alfexe/iStock via Getty Images

As I write this article the morning of Friday, June 17, with the market still open, we sit just slightly off the recent lows on all 3 major U.S. market indexes; the Dow, the S&P 500, and the Nasdaq. Still, these averages are between roughly 19% and 33% off their 52-week highs. The S&P 500 index, perhaps the best overall indicator of the U.S. market, still sits in bear market territory.

U.S. markets haven’t suffered these declines in isolation. Foreign markets have experienced similar drops. As just one example, iShares Core MSCI Total International Stock ETF (IXUS), which tracks the MSCI ACWI ex USA Index, currently sits roughly 25% below its 52-week-high.

I mention this simply to remind investors that, even in the midst of all this turmoil in the U.S. market, opportunities may exist outside our borders as well.

For investors interested in diversifying the stream of dividends feeding your portfolio, in this article, I will feature one ETF in particular that may be worthy of your attention. This is the Vanguard International Dividend Appreciation ETF (NASDAQ:VIGI). We will start by diving into the index from which this ETF is constructed, then take a look at specifics around the ETF itself.

Before we are done, as a bonus, I will offer a very brief look at a second ETF that you might wish to pair with VIGI, to round out your coverage.

So let’s get started, shall we?

Vanguard International Dividend Appreciation ETF – Digging In

Over 16 years ago, on 4/21/06, Vanguard introduced Vanguard Dividend Appreciation ETF (VIG). With some $76.1 billion in Assets Under Management (AUM), it ranks among the largest 20 ETFs in the world.

Perhaps it is not surprising, then, that on February 15, 2016, roughly 10 years after the inception of VIG, Vanguard decided to expand their coverage of the dividend-growth segment beyond the borders of the U.S., with the inception of the Vanguard International Dividend Appreciation ETF. Reflecting the increased costs associated with trading foreign securities, VIGI’s expense ratio is .15%. However, this is excellent for this category.

VIGI seeks to track the S&P Global Ex-U.S. Dividend Growers Index. Using the methodology document for this index, let’s take a quick look at key elements of its construction.

The S&P Dividend Growers Index Series measures the performance of companies that have followed a policy of consistently increasing dividends every year for a specified number of years. The indices are subject to an indicated annual dividend yield exclusion, with the top 25% highest yield ranked eligible companies from the index universe excluded from index inclusion. Companies classified as part of the Global Industry Classification Standard (GICS) Real Estate Investment Trust Industry (REITs), are excluded. Constituents are float-adjusted market capitalization (FMC) weighted, subject to a single constituent weight cap of 4%.

Please note the overall policy of excluding companies with top 25% highest yields. A high current dividend can be the result of a low stock price. And a low stock price may mean one of two things; that a company is in an industry with little to no growth or, even worse, that the company’s finances are in trouble.

The methodology document goes on to feature that, in the case of S&P Global Ex-U.S. Dividend Growers, the following specific criteria apply:

- Included companies must have increased dividends for at least 7 consecutive years.

- Included companies must have three-month median daily traded values of US $500,000 (or US $250,000 for current constituents).

Before we leave this section, allow me to briefly highlight 3 additional features of the index that should serve to lower both volatility as well as transaction costs:

- Stocks are weighted by float-adjusted market capitalization – Basically, this means that closely-held shares are excluded, so only shares available to investors are included in the weighting. The result? Less turnover due to weighting adjustments.

- A three-day rebalance window – What is the benefit of this? As opposed to being forced to complete all trades within one business day, this reduces the market impact of these potentially significant trades.

- A buffer on that 25% high-yielding dividend screen – Existing securities in the index are only excluded if they fall in the highest 15% of yields. This balances risk against the cost of unnecessary turnover.

That last one is interesting. Above, I mentioned the benefit of excluding the companies with the top 25% of yields. However, in the case of existing constituents, the index seeks to somewhat balance that risk against the transaction costs generated by unnecessary turnover.

