jcrosemann

November saw a slight rise in vanadium prices after three months of stalling prices as China starts to increase stimulus to their property sector. VRFBs continue to gain momentum in China and now look like having a big VRFB project in Australia.

Vanadium uses

Vanadium is traditionally used to harden steel. Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart – Price = USD 7.70/lb (China price not given)

![Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart](https://static.seekingalpha.com/uploads/2022/11/25/37628986-1669424431266642.png)

Vanadiumprice.com

China and Europe Ferrovanadium [FeV] 80% prices – China = USD 37.00/kg, Europe = USD 31.75/kg

![China and Europe Ferrovanadium [FeV] 80% prices](https://static.seekingalpha.com/uploads/2022/11/25/37628986-1669424481690673.png)

Vanadiumprice.com

Vanadium demand versus supply

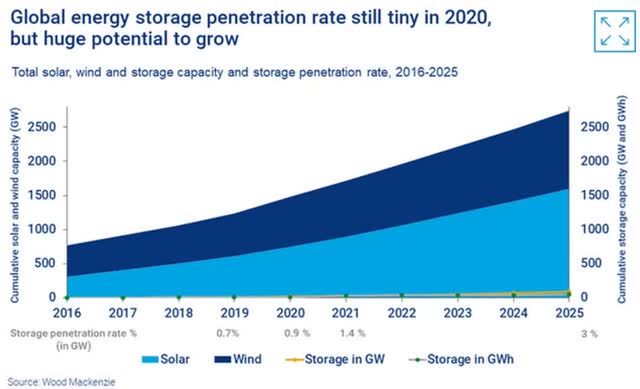

An April 2021 Wood Mackenzie report stated:

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

Woodmac forecasts high growth ahead for solar, wind and energy storage

Woodmac

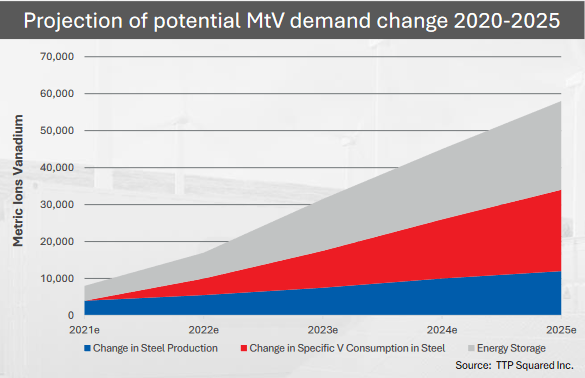

Vanadium demand is projected to surge from now to 2025 (source)

Vanadium Resources courtesy TTP Squared Inc.

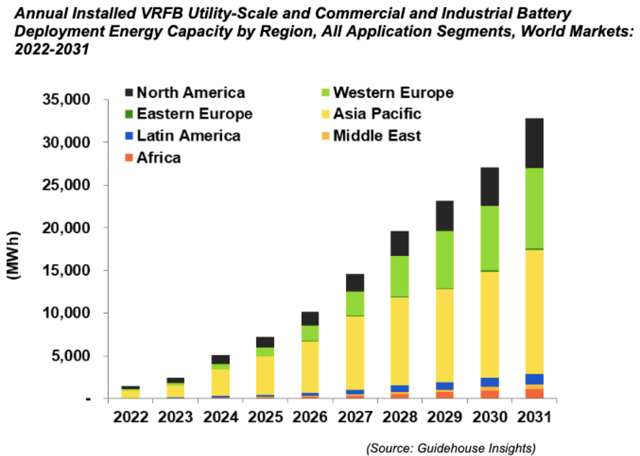

Global VRFB forecast growth by region 2022-2031

Guidehouse Insights

In 2017 Robert Friedland stated: “We think there’s a revolution coming in vanadium redox flow batteries….”

