Chinnachart Martmoh/iStock via Getty Images

Introduction

As a dividend growth investor, I constantly seek new investment opportunities that can provide a steady income stream. I often use market fluctuations to my advantage by starting new positions or adding to existing ones when I find them attractive. It allows me to diversify my holdings and increase my dividend income with less capital.

Consumer staples are often considered a haven during market volatility, as people still need to purchase essential goods and services regardless of economic conditions. PepsiCo (NASDAQ:PEP) is a leader in the consumer staples sector due to its strong execution track record and diverse portfolio of products. The company has consistently delivered strong financial results and has a history of increasing its dividends, making it an attractive option for income-focused investors.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

PepsiCo manufactures, markets, distributes, and sells beverages and convenient foods worldwide. The company operates through seven segments: Frito-Lay North America, Quaker Foods North America, PepsiCo Beverages North America, Latin America, Europe; Africa, Middle East and South Asia, and Asia Pacific, Australia and New Zealand and China Region. It provides dips, cheese-flavored snacks, and spreads, as well as corn, potato, and tortilla chips, cereals, rice, pasta, mixes and syrups, granola bars, grits, oatmeal, rice cakes, simply granola, and side dishes; beverage concentrates, fountain syrups, and finished goods; ready-to-drink tea, coffee, and juices; dairy products; and sparkling water makers and related products.

Fundamentals

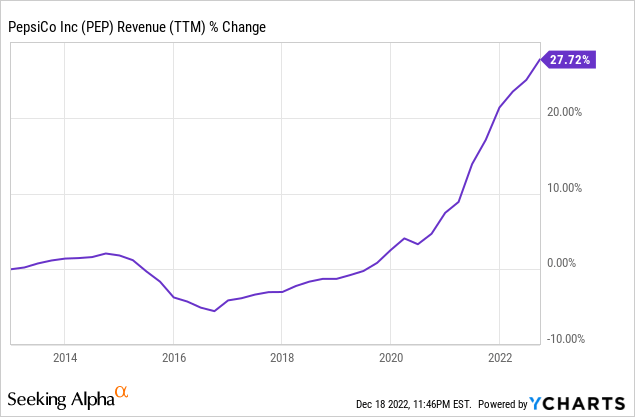

The revenues of PepsiCo have increased steadily over the last decade but at a relatively slow pace. A 28% increase over a decade equates to less than 3% annual growth. PepsiCo increases sales by a combination of volume increases and acquisitions as it adapts its portfolio along the way to address the need of its clients. In the future, as seen on Seeking Alpha, the analyst consensus expects PepsiCo to keep growing sales at an annual rate of ~5% in the medium term.

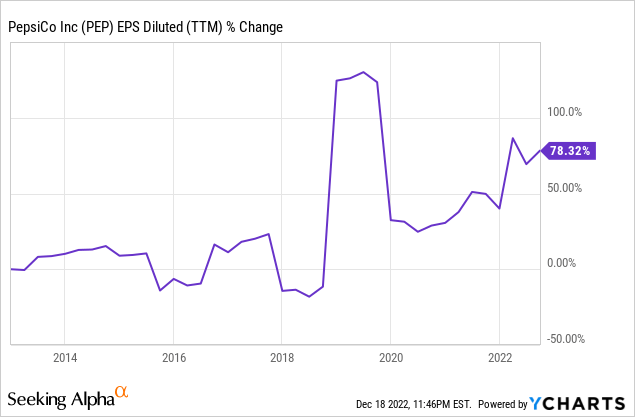

The EPS (earnings per share) has grown much faster over the same period. An ~80% increase over a decade equals an almost 6% annual increase. EPS has increased faster as, in addition to sales growth, PepsiCo benefited from its buybacks and margin improvement as it positions its portfolio towards higher margin products. In the future, as seen on Seeking Alpha, the analyst consensus expects PepsiCo to keep growing EPS at an annual rate of ~8% in the medium term.

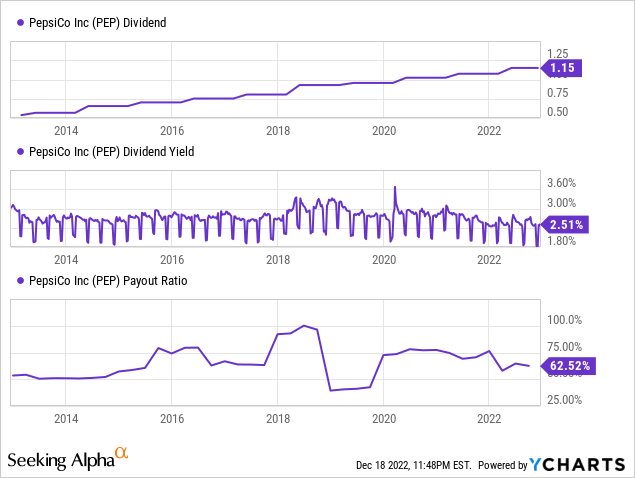

The dividend is where PepsiCo shines, as the company has consistently increased the dividend for 50 years. Moreover, the dividend grew at an annual rate of 7% over the last five years. The growth is in line with the EPS growth and is much faster than inflation. The company’s dividend continues to look good, as the payout ratio is 62%, implying minimal risk for a dividend cut. The entry yield at the moment stands at 2.5%.

