Thomas Barwick

I’ve covered several inflation hedge ETFs in the past, including those focused on commodities, treasury inflation-protected securities, and miners. Companies in the agricultural industry tend to be effective inflation hedges too, but are somewhat under-discussed, so thought an article on a fund focusing on said industry was in order.

The iShares MSCI Global Agriculture Producers ETF (NYSEARCA:VEGI) is an index ETF investing in global agricultural producers, including those focused on agricultural goods, and agricultural input goods, like fertilizer and farm machinery. VEGI’s underlying holdings are seeing strong growth on the back of rising agricultural prices and demand, and valuations remain cheap, a solid combination. The food is a strong investment opportunity, and a buy. VEGI only yields 1.3%, and so is not an effective income vehicle.

VEGI – Basics

- Investment Manager: BlackRock

- Underlying Index: MSCI ACWI Select Agriculture Producers IMI Index

- Expense Ratio: 0.39%

- Dividend Yield: 1.49%

- Total Returns CAGR 10Y: 7.22%

VEGI – Overview

VEGI is an equity index ETF investing in agricultural industry companies. It tracks the MSCI ACWI Select Agriculture Producers IMI Index, an index of these same securities.

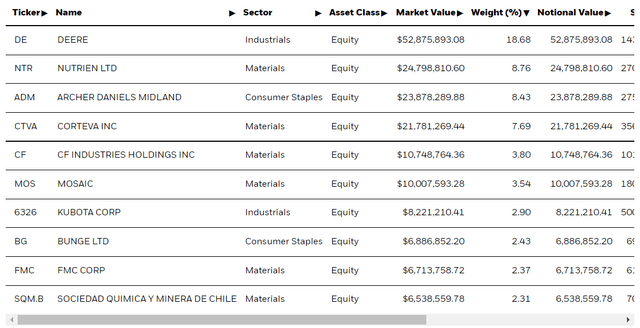

VEGI and its underlying index includes companies directly focused on the production of agricultural goods, like the Archer-Daniels-Midland Company (ADM). ADM produces an incredibly wide assortment of agricultural goods, including bread, milk, plant-based proteins, oils, and juices.

ADM Corporate Website

VEGI and its underlying index also includes companies focusing on the production of input or intermediate agricultural products, including fertilizer, chemicals, and farm machinery. As an example, the fund invests in Deere (DE), which produces a wide assortment of agricultural tractors, harvesters, and assorted farm machinery.

Deere Corporate Website

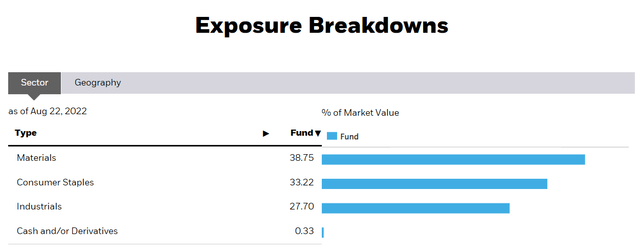

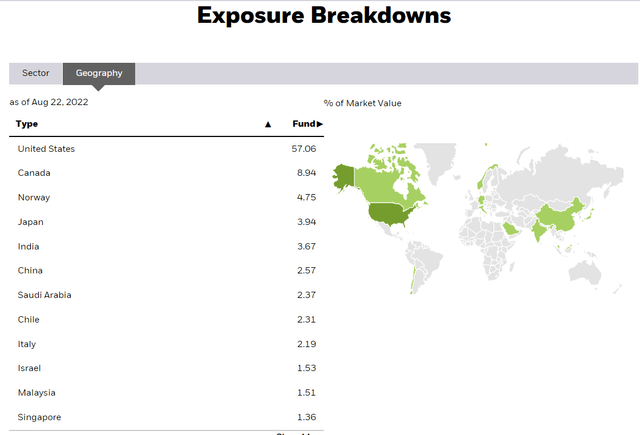

As should be clear from the above, VEGI has a reasonably expansive view of the agricultural industry, which increases the fund’s number of holdings and diversification. VEGI itself invests in 156 different companies, from three different industries, and more than a dozen countries. These are as follows.

VEGI

VEGI

VEGI

Although the fund is materially less diversified than most broad-based equity indexes, including the S&P 500, it is significantly more diversified than most equity industry indexes. Diversification reduces risk and volatility, benefitting shareholders, but the fund remains a broadly concentrated fund, with comparatively less diversification than average.