Vanadium market news

On November 2 Rethink Research reported:

China wants over 100 GW energy storage by 2025……in September 2021 the National Energy Administration published a plan for 62 GW of pumped hydro to be operational come 2025, double the 2021 figure……As for batteries, EPC contracts rose to 13.82 GW / 27.7 GWh in the first eight months of 2022 – a year-on-year increase of almost 500%……The National Energy Administration’s target for 2025 is only 30 GWh, which it calls “only the basic goal.”……Chinese renewable projects are increasingly required to have co-located battery capacity……Shenzhen city……has just this week brought in a subsidy of $27.5 per MWh for battery projects over 1 MW in size……By no means is this all about lithium-ion……Other more direct competitors to lithium-ion are also on the take-off strip – such as flow battery technologies which can be more affordably scaled to longer durations. Vanadium flow appears to be foremost among these. A recent 5.5 GWh tender assigned 1 GWh to vanadium redox flow……Vanadium also had a 500 MW, 2 GWh factory commissioned in Henan province in early October, while Yunnan Province’s Chuxiong Prefecture intends to “build a national all-vanadium flow battery highland” from an announcement a week ago. Already this year vanadium battery projects amounting to 300 MW / 1104 MWh have been commissioned.

On November 25 Ferroalloynet reported (paywalled): “Sichuan: Target to reach 1GW/Year of vanadium battery system integration by 2025.”

On November 25 Vanadiumprice reported:

Now for our first Vanadium Redox Flow Battery. Australia was the first in the world with a lithium-ion big battery, now North Harbour Clean Energy is promising to build out first big Vanadium Redox Flow Battery. The company, in a joint venture with international battery company CellCube, today announced their first project is to develop the continent’s largest VRFB, which generates 4MW-16MWh……The pair also plan to build an assembly and manufacturing line in Eastern Australia to meet GWh demand for long-duration energy storage in the National Electricity Market.

On November 25 Bloomberg reported:

China Central Bank boosts stimulus to aid COVID-hit economy. Reserve requirement ratio for banks cut by 25 basis points. PBOC wants to keep liquidity ample, bolster real economy……The PBOC’s move comes after significant government actions recently to help the economy, including a rescue package for the property sector and an adjustment of some COVID curbs to reduce the damage to the economy……The central bank has also cut its key interest rates twice this year, with the most recent move in August.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTC:OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

On October 28, Glencore announced:

Third quarter 2022 production report. Glencore Chief Executive Officer, Gary Nagle: “Operational performance over the third quarter was impacted by a range of events including extreme weather in Australia, industrial action at nickel assets in Canada and Norway (since resolved) and the emergence of significant supply chain issues in Kazakhstan stemming from the Russia/Ukraine war. Full-year 2022 production guidance has, accordingly, been reduced for those affected commodities.”

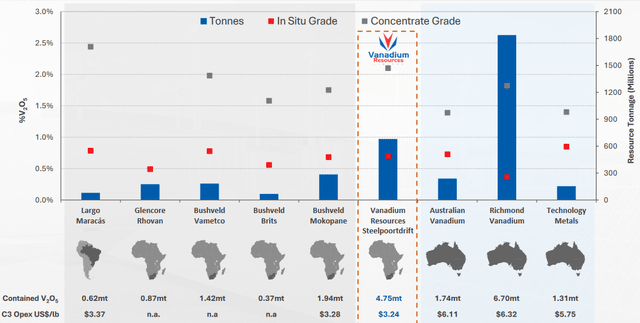

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

On November 2, AMG Advanced Metallurgical Group NV announced: “Lithium performance drives AMG to all-time record earnings and increased full year guidance.” Highlights include:

Vanadium

- “The new vanadium spent catalyst recycling facility in Zanesville, Ohio, which started operating on October 29, 2022, is a clear manifestation of AMG’s industry leadership in the recycling of hazardous refinery waste globally…..we expect the ramp-up to full production to take between three to four months.

- AMG’s innovative lithium vanadium battery (“LIVA”) for industrial power management applications has successfully started up at our plant in Hauzenberg, Germany……”

On November 21, AMG Advanced Metallurgical Group NV announced:

AMG update on energy transformation: LIVA Batteries. AMG Advanced Metallurgical Group N.V. (“AMG”, EURONEXT AMSTERDAM: “AMG”) announces that its subsidiary, AMG LIVA, has put its first battery Hybrid Energy Storage System (“HESS”) into fully automatic operation mode in Hauzenberg, Germany. The HESS battery system is an ecosystem combining Lithium-Ion and Vanadium Redox Flow batteries with artificial intelligence routines and self-learning algorithms to maximize efficiency, safety and lifetime of the batteries, integrating the HESS with the facility’s power system, renewable energy sources, and the electrical grid.

