Cylonphoto

Well, the market has begun to rebound the last few weeks, and Intel Corporation (NASDAQ:INTC) saw its stock rise a bit with this rally. We know that the company just had its Mobileye Global Inc. (MBLY) IPO, which priced above range. Much of the proceeds (nearly $1 billion) will be used for repayment to Intel, so that is some nice cash coming in. The company needs the working capital. The listing also helps get the self-driving unit public attention.

That said, Intel stock has been left for dead by the Street, and is teetering just above levels not seen in 8 years. However, after the just-reported earnings, shares are largely positive on the initial reactions. The stock and company were obliterated, but there are signs of life after this report.

Semiconductor stocks as a whole have been absolutely decimated, and this report is another dagger in the hearts of shareholders. The report suggests demand is slowing, and there has been a global fear that there will be a very slow period for new computers, televisions, cars, and just about all the other products that uses semiconductors.

When Intel hit its lows under $25 a few weeks ago, we started buying, with a plan to scale in. In this column, we update our readers with our interpretation of the just-reported earnings. Even with some of the revelations in this quarter, we still believe that under $25, it is time to scale into Intel. Let us discuss.

Q3 earnings highlight a dire but possibly improving situation

Make no mistake, Intel is not going bust. But it is not good either right now. We will say there are safer semiconductor bets out there, although the entire sector is out of favor. But with this report, the headlines were really tough to swallow. Even with such weak headlines, the yield on the stock is close to 5.5%, and so we are still buyers. It does call into question the dividend safety but we think that management will keep the dividend party going as long as possible as a cut would send shares to levels not seen in decades. It would obliterate shares further, after already being obliterated.

There are a lot of fundamental challenges the company faces. The market has priced in a lot of pain, but once again the Q3 earnings release documented an ongoing weakening environment that CEO Patrick Gelsinger highlighted the need for addressing costs:

“To position ourselves for this business cycle, we are aggressively addressing costs and driving efficiencies across the business”

David Zinsner, Intel CFO added:

[W]e are focused on embracing an internal foundry model to allow our manufacturing group and business units to be more agile, make better decisions and establish a leadership cost structure…. We remain committed to the strategy and long-term financial model communicated at our Investor Meeting

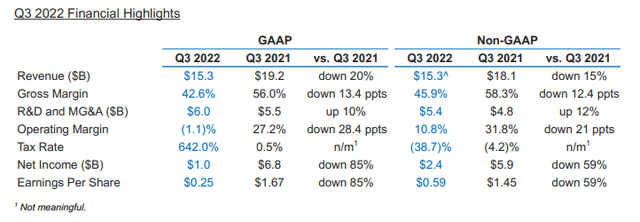

This was pretty clear as day. Take a look at the results here, folks, the year-over-year comps are just painful. This is why the stock is being obliterated:

Earlier this year, the company guided for revenue of $15-$16 billion, on 46.5% margins, and was looking for EPS of $0.35 in the quarter. Well, the company whiffed here on some metrics, but exceeded in others.

So, as you can see, revenue was down 20% from a year ago, or 15% when adjusted for currency. Margins narrowed again as well and missed the company’s own targets. Revenue was mostly in-line. Operating margins were down. And yet, the company is spending MORE on research and general expenses. Unacceptable. Net income was down 85% from last year, or 59% when adjusted. Terrible. Earnings were just painful, down the same 85% to $0.25 on a GAAP basis per share in Q3, though they came in at $0.59 per share adjusted and actually beat estimates.

So, what now?

Looking ahead

Even with the destruction of shareholders, from where we are now, the valuation, even with the declines, is still pretty attractive. There remain very favorable P/E, PEG, EV/sales, EV/EBITDA, and price-to-cash flow metrics. But as we all know when investing for dividend income, cheap can certainly get cheaper. The dividend is still juicy. Growth is nonexistent. But let us not be dramatic here folks. Conditions have deteriorated for everyone in the sector. Intel is, however, being outcompeted, which has compounded the issues. But the business simply is NOT dying. The company is not losing money. Some influx of cash from MBLY is a benefit, though. But what the company absolutely must do is to get spending under control.

The pricing of chips has been on the decline. This will continue to weigh on earnings the next few quarters until there is a sizable turnaround. Demand is waning, despite there being more sources of demand. What once was a lack of supply is now seemingly an oversupply risk for chips, although some industries are still seeing shortages. While chips are used in everything and hence are much more secular than in years past, they are still quite cyclical, and we are on the downtrend of the cycle. Keep that in mind.

It seems that the company is taking steps to rein in costs, however. It looks like there are going to be job cuts at Intel now. While this was reported earlier this month by Bloomberg, this report did not actually confirms that the 114,000-employee base is going to get cut. The release does say $3 billion in cost reductions are on the table. These cuts will help save money.

We are still very excited about the move to implement an internal foundry model for its customers, as well as its own chips. At least we think we are. On the surface, this should be something that should be a long-term victory for the company. However, it is actually not exactly clear what this internal foundry will do for the company or how much money it will save or how it will make the company more efficient. On the surface, of course, it suggests Intel will now become an internal customer of its other business lines, notably of its own fabs. More details could be coming out in the coming days or on the conference call.

Q4 outlook

After this report, we have to be concerned with how Q4 numbers will look.

For Q4, the company has now guided for revenue of $14-$15 billion, on 45% adjusted margins. They are targeting EPS of just $0.20 in the quarter adjusted. That is kind of painful. In addition, they are going to burn about $2-$4 billion in adjusted free cash flow for the year. That hurts.

With the way things have been going, this may be a kitchen-sink estimate that the company can easily hit. But the pain has been real. We really need to see spending cuts, and serious work to recapture market share. If the company cannot turn things around margin-wise and especially on operation margins, then the bountiful dividend could seriously be in jeopardy. There is a long line of dividend payments and increases here. Just look at the last 10 years:

Seeking Alpha INTC dividend history page

We fully believe management will do all it can to keep that dividend intact, but if the numbers are not there, they will have no choice but to eventually cut the dividend. The market could even react very poorly if they do not hike the dividend. But for solvency’s sake, if this downturn lasts years, it could have little choice. Near-term, it should be ok provided this earnings downturn only lasts a couple of quarters. In other words, the dividend should be secure. Seeking Alpha still assigns a slightly above average safety rating to the dividend. There are some risk signs, like increasing payout ratio metrics relative to cash flow, and the cash per share on hand.

Final thoughts

Intel is not going out of business, though it is being priced as if it is in a lot of risk of debt default, bankruptcy, and more. We just do not think this is reality. The company is taking steps to improve its fiscal state, including using a foundry model and cutting staff. We want to see the company get serious about its spending. The dividend is secure in our opinion, for now. The sector is cyclical despite ongoing secular demand.

Despite the weak performance, we still like adding Intel stock to our personal long-term dividend growth portfolios as the stock falls under $25. Right now, shares are getting a small boost on this report, but the outlook was not great. The Street (as do we) likes the cost cutting measures Intel laid out.

Let’s hear from you

Do you think the dividend is going to get cut? Do you think this quarter was better than expected? Will earnings recover before investors see multi-decade lows? Are we wasting space in our dividend growth portfolios with this name?

Let the community know below.

Be the first to comment