With the above in mind, let’s have a look at the fund’s investment thesis.

VEGI – Investment Thesis

VEGI’s investment thesis is quite simple, and rests on the fund’s strong growth prospects and cheap valuations, an incredibly strong, and rare, combination.

Strong Growth Prospects

VEGI’s holdings are all either directly or indirectly exposed to agricultural conditions, demand, and prices, all of which are incredibly favorable.

Demand for agricultural products is increasing, due to the ongoing economic recovery, and sustained economic growth, especially in emerging markets.

Supply for agricultural products is plummeting, due to the war in Ukraine, droughts across the globe, including in the United States, and export bans in several key markets.

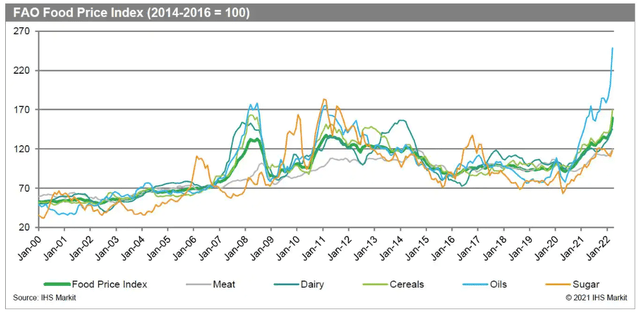

Increased demand but plummeting supply is a recipe for skyrocketing prices, with most agricultural products seeing double-digit price increases in the past few months. As per S&P, food prices have increased by 33.6% in the past twelve months, and by nearly 75% since their 2020s low.

S&P

In other markets, higher prices would ultimately result in lower demand, but that is not the case for most agricultural products, for obvious reasons. Humans will not forgo eating, nor will most countries consign their citizens to starvations or famine, so prices will increase until demand can be met.

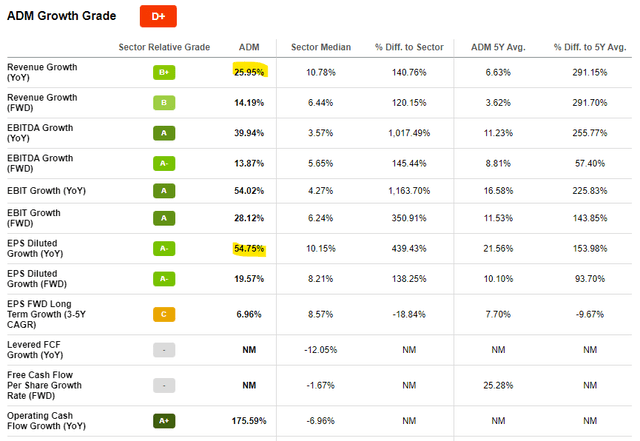

The above is a significant boon for VEGI’s underlying holdings, most of which have seen significant revenue and earnings growth. For VEGI holdings which directly produce agricultural products, including ADM, higher agricultural commodity prices directly increase revenues and earnings. ADM itself has seen revenue growth of 26% in the past twelve months, with earnings growing at a 55% pace.

