suteishi/E+ via Getty Images

Introduction

The now almost pure-play tobacco company Vector Group (NYSE:VGR) reported its second-quarter results on August 5 – it is the second quarterly report of the company after the spin-off of most of its realty operations (Douglas Elliman Inc. (DOUG)) in late December 2021. I have already reported on the company in December and discussed its expected earnings power and balance sheet strength after the spin-off.

With the second quarter results on the table, I thought it appropriate to take a closer look at the company’s performance and recall that DOUG was spun off essentially debt-free, while the arguably highly cash-generative tobacco remainco had more than $1.4 billion in debt and lease obligations to shoulder. In this article, I will not elaborate on the results of the remaining real estate business – with half-year revenues of $15.9 million (i.e., 2.3% of total revenues) and mostly only minority interests in several properties, it is hardly significant.

While Tobacco Majors Report Declining Volumes, Vector Reports Strong Growth

Vector’s tobacco business unit (Liggett) reported quarterly sales growth of approximately 13.6% year-over-year, driven by a 16.2% year-over-year increase in quarterly volumes. Excluding excise taxes, sales growth was still in the double digits (12.2%). However, Vector’s cost of sales also increased sharply, leading to a decline in gross margin of 11.6 percentage points to 48%. However, according to management, the decline in gross margin is not only due to the increase in deep-discount cigarette volume (Montego brand), but also to “a difficult year-over-year comparison due to increased wholesale inventory in the second quarter of 2021 and increased MSA costs”.

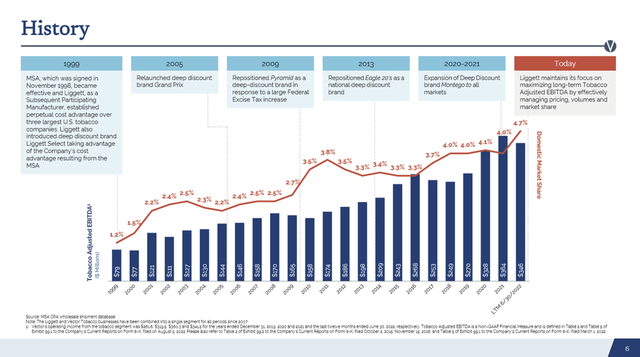

Liggett, which includes discount cigarette brands such as Eagle 20’s, Pyramid, Montego, Grand Prix and others, increased its market share to over 5% from just over 4% in the year-ago quarter. In principle, this is not surprising, as people have less disposable income in their pockets due to high inflation. According to management, the retail prices of Montego, Eagle 20’s and Pyramid are about 50%, 30% and 15%, respectively, below those of leading premium brands. Vector is able to operate profitably at such deep discounts in part because of the company’s favorable treatment under the Master Settlement Agreement (MSA) due to its small sales volume (slide 5, Q2 earnings presentation). However, this likewise implies that Vector’s growth prospects are quite limited. In any case, the expansion of the company’s market share since 1999 (Figure 1) is worth noting, and as a still small company, I would not over-interpret the MSA-related growth constraints. It appears that Liggett has been taking market share from major tobacco companies Altria Group (MO) and Imperial Brands’ (OTCQX:IMBBY) U.S. subsidiary ITG Brands, while British American Tobacco (BTI) (through Reynolds American) has increased its market share through the acquisitions of Newport and Santa Fe, while its legacy brands’ market share continues to decline.

Figure 1: Slide 6 of Vector’s Q2 2022 earnings presentation (taken from seekingalpha.com)

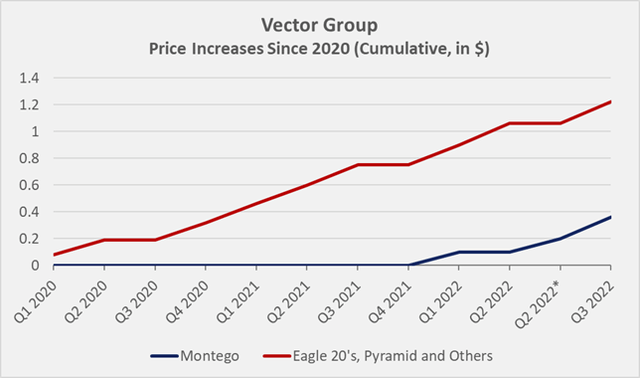

The impact of increasing price consciousness among consumers in a highly inflationary environment was discussed in my previous article, and slide 7 of Vector’s second quarter 2022 presentation illustrates the change in behavior very well – premium brand volumes declined by 8.9% in the latest 12-month period ending June 30, 2022, while the decline in traditional discount brands’ volume by 12.9% is somewhat surprising, considering that the segment includes all of Liggett’s brands except Montego, which is a deep discount brand (i.e., average selling price at least 40% below that of the leading premium brands). This segment grew by 14.3% in volume terms. However, it remains to be seen whether the deep-discount segment will continue to grow strongly for the remainder of the year, as Vector did not increase Montego’s price per pack until January 2022, while list prices for the other brands have increased by $1.22 per pack since January 2020 (Figure 2). On a positive note, Vector’s brands are predominantly sold in non-EDLP stores. “Every Day Low Price” stores are required to sell brands at a price equal to or lower than the lowest price offered for all brands sold in the store. Overall, Liggett’s presence is concentrated in tobacco outlets and discount mass merchandisers rather than convenience stores. However, I would be cautious about extrapolating market share growth into the future, as I believe consumers are adapting relatively quickly and most of the trading down to discount brands has already occurred.

Figure 2: Price increases of Liggett’s brands since 2020 (own work, based on the data found on slide 10 of Vector’s Q2 2022 earnings presentation)

A Look At Vector’s Half-Year Balance Sheet

In my last article, I pointed out that I considered VGR’s balance sheet to be relatively weak. Financial debt of $1.4 billion resulted in interest payments of over $100 million in 2021, which is quite significant considering the three-year average normalized free cash flow of $190 million. However, as Vector’s three-year financial statements published in March 2022 – on which the above calculation is based – still include cash flows attributable to the spun-off Douglas Elliman, the free cash flow of the tobacco business is likely to be in the order of $150 million. As a result, Vector’s interest coverage ratio is quite low. Not much has changed in the first half of 2022, and the company still has $1.4 billion of debt outstanding, consisting of 5.75% senior secured notes due 2029 ($875 million) and about $550 million of 10.5% senior unsecured notes due 2026.

The Company effectively “exchanged” its 6.125% notes issued in January 2017 for 5.75% notes (i.e., a 37.5 basis point discount) in February 2021. Compared to the monthly-average three-month LIBOR rates of 1.026% in January 2017 and 0.190% in February 2021 (i.e., an 83.6 basis point decline) on which the long-term rates are likely based, the relative premium paid by Vector appears reasonable and does not suggest desperation. The relatively low interest rate given Vector’s risk profile at that time is certainly due to the collateralization of the bonds (p. F-39, 2021 10-K).

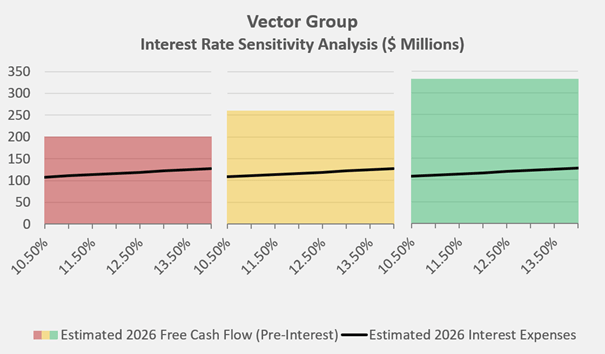

However, with rising interest rates and the approaching maturity of the 10.5% senior unsecured notes, one might think of a potential increased interest rate risk for Vector. The first tranche of notes was issued in a private placement in November 2018, when the monthly-average three-month LIBOR rate was 2.649%. So far in 2022, that rate has increased 265 basis points to 2.901% in August. Personally, I expect the Federal Reserve to stop raising interest rates at a long-term rate of around 4.5% (which is, of course, a more or less blind guess), so it does not seem unreasonable to expect that Vector will be able to refinance its 10.5% notes at a fairly similar or probably slightly higher rate. Figure 3 shows a sensitivity analysis that assumes the company’s free cash flow declines or grows by 5% per year or does not change at all, and that Vector refinances its notes at a rate between 10.5% and 14.0%. Even in the unlikely event that Vector’s free cash flow declines at an annual rate of 5%, the company will be able to service its debt. Of course, the dividend would be in danger of being cut because the company currently pays out $0.80 per share annually, which translates to more than $120 million in related expenses per year. In my opinion, it does not seem unreasonable to expect that the company is able to grow its free cash flow at a low- to mid-single digit rate, considering the previously discussed positive development of its tobacco business and the company’s free cash flow generated to date in the first half of 2022 (p. 7, Q2 2022 10-Q). However, investors should keep a close eye on the company’s gross margin going forward.

