da-kuk/E+ via Getty Images

By Alex Rosen

Summary

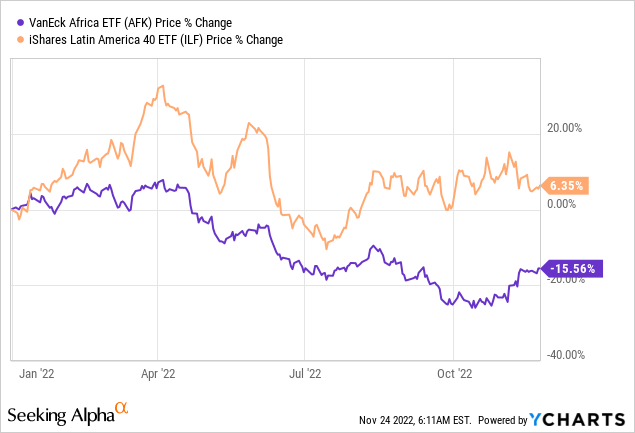

We rate VanEck Africa Index ETF (NYSEARCA:AFK) a sell due to the underlying investment model. AFK focuses on investing in companies based on the GDP of the country as opposed to the actual fundamentals of the companies. As a result, the fund is heavily weighted towards South Africa, with 33% of its holdings there. Additionally, the fund has been a consistently poor performer, having returned -4% over the last ten years.

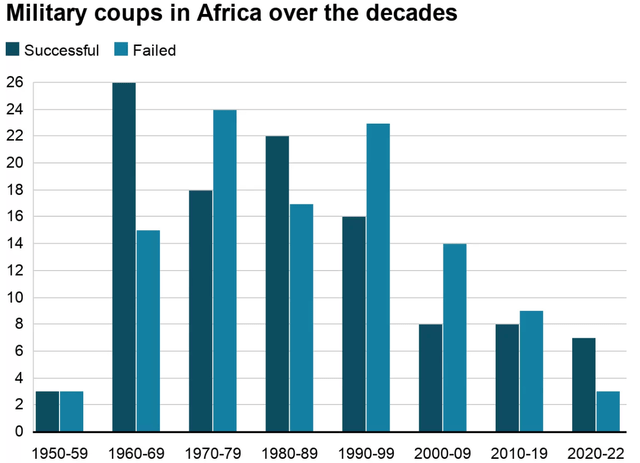

Investors are consistently calling Africa the next big thing, but even a cursory inspection of the facts on the ground shows it is not ready for prime time. The past year has seen a multitude of coups, insurgencies, health crises and climate issues that have really shaped the course of the continent. In fact, in one country, coups are so common they have a time of year they call coup season.

Investing in particular stable countries in Africa may be a wise decision, but a fund that calls itself the Africa Index may inadvertently be picking up some very unstable country holdings in the process.

Strategy

The ETF seeks to offer investors access to the entire continent and not just a few select countries. Holding size is based on GDP as opposed to market cap, so the bigger the country, the more likely it is to be represented. Currently the fund holds 86 unique assets, led by the Kenyan telecom giant Safaricom (SAFCOM) and Australian Mining conglomerate Anglo American (AAL) which has mining interests throughout the African continent.

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Non-U.S. Equity

- Sub-Segment: Africa

- Correlation (vs. S&P 500): Low

- Expected Volatility (vs. S&P 500): High

Africa and Latin America side by side (Ycharts)

Holding Analysis

AFK’s model of focusing on country GDP over market cap makes for an interesting makeup. As can be expected, the largest holding from a country perspective is in South Africa, which constitutes 33% of the portfolio, with Kenya, Morocco and Nigeria coming in second, third and fourth.

Unsurprisingly, telecom, finance and mining are the big three sectors, with the largest individual holdings also found in those sectors. The largest technological advances on the continent are in the mobile banking sector. And as always mining is a key driver of the continental economy.

The expense ratio seems high at .77%, and the Vanguard prospectus states that it is capped at that until May of 2023, so pay close attention to what happens after that.

Strengths

AFK’s attempt to capture the upside market is commendable. There is a lot to be optimistic about in Africa, and AFK attempts to tap into that. It is no surprise that the largest holding is SafariCom (SCOM) as the Kenyan telecom giant’s mobile banking system has the potential to be a real game changer in the global cash transfer system. The M-Pesa cellular data-based cash transfer system has successfully bypassed traditional banking processes and given even the most marginalized segments of society a secure method of conducting business and paying bills without having to handle physical cash or work with banks.

Africa has been, and will for a long time be, the mineral extraction center of the world, and this is both a blessing and a curse. Countries like the Democratic Republic of Congo have enough minerals, fossil fuels and farmable land to support the entire continent’s resource demand. If the day comes when the country becomes politically stable, it has the ability and resources to dethrone Brazil for the title of next big thing.

Weaknesses

Africa is continually plagued by political instability and infighting. Since 2020, the continent has seen at least nine coup attempts including three in Mali (The nine do not include attempts that were thwarted in the planning stages). It is very difficult to build on an unstable foundation, and few if any countries in Africa can honestly say they have a stable foundation from which to grow.

Military Coups consistently Plague Africa (BBC.com)

Opportunities

When things are most chaotic, the greatest opportunity for growth exists. What Africa lacks in development, it more than makes up for in possibility. There are so many gaps that need to be filled and those gaps are what make Africa such an exciting prospect. Companies that are successful in Africa have the ability to realize great windfall profits. The challenge is trying to figure out the best and most sustainable path towards that success.

Threats

Over 100 years of colonization, westernization, industrialization and democratization have done little to improve the lives of the average person in Africa. Over 40% of the people still live below the poverty line, and that number is holding strong.

Global climate change has had a particularly strong affect in parts of Africa, with over 22 million people in Somalia, Ethiopia and Kenya facing starvation due to severe prolonged droughts.

The companies that have managed to succeed have had to work through mass corruption at many levels, begging the question of how stable the foundation of these companies really is..

To add to all this, foreign actors, namely Russia and China, have increasingly made their presence felt in the continent: China through infrastructure investment/rent seeking and Russia through mineral extraction.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Sell

- Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

AFK is not a bad fund in that it does what it’s objective sets out to do. However, it does it at a very high expense ratio (.77%), which is subject to increase and is a fairly illiquid fund, all the while failing to bring back positive returns.

ETF Investment Opinion

Before writing this analysis, I wanted to recommend Africa and AFK. After all, I live here and have invested in the future, but it’s very hard to see a clear path forward based on the current conditions. Therefore, we rate AFK a sell. We like the romanticized idea of investing in Africa, but investing should be done with the mind, not the heart, and the mind says invest elsewhere.

Be the first to comment