AdrianHancu

Investment thesis

I would remain cautious in the near term for Tesla (NASDAQ:TSLA) shares as the valuation model implies that the company is currently fairly valued. Furthermore, I think that there are significant risks and headwinds that are affecting the business in the near term and until these risks and headwinds dissipate, we will likely see further downgrades for management’s guidance as well as analyst estimates.

First, the 3Q22 deliveries miss may imply further challenges and downside to come as management is navigating through a difficult supply chain situation as well as an inflationary environment. As a result, I think that management is walking a very fine line and further hiccups are likely in the near term given the rather challenging supply chain and inflationary environment.

Second, competition is coming for Tesla as its market share continues to fall in the last 1 year as traditional automakers and electric vehicle startups begin introducing many new electric vehicle models and ramping up production. As a result, Tesla faces increasing competitive pressures in all regions around the world as its first mover advantage disappears.

Third, demand for Tesla will start to fall and this will show itself as wait times for Tesla starts to shorten and margins start to contract. This will be due to the inflationary pressures causing electric vehicle prices to rise, a weakening macroeconomic environment globally, as well as an increase in electric vehicle options by other competitors.

3Q22 deliveries miss while demand concerns remain

The preliminary 3Q22 vehicle deliveries of around 344K was below the expectations of 360K to 365K. Tesla produced 366K vehicles in the quarter. Management highlighted that the lower than expected deliveries were due to transit and logistics challenges. I quote what Tesla said in its release below:

Historically, our delivery volumes have skewed towards the end of each quarter due to regional batch building of cars. As our production volumes continue to grow, it is becoming increasingly challenging to secure vehicle transportation capacity and at a reasonable cost during these peak logistics weeks. In Q3, we began transitioning to a more even regional mix of vehicle builds each week, which led to an increase in cars in transit at the end of the quarter. These cars have been ordered and will be delivered to customers upon arrival at their destination.

While I think that demand destruction is the key thing to watch for, I do not think that we have seen convincing evidence of demand falling off yet. That said, that risk remains very real and one that I expect would need to happen for me to be subsequently more positive on Tesla again.

However, for the near term, my takeaway from the miss in 3Q22 deliveries is that Tesla is not to be spared from the difficult supply chain challenges. As a result of the higher inflation numbers we are seeing, as well as supply chain challenges that the company experiences and the pressures from foreign exchange headwinds, I think that there are many headwinds facing Tesla’s business today that would warrant a revision in management’s future guidance as well as analyst estimate downgrades.

Competition is coming, and coming fast

Every automaker in the world that was initially not involved in electric vehicles before has now recognised the seriousness and the significance of the electric vehicle boom that we are seeing before our eyes.

Volkswagen Group (OTCPK:VWAGY), one of the largest automakers in the world, will see its electric vehicle mix as a percentage of total vehicle mix increase to 7 to 8 percent in 2022. It is seeing demand for its electric vehicles globally, as the order intake for Western Europe increased by 40 percent, and electric vehicle deliveries increased more than 3 times even with the tough Covid policies in place in the country. Volkswagen Group is one traditional automaker that has pivoted quickly in the changing auto market to leverage on the electric vehicle boom and it has successfully managed to ramp up its electric vehicle production even with difficult operating conditions and supply chain disruptions. Volkswagen competes for market share mainly in Europe and China, although it is trying to gain greater presence in the United States as well.

