Pixelimage/iStock via Getty Images

Introduction

After Vector Group (NYSE:VGR) saw their economic resilient tobacco business save the day during the severe downturn of 2020, they fortunately also saw their Douglas Elliman real estate business segment capitalize upon the surging real estate market during early 2021 as the economy rebounded, as my previous article explained. Fast forward almost one year later and they have elected to spin-off this real estate business segment to further simplify their company structure, although sadly, it now sees their dividend safety looking thin without Douglas Elliman (DOUG), thereby jeopardizing their high 6.14% yield.

Executive Summary & Ratings

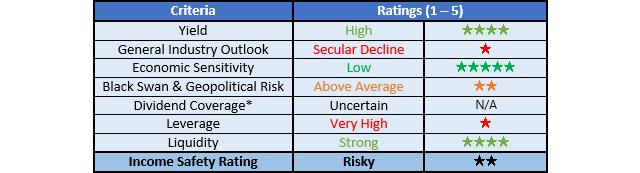

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

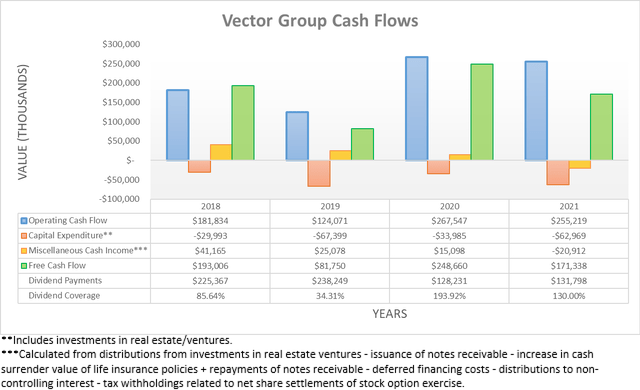

Since their Douglas Elliman spin-off did not occur until the second last day of 2021, their cash flow performance during 2021 still includes its contributions, thereby explaining why their operating cash flow of $255.2m is very similar to their previous result of $267.5m during 2020. On the surface, this appears to have been another business-as-usual year, although when digging deeper, there are two other factors to consider that skewed their surface-level results.

The first factor stems from their working capital movements, which saw a $19.4m build during 2021 versus a $3.2m draw during 2020, which if both removed, would see their underlying operating cash flow increasing a handy 3.85% year-on-year to $274.6m versus their equivalent previous result of $264.3m during 2020. Meanwhile, the second factor relates to their tobacco liability Master Settlement Agreement payments, hereon referred to as MSA payments, which were $36.9m higher during 2021 versus 2020, thereby unfavorably skewing the comparison.

Even more important is their remaining residual operating cash flow when looking ahead following their Douglas Elliman spin-off. When utilizing the financial statements of the latter, it shows their operating cash flow during 2021 was $127.8m or $131.1m once removing their relatively small working capital build, as per their 2021 10-K. Once subtracted from their underlying operating cash flow excluding additional MSA payments, it leaves an estimated underlying residual operating cash flow for their remaining company of $175.1m and given the low growth nature of their now tobacco-focused company, it seems unlikely to expect significant changes during 2022.

Since their latest outstanding share count is 153,868,177, it will cost $123.1m per annum to fund their dividend payments, thereby consuming the majority of this estimated underlying residual operating cash flow even before considering their capital expenditure. Whilst this will decrease too, only a very minimal $4.1m was attributable to Douglas Elliman, as per their previously linked 2021 10-K. This means that the vast majority of their $63m of capital expenditure during 2021 was attributable to their remaining Liggett tobacco business segment as well as their less important and relatively smaller New Valley business segment. Whilst it remains to be seen how much they direct towards capital expenditure during 2022 and beyond, if continued near $60m as during 2021, it would require upwards of $180m of operating cash flow to remain cash flow neutral, which given these estimates, looks difficult and thus as a result, even at best, their dividend coverage appears thin, which hinders their dividend safety.

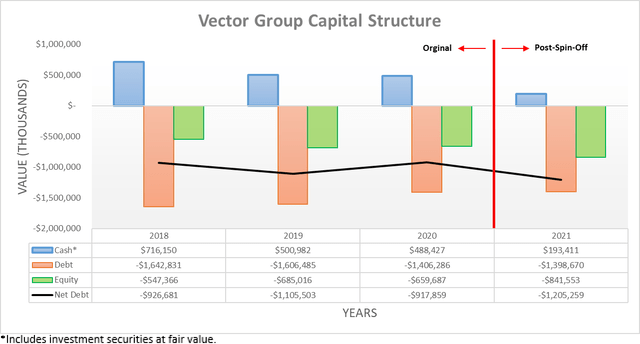

Whilst their cash flow performance throughout 2021 still included their Douglas Elliman business segment, their balance sheet and thus capital structure now reflects their post-spin-off era, which most noticeably sees their cash balance decreasing to $193.4m versus its previous level of $488.4m at the end of 2020. Thankfully their continued cash balance still remains relatively sizeable, although since their debt is essentially unchanged at $1.399b, this still now sees their net debt ending 2021 at $1.205b and thus a significant 31.31% higher year-on-year versus its previous level of $917.9m at the end of 2020.

