jetcityimage

Introduction

San Antonio-based Valero Energy Corporation (VLO) released its second-quarter 2023 results on July 27, 2023.

Note: This article updates my article published on June 15, 2023. I have followed VLO on Seeking Alpha since December 2017.

Valero Energy is one of the three refiners I follow quarterly: Marathon Petroleum (MPC), Phillips 66 (PSX), and Valero Energy.

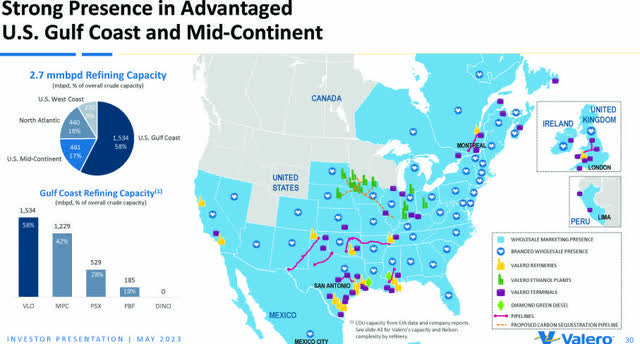

Valero’s assets are extensive and located mainly in North America.

VLO Map Assets (VLO Presentation)

1 – 2Q23 Results Snapshot

The U.S. refiner reported second-quarter 2023 adjusted earnings of $5.40 per share, a significant decrease from $11.36 per share in the year-ago quarter. Nonetheless, the results beat analysts’ expectations again.

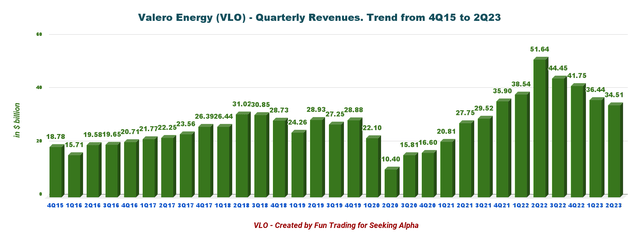

Total revenues decreased from $51,641 million last year’s quarter to $34,509 million in 2Q23, over the consensus estimate.

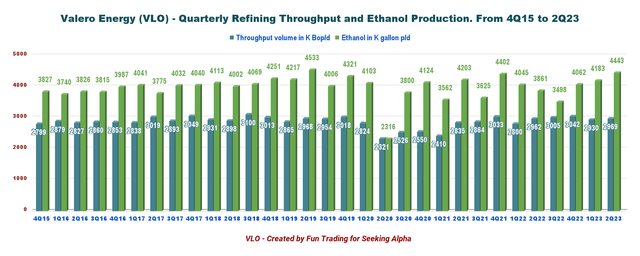

VLO increased its refinery throughput volumes slightly this quarter to 2,969 thousand barrels daily from 2,962K bpd in 2Q22.

The Port Arthur Coker project, which started in early April, positively contributed to Valero’s production this quarter, operating well and at full capacity. The new coker has increased the refinery’s throughput capacity and enhanced its ability to process incremental volumes of heavy crude and residual feedstocks.

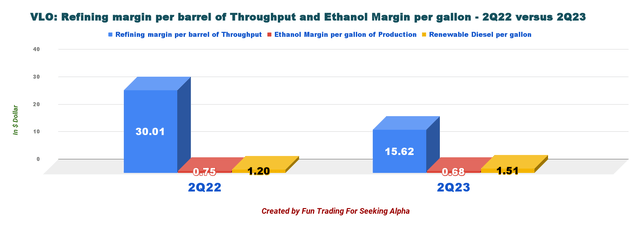

Refining Profit margins were $15.62 per barrel from $30.01 per barrel last year. A sharp decrease (see graph below).

The Chief Executive Officer Lane Riggs said in the conference call:

We are pleased to report solid financial results in the second quarter, underpinned by our strong execution across all of our business segments. Our refineries ran well with throughput capacity utilization of 94% as refinery margins were supported by continued tight product supply and demand balances. Product demand was strong with our US wholesale system setting a sales record of over one million barrels per day in May and June.

The refining margin per throughput barrel decreased to $15.62 from $22.37 the preceding quarter, while the ethanol margin increased to $0.68 from $0.50.

VLO Quarterly Refining Margins 2Q22 versus 2Q23 (Fun Trading)

2- Investment Thesis

As I said in my prior articles, I have been a long-term Valero Energy Corporation shareholder for over two decades and intend to keep a sizeable part of my long position.

The second quarter shows some clear weaknesses, with profit margins dropping by nearly 50% YoY, which should not surprise us. We are entering a period of consolidation after a tremendous bullish run.