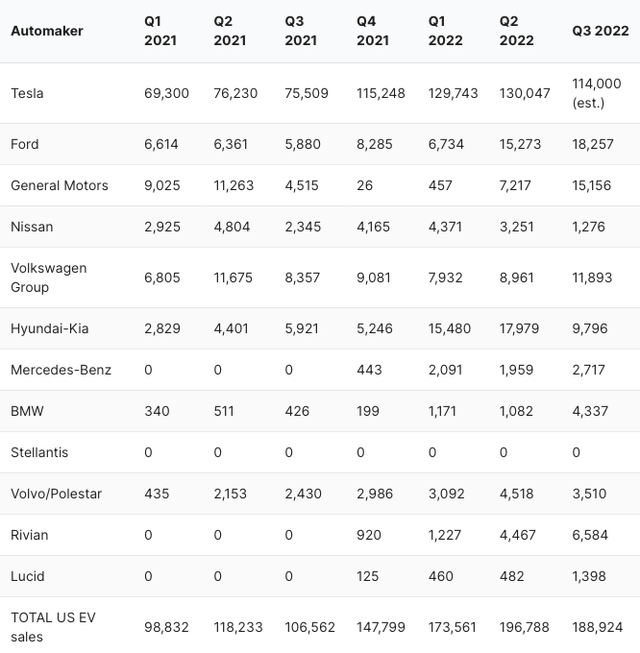

In the United States, there is no shortage of electric vehicle startups like Lucid (LCID) and large automakers like Ford (F) and General Motors (GM) entering the electric vehicle market. Tesla’s market share declined from 70% in 1Q21 to about 60% in 3Q22 in the United States alone, where other automakers are quickly catching up.

US electric vehicle market share (Automotive News)

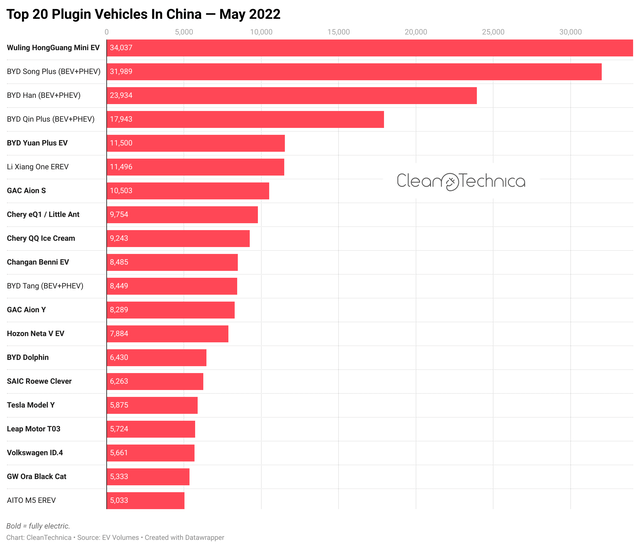

In China, the electric vehicle market is even more competitive, with large players competing for market share and smaller electric vehicles vying for a slice of the pie. As evident from the market share table below on the top 20 electric vehicle model market share, BYD (OTCPK:BYDDF) is a leading player in the electric vehicle space in China. There are other smaller players like NIO (NIO) and XPeng (XPEV) vying for the electric vehicle market share in China. As such, Tesla today faces very intense competition from a wide variety of electric vehicle players and this large supply of electric vehicles could lead to a problem when demand starts to fall.

China electric vehicle market share (CleanTechnica)

All in all, the picture is rather clear. While Tesla may have had a first mover advantage in the electric vehicles market, there are plenty of newcomers as well as industry veterans that are rolling out new electric vehicle models at a very rapid pace. As a result, we will likely see Tesla’s market share in the electric vehicle space continue to fall as competition ramps up.

Faltering of demand

As a result of the increasing competition in the electric vehicle space, I think that we will see the supply of electric vehicles could outstrip demand. This could happen because of weakening macro factors. With rising inflation, the prices of raw materials have resulted in higher pricing for electric vehicles and the consumer will feel the pinch from this soon as inflation starts to bite. In addition, the global macroeconomic environment looks to be starting to weaken as the Fed continues to hike interest rates, resulting in more people expecting that a hard landing is more likely. As a result of a weakening macroeconomic environment, I think we will see consumer sentiment weaken and electric vehicle sales fall off the cliff as consumers reduce discretionary spending.

For Tesla specifically, there are some levers it can pull. If China were to slow down and demand for electric vehicles in China were to fall, I think that Tesla could then use China as a hub for export as many of its other countries in Asia and Europe continue to have long wait times. However, in the scenario where Europe and other regions start to weaken as well, Tesla would have nowhere to hide.

