Scharfsinn86

Due to the Energy Crisis in the Midst of the Energy Transition Towards a Cleaner World, Sustainable Fuels Are by No Means Cheap

The rise in oil and gas prices caused by the war in Ukraine has made airline tickets more expensive, but this does not mean that flying could become much cheaper if aviation could replace petrol and diesel with alternative and greener fuels, as these are also quite expensive.

With traditional hydrocarbons in short supply in the market due to OPEC’s hostile policies, the demand to process additional Sustainable Aviation Fuel [SAF] as part of greenhouse gas emission reduction and carbon neutrality goals, is also generating strong upward pressure on the price of this commodity.

What SAF Can Do for the Environment and How to Take Advantage of the Higher Prices in the Markets

SAF is made from renewable resources, but that doesn’t mean the chemistry is really different from traditional fossil jet fuel, it’s actually very similar. But when SAF is used in place of traditional jet fuel, there is a significant reduction in carbon emissions over the life cycle of the fuel.

To take advantage of strong momentum in renewable jet fuels, as has been the case for several months with rising oil and gas prices, greater exposure to the commodity through its US-listed suppliers could prove profitable if they have strong growth prospects.

Gevo, Inc. (NASDAQ:GEVO) is currently working on projects to provide the aerospace industry with renewable fossil fuels.

Aiming to become a leader within a few years, the company focuses on projects that allow very rapid business expansion.

If the growth strategy is successful, the stock price could potentially improve exponentially from $2.65 per share [as of this writing], making the investment opportunity look very interesting today, albeit with significant risk. Investors also need to be aware of this.

Gevo Shares Compared To The Commodity And Stock Markets; A Risky Investment, But With Huge Positive Repercussions If Growth Takes Place

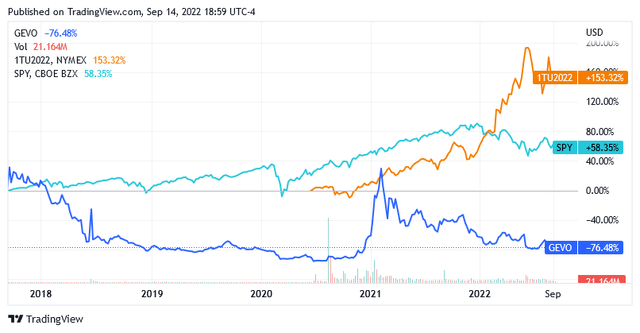

The stock’s recent price action suggests that the shares are developing more like the stock market than the commodities the company will be offering.

SPDR S&P 500 ETF Trust (SPY) is used as a benchmark for the US stock market and Jet Fuel Futures for sustainable aviation fuel.

The stock is driven by an elevated market volatility ratio, as evidenced by a monthly beta of 3.22 over the past 5 years, meaning a decline in the S&P 500 should cause Gevo’s stock price to plummet.

To get out of this peril, the stock needs to make significant strides in its pipeline to transform itself into a SAF market leader so it can track the commodity it aims to deliver.

A failure of the Gevo growth project increases the likelihood that the stock price will fall to even lower levels than the current ones as more bearish sentiment looms in the near term due to the central banks’ hawkish stance-induced recession.

Acquiring shares in Gevo is therefore a risky investment, but if the growth into a leading SAF market player continues steadily, the impact on the value of the stake could be very positive.

The chances of success are not slim as Gevo could gain a better negotiating position vis-à-vis its customers, which would facilitate the financing of the US SAF supplier’s renewable fuel projects.

Gevo will attempt to leverage airlines’ hasty recourse to multi-year SAF deals to hedge against the expected sharp rise in the SAF price due to specific geopolitical conditions and global environmental protection plans, as noted at the beginning of the article.

What is Gevo, Inc. Doing in the Basic Materials’ Specialty Chemicals Industry?

Gevo, Inc. is an Englewood, Colorado-based renewable fuels operator with a mission to support the commercialization of gasoline and jet/diesel fuel while avoiding carbon emissions and working with sustainable technologies to abate greenhouse gas emissions.

The Expansion Takes Place Through the Realization of Project Debt Financing

The company took a significant step towards becoming a leader in the SAF market by signing an agreement to sell fundable fuel with American Airlines (AAL) last July, which has been added to Gevo’s portfolio will.

This is practically a milestone as the US airline will receive Gevo’s annual shipment of 100 million gallons of SAF. With a main fleet of 865 aircraft operating passenger and cargo air transport services through key US hubs and relevant gateways for foreign partners, AAL is such a customer that it will be much easier for Gevo to obtain lender approvals for project financing.

Gevo’s portfolio is growing by more than 40% to the current 350 million gallons or more of SAF to supply annually to aircraft operators for a minimum period of 5 years.

The agreements can guarantee funds estimated at over $2 billion a year or about $11 billion or more over the next 5 years to support the increase in SAF’s renewable fuel production capacity up to what is worthy of a leader.

Since early 2021, Gevo has been developing an energy-dense form of liquid hydrocarbons from renewable energy sources on 245 acres in South Dakota near Lake Preston. This project is called the Net Zero 1 Project.

The property is surrounded by plentiful sustainable corn and high demand for protein feed. It is served by rail transport and has significant potential for generating energy from renewable sources.