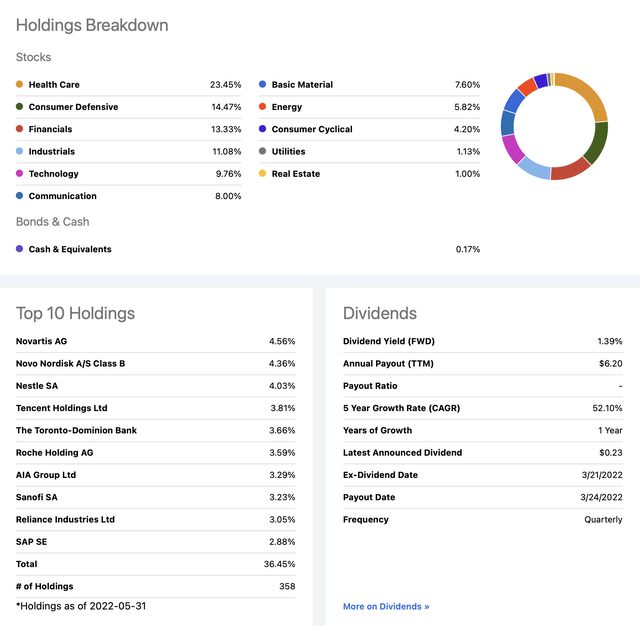

With that, let’s take a closer look at the ETF itself, starting with this excellent graphic from Seeking Alpha.

VIGI: Sector Breakdown, Top 10 Holdings, Dividends (Seeking Alpha)

A significant difference in VIGI as compared to VIG, its U.S. counterpart, is that Health Care is weighted far more heavily in the international ETF, with Industrials and Consumer Cyclical assuming significantly lesser weightings.

In line with this, 4 of VIGI’s top 10 holdings are some of the finest pharmaceutical companies in the world. One of these, Sanofi SA (SNY) is currently partnering with GSK Plc (GSK) to develop a promising COVID vaccine that appears to offer intriguing benefits as compared to the current crop of mRNA-based vaccines. Also, prominently featured is Nestle SA (OTCPK:NSRGF), the world’s largest food & beverage company. Is it any wonder that, in both good and bad economic times, such businesses have proved capable of consistently growing dividends for shareholders?

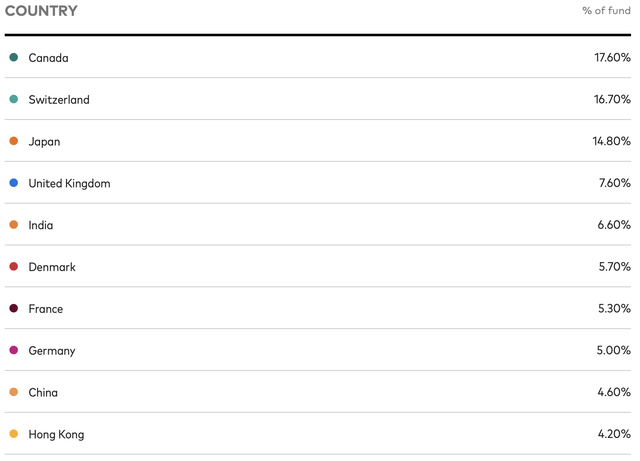

In addition to the comprehensive Seeking Alpha graphic featured above, here’s one more, from the Vanguard Investors webpage for VIGI, featuring the country breakdown. I’ve only included the Top 10 countries from the list.

VIGI: Top 10 Country Holdings (Vanguard Investors VIGI Website)

Taken together, the Top 10 countries comprise some 88.1% of the overall fund. In the verbiage in the prospectus for the index, there is a lot of wording about the overall risks involved in China at the moment. Likely, this doesn’t come as a great surprise. At the same time, it may be noted that China only comprises 4.60% of the fund at the present time.

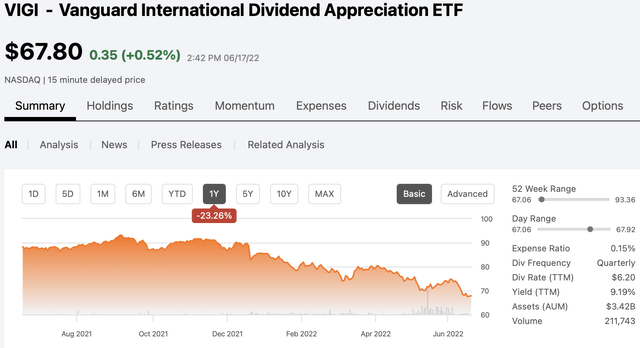

In terms of the bargain that VIGI may offer in terms of price, where do we stand in the big picture? Here’s our last graphic, once again courtesy of Seeking Alpha.

VIGI: Current Price Point (Seeking Alpha)

As I captured the screenshot, the 1Y decline of 23.26% happened to be highlighted. I might add the fact that, at $67.80, VIGI has experienced an even greater decline of 27.4% from its 52-week-high.

Put a different way, that’s about halfway between the current decline of the S&P 500 and Nasdaq indexes, for a basket of companies that have proven their ability to increase dividends for at least 7 consecutive years.