In addition, Tesla may be able to intentionally bring its own pricing down while lowering costs to maintain its current margin profile so that it can continue to attract customers given the inflationary point I mentioned above. That said, I would note that I expect Tesla to also have headwinds as it continues to ramp up on the 2 gigafactories that will cause margins to be slightly lower during this period.

Valuation

We believe a reasonable downside case for the stock is about $200, assuming 6X our 2023 revenue estimate (note that 6X was near the higher end of Tesla’s trading range through 2019, but TSLA often traded at high single-digits to high-teens revenue multiples the last few years as the company became FCF/EPS positive and the long-term outlook for EVs improved substantially).

My 1-year target price incorporates a bull, base and bear case scenarios based on a DCF methodology. The weights given for the 3 scenarios are 10%, 80% and 10% respectively for the bull, base and bear scenarios. In the base case, I assume a discount rate of 12% and terminal multiples of 18x in 2030. My 1-year target price for Tesla is $205, implying 2% downside from current levels.

Risks

Macroeconomic environment

If the global economy were to slow down, it would affect discretionary spending, which would in turn affect automotive sales. As a result, Tesla will also be affected as demand for autos falls. Demand side risks continue to be a major concern for many investors as there is the concern that weakening consumer sentiment may drive lower sales for Tesla in the near term. For example, China saw a slowing growth in electric vehicle sales in the country despite government incentives as the Chinese economy continues to falter, which might also affect Tesla’s demand in the region in the near term.

Increasing competition

There is no doubt that Tesla was one of the pioneers in the electric vehicle space in the United States. However, I think that the good old days of limited competition is over for Tesla. It has a wide range of competitors globally that produce and sell electric vehicles, with plans to drastically increase production and deliveries of electric vehicles in the future. As explained earlier, Volkswagen Group is one traditional automaker making the pivot to electric vehicles, while in regions like China, there are many players, including electric vehicle giant BYD, that are competing for market share in a very competitive electric vehicle market. If the competitive pressures were to persist, this will likely eat into Tesla’s growth and margins profile and the company could also see market share reducing. If so, I would need to revise my forecasts downwards to reflect this.

Supply chain risks

While Tesla is one of the more vertically integrated players in the electric vehicle supply chain given its longer history producing electric vehicles, with the electric vehicle boom we are seeing, every single automaker is now pivoting to the production of electric vehicles. As such, battery materials will be key to ensuring that production volumes and targets are met and production capacity will need to catch up with demand. As such, there is a risk that the supply chain may be inadequate as the battery materials like Nickel or Cobalt that are needed for production of electric vehicles are in short supply. If this is the case, this will lead to lower than expected growth in production and, thus, deliveries for Tesla, which could lead to downward revisions in my forecasts for the company.

Electric vehicle adoption

While this may seem to be a small risk at the moment, there could be a scenario when there is a slower rate of electric vehicle adoption. If this happens, it will lead to an oversupply situation in the market given the large supply of electric vehicles entering the market in the near term. As such, this would lead to poor demand supply dynamics that could affect the pricing for Tesla and eventually affect its margin profile.

Conclusion

While I continue to believe that Tesla is well positioned to grow long-term as the world shifts towards electric vehicles, given the company’s relatively higher degree of vertical integration, it also positions the company well for strong volumes and profitability in the future. However, I think that the near-term challenges and risk provide increasing uncertainty in difficult times. The delivery miss indicates that the company is seeing some troubles with the supply chain disruptions as well as the inflationary environment. On the other hand, there are many electric vehicle startups and larger automakers that are ramping up production and securing their own electric vehicle supply chain, intensifying efforts for Tesla in the near term as it is poised to lose market share. Lastly, the biggest concern that investors have is the potential drop in demand for Tesla’s electric vehicles if the macro conditions continue to worsen. All in all, I think that it pays to be cautious in the near term as Tesla’s shares are currently fairly valued. My 1-year target price for Tesla is $205, implying 2% downside from current levels.

Be the first to comment