Seeking Alpha

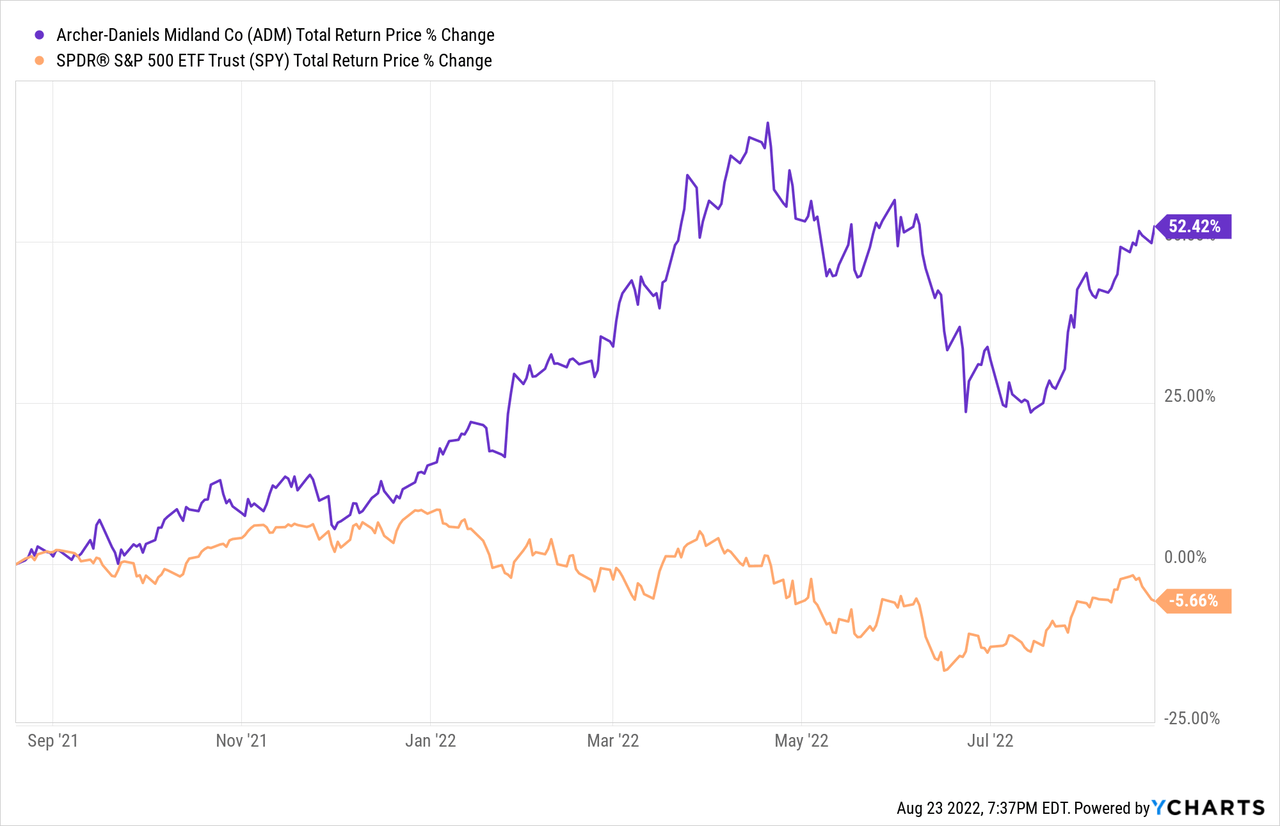

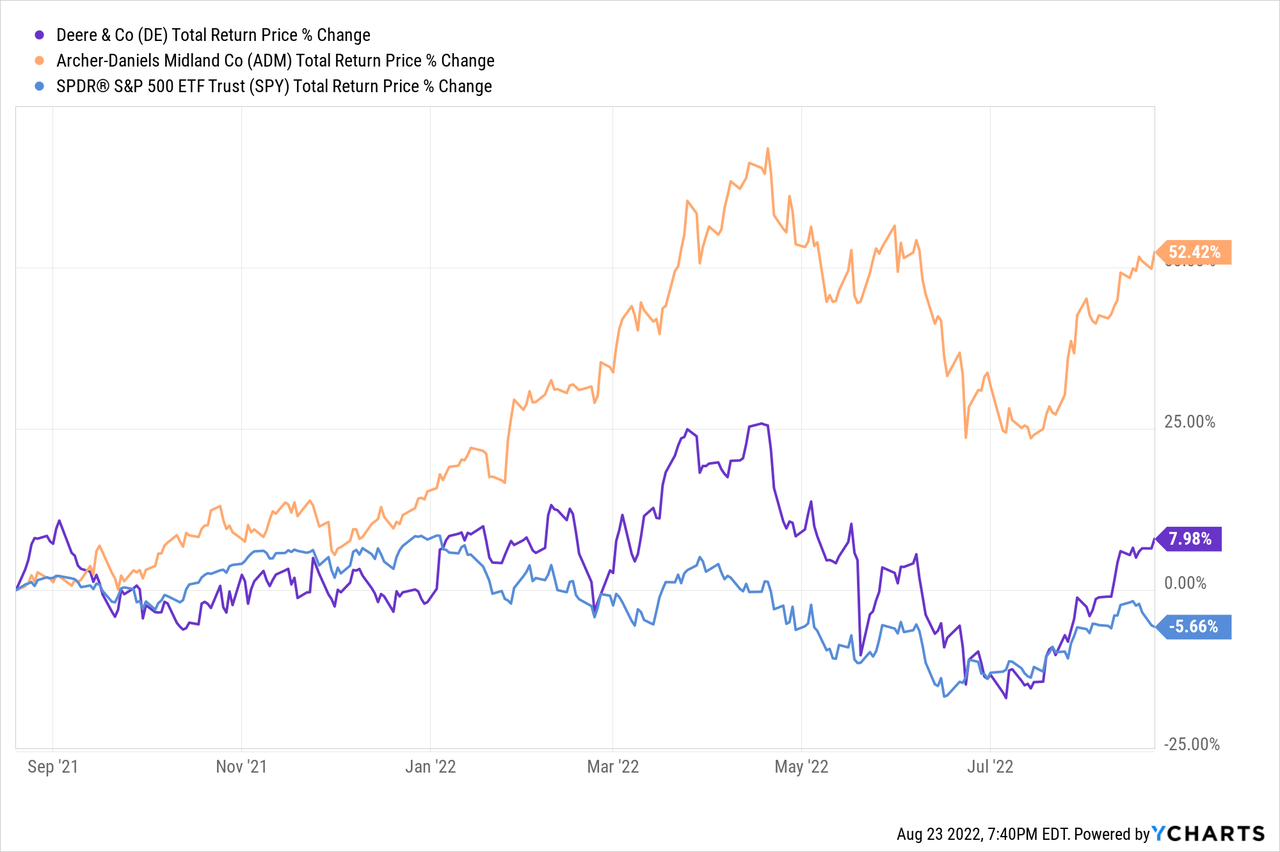

Significant growth should lead to strong, market-beating returns, as has been the case for ADM these past twelve months.

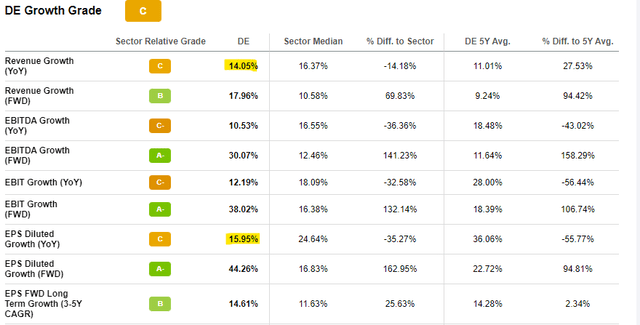

Some of VEGI’s holdings do not directly produce agricultural commodities, but do produce products which are positively impacted by higher commodity prices / demand, and so have also benefitted from current market trends. As an example, Deere has seen increased demand for its tractors and assorted farm machinery products, as agricultural producers boost production, which necessitates buying tractors and the like. Deere has seen revenue growth of 14% these past twelve months, earnings growth of 16% for the same. Growth has been strong, although quite a bit lower than that of ADM.

Seeking Alpha

As with ADM, Deere’s significant growth should have led to strong, market-beating returns, as has been the case these past twelve months. Returns have, however, significantly lagged behind those of ADM.

