Robert Way

Elevator Pitch

I rate Alibaba Group Holding Limited’s (NYSE:BABA) [9988:HK] stock as a Hold.

In my earlier update for BABA written on July 21, 2022, my analysis suggested that it wasn’t “the right time to buy Alibaba’s shares”, because its “undemanding forward P/E valuations are aligned with its weak business outlook in the short term.” With this latest article, I discuss how new COVID-19 lockdown worries might affect Alibaba’s stock price outlook.

I decided to maintain my Holding rating for Alibaba’s shares. The near-term prospects for BABA aren’t going to be good, as China’s COVID-zero approach and lockdowns are expected to remain a drag on the company’s business performance. On the other hand, negatives on this front are already factored into Alibaba’s shares to a considerable extent, taking into account BABA’s -42% stock price fall in the last year. Considering Alibaba’s share price correction and the lack of catalysts in the short term (assuming no change to COVID-19 policy for China), a Hold rating for Alibaba is justified.

BABA Stock Key Metrics

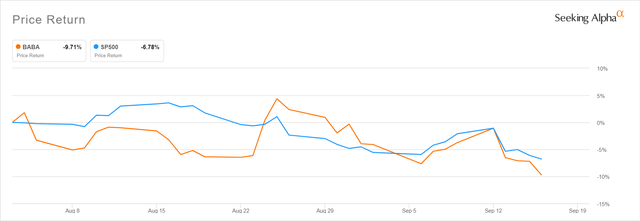

The key metrics for BABA’s stock worth noting are its absolute and relative share price performance after reporting Q1 FY 2023 (YE March 31) results in early-August 2022.

Alibaba’s Post-Q1 FY 2023 Earnings Release Stock Price Performance

Seeking Alpha

Alibaba’s share price has pulled back by -9.7% since it disclosed its most recent Q1 FY 2023 earnings on August 4, 2022 before trading hours. Over the same period, the S&P 500 has performed relatively better with a milder -6.8% decline.

It is noteworthy that Alibaba’s shares have underperformed in the past seven weeks, even though there was positive news flow for the company in this period. Alibaba delivered an earnings beat for Q1 FY 2023; while BABA’s delisting risk was reduced with China allowing the US to access the audit records for US-listed Chinese companies.

In my opinion, China’s COVID-zero stance and related lockdown worries have overshadowed other positive developments for Alibaba, which explains BABA’s recent share price underperformance to a large extent.

Is China Extending COVID-19 Lockdown?

A September 14, 2022 Nikkei Asia article highlighted that “more than 20% of China’s population is currently under some form of coronavirus-related restrictions.” An earlier research report (not publicly available) published by Credit Suisse on September 9, 2022 titled “Expecting Quieter Holidays Amid Extended Lockdown” noted that “47 (Chinese) cities” which contributed approximately 11.9% of China’s GDP “remained in full or partial lockdown.” These numbers offer an indication of the severity of COVID-19 lockdowns and restrictions in China.

On Monday, September 19, 2022, Chinese city Chengdu ended its COVID-19 lockdown after two weeks, which is a positive piece of news. But as long as China keeps its COVID-zero policy unchanged, it is reasonable to assume that lockdowns won’t be a thing of the past in the country. Instead, it is very likely that Chengdu and other Chinese cities will either initiate new lockdowns or have their existing lockdowns extended, if and when the number of confirmed pandemic cases rises.

In other words, when one asks the question of whether China is extending COVID-19 lockdowns in the country or any specific city, he or she is questioning when China will pivot away from its COVID-zero approach.

In my view, China will only consider moving away from its current approach towards the pandemic, either when COVID-19 is declared to have “ended” by the global health authorities or that there is significant progress in terms of vaccination in China.

According to a September 14, 2022 article published in The Guardian, the World Health Organization’s Director General was quoted saying a recent event that “the end (of COVID-19) is in sight” after pandemic-related deaths hit a trough. Separately, if China approves a domestic mRNA (Messenger RNA) COVID-19 vaccine for use in China or allows mRNA vaccines made by foreign companies to be administered in the country sometime in the future, these could be the catalysts needed for a change in China’s COVID-zero policy.

