Michael Vi

Thesis

Veeva Systems (NYSE:VEEV) is the highest Quality Software as a Service (SaaS) company that I know of, delivering a combination of strong growth, a clean balance sheet and strong profitability. The company enjoys a deep and widening moat with very sticky products in a non-cyclical industry (life sciences) that is expected to grow around 6% annually. Most SaaS companies are plagued with low profitability, some appear to be highly profitable but after looking deeper, stock-based compensation often eats away at the shareholder value. In this article, I’ll compare Veeva to some other (previously) high-flying SaaS stocks and explain why I prefer Veeva’s way of doing business and the general problems of SaaS companies.

This article will focus on a comparison of the sector and advantages Veeva has, if you want to read a more in-depth article about the business of Veeva, check out my previous article on the company.

General problems with SaaS

Software as a Service companies have been on a crazy run-up over the last years until the bubble burst in November of 2021. The ISE CTA Cloud Computing Index (CPQ) has returned 200% from August 2017 until November 2021, vastly outperforming the S&P 500 and Nasdaq. Since November 2021 the index plunged 38% though, going down as much as 46%.

ISE CTA Cloud Computing Index (google)

SaaS companies are fast-growing software companies that aggressively spend on marketing and often are unprofitable or hardly profitable. Valuations on most of the popular names are still stretched, which led to the steep sell-off in a higher interest rate environment, when profits are discounted higher and especially profits out in the future aren’t popular anymore. To sum up the problems I want to talk about:

- Aggressive S&M spend

- Low profitability

- High stock-based compensation

- High valuations

Aggressive S&M spending?

Aggressive S&M is a common phenomenon in SaaS companies. A good way to measure the effectiveness of marketing spend is the Magic number, below is the definition from ‘The SaaS CFO’:

The SaaS Magic Number is a widely used formula to measure sales efficiency. It measures the output of a year’s worth of revenue growth for every dollar spent on sales and marketing. To think of it another way, for every dollar in S&M spend, how many dollars of ARR do you create.

I calculated this by dividing the incremental 12-month revenue increase by the last 12 months’ selling and marketing spend. You want to have a relatively high number, anything below 0.75 should be a yellow flag to consider if the amount of marketing spend is worth the cost. Salesforce (CRM), one of my investments, and ServiceNow (NOW) fall into this bucket. Both companies have tremendous marketing spending and should probably look at reducing it.

Veeva Systems has a very healthy magic number of 1.48 and the lowest S&M/Revenue ratio out of the 10 companies. We can see that most companies have relatively high ratios with some spending more than 50% of their revenue on marketing. This requires extremely high growth rates to make the spending worth it. The companies that stand out in this comparison are Bill.com (BILL) and Datadog (DDOG) due to the especially high Magic number close to 3 and the aforementioned CRM and NOW with Magic numbers under 1.

The reasoning for this disciplined approach to S&M can be found in this 2017 interview with CEO and Founder Peter Gassner. In it, he mentioned that he wants sustainable growth and doesn’t like desperate salespeople. He rather hires fewer salespeople and sacrifices some extra bad revenue for higher quality customer relations.

SaaS S&M spending (Koyfin)

Low Profitability and high stock-based compensation?

