cemagraphics/E+ via Getty Images

This article was first released to Systematic Income subscribers and free trials on June 13.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferreds and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the second week of June.

Be sure to check out our other weekly updates covering the BDC as well as the CEF markets for perspectives across the broader income space.

Market Action

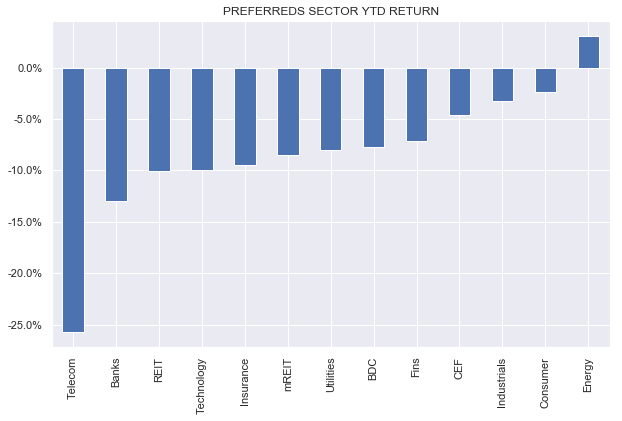

It was a tough week for preferreds as equity prices fell while Treasury yields rose as did credit spreads. All sectors finished in the red. For the month of June, only the CEF sector is still above water. For the year, the Energy sector is eking out a small positive return.

Systematic Income

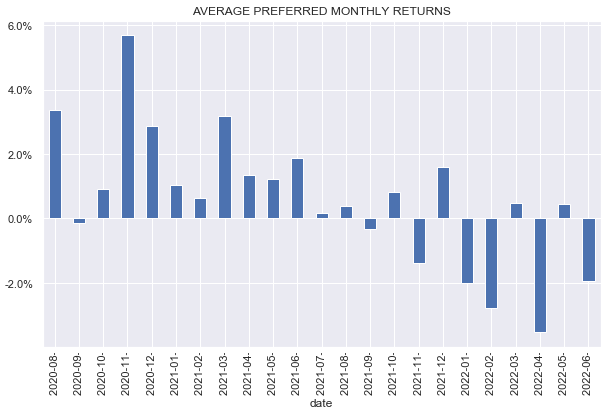

After a small relief rally in May, the sector has so far delivered a -2% total return in June.

Systematic Income

The high CPI print put a damper on the recent rally across the income space and preferreds did not escape unscathed. So long as inflation has not clearly peaked, the income space will remain volatile, allowing investors to reinvest dividends in attractive opportunities.

Market Themes

The downtrend in the income space has revealed some weaknesses across many income portfolios. In this section, we highlight a few diversification dimensions that investors should keep in mind when thinking about portfolio construction.

The first and most obvious dimension is that of credit quality and it is one that often dominates portfolio construction to the detriment of the other key dimensions. All else equal, higher-quality securities will weaken less during risk-off periods and rally less during risk-on periods. They also present with less default risk for which they enjoy a lower yield. Finding the balance between yield and quality is an essential part of income portfolio construction, however, it is not the only one.

Another important dimension to consider in allocating to preferreds is the first call date. Although most preferred issuers are fairly rational economic agents and will not redeem a security unless it is in their economic interest, they can still do so for second-order reasons such as balance sheet or capital structure considerations. This often means that securities with shorter first call dates will be more resilient than those with longer dates, all else equal.

The third dimension is coupon level. Higher-coupon securities boast a lower duration and will have a lower volatility than their lower-coupon counterparts. Higher-coupon securities have held up better this year. At the same time, a sharp rally in the preferreds sector will benefit lower-coupon securities.

The fourth dimension to consider is the coupon type of the security i.e. whether a security is Fixed or Fix/Float. Latter securities can benefit in a period of rising rates as their coupon will often move above its fixed-rate level if the relevant reset rate (usually Libor or SOFR) rises far enough. This is the reason why Fix/Float securities have tended to hold up better this year.

Finally, whether a security is perpetual or term makes an important difference. Term securities have a lower duration profile and will be more resilient in a period of rising yields, all else equal.

A consideration of these features is more likely to prevent unexpected surprises in portfolio performance in response to changing market conditions. Investors can also rotate within these features to respond to the likely change in market variables such as short-term interest rates or credit spreads. For instance, they can tilt to Fix/Float securities when short-term rates are low and to Fixed rate securities when short-term rates are likely peaking. Equivalently, they can tilt to higher-quality securities when credit spreads are tight and to higher-yielding securities when spreads are more fairly priced.

Market Commentary

CLO Equity CEF Oxford Lane Capital Corp (OXLC) has issued a 7.125% 2029 $60m ($69m with the greenshoe) preferred – temporary ticker (OXFCV). This is good for a couple of reasons. First, it’s a term preferred with a 2029 maturity – more recently, the trend has been to issue perpetual preferreds by CLO Equity CEF Funds (e.g. PRIF.PK, ECC.PD), which are much less attractive due to their significantly longer duration profile.

These perpetual preferreds currently yield 7.3-7.5% – so not super attractive relative to a 7.125% yield of the new 2029 preferred (assuming it starts trading around “par”).

Second, the stock has opened at a yield of around 7.5%, which is very attractive relative to the three other term OXLC preferreds, which are all trading well below its yield. The yield curve is relatively flat, so yields don’t slope sharply down with lower maturities which the other OXLC preferreds feature.

Three, it offers more relative value opportunities – a nice way to generate additional returns by rotating within the suite over and above what the yield gives you. And four, CLO Equity senior securities have been remarkably resilient over the past few years. The average OXLC preferred is flat year-to-date for example. This is in large part due to their term profile and high-coupon which lower their duration.

Obviously, the fact that defaults have been low has helped as well, which is not guaranteed to happen next time, however, in a serious drawdown, the CLO Equity funds have been quick to buy back their senior securities in order to support their asset coverage ratios. The funds have fairly strict covenants – more strict than the letter of the 1940 Investment Act and which require mandatory redemption in case of asset coverage breach with some lag.

In reality, this is unlikely to happen as the fund would simply deleverage enough to get the ratio in line within the allowed cure period – another example of how preferreds holders get common shareholders to do them a favour (in addition to having common shareholders pay all the fund’s fees etc). We view the security as attractive right now.

Stance & Takeaways

Hopes that inflation would peak have been pushed back on the back of a surprisingly strong CPI print. Short-term rates have continued to rise, which has, in turn, supported near-term reset securities. Investors who are overweight fixed-rate securities may want to have another look at this subset of the market. Among others, they include the PNC Financial Services Group Series P (PNC.PP), which recently switched to a 3m Libor + 4.0675% coupon, in effect, equivalent to a 5.8% stripped yield based on today’s Libor of 1.69% as well as the AGNC 7% Series C (AGNCN), which will switch to a 3m Libor + 5.111% coupon, equivalent to a 7.15% stripped yield based on today’s Libor. However, as Libor will likely exceed 3% over the coming quarters, the coupons of these securities should increase further, in turn, supporting their price.

Be the first to comment