Figure 3: Interest rate sensitivity analysis, taking the refinancing of the 10.5% 2026 notes into account; note that the pre-interest estimate of free cash flow is a rough estimate as it does not factor in a potential tax-shield effect (own work, based on the company’s 2021 10-K and own estimates)

Bondholders of Vector Group’s 10.5% bonds appear to share my assessment of the company’s financial condition, namely that the company is not in danger of insolvency, although it is certainly not a low-risk company. The notes’ price fell along with the broader market in June 2022, bottoming out at 92 cents on the dollar. Since then, they have returned to par value levels. By comparison, in the midst of the pandemic-driven sell-off, the bonds briefly traded for less than 80 cents on the dollar, due in part to the company’s much greater exposure to the real estate market and, of course, the acute liquidity crisis at the time.

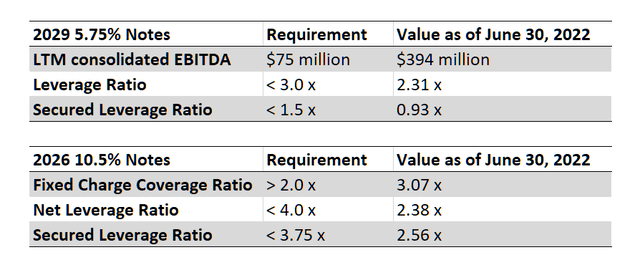

In addition to the unchanged gross debt, it seems worth noting that cash and cash equivalents increased significantly compared to year-end 2021, from $193 million to $324 million, confirming that the tobacco business throws-off significant amounts of cash. However, considering that the company also reported a nearly $140 million increase in cash and cash equivalents at the end of the first half of 2021 compared to year-end 2020, one might conclude that the increase in cash is not due to improved cash flow conversion, even if the prior year results still include Douglas Elliman. In any case, Vector Group’s liquidity remains strong, and it is a stretch to conclude that the company is on the verge of insolvency. This is also underscored by the positive test results associated with the requirements set forth in the debt covenants of Vector’s 5.75% and 10.25% notes:

Table 1: Test results associated with the requirements listed in Vector’s debt covenants; LTM means “last twelve months” (table based on data found on p.47 et seqq., Q2 2022 10-Q)

Concluding Remarks

Vector Group has delivered a strong performance in the first half of 2022. The tobacco business is very resilient and continues to grow, both in terms of volume and sales, while major tobacco companies Altria Group and Imperial Brands continue to experience volume declines. The company’s deep discount segment (Montego cigarette brand) is primarily responsible for the strong performance, but investors should keep an eye on future price increases, as the brand has experienced much more moderate price increases to date than traditional discount cigarette brands such as Eagle 20’s and Pyramid. It should also not be forgotten that the gross margin of the tobacco segment fell by 11.6 percentage points in the first half of 2022 compared to the same period of the previous year.

Vector’s management continues to play a risky game from a debt perspective, largely due to paying too high dividends in the past. Based on my estimates, I doubt the company will have trouble refinancing its 10.5% notes due 2026, but interest coverage remains relatively low and the dividend payout ratio is pretty high, even after the dividend cut announced during the Q3 2019 earnings release. The dividend is currently covered by free cash flow and most likely will continue to be so given the good performance of the business, but it seems unreasonable to expect dividend increases.

Personally, I would only want to own Vector as an income-generating asset, but the combination of a non-growing dividend of currently $0.80 per share (7.5% yield), the high payout ratio, and the weak interest coverage is a disqualifier for investing. I therefore continue to rate the stock a “Sell”, even though I am positively surprised by the recently reported market share gains, which, however, came at a significant cost from a margin perspective.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to read from you in the comments section below.

Be the first to comment