You can view the latest investor presentation here and a recent Trend investing article here.

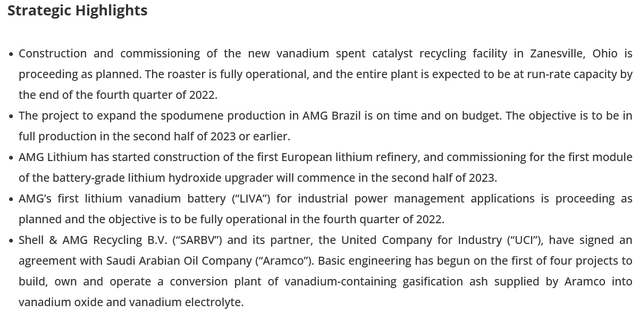

AMG update on expansion plans (source)

AMG Q2, 2022 results announcement

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

No news for the month.

You can view the latest investor presentation here.

Largo Inc. [TSX:LGO] [GR:LR81] (LGORF)(NASDAQ:LGO)

Largo Inc. is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil as well as a producer of VRFBs.

On November 9, Largo Inc. announced: “Largo reports third quarter 2022 financial results; continues its focus on two-pillar growth strategy.” Highlights include:

- “Revenues of $54.3 million vs. revenues of $53.9 million in Q3 2021; Revenues per lb sold1 of $8.80 vs. $9.10 in Q3 2021

- Net loss of $2.6 million vs. net income of $9.2 million in Q3 2021; Basic loss per share of $0.04 in Q3 2022; Inclusive of approximately $3.0 million in non-recurring expenditures such as legal and listing costs for Largo Physical Vanadium Corp. (“LPV”) and an increase in legal provisions

- Cash provided before working capital items of $4.3 million vs. $20.3 million in Q3 2021; Net cash provided by operating activities of $10.0 million vs. $15.5 million in Q3 2021

- Operating costs of $45.6 million vs. $32.1 million in Q3 2021 and cash operating costs excluding royalties per pound1 of V2O5 equivalent sold of $4.86 in Q3 2022 vs. $3.53 in Q3 2021

- Cash balance of $62.7 million and a net working capital2 surplus of $114.1 million exiting Q3 2022

- V2O5 equivalent sales of 2,796 tonnes (inclusive of 351 tonnes of purchased material) vs. 2,685 tonnes (inclusive of 136 tonnes of purchased material) sold in Q3 2021

- Production of 2,906 tonnes (6.4 million lbs3) of V2O5 vs. 3,260 tonnes in Q3 2021

- Progress continued on the implementation of the Company’s ilmenite concentration plant at the Maracás Menchen Mine, including receiving all required metallic flotation structures and building of desliming, flotation, filtration, warehouse and pipe rack structures; Expects commissioning to be completed in Q2 2023

- Largo Clean Energy (“LCE”) signed a non-binding MOU with Ansaldo Green Tech in August 2022 to negotiate the formation of a joint venture for the manufacturing and commercial deployment of vanadium redox flow batteries (“VRFB”) in the European, African and Middle East power generation markets.”

Vanadium Market Update4

- “The Company maintained a strong focus on developing new markets for its high purity products and concluded its first sale of vanadium trioxide (“V203”) in Europe in Q3 2022.

- High purity vanadium demand has increased following ongoing recovery from 2020 COVID-19 impacts, which was partially offset by a softening of steel demand in Q3 2022…..”

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio,” as well as being a small vanadium producer.

On November 8, Energy Fuels Inc. announced: “Energy Fuels announces Q3-2022 results, including continued robust balance sheet and market-leading U.S. uranium & rare earth positions.” Highlights include:

- “…..During the first nine months of 2022, the Company sold approximately 642,000 pounds of existing inventory of vanadium (“V2O5“) (as ferrovanadium, “FeV“), for an average weighted net price of $13.69 per pound of V2O5. Vanadium markets have dropped in recent months. Therefore, the Company has halted sales of its inventory which currently stands at approximately 987,000 pounds of V2O5. However, the Company expects to resume sales as markets may improve in the future. The Company is evaluating the potential to resume vanadium recovery at the Mill in the future as market conditions may warrant for future sale and to replace sold inventory, where its tailings pond solutions contain an estimated additional 1.0 to 3.0 million recoverable pounds of V2O5.”

