jhorrocks

Valero Energy Corporation (NYSE:VLO) stock price increased by 10% in the past five days to $128 per share. The U.S. on highway diesel fuel prices increased in the past three weeks. Also, U.S. regular gasoline prices are now much higher than a year ago. According to SA ratings (Wall Street price target), VLO has a low price target of $109, an average price target of $135, and a high price target of $158 per share. Due to the hiked refinery product prices in the United States, the company will report significant profits in 2H 2022 and 1Q 2023. The stock is a buy.

Quarterly highlights

In its 2Q 2022 financial results, VLO reported revenues of $51641 million, compared with 2Q 2021 revenues of $27748 million, driven by hiked refining revenues. The company’s cost of sales increased from $25249 million in 2Q 2021 to $42946 million in 2Q 2022, driven by significantly higher cost of materials. VLO’s net income attributable to stockholders increased from $162 million in 2Q 2021 to $4693 million in the second quarter of 2022. VLO reported a 2Q 2022 earnings per diluted shares of $11.58, compared with 2Q 2021 earnings per diluted share of $0.39.

In the U.S. Gulf Coast region, VLO’s adjusted refining operating income increased from $227 million in 2Q 2021 to $3330 million in 2Q 2022. The company’s throughput volumes in the region increased from 1731 thousand barrels per day in 2Q 2021 to 1750 thousand barrels in 2Q 2022. In the U.S. Mid-Continent region, VLO’s adjusted refining operating income increased from $139 million in 2Q 2021 to $940 million in 2Q 2022. The company’s throughput volumes in the region decreased from 476 thousand barrels per day in 2Q 2021 to 449 thousand barrels in 2Q 2022. In the North Atlantic region, VLO’s adjusted refining operating income increased from $1 million in 2Q 2021 to $1231 million in 2Q 2022. The company’s throughput volumes in the region increased from 356 thousand barrels per day in 2Q 2021 to 483 thousand barrels in 2Q 2022. In the U.S. West Coast region, VLO’s adjusted refining operating income increased from $75 million in 2Q 2021 to $621 million in 2Q 2022. The company’s throughput volumes in the region increased from 272 thousand barrels per day in 2Q 2021 to 280 thousand barrels in 2Q 2022.

“We continue to maximize refinery run rates while executing our long-standing commitment to safe, reliable, and environmentally responsible operations,” the CEO commented. “Our refinery utilization rate increased from the pandemic low of 74 percent in the second quarter of 2020 to 94 percent in the second quarter of 2022,” he continued.

