yields.

Until we see unemployment rates rise, inflation has no reason to slow down. On the supply side, things will not get markedly better, with key drivers of inflation persisting due to geopolitical factors. Manufacturing data or consumption data pulling back but only to pre-COVID levels, meaning only the reversal of the service-to-goods shift has occurred, is not enough to stop inflation on tighter supply in general and the propagation of inflation through the wage-price spiral.

Remarks On JDST

JDST tracks a VanEck ETF of gold miners and weights its holdings such that every day at close a -2x factor on the returns should be achieved. With gold miners being dependent on the outlook of gold, JDST is a bet against gold.

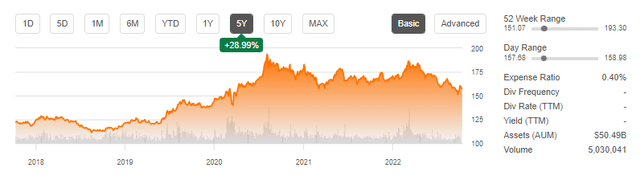

As such, the JDST’s price has risen in line with the slight declines of gold from broadly high levels, with gold trading in the lower range of the new trading range since 2020.

Because a decent amount of engineering and rebalancing needs to go into curating this ETF, expense ratios are pretty high at 0.87%.

Does it make sense to bet against gold? While it is clear that rates are going to go higher from here before the Fed is satisfied with their inflation crusade, the roiling of the markets that will come keep some support for gold as a speculative asset. Investors may not be inclined to put money into a very appreciated dollar, with concerns that there could be dollar volatility as other countries catch up with their own rate hiking. Treasuries aren’t necessarily the place to go as a safe haven, although it really is looking like a good place to be given where risk-free rates are going, and especially when gold cannot offer a yield.

We wouldn’t bet against gold, but we certainly wouldn’t bet on it either. The main issue is that despite the 2x leverage, we think the ambiguous situation with gold with its safe haven proposition could mean that substantial returns may be limited. With expense ratios being quite high, you lose money for sure on that while also risking bad timing with JDST if there’s a peak in rate cycles, and gold perhaps looks less impeachable. Overall, it’s a pass.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment