Pavel Byrkin

Thesis

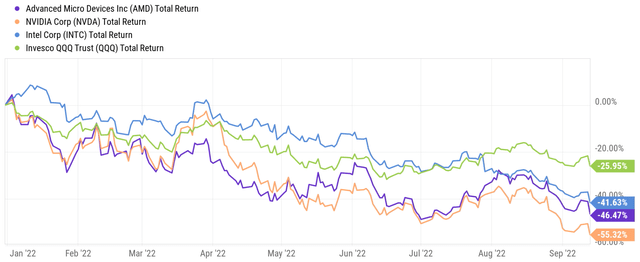

Chips stocks are experiencing a bloodbath lately given their highly cyclical nature. The brewing economic trouble ahead, such as red-hot inflation data and mounting geopolitical tensions, adds further fuel to the fire sale. The NASDAQ 100 index has suffered more than a 26% correction YTD. Against this overall backdrop, all the leading chips stock have suffered far worse losses, as seen. To wit, Intel (INTC) has retreated by more than 41% and ironically is the “best performing” major chips stock in the past year. Nvidia (NVDA) suffered a loss of 55.3%, which will require a 123% rally to break even.

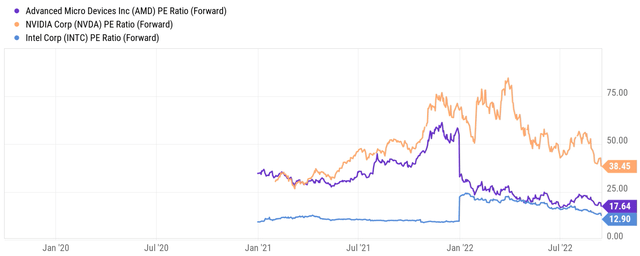

And the main topic of today, Advanced Micro Devices, Inc. (NASDAQ:AMD) has suffered a loss of more than 46%. The combination of such price correction and earnings growth has now bought AMD’s FW P/E to about 17.6x (less than ½ of NVDA’s 38x FW P/E). As you can see from the chart below, this is the lowest level since 2021, and also a very attractive level in multi-years. The valuation is even more compressed when adjusted for its growth potential. As you will see in a later section, its P/E/growth (“PEG”) ratio is now only 0.57x, and a simple reality check will show a highly asymmetric return profile in the next few years.

On the other hand, business fundamentals remain strong. AMD currently provides the best product lineup not only in its own history but also arguably in the industry. As to be elaborated immediately below, I see both the Zen4 CPU and Xilinx synergy as key drivers to unlocking its next growth cycle. They will further strengthen its already strong product lineups, widen its moat, and sustain its pricing power for years to come.

Source: Seeking Alpha data Source: Seeking Alpha data

Xilinx and Zen4 further strengthen product lineup

AMD currently features the best product portfolio not only in its own history but also arguably in the industry. These products include a rich mix of lineups such as EPYG server processors, high-end Ryzen processors, and premium gaming consoles. These products successfully cater to critical high-grow market sectors including desktop and mobile computing, PC and gaming, GPU, data center, et al. As a result, many segments have been posting robust growth. Take the Computing & Graphics and the Enterprise, Embedded & Semi-Custom segments as an example. Both feature some of the most advanced products and had been posting hefty double-digit YoY in the March quarter.

Source: AMD 2022 Q2 earnings release

Admittedly, the business reported some headwinds in the June quarter. Growth slowed down and margins are under pressure (as to be elaborated on in the next section). However, I see such issues to be temporary and part of the normal business cycle. The products are what matters in the end at a fundamental level. And I see both its Xilinx acquisition and Zen4 as making its already-strong product portfolio even stronger. AMD completed the $35 billion Xilinx acquisition in mid-February, and it has already been additive to existing operations. It added nearly $560 million to the top line during the short period after its acquisition. And the potential synergist benefits are only getting started in areas like AI, as commented by CEO Lisa Su in the Q2 earnings release (abridged and emphases added by me):

… we have identified greater than $10 billion in long-term revenue synergy opportunities as we bring the AMD and Xilinx assets together. Our largest opportunity is in AI and we have already started executing new hardware and software roadmaps to capture the significant opportunity we see to drive pervasive AI across cloud, edge and endpoints.

At the same time, the launch of the long-expected Zen4 processors is on track, as also commented Dr. Lisa Su in the Q2 earnings release (abridged and emphases added by me):

… we are on track to launch our all-new 5-nanometer Ryzen 7000 desktop processors and AM5 platforms later this quarter, with leadership performance in gaming and content creation. Taking a step back, while there has been additional softness in the PC market in recent months, we believe we are very well positioned to navigate through the current environment based on the strength of our existing product portfolio and upcoming product launches.

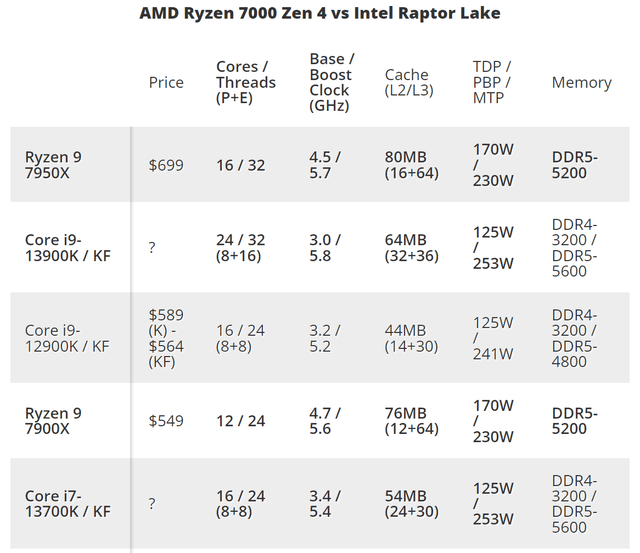

These new Zen4 chips are expected to compete with Intel’s Raptor Lake series. The chips offer the “six fives,” features highly anticipated by high-end users like content generators and gamers: DDR5 memory, PCIe 5.0, 5nm, AM5, and 5.5 GHz+ clock speed. The 16-core Ryzen 9 7950X is the flagship in the new series. AMD claims it to be the fastest CPU in the world and it will come at a premium pricing of $699, which will help to further strengthen AMD’s margin and growth, as detailed next.

Headwinds and margin pressures

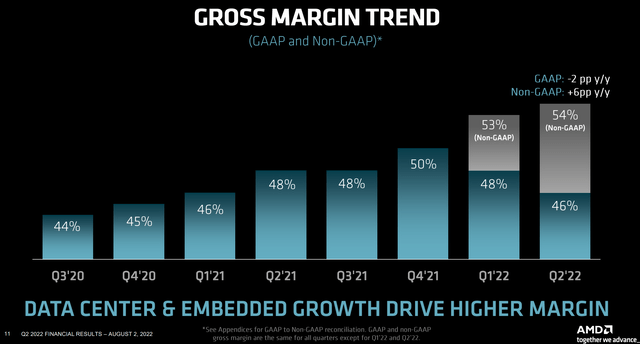

As aforementioned, the business reported some headwinds in the June quarter. Growth is expected to slow down in the coming quarters and margins are under pressure. Under GAAP basis, Q1 2022 gross margin came in at 48%, 200 basis points below the 50% record set in Q4 2021. And Q2 2022 gross margin contracted by another 200 basis points to 46% as seen below.

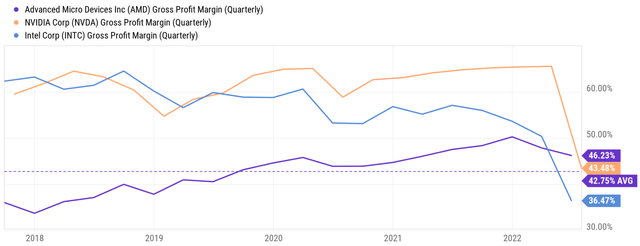

To put such pressure under a broader perspective, the following chart compares AMD’s gross margin in recent years to NVDA and INTC. As seen, there is little doubt that the whole chip sector is currently going through a contracting phase of the cycle. All leading stocks have seen a sharp compression in their margins. NVDA suffered the most, with margin nosing diving from a peak of almost 65% in the previous quarter to the current level of 43%. AMD’s margin suffered the least. And its current margin of 46% is still above its long-term average of 42.75% and also above both NVDA and INTC.

Going forward, I see both the Zen4 release and Xilinx synergy to help maintain its margin advantage. As mentioned, I expect the leading performance and premium pricing on Zen4 to create margin headwinds. I also expect the Xilinx synergy to add scale and scalability and to improve overall cost absorption. In the March quarter, the cost of goods sold declined 180 basis points as a percentage of total revenues thanks to better cost absorption.