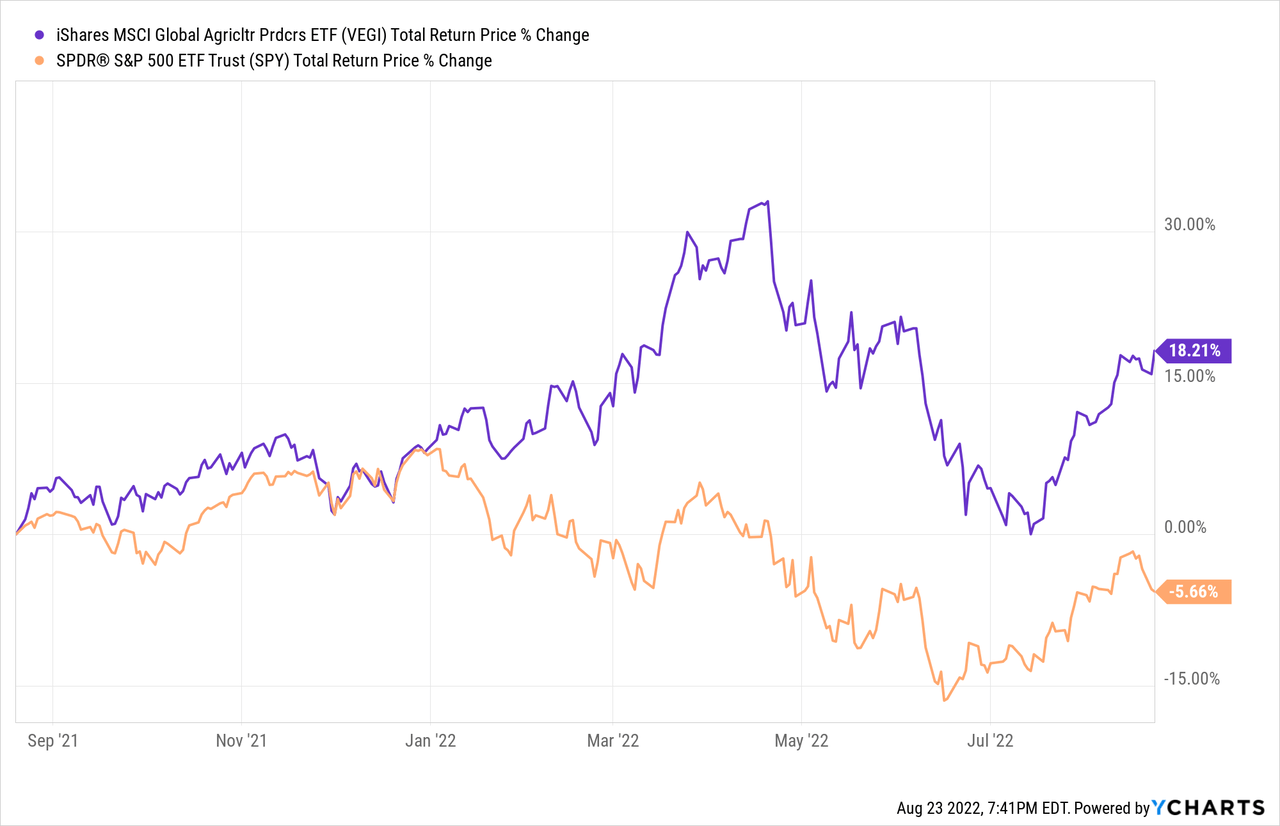

VEGI’s underlying holdings are generally quite similar to ADM or Deere, and so the fund itself has also outperformed these past twelve months, as expected.

Insofar as agricultural demand and prices remain high, VEGI should continue to outperform, a significant benefit for the fund and its shareholders. As commodity prices are a key component of inflation, the fund performs as something of an inflation hedge ETF, which could be of use and interest to investors as well.

Cheap Valuation

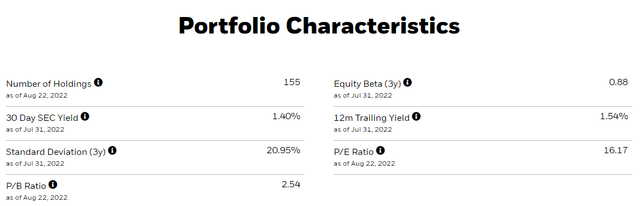

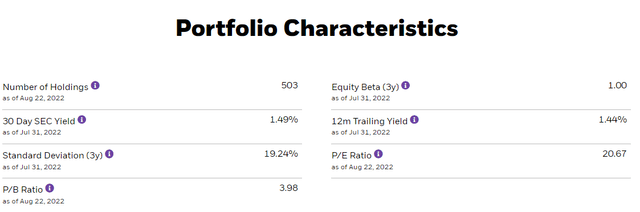

Strong growth prospects sometimes come at the expense of valuations, but that is not the case for VEGI. The fund currently sports a PE ratio of 16.2x, and a PB ratio of 2.5x, both moderately below-average figures.

VEGI

As a comparison, the S&P 500 currently sports a PE ratio of 20.7x, and a PB ratio of 4.0x. Both figures are higher than those of VEGI.

IVV

VEGI’s comparatively cheap valuation is a benefit for the fund and its shareholders, especially considering its strong growth prospects. Cheaply valued funds tend to sport premium valuations, but that is not the case for VEGI.

The fund’s cheap valuation is also a benefit, insofar as it indicates that prospective investors are still early, and further gains are still possible.

VEGI – Risks and Drawbacks

VEGI is a strong fund and investment opportunity, but it is not one without risks or drawbacks.

One particular risk stands out: the fund’s significant agricultural commodity price exposure. VEGI’s underlying holdings see significant revenue and earnings growth when agricultural prices and demand are strong, but see significant declines when these weaken. Agricultural commodities are cyclical products, and so periods of significant declining prices are common. Although prices are high right now, these will almost certainly not persist forever, and shareholder returns will likely plummet once this occurs.