The market outlook

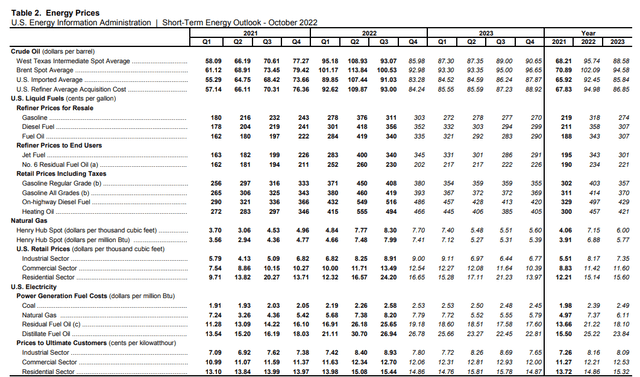

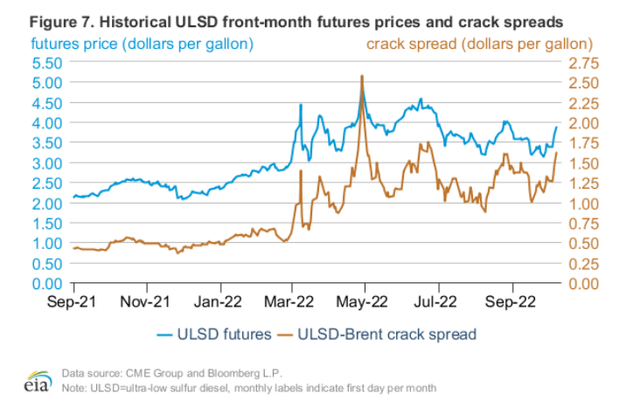

According to EIA’s recent short-term energy outlook, diesel fuel price in the second quarter of 2022 was $418 per barrel (see Figure 1). In the third quarter of the year, diesel fuel price was $356 per barrel. EIA expects diesel fuel prices to be $352/b and $332/b in 4Q 2022 and 1Q 2023, respectively. It also expects that retail diesel prices will average $4.86/gal in 4Q22 and $4.29/gal in 2023. The company’s U.S. Gulf Coast ultra-low sulfur diesel (ULSD) less Brent crack spread in the second quarter of 2022 was 55.95/b. Its U.S. Mid-Continent ULSD less Brent crack spread was $60.16/b in 2Q 2022. The company’s North Atlantic ULSD less Brent crack spread was $70.25/b. According to Figure 2, the front-month futures price for ULSD for delivery in New York Harbor settled at $3.86/gal on 6 October 2022, a 30 cents/gal increase from 1 September 2022. The ULSD less Brent crack spread increased 25 cents/gal during the same period and settled at $1.62/gal on October 6. ULSD less Brent crack spread decreased in September due to lower estimated demand in the United States and broader expectations of wavering economic activity. Also, in September, distillate consumption was the lowest in 2022, due to lower trucking and industrial demand. EIA expects distillate consumption to increase in the fourth quarter of 2022, as agricultural demand (related to the fall harvest season) and winter demand (related to distillate heating oil) climb. Thus, distillate crack spreads will remain higher than historical levels in 4Q 2022 and 1Q 2023.

Figure 1 – U.S. energy prices

Figure 2 – Historical ULSD front month futures prices and crack spreads.

