DINphotogallery Torm logo (Torm)

Investment thesis

One of our companies services the oil refinery industry in South East Asia, hence we follow closely what developments come from that side of the business.

Our interest in the maritime transportation of clean oil products came from our realization some time ago that we would see a big shift in trade patterns with several refineries shutting down and new mega refineries being commissioned in the Middle East, India, and China.

This change adds tons/miles as cargoes need to be shipped longer distances. It benefits the larger-size ships the most. When we had come to this conclusion, it was prior to Russia invading Ukraine. This put even more upward pressure on the freight market as it disrupted earlier shorter trade routes.

One beneficiary of this is Frontline (FRO) which has a fleet of Long Range (LR2) vessels. But their business is mainly in the transportation of crude oil.

A company that is purely into the transportation of clean oil products is TORM plc (NASDAQ:TRMD).

This Danish shipping company with roots going back all the way to 1889, owns a fleet of 57 product tankers and has in addition another 23 vessels on long-term charters or leases. 73% of them fall into the category of Medium Range vessels ranging from 45,000 to 50.000 deadweight. The balance is Long Range vessels.

TRMD has been listed on Nasdaq since 2017 and Oaktree is the largest shareholder with about 66% of the shares.

With record high rates achieved in this segment, we want to explore the possibility of deploying some of our capital into investment in TORM at this point in time

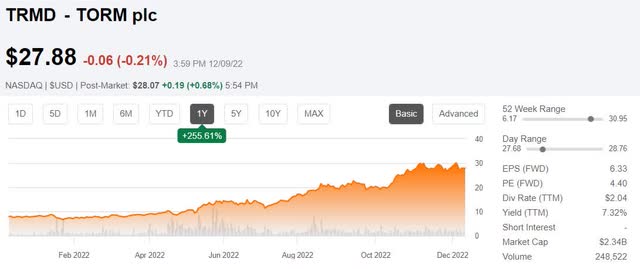

Last year would have been a good time since the share price has risen 256% in a year

Torm’s share price up 255% in 1 year [SA]

But what about now after the share price has gone from $6.17 to $27.88?

Q3 and First 9-Months Financial Results

TORM delivered its best quarterly results on record during the Q3 of 2022.

On the top line, the revenue increased from $339 million in Q2 to $448 million in Q3. Over the first nine months, it more than doubled from $430 million to $996 million.

Product tankers benefited greatly from higher freight rates mostly from trade dislocation caused by the sanctions and self-sanctioning of Russian product exports as a consequence of the Russian invasion of Ukraine. We are also starting to see the impact of changes to refinery locations, as we have pointed out in earlier articles on product tankers.

Net operating profit in Q3 was $217.1 million. After an accounting loss on sale of a vessel of $9.2 million and some provisions totaling $6 million, they had a net profit of $201.9 million.

For the first nine months, this profit has been $314.6 million.

What a difference a year can make. The corresponding number for the first nine months of 2021 was a loss of $33.1 million.

The average TCE for Q3 was $44,376 per day per vessel.

The Product tanker market is still strong and with TORM already having covered as of the 6th of November, as much as 55% of their fleet/days, for Q4 at an average TCE of $45,257 per day per vessel, we can safely assume that the net profit for Q4 should be as good, if not somewhat higher in the last quarter of 2022.

As such, we estimate the total net profit for 2022 to be approximately $525 million. With 81.6 million ordinary shares outstanding, we get an EPS of $6.43

That gives us a P/E of just 4.3

ROE so far this year is 36.3%

In terms of their balance sheet, the loan-to-value rate is 53.6%. We like to look at this leverage up against the age of the fleet.

The average age in 2023 will be as follows:

- LR2 vessels = 7.8 years (comfortable)

- LR1 vessels = 14.5 years (not comfortable)

- MR vessels = 11.8 years (mid-life)

MT “Torm Elizabeth” – LR1 vessel 75,000 deadweight, built 2020 (Torm)

In view of an average age of 11.8 years for their total fleet, it is not the most modern but at quite a comfortable level. Excessive free cash flow could also be used to reduce the leverage rate somewhat.

We noticed that 53 of their fleet are installed with scrubbers another 15 are planned to get conversion work to outfit scrubbers.

TRMD’s NAV is $2,059 million. This works out to $25.23 per share which gives us a Price/NAV of 1.10

As such, it is not particularly cheap as there are other maritime stocks out there trading at discounts to their NAV.