I will leave you to ponder that last sentence as we conclude this section. Might it just be the case that there is some value represented there?

BONUS Coverage: Vanguard International High Dividend Yield ETF

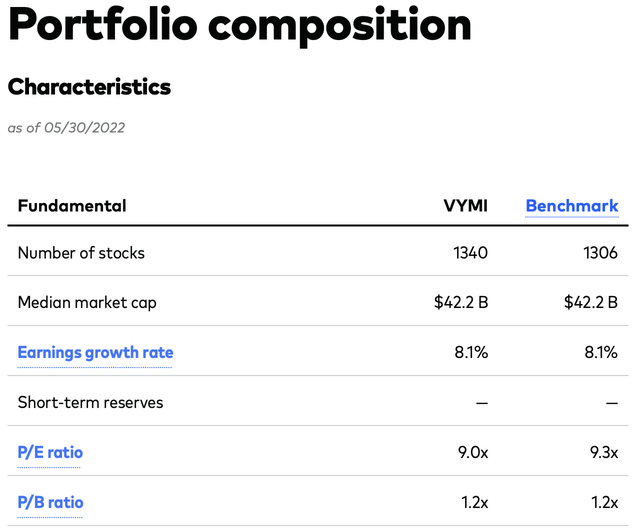

As a bonus, I would like to share some updated coverage of Vanguard International High Dividend Yield ETF (VYMI). I actually wrote about VYMI back in February, in an article entitled VYMI: Potential High-Yield Contrarian Play But You Can Do Better.

You can go back and take a look at that article to see some of my concerns. At the same time, VYMI’s overall P/E and P/B metrics were fairly low even at that time. Here is how they looked as of May 30, and bear in mind the market has dropped even lower since then.

VYMI: Various Pricing Ratios (Vanguard Investors VYMI Website)

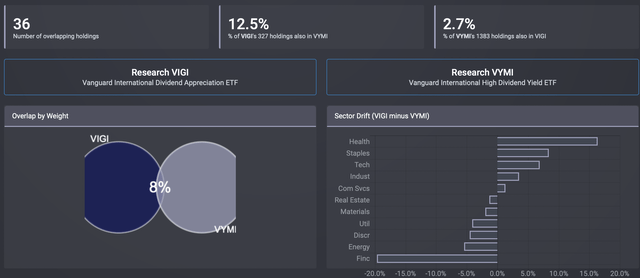

I got curious, so I ran VIGI and VYMI through the overlap tool on etfrc.com. What I found was pretty interesting. As can be seen, there is only roughly an 8% overlap between the two funds. Further, many sector weightings are very different. As examples, Financials and Energy are more heavily weighted in VYMI (focused on high current dividends) , whereas Health Care and Consumer Defensive are featured in VIGI (focused on dividend growth).

VIGI Vs. VYMI – Overlap and Sector Drift (etfrc.com)

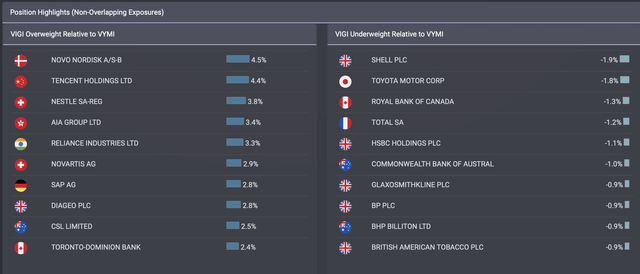

Next, here’s how that plays out in some of the individual holdings of the two funds.

VIGI vs. VYMI – Under and Overweights (etfrc.com)

I simply wanted to share that with you because it appears to be the case that a mixture of the two could offer greater diversification, with VYMI’s higher dividend ratio bolstering your income from sources outside the U.S.

Summary And Conclusion

As featured, not only the U.S. market has been hit hard during the recent market decline. So have foreign stocks.

If you are interested in diversifying your sources of dividend income, either or both of these ETFs could prove to be nice additions to your portfolio. Of the two, VIGI is more selective in stocks allowed for inclusion. VYMI takes more of a “broad brush” approach, allowing in a far greater number of stocks and then, by market-weighting them, effectively allowing the cream to rise to the top and the dregs to fall to the bottom, as it were.

I hope you have found this article interesting. Please, feel free to share your comments, questions, and yes even criticisms in the comments section below.

Until next time, I wish you…

Successful investing

Be the first to comment