sefa ozel

The Vanguard Energy ETF (NYSEARCA:VDE) is unlikely to make impressive gains for investors in 2023 after generating stellar returns in the past two years. There is a significant downside risk for VDE because the shares haven’t yet realized the impact of the recent drop in oil prices along with the anticipated volatility in 2023. In addition, a dramatic decline in corporation earnings and cash flows in the coming quarters could also weigh on investors’ sentiments. Consequently, it might be prudent to sell VDE to avoid the potential selloff and take advantage of the gains from the past two years.

Oil Price Outlook and Demand Destruction

In June, when oil prices were trading around $110 a barrel, I predicted a major drop in the second half of 2022 and high volatility in 2023. So far, I am right as oil has fallen to the $70 range, a decline of almost 35% since June 2022. High-interest rates, demand destruction, and increasing supplies led me to predict a collapse in oil prices. I now once again expect increased volatility for oil prices in 2023 due to high-demand destruction and increasing supplies. As global economic growth is expected to slow for a second consecutive year in 2023, oil demand is also likely to decline. Additionally, European and North American economies, which produce half of the global output, will likely suffer recessions in the quarters ahead.

Oil price history (Seeking Alpha)

In the last two decades, oil prices have fallen significantly whenever global economies struggle to generate growth or experience recession. In 2008, for instance, oil prices fell significantly due to a global recession. Furthermore, with the exception of 2017, oil prices were under intense pressure from 2014 to 2020 due to a negative or little global GDP growth. In 2021, however, oil prices gained momentum as global economic growth soared to 5.7%, while sanctions on Russian imports pushed oil prices above $120 a barrel in the first half of 2022.

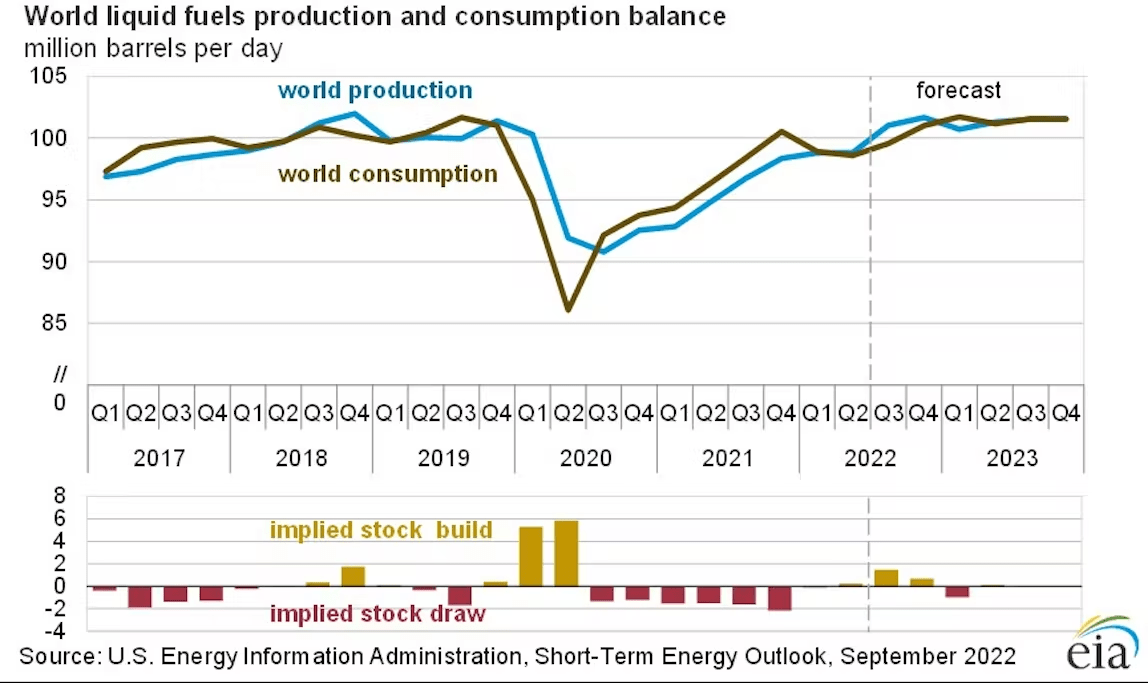

Oil supply and demand (Energy Information Administration data)

Slow economic growth mostly raises the risk of excessive supplies. In 2023, there is a high risk of excess supplies compared to demand. EIA anticipates tight oil market dynamics with expectations for global oil demand in the range of 100.98 million bpd next year compared to supplies of around 100.67 million bpd. If the economic downtrend intensifies and US and Eurozone economies enter a recession, supplies could significantly surpass global oil production.