The Net-Zero 1 project expects net-zero emissions of CO2 and other greenhouse gases over the lifetime of the company’s fuel production, including the combustion of the fuel not only in an engine but also in the boiler.

Each year, Net-Zero 1 is expected to deliver more than 60 million gallons of jet fuel and gasoline from renewable sources.

Once Gevo has completed some initial engineering activities and project planning, it will be able to determine the cost of capital with greater precision than a preliminary estimate for Net-Zero 1 of $700 million to $800 million.

Gevo indicates having enough money to fully fund Net-Zero through equity investments, but other financing solutions are currently being explored. While Net-Zero Projects 2, 3, etc. in the region are being evaluated for acquisition and future development as the company wins additional fundable contracts to supply SAF and hydrocarbon fuel.

Other projects include Gevo’s current commitments to ramp up renewable natural gas production from dairy manure. Renewable natural gas [RNG] is provided for the Californian market.

Besides SAF and RNG, sustainable projects also include renewable fuels and diesel, as well as isooctane and isobutanol. Plus isobutylene, ethanol, animal feed and animal protein.

Thanks to a strategic alliance partnership with Axens North America, Inc., an international expert in hydrocarbon and alternative fuel management, Gevo can also participate in the commercial development of ethanol-to-jet and sustainable aviation fuel technologies.

Financial Position: No Real Risk of Major Financial Issues Ahead

As of June 30, 2022, the balance sheet had $470 million in cash on hand and short-term investments, which was abundantly above the total debt of approximately $92 million.

Gevo has an Altman Z-Score of 2.77, meaning the company is still in a grey area from a financial perspective, but not far from safe areas. The score does not rule out the risk of bankruptcy, although it currently seems unlikely.

Stock Valuation: Shares Are Worth Considering also from a Purely Technical Point of View

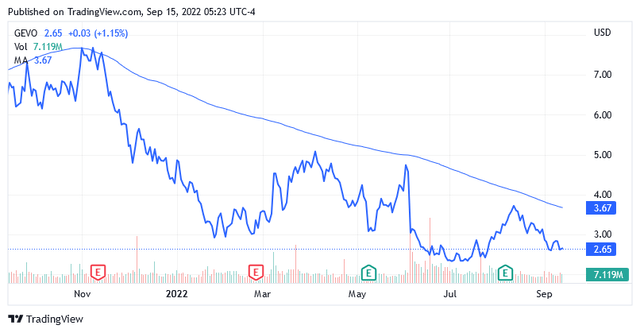

Shares are changing hands at $2.65 for a market cap of $646.88 million and a 52-week range of $2.18 to $7.93 as of this writing. This stock price doesn’t look expensive at all, as some comparisons below with certain technical indicators show.

The stock price is currently low compared to recent valuations as it is 50% below the $5.055 midpoint of the 52-week range. In addition, this stock price is well below the long-term trend of the 200-day moving average of $3.67, as the following chart shows.

The 14-day relative strength index of 40.06 indicates that shares are far from oversold levels despite falling sharply over the past year.

As such, the stock price still has room for another decline from last month’s peak of $3.72 on Aug. 12, just a few days after second-quarter 2022 results reported the deal with AAL. However, the stock price seems to have stabilized as it is trading sideways in the $2.9-$2.5 interval.

So, technically, the stock doesn’t look expensive, and is worth considering given the strong upside potential, although the investment risk isn’t low.

Wall Street’s Recommendation and Price Target

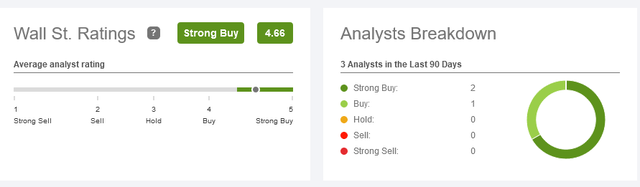

On Wall Street, the stock has 2 strong buy ratings and one buy rating.

seekingalpha/symbol/GEVO/ratings/sell-side-ratings

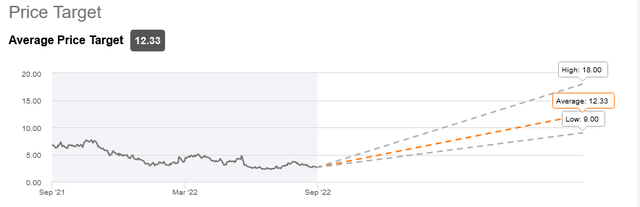

The average price target of $12.33 implies growth of 367% from current levels.

seekingalpha/symbol/GEVO/ratings/sell-side-ratings

Conclusion – Compared Strong Growth Potential, The Company Offers An Amazing Investment Opportunity

The company aims to become a leading supplier of fossil fuels produced from renewable sources and with minimal environmental impact. The company is currently expanding its contract portfolio for the future supply of sustainable jet fuel, building on the company’s success in financing energy projects.

In a highly competitive scenario where energy guzzlers are putting significant pressure on sustainable fossil fuel demand to avoid the impact of rising prices, it will be interesting to see if Gevo’s bargaining position strengthens.

In this case, the impact on the share price, mediated by a greater capacity to finance renewable energy projects, promises to be very positive. A recent agreement with American Airlines Inc. increases the success rate of financing projects aimed at commercializing renewable fuels in the airline industry.

Added to this are the direct effects on the share price from the increase in commodity prices on the futures markets.

Be the first to comment