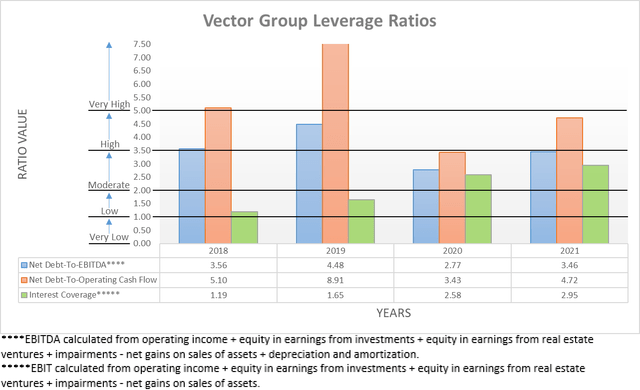

Quite unsurprisingly, their higher net debt saw their leverage climb higher, which is obviously not positive for the safety of their dividends going forwards, thereby further compounding the risks posed by their prospects for thin coverage. This saw their net debt-to-EBITDA increase to 3.46 at the end of 2021 versus its previous result of 2.77 at the end of 2020, which now sits at the cusp of the high territory of 3.51. Meanwhile, this also saw their net debt-to-operating cash flow increase to 4.72 versus its previous result of 3.43 during these same periods of time, which has now gone from sitting at the top of the moderate territory towards the top of the high territory.

Whilst this is already not ideal, these results still include the benefits of their Douglas Elliman business segment, which if removed, would obviously see their leverage surging even higher to concerning levels. To provide an example, if utilizing their previously estimated underlying residual operating cash flow of $175.1m for 2021, which as a reminder excludes the portion attributable to Douglas Elliman plus their working capital build and additional MSA payments, it sees their net debt-to-operating cash flow at 6.88 and thus well above the threshold for the very high territory of 5.01. Even without their uncertain dividend coverage outlook, this would have already made their dividends risky and thus even further raises the stakes.

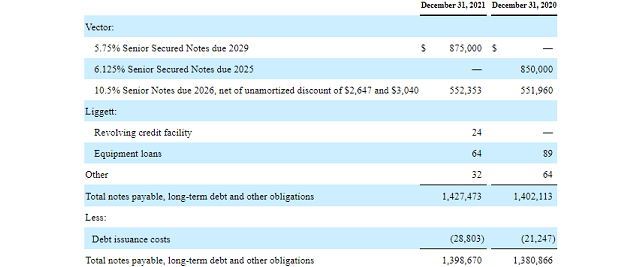

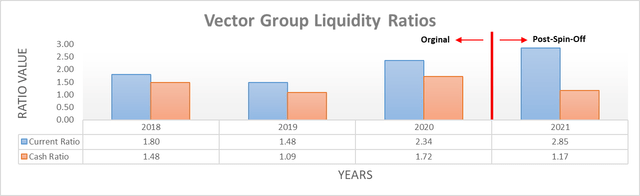

Whilst their spin-off has been detrimental for their dividend coverage and leverage, thankfully their continued relatively sizeable cash balance has ensured that liquidity remains strong with a current ratio of 2.85 and a cash ratio of 1.17. Although on the other hand, their credit facility only retains a relatively minor $80.8m of availability despite not being heavily drawn upon, which implies that as a relatively small tobacco company, debt markets are not necessarily too interested in extending financing. This makes maintaining their relatively large cash balance very important and thus as a result, they cannot safely plug holes in their dividend coverage, thereby reducing its safety. If they were facing impending debt maturities, this would be very concerning but thankfully, their nearest one does not fall due until 2026 and thus they have years of breathing room, as the table included below displays.

Vector Group 2021 10-K

Conclusion

Whether their Douglas Elliman spin-off unlocks value for their shareholders in the medium to long-term remains to be seen, although it remains abundantly clear that it has not only deteriorated their dividend coverage but also sent their leverage surging to very high levels. When combined, these are toxic for the safety of their dividends, which remain a core appeal of their now tobacco-focused company and thus offsets the desirability of their high yield, which I believe makes maintaining my hold rating appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Vector Group’s SEC filings, all calculated figures were performed by the author.

Be the first to comment