jcrosemann/iStock via Getty Images

Welcome to the Vanadium miners news.

July saw a steady month of news with several juniors making good progress. The big news for the month was the commissioning of the first phase of the world’s biggest flow (VRFB) battery in China.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart – Price = USD 7.50/lb (China price not given)

Vanadiumprice.com![Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart](https://static.seekingalpha.com/uploads/2022/7/27/37628986-16589732244714253.png)

China and Europe Ferrovanadium [FeV] 80% prices – China = USD 33.50/kg, Europe = USD 33.75/kg

Vanadium demand versus supply

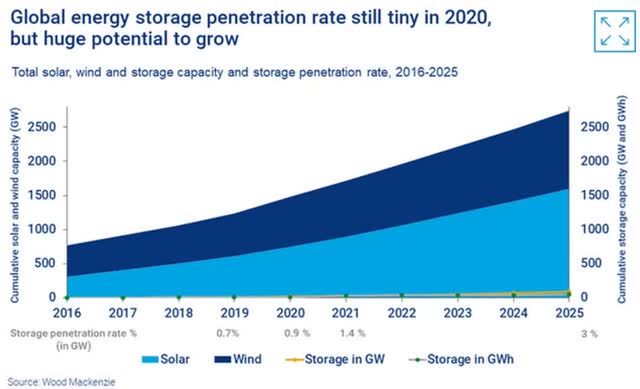

An April 2021 Wood Mackenzie report stated:

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

Woodmac forecasts high growth ahead for solar, wind and energy storage

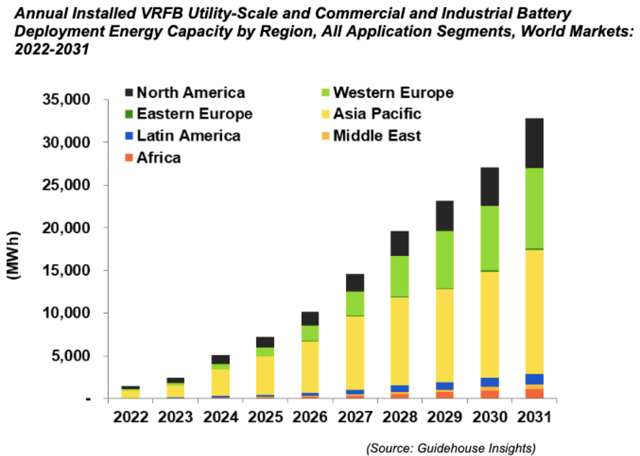

Global VRFB forecast growth by region 2022-2031

An early 2021 Roskill post stated:

The vanadium market is set to tighten over the year and more so in 2022, driven by higher demand but also by tighter supply, as Chinese steel slag producers are running close to capacity. Outside of China, incremental supply will also be limited and come mainly from AMG’s new facility in Ohio, USA, and Bushveld’s Vametco gradually increasing its production in South Africa… Vanadium redox batteries (VRBs) could become a major market for vanadium amid growing demand for energy storage, should the technology develop… On the supply side, Roskill does not expect significant tonnages from new projects to enter the market before 2024.

In 2017 Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries…

Vanadium market news

On July 21 Energy Storage News reported:

First phase of 800MWh world biggest flow battery commissioned in China. Commissioning has taken place of a 100MW/400MWh vanadium redox flow battery (VRFB) energy storage system in Dalian, China. The biggest project of its type in the world today, the VRFB project’s planning, design and construction has taken six years… VRFB developer and manufacturer Rongke Power supplied the battery technology… One thing limiting the size and scale of flow batteries today is access to vanadium pentoxide, which is used in their electrolytes. While vanadium itself is abundant in both its raw primary form and as a secondary byproduct of steel production, not many facilities to process it into electrolyte exist.

On July 27 Energy Storage News reported:

US installs 5GWh of battery storage in H1 2022 but overall clean power deployments fall.

Note: The 5GWh of battery storage is across all types of energy storage.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

On June 30, Glencore announced: “Glencore publishes payments to governments report 2021.”