Market development

On the 5th of December 2022, the EU sanctions against Russian oil products started to take effect. Since the 3rd of December, G7 members formally set a price cap on Russian oil at 60 USD per barrel, to which Russia has responded that they will not sell oil at such prices to G& members.

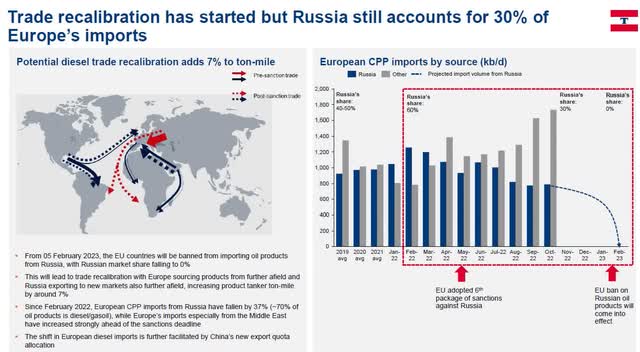

The EU ban on Russian oil products leads to a need to recalibrate the whole all product tanker trade ecosystem with Europe having to source more diesel from regions further afield, while Russia also needs to find new markets for diesel in regions further way.

Oil products trade recalibration (Torm’s Q3 of 2022 presentation)

According to TORM’s own internal estimates, a full recalibration of the diesel trade close would add around 7% to the ton-mile demand for product tankers. This bar meant that Europe cut its import of oil products from Russia by around 40% compared to the high base in February 2022, meaning that 60% still needs to be redirected within the next few months.

We have seen positive signs from China as they are loosening up their earlier “zero-covid” strategy so we should see more economic activities there. This will lead to increased mobility and the need for refined oil products. Another important aspect, which we have also earlier alerted our readers of is that China intends to be a major player in exporting refined oil products. They have recently allocated new higher product export quotas.

We have pounded the table about the fundamental drivers that is coming from the closures of refineries and the opening up of new capacity which needs longer sea voyages.

According to TORM, since 2020, more than 2 million barrels per day of refining capacity has been closed down permanently and a further 0.6 million is scheduled to be closed down during this year and into 2023. Some of that, another 1 million barrels per day of capacity is at risk of being shut down. More than 4 million barrels a day of new capacity coming online mainly in the Middle East, China, and India.

All this is boding well for TORM and other owners of product tankers.

Risks to the thesis

As TORM is based in the land of Denmark, where clearly not all is rotten, as Marcellus told Horatio in Shakespeare’s Hamlet, this business is very profitable at the moment.

On the topic of trying to predict how long the good times will last, we remember what the famous Danish physicist Niels Bohr once stated:

Predictions are very difficult – particularly about the future”.

TORM’S CFO Kim Balle might have thought of his statement when he answered a question during the conference call for Q3 about whether TORM had a specific target on leverage:

In the market that we have right now, it is wise to consider if you should potentially bring it down a bit more by utilizing the market and the window that is right now. Hopefully, it will stay here for quite a while, but in our industry, you never know“.(highlighted by author)

And herein lies the largest risk. When all the wise men, not just at TORM, but those that have all available information, are unable to predict what the market is going to do, neither can we nor you.

Conclusion

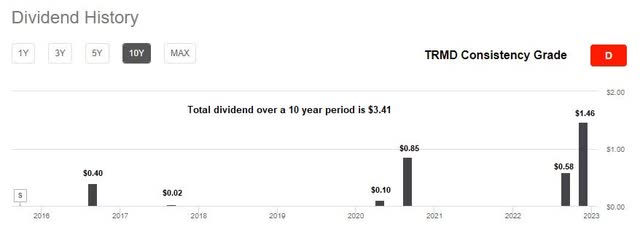

If history says anything about what might happen in the future, the industry as a whole, and not just product tankers, have a rather poor track record.

This can be seen if we just glance at TORM’s ability and willingness to pay a dividend over the last 10 years.

Torm’s 10-year dividend history [SA]

Despite the mega rise of more than 200%, we still think that investors will be rewarded well with a good yield and potentially a higher share price.

Therefore, we put a Buy stance on our initial coverage of TRMD. The only caveat is that it is important to note that this is a risky industry with a long history of volatility.

Be the first to comment