Reality check and projected returns

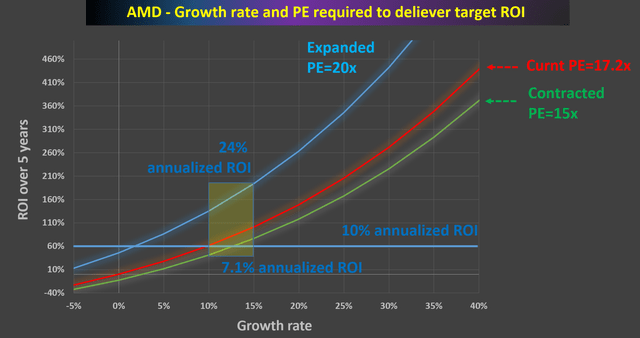

Based on the above valuation comparison and business fundamentals, the following chart shows a back-of-the-envelope calculation of projected returns in the next 5 years. This is what I call a reality check or a common-sense test. It is an estimate of the growth rate required to deliver a target ROI in the next five years. In particular, the light-blue horizontal lines mark the growth rate and valuation required to deliver a 10% annual return (1.1^5 = 160%).

The red line shows the returns if the valuation remains constant at the current levels of 17.2x P/E. The blue line shows if the P/E expands in the next 5 years to 20x. And finally, the green line shows the scenario of a P/E contraction to 15x. Under these assumptions, the purple box shows where I think the most likely return scenarios would be. As seen, AMD is projected to provide an annual return between 7.1% to a whopping 24% assuming a growth rate between 10% to 15%.

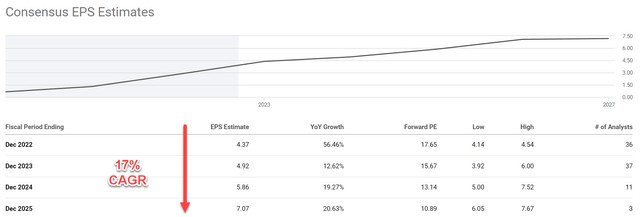

And as you can see from the 2nd chart below, the consensus estimates project a 17% CAGR in the next few years. Thus, the assumption of a growth rate between 10% to 15% represents a conservative projection.

Source: Author based on Seeking Alpha data Source: Author based on Seeking Alpha data

Risks and final thoughts

Besides the margin pressure mentioned above, AMD also faces other risks. As a highly cyclical stock, the projected growth rate could contain large uncertainties. These uncertainties are capsulated in the large variance in the consensus forecasts as shown above. The variance between the optimistic and pessimistic forecasts is more than a factor of 1.5x for 2024 FY for example (EPS of $5.0 on the lower end to $7.52 on the high end). In terms of annual rate, the low-end forecasts predict an 11% CAGR between now and 2025 (from an EPS of $4.37 in 2022 to $6.05 in 2025), and the high-end estimate projects a 21% CAGR (from an EPS of $4.37 in 2022 to $7.67 in 2025). Although as described in my simple reality-check, even a conservative assumption of 10% to 15% growth rates could lead to solid returns.

To conclude, chip stocks are notorious cyclical and AMD is no exception. And there is little doubt that we are going through a contracting phase of the cycle. The stock has lost more than 46% in the past year and more than 9% in a single day on 9/13. Such large corrections, combined with its healthy fundamentals, have created a high asymmetric risk/reward profile. Under current conditions, a 20%+ annual return is likely even under conservative growth scenarios. And the downside is limited even if valuation further contracts.

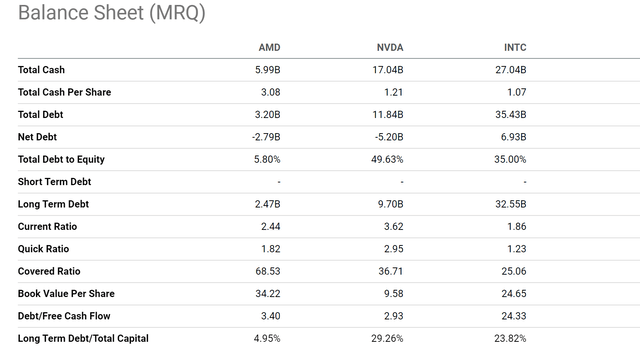

Finally, the stock also features a strong balance sheet, a key to survival in a highly cyclical sector. As seen in the chart below, currently, AMD has about $5.99 billion of cash on its ledger, translating into $3.08 per share. It has some debt ($3.2B) but the debt is lower than the cash position. As a result, it carries a net cash position, a sizable $2.8B, on the ledger. When we subtract the cash out of the stock price, its PE would become even lower (slightly though, by about 1.8%). Lastly, as you can tell from the following comparison, AMD has the strongest balance sheet among its peers in terms of debt-to-equity ratio (only 5.8%) and debt-to-total-capital ratio (only 4.9%).

Be the first to comment