marekuliasz/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the Invesco California Value Municipal Income Trust (NYSE:VCV) as an investment option at its current market price. The trust’s investment objective is to “provide current income exempt from federal and California income taxes”.

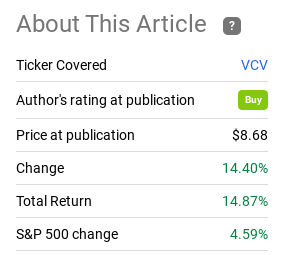

This is a CEF I suggested buying last month and in hindsight that call was very lucrative. VCV is up almost 15%, handily beating equity markets, which is unusual for muni funds during risk-on periods:

Fund Performance (Seeking Alpha)

Given such a large boost in a short time-frame, I wanted to take another look at VCV to see if I should change my outlook. Honestly, I went into this expecting to downgrade my rating to “hold” because that is typically what I would do when double-digit gains occur in just over a month. But after careful review, I see potential for further upside and will be keeping my “buy” rating in place. I will explain the reasons why in detail below.

Large Discount To NAV Remains In Place

To start the review, I will focus on a key metric I always consider in any CEF coverage. This is the fund’s discount or premium to NAV. As my followers know, I am value driven, and prefer funds in discount territory and rarely pay more than a 5% premium for the privilege of owning any CEF. In the case of VCV, I saw quite a bit of value in early November because the fund had a discount to NAV in excess of 13%. This seemed like just too much value to pass on – and that was true.

Given VCV’s 15% rise in the interim, it was logical for me to expect the discount to narrow considerably. The good news is that while the discount has narrowed, that move has been modest. The bulk of the market price return has coincided with gains to the underlying value. This allows the fund to still trade at a very attractive discount:

| NAV | Market Price | Discount To NAV |

| $11.14/share | $9.94/share | 10.8% |

Source: Invesco

The takeaway here is straightforward. VCV was cheap before and, while it is slightly less cheap, it still offers investors a good value at these levels. This supports maintaining a bullish rating on the fund.

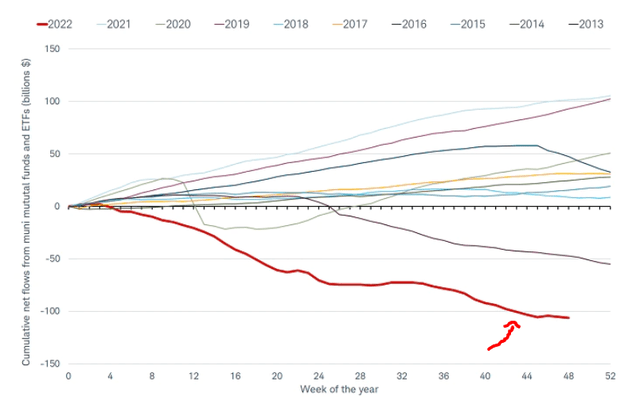

Munis Remain A Contrarian Play

My next point is a consideration for VCV, but really for any muni play at the moment. This is the fact that munis remain unloved by retail investors – despite seeing a rebound over the past few months. While munis are traditionally a boring space that see steady inflows, 2022 has been different. There have been consistent outflows in the sector this year, a sharp divergence from historical trends:

Fund Flows (Muni Sector) By Year (Charles Schwab)

The conclusion I draw here is now is the time to continue buying. Investors have been fleeing the sector en masse, and that is bound to end at some point. The time to buy any quality sector/theme/stock, etc., is when the average investor doesn’t want it. That is when you can generate “alpha” over the longer term. This seemingly irrational selling has been painful for muni investors throughout 2022, but I believe it opens up the door for long-term gains for those who continue to buy and stay patient.

Supply Remains Tight, Supporting Valuations

Another reason to like the sector as a whole has to do with the supply-side of things. With interest rates rising, municipalities have had less incentive to issue debt, especially long-term debt. After years of benefiting from low rates, state and local governments are not keen to take on such an expensive (relative) burden of borrowing. While not necessarily healthy for the sector if credit quality suffers, the positive note for the time being is that it is keeping supply relatively tight:

Muni Issuance (Bloomberg)

This adds further support to the backdrop that muni bonds are supported at current valuations. While I was contemplating taking the easy win from VCV, I just don’t see a compelling reason to sell when the valuation is reasonable, the sector is a contrarian play, and low supply is supportive or prices. This tells me that a turnaround for the sector is set to continue in early 2023.

California Is In Good Shape

I will now shift to the state of California. So far I have discussed VCV’s valuation and the broader muni sector, but readers should recognize this is a CEF that investors almost exclusively in bonds issued by municipalities within the Golden State. Therefore, a dive into the fiscal picture there is important.