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

On July 5, AMG Advanced Metallurgical Group NV announced:

Shell & AMG Recycling B.V. and the United Company for Industry announce an agreement with Aramco to construct and operate a World-Class Metals Supercenter Complex in Saudi Arabia… In support of this initiative, this Agreement aims to be the initial phase of the Supercenter complex, with the processing of the metal vanadium concentrate from the Jazan Integrated Gasification Combined Cycle Plant, licensed by Shell, to produce high-purity Vanadium Pentoxide; build a regional research and development center for testing a residue-upgrading catalyst; install a Lithium Vanadium Battery (“LIVA”); and install a vanadium electrolyte production plant, an important step in the development of a market for Vanadium Redox Flow Batteries in the Kingdom.

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On June 30, Bushveld Minerals announced: “Full year results for the 12-month period ended 31 December 2021.” Highlights include:

- “Group Revenue of US$106.9 million, a 18.8% increase over 2020 (2020: US$90.0 million), supported by improved average realised price of vanadium.

- Group production of 3,592 mtV, at the upper end of 2021 revised guidance of between 3,400mtV and 3,600mtV. H2 2021 Group production of 2,018 mtV, a 28.2% increase over H1 2021 (H1 2021: 1,574 mtV), supported by operational improvements implemented from Q2 2021. Operational stability has continued into H1 2022, resulting in 12 months of stable production levels.

- Group Sales of 3,314 mtV, a 13.7% decrease over 2020 (2020: 3,842 mtV), as a result of international and domestic logistical challenges.

- Underlying Group EBITDA1 loss of US$7.5 million an improvement of US$7.4 million relative to 2020 (2020: EBITDA loss US$14.9 million). H2 2021 underlying EBITDA profit of US$3.3 million, supported by strong production levels, higher realised prices and continuing to trade on an EBITDA positive basis in H1 2022. The Group has been EBITDA positive for the past 12 months.

- Ended the year with cash and cash equivalents of US$15.4 million held at 31 December 2021 (2020: US$50.5 million). Gross Debt of US$82.1 million (2020: US$89.2 million). Prioritised significant investments including: growth initiatives at Vanchem (US$4.2 million), construction of BELCO electrolyte plant (US$4.9 million), investment in CellCube (US$10 million) and debt repayments (US$3.9 million).

- Successfully realised its investments in AIM-listed companies AfriTin Mining Limited and Invinity Energy Systems Plc for approximately US$3.5 million and US$12.7 million respectively.

- Obtained an indirect shareholding of 25.25% into CellCube, a Vanadium Redox Flow Battery original equipment manufacturer…”

You can view the latest investor presentation here.

Largo Inc. [TSX:LGO] [GR:LR81] (LGORF)(NASDAQ:LGO)

Largo Inc. is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil as well as a producer of VRFBs.

On July 14, Largo Inc. announced: “Largo reports stronger second quarter 2022 production and sales results with 3,291 tonnes of V2O5 equivalent sold; announces automatic repurchase plan pursuant to its normal course issuer bid.” Highlights include:

- “V2O5 production of 3,084 tonnes (6.8 million lbs1) in Q2 2022 vs. 3,070 tonnes produced in Q2 2021 and 26% above production Q1 2022.

- Record monthly V2O5 production of 1,168 tonnes in May 2022; April 2022 production was impacted by a minor issue in the de-ammoniator area at the end of the month while June 2022 production was impacted by kiln availability.

- Global V2O5 recovery rate3 of 81.8% in Q2 2022 vs. 79.9% in Q2 2021.

- V2O5 equivalent sales of 3,291 tonnes of in Q2 2022, a 9% increase over the 3,027 tonnes sold in Q2 2021 and 47% above sales in Q1 2022.

- During Q2 2022, the average benchmark price per lb of V2O5 in Europe was $11.08, a 3% increase from the average of $10.72 seen in Q1 2022 and a 35% increase over the average of $8.19 seen in Q2 2021.

- Construction of the Company’s ilmenite concentration plant continues according to schedule and the Company expects to begin commissioning in Q2 2023.

- …2022 V2O5 production guidance of 11,600 – 12,400 tonnes maintained.