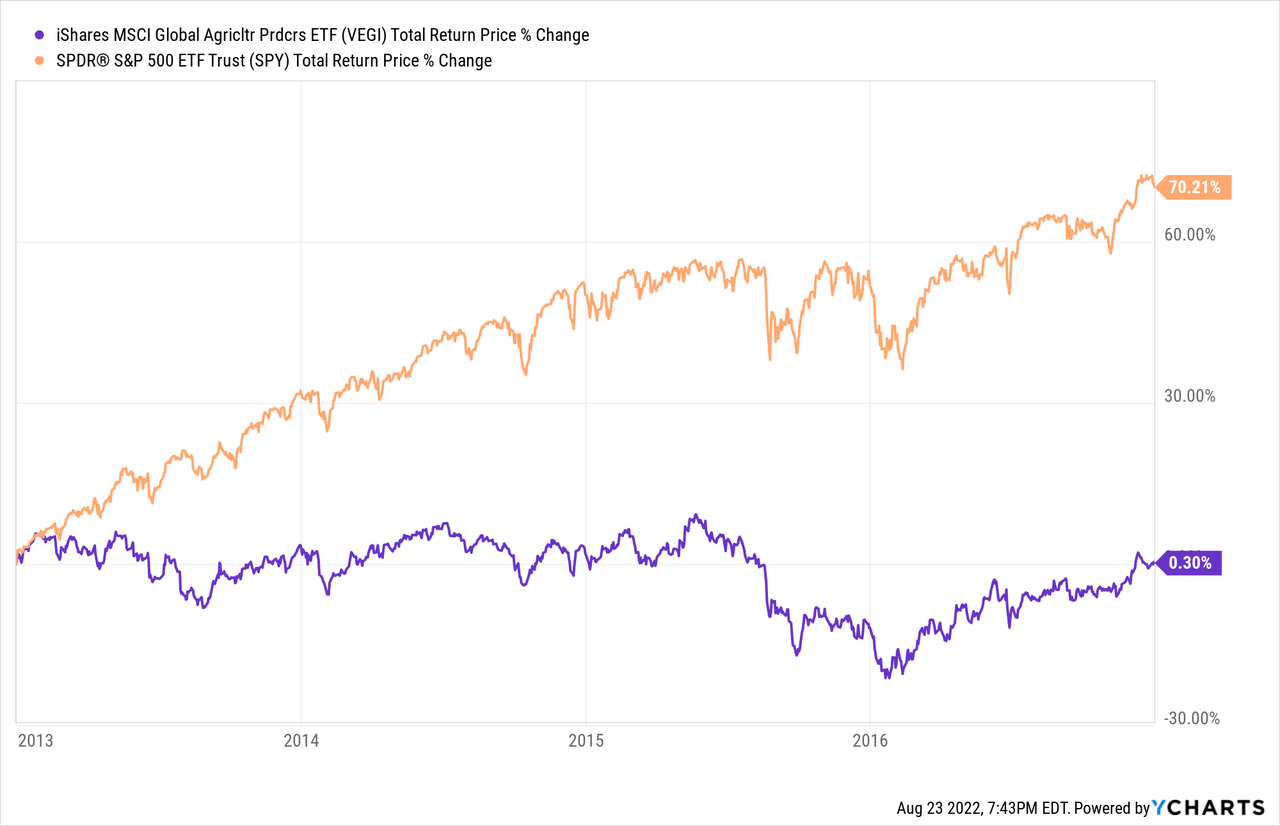

As an example of the above, commodity prices were quite weak from 2013 to 2017, during which VEGI significantly underperformed.