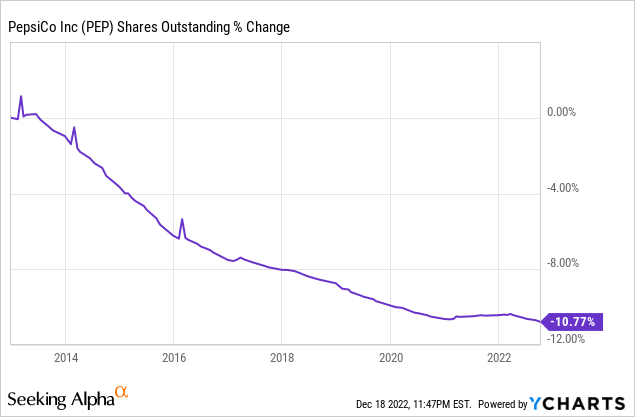

In addition to dividends, companies, including PepsiCo, return capital to shareholders via share repurchase plans. Buybacks create value by supplementing the EPS growth by lowering the number of shares. Over the last decade, the number of outstanding PepsiCo shares decreased by 11%. Buybacks are highly effective when a company is attractively valued and should only be used after enough capital has been invested in propelling growth.

Valuation

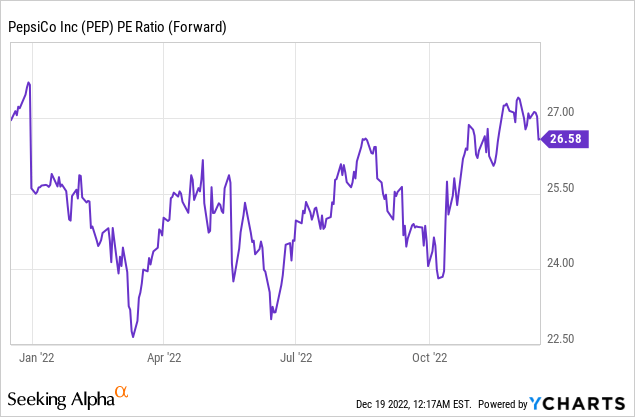

PepsiCo’s P/E (price to earnings) stands at 26.6 when using the forecasted EPS for 2022 and 24.7 when using the 2023 predicted EPS. In both cases, it looks on the expensive side. Over the last twelve months, the valuation has barely changed, yet the current valuation is almost at the highest point this year. Paying this price for a company that grows at 7% annually doesn’t look very attractive.

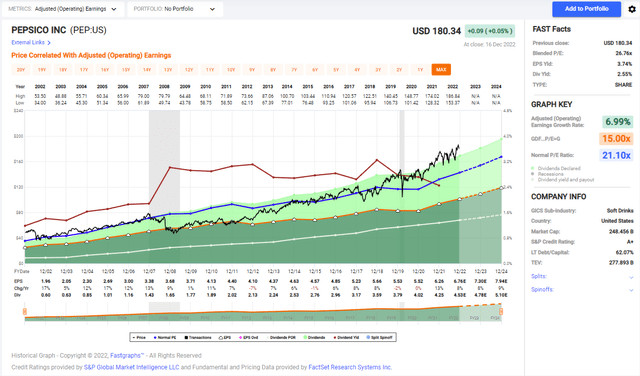

The graph below from Fastgraphs amplifies my initial understanding of the valuation. PepsiCo’s average P/E ratio over the last two decades was 21, and the annual growth rate was 7%. Therefore, the company has continually been trading for some premium. The premium makes sense as the company is a very high-quality blue chip. However, the current valuation shows that the premium increased significantly while the growth rate hasn’t changed.

PepsiCo has strong fundamentals, including growing sales, earnings per share, dividends, and share buybacks. However, despite these positive attributes, the valuation of the company’s stock may not be attractive enough at this time. The premium traditionally attached to PepsiCo’s stock has increased significantly, so the company must show significant growth opportunities to justify it.

Opportunities

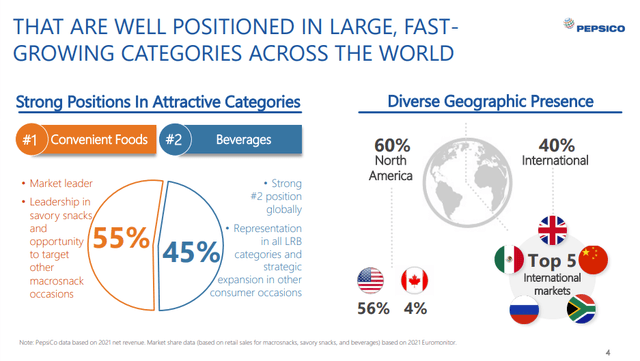

One of the critical opportunities for PepsiCo is its diversification in products and geographies. PepsiCo has a diverse portfolio of products that includes well-known brands such as Lay’s chips, Mountain Dew, and Gatorade, as well as healthier options such as Quaker oatmeal and Tropicana juice. This diversification helps to mitigate the impact of any single product or market on the company’s overall performance. In addition, PepsiCo has a global presence, with operations worldwide. It further diversifies the company’s revenue streams and helps insulate it from any region’s economic conditions.

