ThitareeSarmkasat

When we look back at the early winners from the pandemic, perhaps the name most talked about will be Zoom Video Communications (NASDAQ:ZM). The unified communications platform saw its revenues surge and stock soar on the major shift to employees working from home. A couple of years later, however, the growth boom has all but ended, and the company’s report on Monday was the latest disaster result for Cathie Wood and ARK Invest.

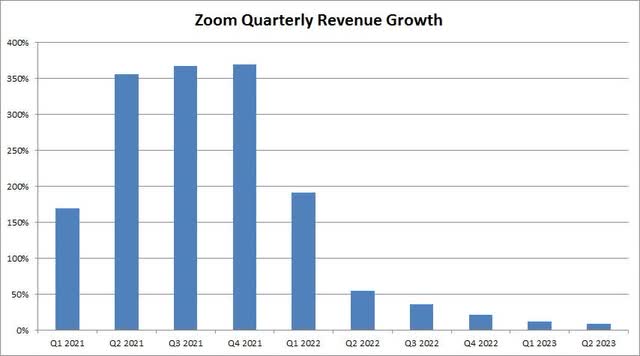

In its latest fiscal quarter before the coronavirus really took off, Zoom reported revenue growth of 78% year over year. That percentage was slowing a bit then though as the company was facing higher base numbers from prior year periods. However, things took off over the next couple of quarters, with the firm reporting a 369% increase in its top line for the Q4 2021 fiscal period. Growth has nearly evaporated since then, as seen in the chart below, with the latest quarter showing a revenue increase of just 8%.

Zoom Quarterly Revenue Growth (Company Filings)

For the fiscal second quarter, revenues came in a tad under $1.1 billion. This was below the street’s expectation for $1.12 billion, and was barely any sequential growth. What’s worse yet for the company is that fiscal Q3 guidance called for revenues to be between $1.095 billion and $1.100 billion. Not only does this imply a potential sequential decline for the company, but this range was handily below the average street estimate for $1.15 billion.

On the bottom line, Non-GAAP net income per share was $1.05, which did beat estimates by more than a dime. However, this number was down a bit from the second quarter of fiscal year 2022, where non-GAAP net income was $1.36 per share. On a GAAP basis, EPS came in at just 15 cents, down dramatically from the $1.04 reported in the year ago period. With GAAP operating income at its lowest point in more than two years, it is possible that we could even see a GAAP net loss in Q3 if expenses aren’t controlled enough.

Like revenues, the company also gave unimpressive guidance for Q3. Non-GAAP diluted EPS are expected to be between $0.82 and $0.83, whereas the street was looking for $0.92 in the third quarter. It’s also not good to see that while revenues will be flat to slightly down sequentially, management is calling for a more than 20% drop in non-GAAP EPS from Q2 to Q3, despite some helping coming from the buyback. This means that margins are compressing at a significant pace.

With earnings plunging from the year ago period, free cash flow also took a dive for Q2, falling from $455 million to $229 million. While the company is generating a good deal of cash still and has a strong balance sheet, it apparently is out of ideas to stimulate future revenue growth in the short term. Management did use almost $300 million to repurchase stock in Q2, but that’s hardly helping shareholders at this point.

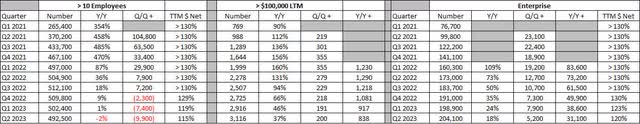

It’s not just revenue growth that has slowed dramatically at this point. As I discussed in my earnings wrap up three months ago, a number of key business metrics were showing some very troubling signs. If you look at enterprise customers, the growth rate continues to slow as the table below shows. The number added on a sequential basis was the lowest in more than two years, with the trailing twelve month net dollar expansion rate of 120% also showing a bit of weakness from prior quarters.

Key Business Metrics (Company Earnings Reports)

With Enterprise customers now representing 54% of the company’s total, this growth decline is an important item to watch for the future. The number of firms with more than 10 employees using Zoom also showed an accelerating drop, now coming in with a year over year decline. The net dollar expansion rate for this segment lost another 4 percentage points in the period, and is down more than 15 points in the last three quarters. Remaining performance obligations showed 37% growth over the prior year period, but that was down from 44% in Q1 and 66% in Q2 last year.

As for Zoom shares, they currently trade for a fraction of the more than $588 seen at the peak. Initially after Monday’s report, the average price target dipped from more than $125 to under $112. While that still implies decent upside from current levels, that analyst number was at more than $473 in early 2021 and we saw how that turned out. Shares dropped more than 16% on Tuesday, closing just a couple of bucks from a multi-year low.

This is another major disappointment for Ark Invest and Cathie Wood. The firm has put a $1,500 price target on Zoom for 2026, and yet the company’s results just keep disappointing. Whereas Ark Invest is calling for Zoom’s revenues to show accelerating growth, that’s just not happening now, with guidance calling for a sequential decline being a major red flag. Zoom is one of the top holdings in both the ARK Innovation ETF (ARKK) and the ARK Next Generation Internet ETF (ARKW), both of which are well off their all-time highs partially thanks to Zoom. As I mentioned in a previous article, Cathie Wood’s flagship fund had already seen more than twenty of its components with some sort of key miss during earnings season, so Zoom now adds to that list.

In the end, Zoom’s Q2 report on Monday was another awful one. The company missed street estimates for revenues, and while the adjusted bottom line beat, GAAP net income and free cash flow plunged from year ago levels. Guidance for Q3 was really bad, with revenues and adjusted earnings per share forecast to be well below analyst expectations. Key business metrics are also showing even more trouble than they were roughly three months ago. While Cathie Wood and her team see the stock soaring dramatically over the next 4 plus years, Zoom shares aren’t too far away from a new low, which could easily be seen in the coming days after Tuesday’s drop.

Be the first to comment