Erika Goldring/Getty Images Entertainment

Vera Bradley (NASDAQ:VRA) operates as a casual, affordable, and fun brand with its two prominent brand names, Vera Bradley and Pure Vida. Upon acquiring a 75% stake in Pure Vida in 2019, the company has been focusing on developing a robust business model.

Vera Bradley– Founded in 1982, the segment produces women’s handbags, luggage, and other travel items, home accessories, and unique gifts. As the segment quickly relates to consumer demand, management’s focus on face mask sales has driven revenue growth in the last year. Still, investors must consider that such revenue might not sustain in the upcoming quarters, and the overall revenue might decline considerably.

Also, with its focus on high-potential stores, the company has been closing its underperforming stores and reinvesting the money in new outlets and e-commerce, which will further drive business efficiency and margins.

Pure Vida– With its well-known website, it offers a wide range of bracelet jewelry and lifestyle products to its customers. Most of the revenue comes from its two major websites, and as the management is relentlessly working on brand development, the overall performance might improve in the upcoming years.

With various initiatives such as a digital-first strategy, innovative pipeline generation, and strong community development, the revenue might increase in the future.

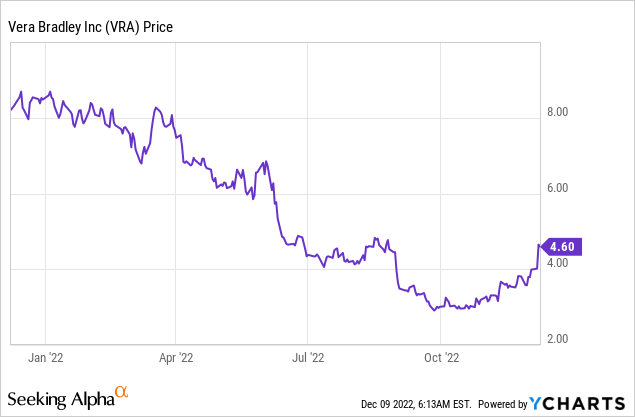

stock price (YCharts)

Recently, as a result of the inflationary environment and reduced profitability, the stock price has been dropping consistently; the stock has lost over 63% of its value from its 2021 levels and has been trading for $4.6 per share despite a strong financial position along with a robust business model. In my view, the stock has become substantially undervalued and, from this point, provides significant upside potential. I assign a buy rating to the stock.

Historical performance

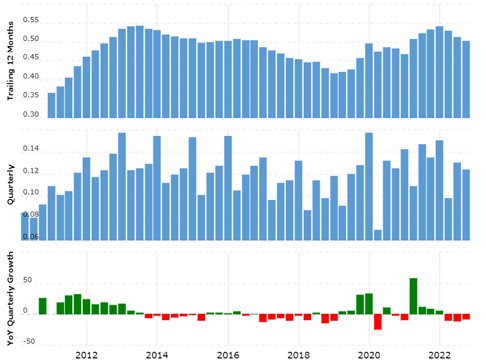

revenue growth (macrotrends.net )

Over the last ten years, revenue has been volatile and fluctuating at the same levels; in the last year, the company has posted revenue of $540 million, which has been increasing over the last few years. Also, net profit margins have reduced significantly in the last 5-6 years and oscillated between $7 million to $20 million. Whereas in the early years of the decade, the company earned over $40 million. Note that management has been buying back shares; as a result, total outstanding shares have reduced from 41 million to 31 million.

The company is debt free and has significant liquid assets, strengthening the business model. Also, the company has a balance sheet of over $483 million comprised of huge liquid assets and considerably low intangibles, which further reduces the risk of impairment losses. Although the cash reserves have dropped considerably due to the high inventory level, the company could convert it into cash as the supply chain issue normalizes.

It should be appreciated that the rise in inventory levels is moderate as compared to other retailers, such as Qurate retail, which has been facing a large build-up of inventory. Furthermore, over the period, the company has generated substantial cash flow from operations, and in the last year, CFO stood at about $40 million. Such solid and consistent cash flow gives the business model a significant advantage.

Strength in the business model

The company has over $247 million in net current assets with virtually no long-term debt. Also, the total market capitalization is about $145 million, which shows that the company has been trading for about 0.56 times its current assets. Having such a high working capital compared to the valuation provides huge margin of safety to the stock.

Risk factors

The current recessionary environment might last longer; the company might face significant pressure on its margins in such cases. Also, the recent marketing initiatives to develop brand awareness might bring significant costs to the company, affecting the net profit for a considerably longer period. In such cases, the stock price might suffer in the upcoming quarters, but the overall long-term outlook remains favorable.

Recent development

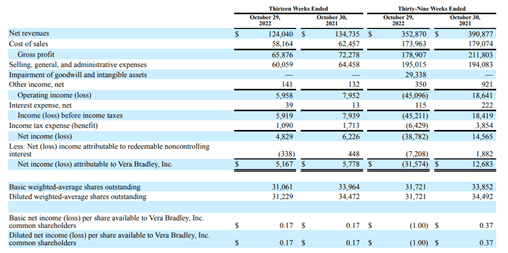

quarterly results (quarterly reports)

In the recent quarter (13 weeks), revenue has declined from $134 million the same quarter last year to $124 million, primarily due to adverse economic conditions. Also, net profits dropped from $5.7 million last year to $5.1 million, which still seems a substantially attractive performance in the inflationary environment.

But the operating results for the last nine months (39 weeks) have turned negative due to the higher selling cost as a percentage and over $29 million of goodwill impairment.

As the management focuses on brand development through market expenditures and collaborations, selling expenses might remain considerably high. But these efforts can bear fruit in the upcoming years. As the operating costs have been rising and the company has been investing in promotional activities, the management expects EPS of $0.16 to $0.20 in the fourth quarter.

Furthermore, high cost and advertising spending might affect the business performance in the upcoming quarters. Still, the overall long-term look remains favorable. Also, the solid financial position and robust business model provide a significant margin of safety.

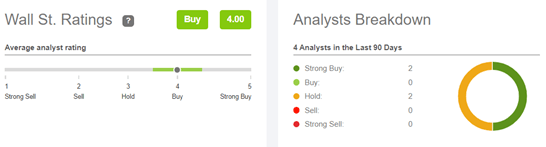

financial ratings (seeking alpha)

Currently, the company has been trading for about $145 million. In contrast, it produced over $20 million in net profits last year and over $40 million in cash flow from operations for a very long period, which shows that the stock is trading for just seven times its earnings. Historically, it had been trading for more than 20 times its earnings. I believe the stock has become substantially undervalued and provides enormous upside potential. I assign buy rating to the stock.

Be the first to comment