On November 14, Energy Fuels Inc. announced:

Energy Fuels executes definitive agreement to sell Alta Mesa ISR Project to enCore Energy for $120 million, facilitating the Company’s plans to accelerate both uranium and rare earth production…..

Ferro-Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

No significant news for the month.

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

On November 2, Western Uranium & Vanadium Corp. announced:

Western Uranium & Vanadium provides companyupdates….. Mining Operations – Sunday Mine Complex……Mining operations are targeted to restart in January 2023.

Investors can read the latest company presentation here.

Vanadium developers

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On October 31, Neometals announced: “Quarterly activities report for the quarter ended 30 September 2022.” Highlights include:

Corporate

- “Cash balance A$50.8 million, receivables and investments of A$29.8 million and no debt.

- Neometals included in ASX 300, first recycling revenues booked by Primobius and 3rd annual Sustainability Report completed.“

Core Battery Materials Business Units

Vanadium Recovery Project (“VRP”) (earning into 50:50 JV with Critical Metals Ltd)

- “AACE®1 Class 3 Engineering and Cost Study confirms potential for lowest quartile operating costs.

- Feasibility study, including above cost estimates, is being advanced in parallel with negotiations for additional slag feedstock from Swedish Steel AB, by-product offtake with Betolar plc, product offtake and financing.

- Finnish environmental permit was granted post quarter end.”

Upstream – Mineral Extraction

Barrambie Titanium and Vanadium Project (“Barrambie”) (100% NMT)

- “Commercial smelting trials on mixed gravity concentrates successfully completed in China with leading chloride-grade titanium slag producer Jiuxing. Test work results expected for release in Nov 22.

- Pre-feasibility study advanced with completion on track for Dec 2022. Study will allow the evaluation of the production of direct shipping ore, mixed gravity concentrates and separate ilmenite and iron/vanadium concentrates for export from Geraldton.”

On November 3, Neometals announced: “Successful commercial-scale smelting trials for Barrambie.”

On November 17, Neometals announced: “Robust outcomes from Barrambie Titanium Project PFS.” Highlights include:

- “Neometals completes Class 4 Pre-Feasibility Study (“PFS”) for production of titanium (ilmenite) and iron-vanadium concentrate from titanium-rich Eastern bands at Barrambie.

- Average free cash (before tax, depreciation and amortisation) of AUD $136M p.a. over the first 10 years.

- Probable Ore Reserve of 44.5 Mt at 18.7% TiO2, 44.1 % Fe2O3 and 0.61% V2O5.

- PFS assumes a simple mine, crush, mill and beneficiate operation to produce mixed gravity concentrate at Barrambie, followed by additional processing at a site with lower cost natural gas supply east of Geraldton.

- The PFS confirms ‘value-in-use’ for Barrambie’s product basket and supports dialogue with potential offtake partner Jiuxing.“

You can view the latest investor presentation here.

Australian Vanadium [ASX:AVL] [GR:JT71] (OTCQB:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia. VSUN Energy was launched by AVL in 2016 to target the energy storage market for vanadium redox flow batteries [VRFBs].

On November 21, Australian Vanadium announced: “AVL receives $618,904 R&D refund for 2021/21 tax year.”

Catalysts include:

- Early 2023 – Updated Mineral Resource Estimate due.

- 2023 – Possible further off-take and/or JV partner announcements.

You can view the latest investor presentation here, or read a Trend Investing CEO interview here.

Technology Metals Australia [ASX:TMT]

The Company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia. Technology Metals Australia is studying (“Integration Study”) to combine the high grade, high quality Yarrabubba deposit with the Gabanintha Vanadium Deposit to form the Murchison Technology Metals Project (MTMP).

On November 7, Technology Metals Australia announced: “MTMP Global mineral resource upgrade. Delivers 26% increase to measured and indicated resource.” Highlights include:

- “MTMP Measured and Indicated Mineral Resource Estimate grows to 63.2Mt at 0.9% V2O5 within Global Mineral Resource Estimate of 153.7Mt at 0.8% V2O5.

