cagkansayin

The Vanguard Long-Term Corporate Bond ETF (NASDAQ:VCLT) now offers yields of almost 6% thanks to the surge in long-term bond yields and the slight rise in credit spreads. Regular readers will be aware of my bullish views on Treasury bonds, and while the VCLT is at risk of a rise in credit spreads as the economy continues to deteriorate, falling Treasury yields are likely to more than offset any such rise, generating positive returns for the VCLT.

The VCLT ETF

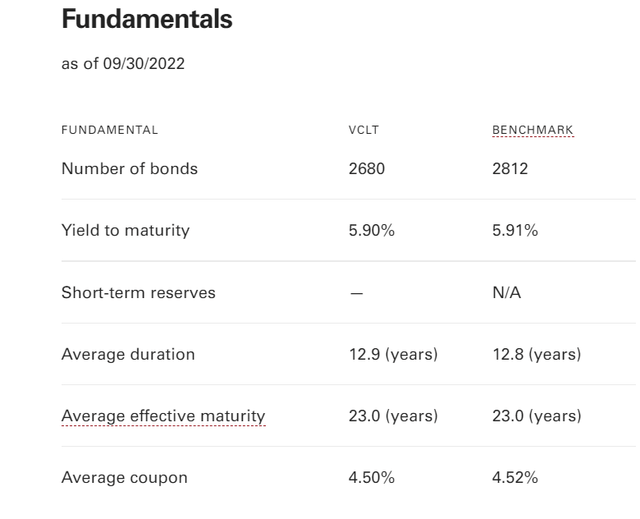

The VCLT holds a broad portfolio of long-term investment-grade corporate bonds, and tracks the Bloomberg U.S. Long-Term Bond Index. With a weighted average maturity of 23 years, the fund is highly sensitive to interest rate changes but has relatively low credit risk, with slightly over half of the fund’s holdings in A-rated credits or higher. The fund has a yield of 5.9% and charges an expense fee of just 4bps per year. VCLT should appeal to investors looking to take advantage of current elevated long-term bond yields but also looking to boost returns by adding a slight degree of credit risk. When compared to the iShares iBoxx Investment Grade Corporate Bond ETF (LQD), the VCLT has a similar yield but significantly higher maturity, meaning higher volatility should be expected.

Yields Are The Highest Since The Global Financial Crisis

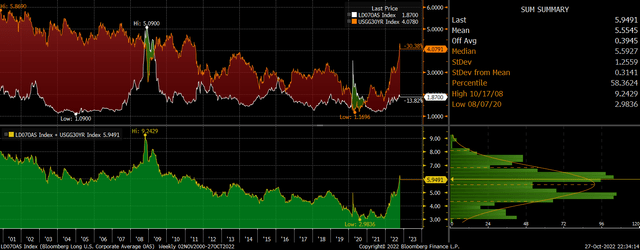

The rise in long-term Treasury yields, as well as the slight increase in credit spreads, has seen the yield on the VCLT surge since the start of the year. The following chart shows the current yield on the Bloomberg U.S. Long-Term Bond Index broken down into the yield on 30-year Treasuries and the spread over Treasuries. The current yield is the highest since 2011, with yields a full percentage point over those seen at the height of the Covid crash despite significantly lower credit spreads.

US Long Term Corporate Bond Yields (Bloomberg)

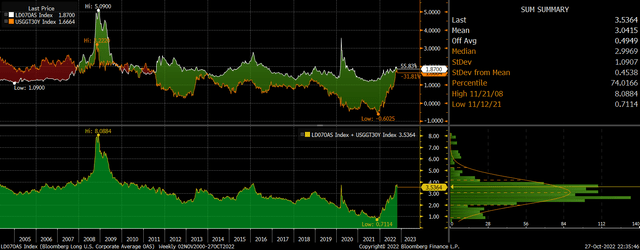

We can also look at the current real yield on long-term corporate bonds by adjusting the above yield by long-term breakeven inflation expectations. Despite inflation expectations remaining near all-time highs, real yields are still elevated meaning that investors should expect to outperform inflation significantly over the long term.

US Long Term Real Corporate Bond Yields (Bloomberg)

Could Treasury Yields And Credit Spreads Fall Together?

In the short term, there is potential for both UST yields to fall and credit spreads to compress, both of which would be positive for the VCLT. The reason being that any dovish shift by the Fed would not only lead to a fall in Treasury yields, but it could also help to calm default fears, which have risen largely due to concerns that Fed has tightened too aggressively. Since the start of the year, the correlation between UST yields and corporate credit spread has been strongly positive, in stark contrast to the trends seen over the past two decades.

Any Rise In Spreads Likely To Be Offset By Falling UST Yields

I am particularly bullish on U.S. Treasuries and see the potential for the VCLT to rise significantly as UST yields move lower in response to growing signs of economic weakness. The key question is whether any decline in UST yields will be offset by rising credit spreads as was the case during the global financial crisis. In 2008, despite the crash in UST yields, rising default risk saw yields rise above 9%. Given the high duration of the VCLT, a similar move could see the ETF lose 40% of its value.

That said, a repeat of the 2008 crash is by no means a core scenario. While I believe equity markets are more overvalued than they were back then, leverage in the banking sector is far lower and so is the potential for deflation. The spike in 2008 was driven in part by fears that the Fed and Treasury would be powerless to stop deflation, but actions by policymakers since then have shown the extent that they are willing to go to avoid such a scenario, which suggests we will not see the kind of crisis in credit that we saw back then. Should we see credit spreads spike amid continued economic deterioration, this would likely cause the Fed to pare back its rate hikes, causing UST yields to fall sharply, supporting the VCLT.

Summary

The VCLT offers an attractive yield of just shy of 6%, which is the highest we have seen since the end of the global financial crisis. The spike since the start of the year has been driven mainly by rising UST yields, but this has also led to a slight rise in credit spreads, which adds to future return prospects. In the short term, there is potential for a simultaneous decline in UST yields and corporate credit spreads. Should we see credit spreads spike higher in response to ongoing economic weakness, I would expect falling Treasury yields to more than offset the negative impact on the VCLT.

Be the first to comment