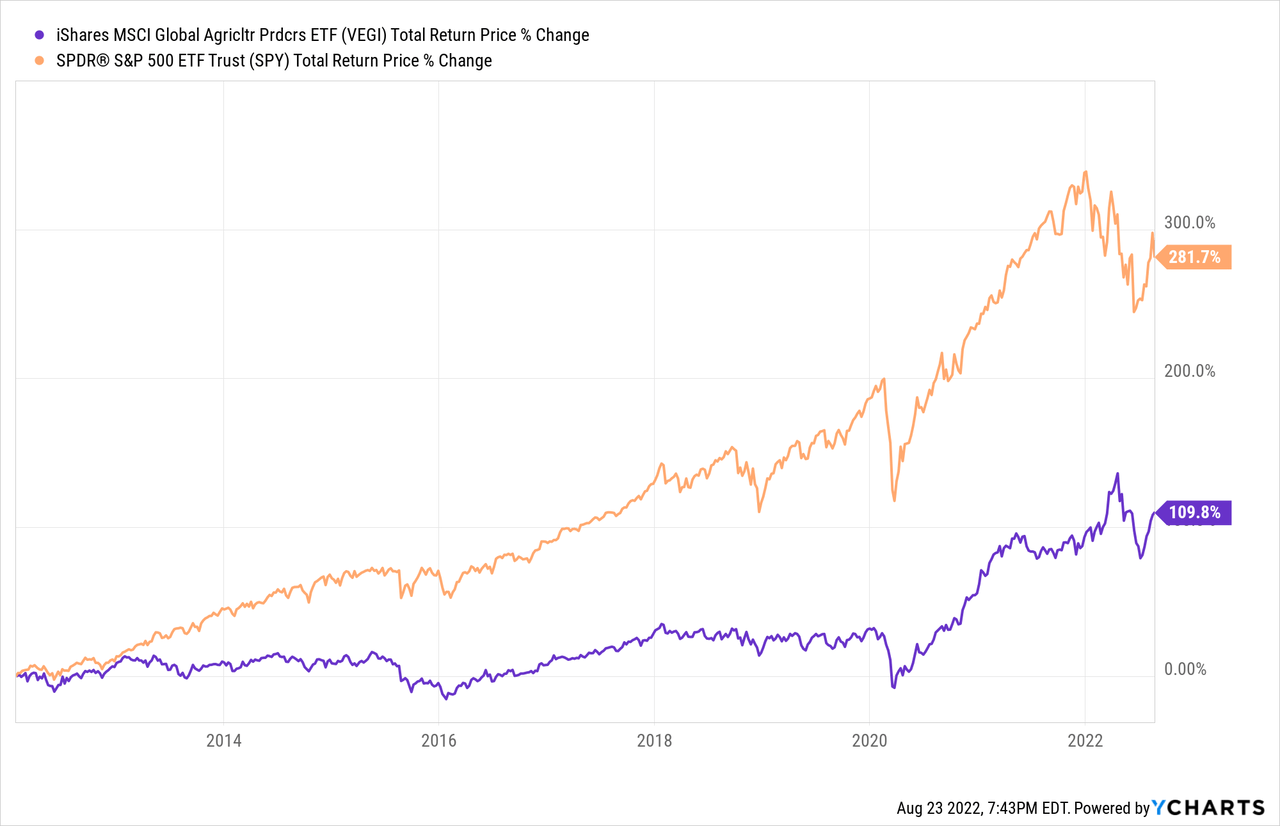

Commodity prices remained relatively weak until mid-2020. So, commodity prices have mostly remained quite weak during the past decade. VEGI should have underperformed under these conditions, as was indeed the case.

Although VEGI will not necessarily underperform during the next decade, the fund will underperform during the next agricultural commodity price crunch, a significant negative for the fund and its shareholders. Significant losses and underperformance are possible, even likely during a sufficiently long time frame. In my opinion, and considering commodity price volatility, VEGI is an inappropriate investment for more risk-averse investors.

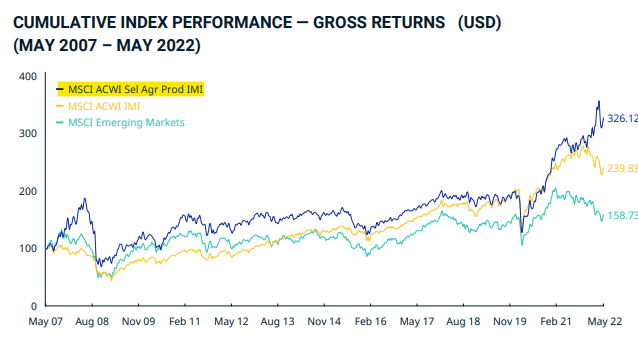

As a final note, the fund’s long-term underperformance is at least partly due to bad timing. VEGI was created in early 2012, a year before a significant, long-lasting commodity price crunch. VEGI’s performance would be much stronger if the fund had being created a few years before, to take advantage of above-average commodity prices in prior years, or a few years after, once prices had bottomed. MSCI, the index provider, has back-tested performance starting from 2007, and the fund’s performance, or that of its underlying index, looks much stronger from that starting point.

MSCI

Conclusion

VEGI’s strong growth prospects and cheap valuation make the fund a buy.

Be the first to comment