- Maiden Yarrabubba Measured Mineral Resource Estimate of 5.9Mt at 1.0% V2O5 and 11.2% TiO2.

- Global Measured Mineral Resource Estimate grows 10 fold to 12.1Mt at 1.0% V2O5 – expected to support significant growth in Proven Ore Reserve.

- Measured and Indicated Mineral Resource Estimate for the MTMP excludes oxide mineralisation.

- Upgrade of Global Mineral Resource Estimate to underpin an updated MTMP Proven and Probable Ore Reserve estimate for inclusion in the Bankable Financial Model.”

You can view the latest investor presentation here.

TNG Ltd [ASX:TNG] [GR:HJI] (OTCPK:TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

On October 26, TNG Ltd. announced: “September 2022 quarterly activities report.” Highlights include:

- “Conditional Letters of Support/Interest for up to A$800 million in debt funding received for the Mount Peake Project from Australian, German and Korean Government backed funding sources.

- Technical reports for the Environmental Impact Assessment well advanced, with the Referral document expected to be submitted to the Northern Territory Environmental Protection Agency (NTEPA) late 2022/early 2023.

- Planning completed for a brownfields drilling program at the Mount Peake Project expected to be undertaken during the December Quarter, supported by $143,000 in co-funding under the Geophysics & Drilling Collaborations program administered by the Northern Territory Geological Survey.

- The Company’s cash position at 30 September 2022 was $9.2 million.“

On November 22, TNG Ltd. announced:

Management update……Paul Burton will step down as Managing Director and CEO on 25 November 2022 to pursue new career opportunities after 16 years of service to the Company.

You can view the latest investor presentations here.

Vanadium Resources Limited [ASX:VR8] [GR:TR3]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On October 27, Vanadium Resources Limited announced: “Activities report – September quarter 2022.” Highlights include:

- “Company subsidiary Vanadium Resources (Pty) Ltd (“VanRes”) entered into an Option Agreement to acquire 135 hectares of Property for planned Salt Roast Plant.

- HCF appointed as debt funding advisor to assist the Company with arranging debt finance for the development of the Steelpoortdrift Vanadium Project.”

Post Quarter Highlights

- “Definitive Feasibility Study1 (“DFS”) and updated Mineral Resource and Ore Reserve estimates released for the Steelpoortdrift (“SPD”) Project.

Vanadium Resources Limited

- Mineral Resources now amounts to 680Mt (2.7% increase) at 0.70% vanadium pentoxide (“V2O5”) at a cut-off grade of 0.45% V2O5 – the Measured Mineral Resources increased by 58% to 145Mt at 0.72% V2O5.

- Ore Reserves total 76.86Mt at 0.72% V2O5 with 30.23Mt of Proven Ore Reserves at 0.70% V2O5 and 46.62Mt of Probable Ore Reserves at 0.72% V2O5.

- Additional LOM of up to 67 years readily available in the designed open pits within a low environmental and social impact inclusion zone, and Life of Mineral Resource in open pit is +180 years at current throughput rates.”

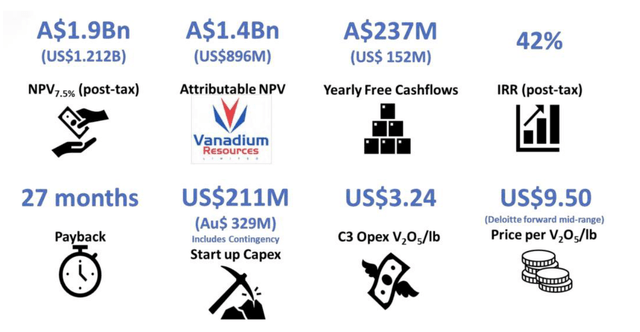

You can view the latest investor presentation here. Below is an interesting screenshot from the company presentation that compares various vanadium projects globally.

Vanadium Resources

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

No significant news for the month.

You can view the latest investor presentation here.

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:VRBFF)

VanadiumCorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

No news for the month.

You can view the latest investor presentation here.

