gorodenkoff Vanda

Does the company have a short-range or long-range outlook in regard to profits? – Phillip Fisher

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on October 01, 2022.

Biotech investing is one of the most intellectually rewarding endeavors. For someone who loves to analyze data like myself, there is no shortage of foods for the brain. Moreover, you get to learn about lifesaving treatments that can bring you profits while delivering hopes to others. Notably, there are countless companies innovating and launching their drugs. Depending on their growth stage (i.e., preclinical, clinical, or commercialization), they would have different risk/reward profiles.

As you can see, I follow a company from the earliest stage throughout its entire lifecycle. My focus is on the cycle that generates the most aggressive growth and thereby higher profits for you. As such, I’d like to bring to your attention Vanda Pharmaceuticals Inc. (NASDAQ:VNDA) — a company that successfully transitioned from the clinical to launch stage. Already enjoying some level of success, Vanda is now facing some marketing/reimbursement challenges. Nevertheless, the firm is determined to deliver more growth. In this research, I’ll feature a fundamental analysis on Vanda and share with you my expectations of this intriguing growth equity.

Figure 1: Vanda chart

About The Company

As usual, I’ll provide a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the next section. Operating out of Washington, DC, Vanda Pharmaceuticals is focused on the innovation and commercialization of novel medicines to fill the unmet needs in psychiatry. I noted in the prior research,

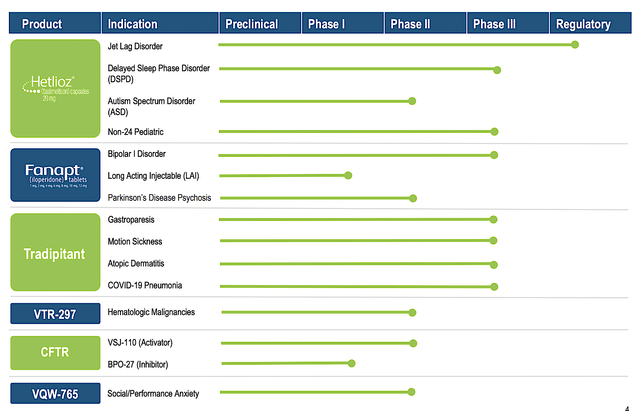

You can see that Vanda is brewing a deep pipeline of highly promising drugs. Interestingly, the two therapeutics (Hetlioz and Fanapt) are already approved and generating strong sales increases. And yet, Vanda is aggressively expanding their label which is indicative of a prudent growth strategy. In other words, growing by label expansion is a risk-deleveraged approach. Based on the vast number of label expansions, there is a good chance that at least one would become an investment bonanza.

Figure 2: Therapeutics pipeline

OliPass Partnership

As you can imagine, a partnership can bring in new future revenue while significantly increasing Vanda’s worth. On that note, Vanda disclosed on September 29 that the company entered into a collaborative partnership with OliPass. As a partnership can substantially change an investing thesis, you should take a closer look into this latest development.

Inked as a research and development partnership, both firms will jointly advance a set of “antisense oligonucleotide molecules” (i.e., ASO) using OliPass’ proprietary peptide nucleic acids (“OPNA”). Essentially, they are set to develop ASO drugs for diseases where there are “altered gene-expression.” As such, they would edit/modify the gene expression of those conditions to ameliorate the disease. Commenting on the partnership, Vanda’s President and CEO (Dr. Mihael H. Polymeropoulos) enthused:

We are excited to have a partner to enhance our antisense oligonucleotide program platform aimed at the treatment of disorders with well-understood genetic mechanisms and for which there is a high unmet medical need. Olipass’ delivery platform holds the promise of efficient delivery of our ASO’s in pursuit of the development of precision therapeutics.

OPNA

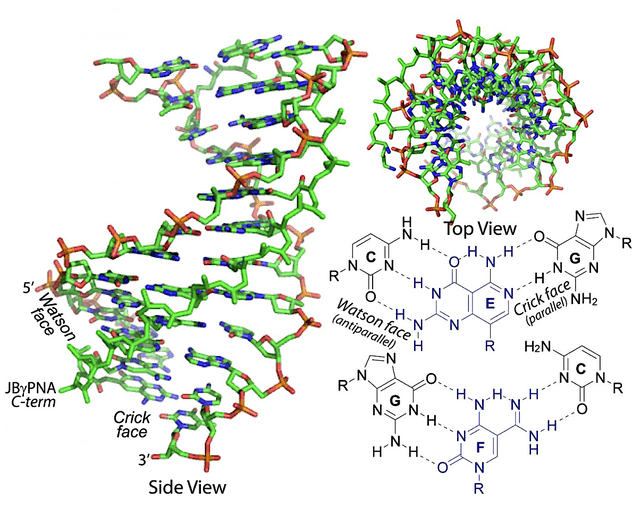

To appreciate this partnership, you should go over the salient science of OPNA. Of note, DNA are “negatively charged” molecules that direct most physiological processes in the body. From DNA, your body makes another molecule coined RNA which is also negatively charged. Depending on what binds to the RNA, that can direct the normal bodily process or cause disease. As you often hear the cliché, “Opposites attract.” It’s true that the negative charged molecules tend to bind to positively charged ones.