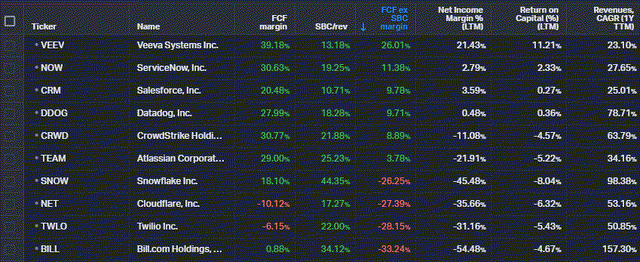

Due to the previously discussed high spending on customer acquisition, SaaS companies often operate at a loss or close to it. If we just look at the Free Cash flow margin, it doesn’t look that bad. 7/10 of the companies with margins between 18 and 39%, just 2 companies with negative FCF margins. The problem is that most SaaS companies incorporate stock-based compensation programs as a major part of employee compensation. In a highly competitive landscape, these incentive packages are needed to retain quality employees, a big costly issue with the SaaS business. I added an SBC/Revenue column and we can see that every company dilutes current shareholders heavily. From 10% of revenue (Salesforce) to 44% of revenue (Snowflake) it is a wide range. Veeva is on the low end with 13% of revenue. When assessing the profitability of a company we have to factor in these costs, even though most companies don’t in their investor relations. This dilution is a real cost to shareholders because, after all, we want to maximize the value per share. For that reason, I subtracted SBC from FCF to get to the FCF margin excluding SBC. This paints a very different picture and all of a sudden only 2/10 companies have margins over 10% (with ServiceNow just barely at 11.38%). Veeva really sticks out here with a phenomenal 26% FCF margin ex SBC, leagues ahead of the competition. The same picture is shown in the Net income margin and especially in the Return on Capital, where Veeva is the only company achieving a ROC higher than its WACC(weighted average cost of capital), according to GuruFocus, the company’s ROC is also significantly higher at 26%.

CEO Gassner is a frugal investor that from the beginning ran Veeva with a hurdle rate for everything he did, a rare sight in the SaaS world and a differentiating factor for Veeva.

SaaS comparison profitability (Koyfin)

High Valuation?

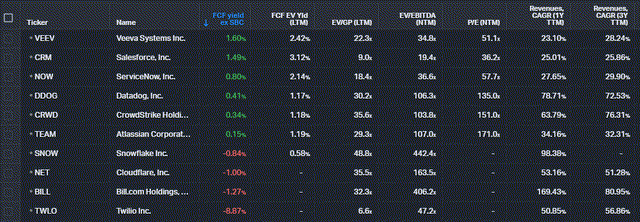

At this point, we established that Veeva is an outstanding company, but even the best company can be a bad stock if we buy too high. If we look at the valuation of the list we see that all have high valuations, Salesforce being the cheapest. The PE ratio is elevated for all the companies and FCF yields aren’t too juicy either after accounting for SBC. The reason it might be worth it to invest in Veeva anyways though is the high visibility, durability and longevity of the earnings growth this company will most likely experience. With most revenue being recurring and a Net retention rate above 120% on top of long-term contracts with a sticky ecosystem chances are high that this company will compound for a very long time.

SaaS comparison valuation (Koyfin)

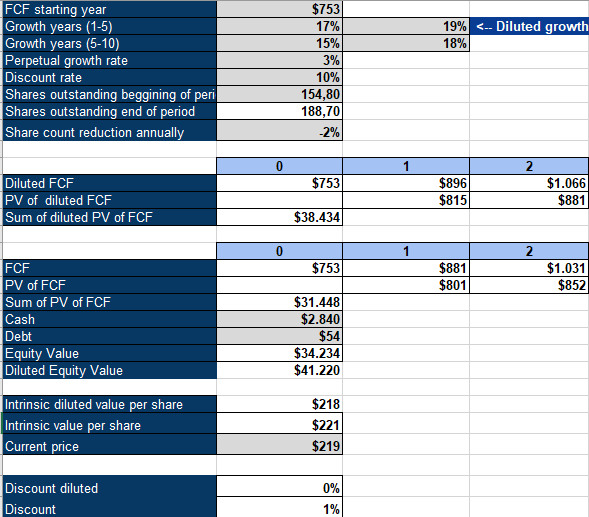

Another way I like to look at valuation is through an inverse DCF model. Assuming a 2% annual dilution the current share price of $219 assumes 18-19% FCF growth over the next decade. This is higher than Seeking Alpha’s Consensus Earnings growth projections, but I think it can be achieved.

Veeva Systems inverse DCF (Authors model)

Conclusion

To conclude, Veeva Systems is an outstanding SaaS company with the best management team in my opinion in the sector. Profitable growth has a long runway, but it is hard to rate this a buy at this still elevated valuation. I own shares and I continue to slowly DCA into it every month, but I wouldn’t put a lump sum of money into the stock right now. I’d want the growth estimates to be around 15% for a larger one-time investment on top of my existing position.

Be the first to comment