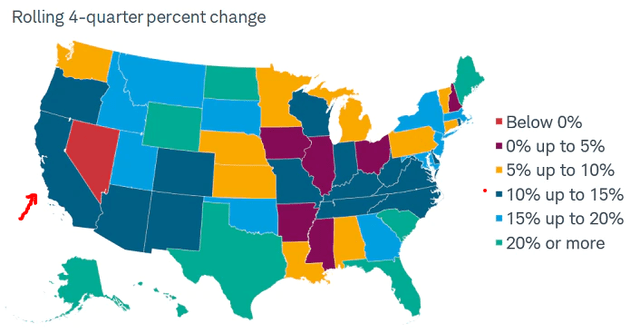

Fortunately, California has been benefiting from the trend of rising tax receipts along with the majority of the country. While some states have seen larger percentage increases, California is still seeing 10-15% growth in collections on a rolling quarter-by-quarter comparison:

Tax Revenue Change (By State) (Bureau of Labor and Statistics)

Given that over 70% of VCV’s holdings are rated investment-grade and are backed by a state that is seeing increasing tax receipts, I am comfortable owning this exposure. I continue to see limited default risk, even in the event of a difficult recession in 2023. The state is positioned well enough to get through some short-term volatility, and is less at-risk than other states that have not recovered from the pandemic as quickly.

Potential Benefits From ESG Interest

Drilling down further into the state of California, I will give yet another reason why I like the muni exposure to this jurisdiction. As my readers know, VCV is one of three muni funds I own. Yet, I do not live in the state of California (I reside in North Carolina), so I miss out of the state tax savings from this fund.

This may seem illogical – why buy a Cali-muni fund when I live out of state? The answer is multi-fold. One, there are very limited North Carolina muni funds out there. So my choices are mostly national muni CEFs/ETFs, which I do own. Two, I still get the federal tax savings, which I am mostly concerned with since North Carolina has reasonable state income taxes. I still get the primary federal exemption from Cali-issued muni bonds, similar to national (or any other state’s) muni funds. Three, issues from California are also likely to continue to draw investor interest from around the country. I base this on the fact that California is leading the way in issuing “green” or ESG-friendly muni bonds. The logic here is that investors who want exposure to this theme and / or fund managers who are trying to boost their green credentials are going to be especially interested in this space.

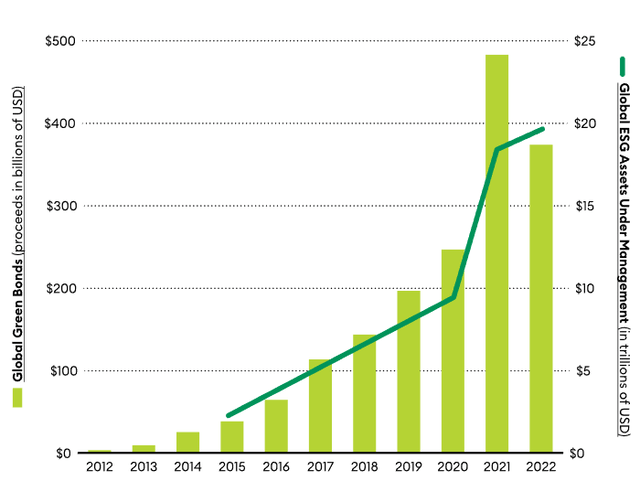

This is an important, ongoing trend across the globe. So, capturing exposure to this arena could have both short and longer term (positive) implications for one’s portfolio. To illustrate, consider the graph below, with highlights the rise in “green/ESG” bond issuance and the amount under management:

Rising Investor Interest in “Green” or ESG Bonds (PwC)

Clearly, this is an emerging play that is growing in popularity. But how do California’s muni bonds fit in?

The answer lies with the ongoing efforts from the Community Choice Financing Authority (CCCFA). This is an agency with the power to issue tax-free municipal bonds, with the goal of prepaying for customers electricity and energy usage. Under the right circumstances, the CCCFA will be able to facilitate the issue of a tax-exempt municipal bond known as a “Clean Energy Project Revenue Bond”. According to the CCCFA, which acts as the issuer, these bonds enter into long-term power supply agreements for zero-emission clean electricity sources like solar, wind, geothermal, and hydropower.

Essentially, this puts Cali-focused muni funds in a unique position to market themselves as an ESG alternative for investors. Granted, the market is still very small, but this state is on the forefront of such efforts and the sector is only likely to grow in both size and investor popularity in the years to come. This makes Cali-based munis more interesting to me than the average state, and supports my continued ownership of VCV.

Bottom-line

Looking forward into 2023, there are a few reasons to consider munis. For one, they remain a way to provide a portfolio buffer against a drawdown in equities. Despite the heavy losses in the S&P 500 already in 2022, there are concerns over global economic activity that could pressure stocks further. The bond market is telling us blatantly to be careful, as the yield curve has inverted to a level tested only a few times over multiple decades:

Yield Curve (Yahoo Finance)

The concern here is that if we hit a severe recession, stocks will get hit much harder than bonds. That offers plenty of merit to being long funds like VCV.

Two, sectors like munis that have seen heavy selling in 2022 could be in-line for a reprieve in early 2023. I would expect some year-end selling has been occurring due to tax-loss harvesting. As we move into the new year, that backdrop is removed, meaning that investors can front-run an increase in demand by getting in now. Three, many CEFs, such as VCV, still trade at steep discounts and are backed by IG credit.

When I take all these factors into consideration, I see a buy case for VCV despite its double-digit gain in the past five weeks. Therefore, I will keep looking to add to my position on any forthcoming weakness, and suggest readers give this idea some consideration going forward.

Be the first to comment