Figure 3: OPNA

Here, Vanda/OliPass is harnessing the power of the positively-charged molecule OPNA to improve the penetration and binding to nucleic acids (i.e., DNA/RNA). Notably, all that is designed to improve the diseases outcomes. As a testament to their potential, their OPNAs already demonstrated therapeutic efficacy in animal models at very low dosage (i.e., 10 ng/kg).

Keep in mind, there is existing ASO technology. To differentiate itself, The ones being developed by the partnership are precisely engineered to improve efficacy at much lower dosage. That aside, these OPNA can bind to pre-mRNA that is still in the cell’s nucleus (i.e., core) to hit disease targets that were once thought unconquerable.

Two ASO Targets

Wasting no time, Vanda stated that the partnership recently found two ASA targets for development. One is catered for orphan (i.e., rare) disease. The other is geared for many other immuno-oncology (i.e., I/O) conditions. The next step is to take these preclinical data in clinical testing. Commenting on the partnership, OliPass CEO (Dr. Shin Chung) stated,

Vanda shares a vision with us on the potential for antisense oligonucleotides to open up a broad range of therapeutic options to patients. We look forward to working together to enhance the therapeutic profile of these molecules and playing an integral role in bringing them into the clinical setting.

As you can imagine, targeting orphan disease is prudent. After all, there is a dire demand for novel therapeutics to deliver hopes to patients. From the business perspective, an orphan drug commands a premium reimbursement to offset the lengthy and costly developmental process. Hence, that would improve the profit margin.

Focusing the I/O target is also wise. After all, there is a vast number of I/O conditions having high demand for novel therapeutics. Differentiated molecules like OPNA can garner tremendous sales/value.

Putting things into perspective, all of this is very early in the development process. If they work, it would take many years (roughly five to seven) before you can see the drug on the market. Thereafter, it’d take about two years to ramp up sales.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll dig deeper into the 2Q2022 earnings report for the period that concluded on June 30.

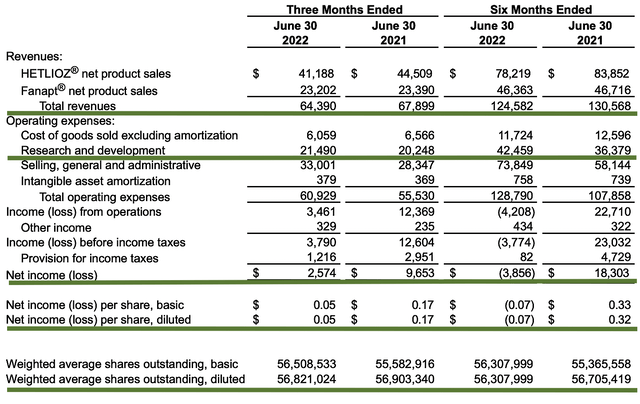

As follows, Vanda procured $64.3M in revenues compared to $67.9M for the same period a year prior. As you know, the slight topline decline is related to reimbursement issues. You can project similar challenges until there is a concrete resolution with Medicare Part D reimbursement. I don’t believe that will happen soon. Therefore, Vanda would need to find other avenues like label expansion, R&D and/or partnership to boost sales.

That aside, the research and development (R&D) for the respective periods registered at $21.4M and $20.2M. I viewed the R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $2.5M ($0.05 per share) net income compared to $9.6M ($0.17 per share) net gain for the same comparison. As you can see, the higher R&D and lower reimbursement for Hetlioz caused the bottom line to depreciate. Still, the company is operating at a net profit.

Figure 4: Key financial metrics

About the balance sheet, $440.9M in cash, equivalents, and investments. Against the modest $60.9M quarterly OpEx and on top of the $64.3M quarterly revenue, there is no concern about the cash runway. Simply put, the cash position is strong relative to the burn rate.

While on the balance sheet, you want to check to see if Vanda is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding decreased from 56.9M to 56.8M, the company has actually increased your stock value through shares reduction.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” Asides from the risks that the OliPass partnership might not bear fruits, I noted in the prior article:

At this point in its life cycle, the biggest concern for Vanda is whether the company can continue to ramp up sales for Hetlioz and Fanapt. There is a risk that the company won’t be able to fix the reimbursement issues. The ongoing legal battles might incur higher costs and thereby cut into the net profits. That aside, there is a high risk that tradipitant won’t gain FDA approval for gastroparesis on its first round to the FDA. In such a situation, Vanda shares are likely to tumble by 30% and vice versa.

Conclusion

In all, I maintain my buy recommendation on Vanda Pharmaceuticals with the 4.8/5 stars rating. Vanda is a story of investment success. Despite the recent sales deviation, the company is still banking a net profits and the long-term trends in both Hetlioz and Fanapt sales are excellent. While the reimbursement environment remains uncertain, you can expect the additional label expansions to sustain long term sales growth. The OliPass partnership signaled the management’s ultra long growth vision.

Looking ahead, the Phase 3 studies for Fanapt label expansion for Bipolar is poised to post results by yearend. As I’m not an expert on Bipolar, I will refrain from making this forecast. That aside, the company will file an NDA for tradipitant for gastroparesis in the coming months. That aside, the Phase 2 study of VQW-765 for anxiety will post results yearend 2022. Lastly, Vanda is still pursuing approval of Hetlioz for jet lag. While I don’t expect all of their expansions to bear fruits, one or a few approvals should substantially increase sales.

Be the first to comment