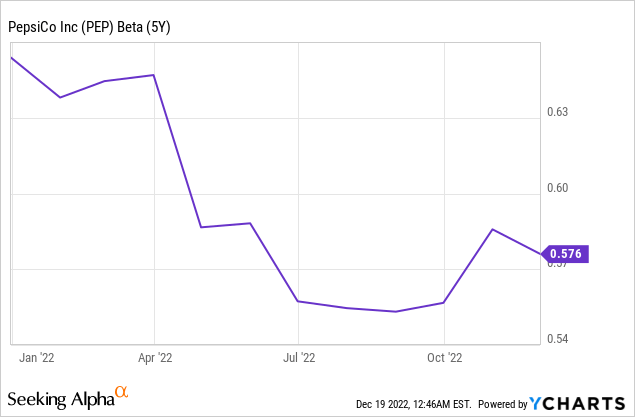

Another opportunity for PepsiCo is its low beta, which makes it a haven for investors seeking stability during market volatility. Beta measures the volatility of a stock relative to the overall market, with a beta less than 1 indicating lower volatility. PepsiCo has a beta of 0.58, which means that it tends to be less volatile than the overall market and can provide a degree of protection for investors during times of uncertainty. Therefore, in the short and medium term, as the markets are still volatile, we may see the price continues to increase.

PepsiCo’s clever adaptation to changing consumer preferences and market conditions is also a critical opportunity for the company. PepsiCo has a track record of adapting to new trends and evolving its product offerings to meet changing consumer needs. For example, the company has introduced plant-based snacks and beverages and has committed to reducing its use of single-use plastics in its packaging. It also acquired SodaStream to offer a more eco-friendly way to serve sodas. These efforts demonstrate PepsiCo’s ability to stay ahead of the curve and remain relevant to consumers in a rapidly changing market.

Risks

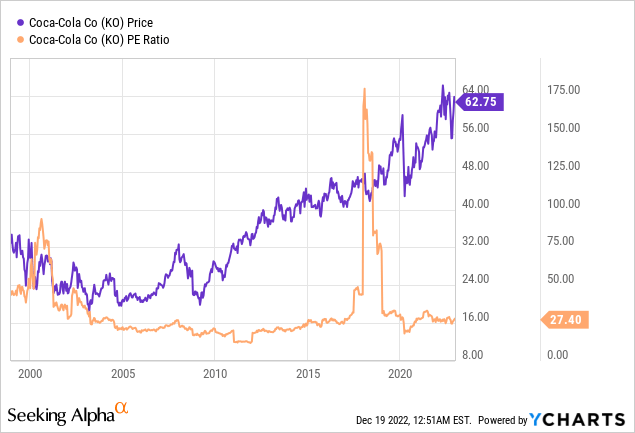

One potential challenge for PepsiCo is the lack of a margin of safety due to its high valuation and the possibility of a return to average valuation. There is no cushion for investors if the company’s performance does not meet expectations. If volatility subsides, PepsiCo’s current valuation may not hold even if it does perform. The chart below shows its peer Coca-Cola (KO) and how in the early 2000s, its value increased significantly due to valuation expansion. Once that valuation returned to its mean, it took almost a decade for the share price to return to its all-time high despite constant growth.

Another potential challenge for PepsiCo is the potential for inflationary pressures to impact the company’s margins. Inflation can erode the value of a company’s profits and can also lead to higher costs for raw materials and other inputs. To maintain profitability, companies may need to increase prices, which can risk losing market share to competitors.

The competition is a challenge, to begin with, as PepsiCo sells consumer staples with relatively low barriers to entry. It faces intense competition from other branded companies, such as Coca-Cola, and private label products from large food retailers like Walmart (WMT). This competition can be especially fierce in times of inflation, when consumers may be more price-sensitive and more likely to switch to lower-priced alternatives.

Conclusions

PepsiCo has solid fundamentals across the board, with a history of effectively managing business risks and decent growth opportunities in the future. However, its current valuation seems somewhat out of touch with its growth rate and the other underlying factors. It is something that investors should consider before adding the stock to their portfolio, as paying a premium and having no margin of safety is a significant investment risk.

Given these considerations, I believe that shares of PepsiCo are a HOLD at this time. The significant premium attached to the stock may be concerning for long-term investors who want to see a better balance between an investment’s potential risks and rewards. It may be wise to follow the company closely and wait for a pullback in the stock’s price before considering adding it to dividend growth portfolios.

Be the first to comment