- Largo Clean Energy (“LCE”) continued electrolyte production and stack manufacturing in Q2 2022 while obtaining International Standards Organization (“ISO”) 9001 certification.

- The proposed qualifying transaction and Largo Physical Vanadium Corp. (“LPV”) (see press release dated April 19, 2022) remains subject to standard TSX Venture Exchange regulatory approval; The Company will provide an update on LPV’s status once the TSXV approval process is complete.”

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio”, as well as being a small vanadium producer.

No news for the month.

Ferro-Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

On July 1, Ferro-Alloy Resources announced: “Balasausqandiq feasibility study update.”

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

On July 27 Western Uranium released a market update.

In building Western’s in-house mining capability, three separate equipment packages have been acquired and readied for deployment. This full complement of mining equipment was purchased at attractive prices and is sufficient to support the initial mining operations at the Complex.

Investors can read the latest company presentation here.

Vanadium developers

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On July 8, Neometals announced: “Vanadium recovery study confirms lowest quartile cost potential.” Highlights include:

- “Class 3 Engineering Cost Study component of Feasibility Study completed with assistance from leading Nordic engineering group Sweco Industry Oy.

- Operating cost estimate of US$ 4.38/lb V2O5 places VRP1 project in lowest quartile of the industry cost curve.

- Capital cost estimate of US$ 341 M for upsized 300ktpa plant (including 15% contingency).

- Permitting activities well advanced with Environmental Permit submitted to Finnish regulators and a decision expected in September 2022.”

On July 13, Neometals announced: “Cooperation agreement with Mercedes-Benz now legally binding.” “Highlights include:

- “Neometals lithium-ion battery recycling JV, Primobius, has executed a purchase order from Mercedes-Benz recycling subsidiary, LICULAR GmbH (“LICULAR”) to complete front-end engineering for the shredding section of LICULAR’S integrated recycling plant.

- The Cooperation Agreement between Primobius and LICULAR is now legally binding.

- LICULAR’s planned 10tpd integrated recycling plant timetable contemplates execution of an equipment supply agreement in the December quarter of 2022.”

You can view the latest investor presentation here.

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia. VSUN Energy was launched by AVL in 2016 to target the energy storage market for vanadium redox flow batteries [VRFBs].

No news for the month.

Catalysts include:

- 2022/23 – Possible further off-take and/or JV partner announcements.

You can view the latest investor presentation here, or read a Trend Investing CEO interview here.

Technology Metals Australia [ASX:TMT]

The Company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

On July 14, Technology Metals Australia announced: “Vanadium electrolyte study to supply Australian batteries.” Highlights include:

- “Technology Metals to commence feasibility study to produce vanadium electrolyte in Australia utilising its own high-quality vanadium feedstock…

- New wholly owned subsidiary, vLYTE established for the production, marketing and sales of vanadium electrolyte.”

On July 20, Technology Metals Australia announced: “Quarterly activities report for the three months ended 30 June 2022.” Highlights include:

- “Outstanding results received from roast-leach testwork undertaken on Yarrabubba material as part of the Integration Study for the Murchison Technology Metals Project (MTMP).

- Notice to proceed with front end engineering & design (FEED) services on key roasting kiln section of the MTMP processing plant issued to leading kiln supplier, Danish company FLSmidth.

- Early Works Agreement executed with APA Operations Pty Ltd, a wholly owned subsidiary of APA Group Limited (ASX: APA) for the proposed Gabanintha Gas Pipeline.

- Implementation Phase of the MTMP has commenced with TMT targeting a decision to develop for MTMP by the end of 2022…

- As at 30 June 2022, the Company had cash of $18.6 million.”

You can view the latest investor presentation here.

TNG Ltd [ASX:TNG] [GR:HJI] (OTCPK:TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

On July 8, TNG Ltd. announced: “Export finance Australia issues conditional letter of support for the Mount Peake Project of up to $300m in debt funding. The conditional letter of support is a cornerstone component of the finance package for the future construction of the TNG’s flagship Mount Peake Project.” Highlights include:

- “The Australian Government’s Export Credit Agency (“ECA”), Export Finance Australia (“EFA”), issues conditional and non-binding Letter of Support for up to A$300 million of debt funding for the Mount Peake Vanadium-Titanium-Iron Project.