Richmond Vanadium Technologies Pty Ltd (“RVT”) ASX IPO planned for late 2022 – Spin-off from Horizon Mining [ASX:HRZ]

RVT now owns 100% of the Richmond Vanadium Project. It has a global Mineral Resource of 1.8Bt @ 0.36% Vanadium Pentoxide (V2O5).

On October 25. Proactive Investors announced:

Horizon Minerals has priority offer in Richmond Vanadium Technology IPO. The IPO to raise between $25 million and $35 million opened on October 24, 2022, with funds raised to primarily be used for a bankable feasibility study at the Richmond Vanadium Project in North Queensland.

On November 16, Richmond Vanadium Technologies Pty Ltd announced: “IPO indicative demand exceeds minimum subscription.” Highlights include:

- “IPO supported with indicative demand that exceeds the minimum subscription of $25m.

Phenom Resources Corp. [TSXV:PHNM] (OTCQX:PHNMF) (formerly First Vanadium Corp.)

The Carlin Gold-Vanadium Property hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a Historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

On November 23, Phenom Resources Corp. announced:

Phenom Resources expands the vanadium deposit on its flagship Nevada Project. Paul Cowley, President and CEO of the Company, states, “The 2022 summer drilling program met its objectives by expanding the size of the vanadium deposit in three of the four sectors (north, west and east) beyond the limits of previous drilling showing continuity of consistent good vanadium grades and widths near surface. With the success of this program, it opens up the deposit to further expansion in four new areas, outlined in Figure 1, which will be drilled before a new resource estimate is done.”

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTC:OTCPK:SYAAF) (OTC:SRHYY)

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTC:DMNKF)

Other listed vanadium juniors

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Golden Deeps [ASX:GED]

- Intermin Resources [ASX:IRC]

- Maxtech Ventures [CSE:MVT]

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Pursuit Minerals [ASX:PUR]

- QEM Limited [ASX:QEM]

- Sabre Resources [ASX:SBR]

- Strategic Resources [TSXV:SR] (OTCPK:SCCFF)

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Voyager Metals Inc. [TSXV:VONE][GR:9VR1] (OTC:VDMRF) (formerly Vanadium One Iron Corp.)

- Venus Metals [ASX:VMC]

- Victory Metals [TSXV:VMX]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Enerox GmbH (90% Bushveld/10% Cellcube Energy Storage Systems)

- Invinity Energy Systems (LSE:IES) (IVVGF) (OTCQX:IESVF)

Conclusion

November saw slightly higher V2O5 prices and slightly higher ferrovanadium prices.

Highlights for the month include:

- China wants over 100 GW energy storage by 2025, 30 GWh from batteries. Already this year vanadium battery projects amounting to 300 MW / 1104 MWh have been commissioned in China.

- Chinese renewable projects are increasingly required to have co-located battery capacity……Shenzhen city has just this week brought in a subsidy of $27.5 per MWh for battery projects over 1 MW in size.

- Sichuan: Target to reach 1GW/Year of vanadium battery system integration by 2025.

- North Harbour Clean Energy is promising to build the first big Vanadium Redox Flow Battery in Australia in a JV with CellCube which generates 4MW-16MWh.

- China Central Bank boosts stimulus to aid Covid-hit economy. Reserve requirement ratio for banks cut by 25 basis points.

- AMG’s new vanadium spent catalyst recycling facility in Zanesville, Ohio, started operating on October 29, 2022. AMG’s lithium vanadium battery production has successfully started up in Germany.

- Western Uranium & Vanadium Sunday Mine Complex mining operations are targeted to restart in January 2023.

- Neometals reports robust outcomes from Barrambie Titanium Project PFS.

- Technology Metals Australia delivers 26% increase to M& I Resource at their Murchison Technology Metals Project (MTMP).

- Vanadium Resources DFS for the Steelpoortdrift Project results in a post-tax NPV7.5% of A$1.9b and 42% post-tax IRR. Start up CapEx A$329m.

- Richmond Vanadium Technologies Pty IPO indicative demand exceeds minimum subscription.

- Phenom Resources expands the vanadium deposit on its flagship Nevada Project.

As usual all comments are welcome.

Be the first to comment