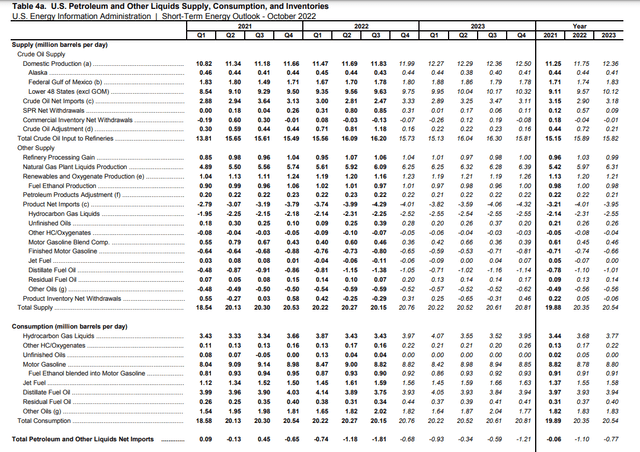

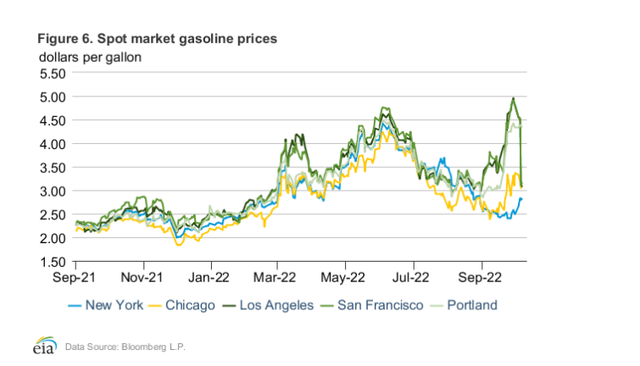

Furthermore, U.S. motor gasoline consumption was 9.0 million b/d in 2Q 2022, compared with a motor gasoline consumption of 9.09 million b/d in the second quarter of 2021 (see Figure 3). EIA expects U.S. motor gasoline consumption to be 8.82 million b/d in 2H 2022 and 8.42 million b/d in 1Q 2023. In 3Q 2021 and 4Q 2021, U.S. motor gasoline consumption was 9.14 and 8.98 million b/d, respectively. Gasoline prices in 2H 2022 and 1Q 2023 will remain high due to economy-driven increases in transportation demand. However, due to the economic recession, gasoline prices in 2H 2022 and 1Q 2023 will be lower than in 2Q 2022 (see Figure 4). EIA expects U.S. retail gasoline price to be $3.80 per gallon in 4Q22 and $3.57/gal in 2023. In the second quarter of 2022, spot market gasoline prices in the United States were about $4 per gallon. On September 2022, spot market gasoline prices in Los Angeles and San Francisco experienced a sharp increase to $5 per gallon and then dropped to about $3 per gallon. The company will continue benefitting from the increased gasoline prices; however, not as much as in 2Q 2022.

Figure 3 – U.S. petroleum and other liquids supply and consumption

Figure 4 – U.S. spot market gasoline prices

Valero Energy’s performance outlook

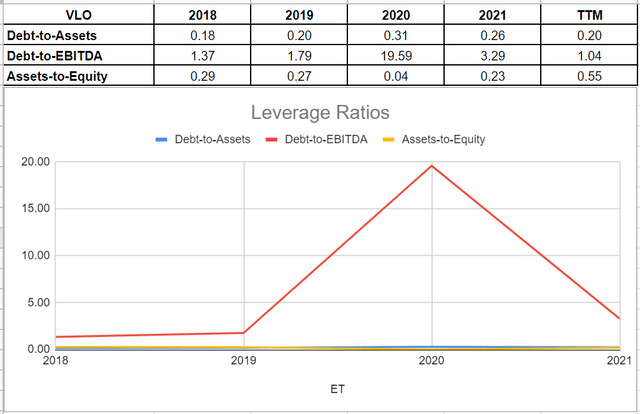

In this detailed analysis, I have investigated Valero Energy’s performance across the board of leverage ratios. Leverage ratios could be very insightful to show how the company is financing its assets and business operations. In other words, does it use debt or equity financing for most of its operations? In this analysis, I used some common leverage ratios that have significant comparability to its debt. The ratios are calculated in comparison with previous years to be more helpful.

The debt-to-assets ratio is one of the significant calculations that measures the company’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. Thereby, the higher the ratio, the greater the degree of leverage and financial risks. It is observable that after a modest increase to 0.31 in 2020, the debt-to-asset ratio of Valero Energy has decreased to 0.26 and 0.20 in 2021 and TTM, respectively. Moreover, VLO’s debt-to-EBITDA ratio, which determines the probability of defaulting on debt, decreased amazingly to 1.04 in TTM versus its level of 3.29 in 2021. Finally, after a deep drop to 0.04 in 2020 from its previous level of 0.27 in 2019, its asset-to-equity ratio increased to 0.23 and then 0.55 in 2021 and TTM, respectively. Notwithstanding an increase in this ratio, its asset-to-equity ratio is still far lower than 2, which means that the company funds more assets by issuing debt than by equity. As a result, the leverage ratios of Valero Energy Corporation indicate the company’s solvency and its ability to meet its current and future obligations (see Figure 5).

Due to the strong market condition and the company’s performance outlook, I expect the company’s adjusted refining operating income to remain high in 2H 2022 and 1Q 2023. The company is well-positioned to benefit from the increased prices and strong demand and report significant profits in the next few quarters. However, VLO’s financial results will not be as strong as in the second quarter of 2022 as refinery products consumption and price levels are expected to be lower than in the second quarter of 2022.

Figure 5 – VLO’s leverage ratios

Summary

In terms of the market condition, the demand for refinery products, and diesel & gasoline prices are high enough, so the company could report strong results as it did in the second quarter of 2022. In terms of financial health, VLO’s coverage ratios indicate that the company is able to cover its obligations. The stock is a buy.

Be the first to comment