imaginima/E+ via Getty Images

Investment Thesis

Valero Energy (NYSE:VLO) is a manufacturer and marketer of liquid transportation fuels. Approximately 80% of its adjusted operating profits come from its refining business unit. Consequently, its refining operations are the thesis mover.

Even though Valero tracks oil prices, it makes its money on the spread between oil prices and the mark-up on refined petroleum products (such as gasoline, diesel, jet fuel, and petrochemicals).

Before investors get too excited, investors should keep an eye on electricity and natural gas prices, because these input costs could plague Valero’s ability to report strong profits.

That being said, even with higher energy prices around the world, Valero’s geographic locations make it a low-cost operator.

Therefore, with demand for gasoline and diesel likely to remain elevated in 2022, this altogether bodes very well for shareholders.

All the while, shareholders also get an attractive 3.9% dividend yield while participating in Valero’s future upside.

For dividend seekers, this is a great pick.

Valero’s Revenue Growth Rates Will Go Into Q1 Very Strong, With a But

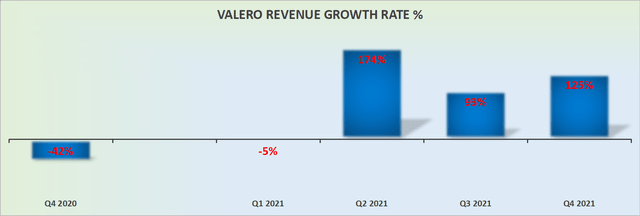

Valero revenue growth rates

As you can see above, for Q1 of last year, Valero’s revenue growth rates were negative 5%. Common sense immediately tells you that in today’s pricing context, against that quarterly comparison, Q1 2022 will report very strong top-line growth rates.

That being said, the uncertainty here is what do prospects look like further into 2022?

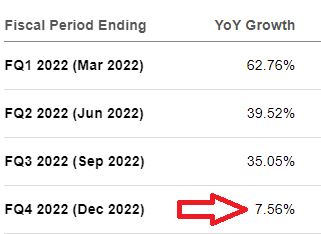

Valero consensus revenue

As you can see above, the expectation right now is that after we step away from Q1 2022 and get further into 2022, there’s the assumption that Valero’s revenue growth rates will compress to mid-single-digits.

However, this is a consensus estimate that I believe is overdue for an upgrade. Why? Because demand for Valero’s product is very strong right now.

Why Valero Energy? Why Now?

Valero investor presentation

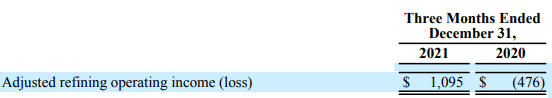

Valero is an international manufacturer of petroleum-based products. It has Refining, Renewable Diesel, and Ethanol business units. That being said, for Q4 2021, approximately 80% of its operating income came from its Refining segment. Consequently, the real opportunity here is its Refining business.

Valero Q4 2021 results

Q4 2021 saw Valero’s adjusted refining operating income swing from negative $0.5 billion to positive $1.1 billion. What a transition to make in 12 months.

Furthermore, during its Q4 2021 earnings call, Valero contended that Refining margins are going to remain elevated in the near term.

However, how long these elevated margins remain is anyone’s guess. However, for shareholders, luckily, the thesis here isn’t only focused on predicting the differential between sour crude oil and Brent crude oil.

The Bullish Thesis in One Picture

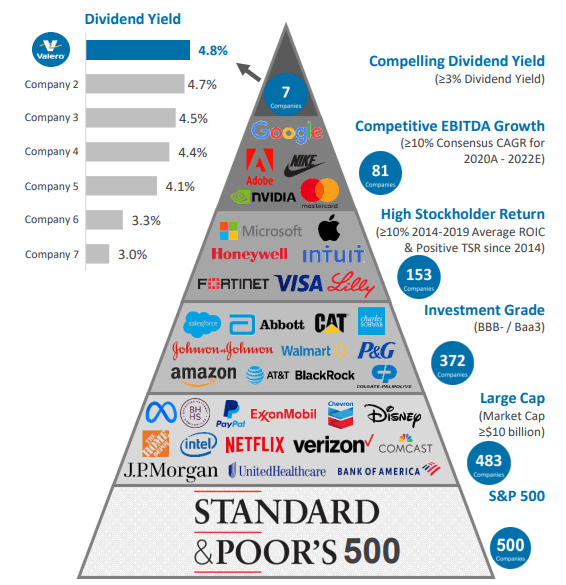

Valero investors presentation

The graphic above drives home the opportunity for investors.

You have a large-cap company, that’s got a long history of high returns on invested capital while operating its balance sheet as investment grade, all the while reporting above double-digits CAGR shareholder returns.

This makes Valero a very ”safe” investment opportunity. We are talking about a blue-chip company that’s paying 3.9% dividend yield at current prices.

For investors that are looking for something slightly more defensive while tech companies’ share prices continue to implode lower, I believe that Valero provides investors with a very fair opportunity for satisfactory returns going forward.

VLO Stock Valuation – Cheaply Priced

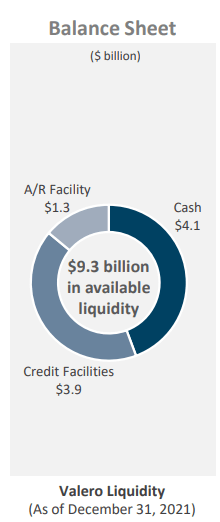

Next, let’s discuss Valero’s balance sheet. Valero carries approximately $12 billion of total debt and finance lease obligations. However, as you can see below, it also carries slightly over $4 billion of cash.

Valero investors presentation

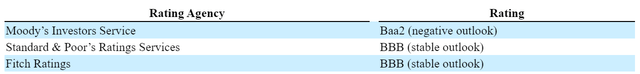

When we consider its net debt position is approximately $8 billion, together with its available credit and revolver facility, it’s easy to understand how Valero’s balance sheet is investment-grade:

Valero 10-K

In sum, for investors that want to ensure that their business is going to give them a sustainable, headache-free, growing, rich, dividend yield, I believe that Valero nicely fits this profile.

The Bottom Line

Valero investors presentation

As you can see above, Valero is committed to a high return on earnings of around 40% to 50%. This is not the sort of business that’s steadfast in growing its asset base just for the sake of it.

The one-liner is this: If you believe that demand for oil products is going to remain high and want a safe and high dividend, then you’d do well to consider Valero.

Be the first to comment