VDE and Energy Stocks Likely to Fall

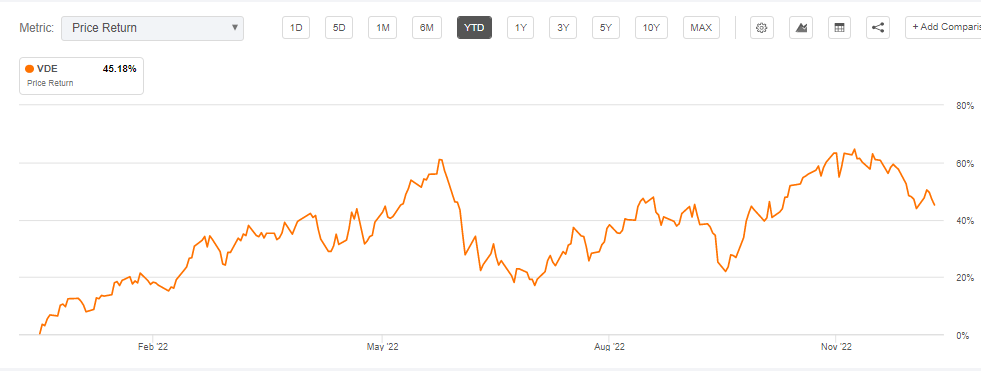

VDE’s share price performance (Seeking Alpha)

The recent drop in oil prices has not yet significantly affected VDE’s share price. This is because optimism over forecasts for $100 a barrel in 2023 along with record-breaking results in the past few quarters supported energy stocks in the second half. However, I expect this trend to change in the coming months as oil prices are unlikely to bounce back in 2023. Instead, I expect more pressure on prices due to excessive supplies compared to demand. Therefore, I expect VDE shares to realize the impact of oil price volatility in the coming months.

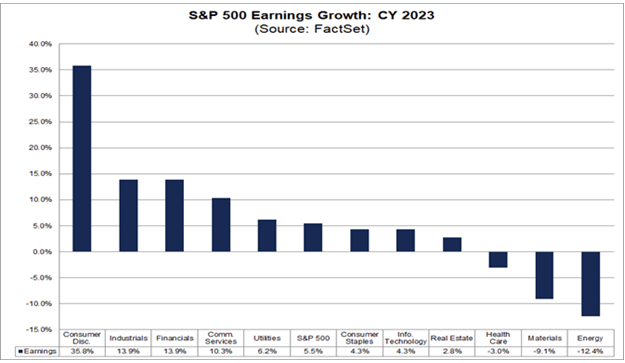

2023 Earnings Outlook (FactSet.com)

Further, declining earnings may weigh on investors’ sentiments. According to FactSet data, energy sector earnings are expected to decline by over 12% year-over-year in 2023. A majority of the decline is expected in oil & gas refining & marketing (-37%), integrated oil & gas (-15%), and oil & gas exploration & production (-1%) industries, which isn’t good for VDE since the majority of its top 10 stocks, which represent 66% of the overall portfolio, belong to these industries.

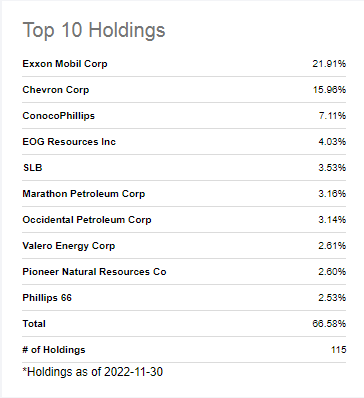

VDE’s top 10 portfolio holdings (Seeking Alpha)

According to Wall Street estimates, Exxon (XOM), which is its largest stock holding with a portfolio weight of 21.91%, could see a year-over-year earnings decline of 19% in 2023 and 17% the following year. During the same time, revenues are also expected to fall by a high single- to double-digit percentage. Chevron’s (CVX) earnings and revenue forecasts are also similar to Exxon’s. ConocoPhillips (COP), the largest US E&P company and third largest company in VDE’s portfolio, is also expected to see negative earnings and revenue growth in the future. Moreover, oil & gas refining and marketing companies like Marathon Petroleum Corporation (MPC), Valero Energy (VLO), and Phillips 66 (PSX) are likely to get a harder hit than the rest of the energy sector. Wall Street estimates reflect a 49% year-over-year drop in Marathon’s earnings in 2023.

Valuation Risk

Valuations are crucial when it comes to predicting future price movements. The share price of energy ETFs like VDE is almost double their pre-pandemic level. Despite that, the trailing price-to-earnings ratio of the energy sector is almost half that of the broader market index. The low PE ratio is attributed to the extraordinary revenue and earnings growth in 2021 and 2022. Yet, a closer look at VDE’s top portfolio components can reveal more information. According to Seeking Alpha’s quant system, Exxon earned a negative C grade on valuation because of its high price-to-earnings and sales ratio compared to the sector median. ConocoPhillips and Chevron both received a D grade on valuations since their valuations are higher than Exxon’s and the sector median. Overall, the key stock holdings of VDE look expensive compared with the sector median, which lowers prospects for upside in 2023. Also, negative revenue and earnings growth will hurt valuations in the future.

In Conclusion

As shares haven’t fully factored in the potential risk, investors who held long positions in energy stocks and ETFs like VDE should consider selling them now. Share prices are likely to fall in the months ahead due to a significant drop in earnings and potential volatility in oil prices. Furthermore, the StanChart crude oil positioning index, which fell sharply over the past few weeks to negative 73, indicates that investors are selling their long positions to take advantage of recent gains. Meanwhile, investors planning to purchase VDE should wait for a better entry point due to the high risk of downside movement.

Be the first to comment