The current consensus is that China will stick with its COVID-zero strategy in 2023 at the very least. This implies that extensions of existing lockdowns or the initiation of new ones will be recurring events in China for the foreseeable future.

Is Alibaba Impacted By The COVID-19 Lockdown?

If one wishes to understand how Alibaba will be impacted if COVID-19 lockdowns continue in China, it is necessary to review BABA’s financial performance for Q1 FY 2023, or the period between April 1, 2022 and June 30, 2022. Q1 FY 2023 or the second quarter of 2022 in calendar year terms, was the worst period of time for China in terms of the intensity and extent of pandemic lockdowns, and this is evidenced by the fact that the country’s GDP grew by just +0.4% in that quarter.

In Q1 FY 2023, a number of Alibaba’s business segments were negatively affected by the COVID-19 lockdowns in China. As I indicated in an earlier section of this article, BABA did achieve better than expected earnings for Q1 FY 2023, but the company’s financial performance for the recent quarter was still poor in absolute terms.

Adjusted EBITA for BABA’s China Commerce business segment contracted by -14% YoY from RMB50.8 billion for Q1 FY 2022 to RMB43.6 billion in Q1 FY 2023. The company’s Cainiao (its logistics) business segment saw its adjusted EBITA loss widen from -RMB146 million to -RMB185 million during the same period. Disruptions to logistics services and networks in various parts of China as a result of COVID-19 lockdowns in Q1 FY 2023 led to the underperformance of Alibaba’s China Commerce and Cainiao business segments.

Adjusted EBITA for Alibaba’s Cloud business segment, otherwise referred to as AliCloud, fell by -27% YoY from RMB340 million in the first quarter of fiscal 2022 to RMB247 million in the most recent quarter. At the company’s Q1 FY 2023 earnings call, Alibaba noted that the COVID-19 lockdowns led to “a delay in parts of our hybrid cloud projects.” Separately, BABA’s Local Consumer Services business segment registered an adjusted EBITA loss of -RMB5.3 billion in Q1 FY 2023, which was worse than the -RMB4.8 billion adjusted EBITA loss the company recorded for Q1 FY 2022. Alibaba highlighted at its most recent quarterly results briefing that “Ele.me’s (food delivery business arm) restaurant delivery volumes were negatively impacted by COVID restrictions.”

In summary, Alibaba’s businesses were badly hit by COVID-19 lockdowns in the most recent quarter. If lockdowns of a similar intensity and extent occurred in the future, it won’t be a surprise to see BABA performing badly again as it did in Q1 FY 2023.

Where Is Alibaba Stock Heading?

Alibaba’s stock price is likely to be range-bound in the short term, rather than heading up or down in a big way.

BABA is a proxy for the Chinese economy and market, so a positive re-rating of its valuations is heavily dependent on the change in investor sentiment towards China. This point of view is validated by investor feedback at a recent roadshow. Based on a recent September 13, 2022 research report (not publicly available) published by Deutsche Bank (DB) titled “Asia Macro Strategy: Notes from London”, “the only topic of consistent interest” with regards to China among institutional investors which the bank visited on a roadshow in London “was China’s Covid strategy, and when/what the catalyst for a pivot could be.”

In other words, unless China moves away from its current COVID-zero stance, there aren’t other catalysts that are sufficiently substantial to change investor sentiment with regards to China and re-rate BABA’s shares.

Is BABA Stock A Buy, Sell, or Hold?

BABA stock remains as a Hold as per my analysis. Alibaba’s shares have dropped by -42% in 2022 thus far, which has priced in COVID-19 lockdown worries to a large degree. But BABA doesn’t justify a Buy rating yet, as there aren’t any signs or indicators pointing to a change in China’s COVID-19 policy. As such, a Hold investment rating for Alibaba is fair.

Be the first to comment