- The Mount Peake Project is one of only 15 Australian critical minerals projects identified by the Australian Government in its critical minerals priority road map…”

On July 19, TNG Ltd. announced: “German ECA Euler Hermes issues letter of interest for A$300m and seven Australian and international project finance lenders issue expressions of interest to tng for financing of Mount Peake Project of support for the Mount Peake Project of up to $300m in debt funding. The support from both government agencies and banks forms part of the multi-source funding pathway for TNG’s flagship Mount Peake Project.” Highlights include:

- “Federal Republic of Germany Export Credit Agency, Euler Hermes, issues Letter of Interest including indicative key terms for German ECA financing of A$300 million.

- Letters of Interest also received from seven Australian and International Commercial and Investment Banks.

- The support received from Euler Hermes and Tier-1 banks follows on from the conditional Letter of Support received from Export Finance Australia, Australia’s ECA, for a debt facility of up to A$300 million.

- This brings the current total conditional Letters of Support / conditional Letters of Interest from Government (Australian and German) related funding sources to A$600 million.

- The Company is still progressing processes with other Government related potential funding sources.

- KPMG Corporate Finance and Germany’s KfW IPEX-Bank GmbH supported TNG in achieving these landmark financing milestones.”

On July 21, TNG Ltd. announced:

TNG advances vanadium energy strategy through agreement with Perth-Based Ultra Power Systems. Agreement advances TNG’s green energy opportunities in vanadium electrolyte production and vanadium redox flow batteries for Australia.

On July 26, TNG Ltd. announced: “TNG secures co-funding under the NT Government Geophysics and Drilling Collaboration program for the Mount Peake Project.” Highlights include:

- “TNG secures $143,000 in co-funding under the Geophysics and Drilling Collaborations program, funded by the Resourcing the Territory initiative and administered by the Northern Territory Geological Survey.

- Drilling program aims to obtain samples from the feeder zone and lower sections of the composite Mount Peake gabbro intrusive, to determine the potential for Ni-Cu, Cr and PGE mineralisation below the Mount Peake V-Ti Resource.

- Drilling scheduled to be undertaken in the second half of 2022.”

On July 27, TNG Ltd. announced:

June 2022 quarterly activities report. Further key funding commitments secured for Mount Peake with Clough appointed as preferred EPC contractor… The Company’s cash position at 30 June 2022 was $14.4 million.

You can view the latest investor presentations here.

Vanadium Resources Limited [ASX:VR8]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

No news for the month.

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

On July 18, King River Resources announced:

Quarterly activities report 30 June 2022… Metallurgical testwork of the Speewah Project continued during the quarter with the focus on extracting high purity vanadium pentoxide (V2O5), titanium dioxide (TiO2) and iron metal (Fe) products to address the current interest in battery metals and master alloy compounds… The Company’s cash position as at 30 June 2022 was $2,945,395. KRR received the final 50% funding instalment from the Northern Territory government for the Geophysical and Drilling Collaboration Program Grant in the amount of $16,415.50. The grant was in respect to the airborne magnetic survey completed over tenement EL31634 southeast of Tennant Creek within the Barkly project…

You can view the latest investor presentation here.

Vanadiumcorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:VRBFF)

Vanadiumcorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

On July 20, Vanadiumcorp Resources Inc. announced: “VanadiumCorp announces a financing and appointment of a new Quebec Director.”

You can view the latest investor presentation here.

Richmond Vanadium Technologies Pty Ltd (“RVT”) ASX IPO planned for Sept./ Oct 2022 – Spin-off from Horizon Mining [ASX:HRZ]

RVT now owns 100% of the Richmond Vanadium Project. It has a global Mineral Resource of 1.8Bt @ 0.36% Vanadium Pentoxide (V2O5).

On July 18, Horizon Minerals announced: “Quarterly activities report for the period ended 30 June 2022.” Highlights include:

- “Restructure and demerger of the Company’s 25% interest in the 1.8Bt Richmond vanadium project in northwest Queensland completed.

- Richmond Vanadium Technology (RVT) now owns 100% of the project with shares held by Horizon (25%) and the existing shareholders of RVT (75%).

- New RVT Board in place and the IPO process commenced to seek a listing on the ASX with Horizon shareholders to receive and in-specie distribution and priority offering.

- Exploration drilling continues with 8,879m completed at the Greater Boorara, Yarmany and Black Flag areas testing high priority multi-commodity targets.

- Nickel sulphides intercepted at the Euston prospect with follow up drilling and down hole EM surveys underway and further assay results pending.

- Highly anomalous Platinum-Palladium-Nickel-Cobalt results received within the Lakewood project area with further results expected in the September Quarter 2022.

- Non-core asset divestment process commenced including the sale of the Gunga West gold project tenements for cash and a toll milling allocation.

- Placement of 44.4 million fully paid ordinary shares completed at $0.09 per share raising $4 million (before costs)…

- Cash at the end of quarter of A$5.58 million and listed investments totalling A$2.3 million.”

Phenom Resources Corp. [TSXV:PHNM] (OTCQX:PHNMF) (formerly First Vanadium Corp.)

The Carlin Gold-Vanadium Property hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a Historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

On July 7, Phenom Resources Corp. announced:

Phenom submits multiple grant applications for U.S. Federal funding for the Carlin Vanadium Project…

On July 18, Phenom Resources Corp. announced:

Phenom Zeros in on the gold target on the Carlin Gold-Vanadium Project, Nevada. Phenom Resources Corp. (TSXV: PHNM) (OTCQX: PHNMF) (FSE: 1PY0) (“Phenom” or the “Company”) is pleased to announce drill results from RC22-015, the first hole this year into the gold system under the vanadium resource on its 100% owned Carlin Gold-Vanadium Project, Nevada… The Company’s property position covers a 4.8 kilometre strike-length of the graben fault. Only 600m of this strike-length has been tested to date.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF) (OTCPK:SRHYY)

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTC:DMNKF)

Other listed vanadium juniors

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Golden Deeps [ASX:GED]

- Intermin Resources [ASX:IRC]

- Maxtech Ventures [CSE:MVT]

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Pursuit Minerals [ASX:PUR]

- QEM Limited [ASX:QEM]

- Sabre Resources [ASX:SBR]

- Strategic Resources [TSXV:SR] (OTCPK:SCCFF)

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Voyager Metals Inc. [TSXV:VONE][GR:9VR1] (OTC:VDMRF) (formerly Vanadium One Iron Corp.)

- Venus Metals [ASX:VMC]

- Victory Metals [TSXV:VMX]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Enerox GmbH (90% Bushveld/10% Cellcube Energy Storage Systems)

- Invinity Energy Systems (LSE:IES) (OTCPK:IESVF)

Conclusion

Europe vanadium pentoxide spot prices were significantly lower last month. China and Europe Ferrovanadium prices were also significantly lower.

Highlights for the month include:

- First phase of 800MWh world biggest flow battery commissioned in China.

- U.S installs 5GWh of battery storage in H1 2022 (note: Includes all types of energy storage).

- Shell & AMG Recycling B.V. and the United Company for Industry announce an agreement with Aramco to construct and operate a World-Class Metals Supercenter Complex in Saudi Arabia.

- Bushveld Minerals group produced 3,592 mtV in 2021.

- Largo Inc. reports Q2, 2022 V2O5 production of 3,084 tonnes.

- Neometals vanadium recovery study confirms lowest quartile cost potential (operating cost estimate of US$ 4.38/lb V2O5).

- Technology Metals Australia to commence Vanadium electrolyte study to supply Australian batteries.

- TNG Ltd – Export finance Australia issues conditional letter of support for the Mount Peake Project of up to $300m in debt funding. TNG Ltd also receives Germany Export Credit Agency issues Letter of Interest including indicative key terms for German ECA financing of A$300 million.

- Richmond Vanadium Technology (RVT) now owns 100% of the Richmond Vanadium Project.

As usual all comments are welcome.

![China and Europe Ferrovanadium [FeV] 80% prices](https://static.seekingalpha.com/uploads/2022/7/27/37628986-16589732778934345.png)

Be the first to comment