The crucial issue at stake here is the extreme volatility of the refining sector, which requires a particular trading/investing strategy.

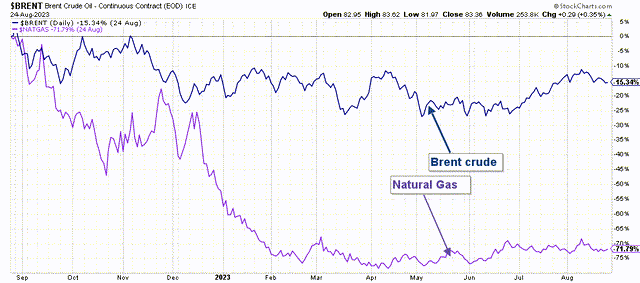

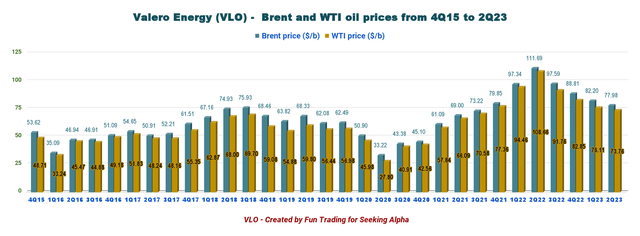

Oil and gas prices have corrected significantly YoY, with Brent down 15.3% and NG nearly 72%.

VLO 1-Year Brent and NG (Fun Trading StockCharts)

On August 15, 2023, Bank of America downgraded the refining sector to neutral, including VLO, MPC, PSX, and DINO:

Refiners including Valero Energy and Marathon Petroleum trade lower on Tuesday, -4.1% and -4.2% respectively, as Bank of America said it is taking a “strategic pause” on the sector after the group’s strong performance leaves limited room for further upside.

The analyst sees “risks that margins are peaking on transitory issues, leaving an unfavorable balance of risk at the same time as seasonal trends pressure margins in coming months,” which I agree with.

As always, the biggest uncertainty for refiners is the demand outlook, “which will depend on the magnitude of any global economic slowdown and the pace of its recovery over the next few years.”

However, the long-term outlook remains solid, with global liquid demand recovering by 2025.

Based on the high and low range of our economic scenarios, global oil demand could grow by 0.3 to 5 MMbd by 2025 versus 2019 .

Thus, trading short-term LIFO and profiting from those wild fluctuations attached to this cyclical industry is needed.

I recommend using 40%-50% of your short-term position while keeping a core long-term stake for a much higher target or enjoying steady dividends.

VLO pays a dividend yield of 3.14%, which is relatively high and safe.

| Company | MPC | PSX | VLO |

| Yearly Dividend | 3.00 | 4.20 | 4.08 |

| Share price | 143.83 | 112.29 | 130.01 |

| Dividend Yield | 2.09% | 3.74% | 3.14% |

3 – Stock performance

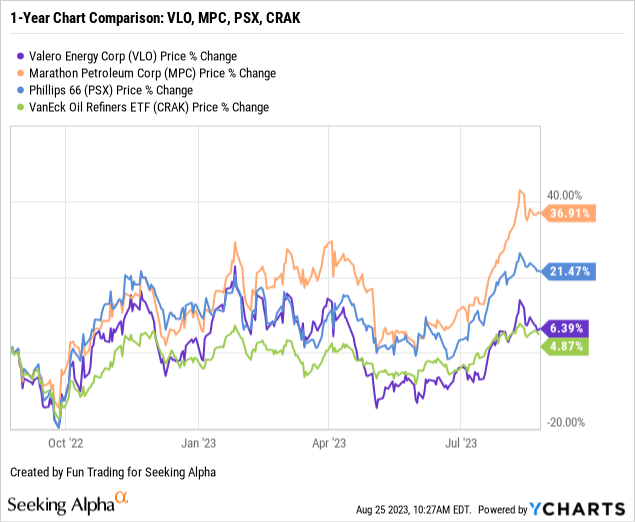

VLO is now down 6.5% on a one-year basis, underperforming Phillips 66 and Marathon significantly.

Valero Energy: Selected Financials History – The Raw Numbers (Second Quarter Of 2023)

| Valero Energy | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

| Total Revenues in $ Billion | 51.64 | 44.45 | 41.75 | 36.44 | 34.51 |

| Net Income in $ Million | 4,693 | 2,817 | 3,113 | 3,067 | 1,944 |

| EBITDA $ Million | 6,854 | 4,498 | 5,020 | 4,832 | 3,534 |

| EPS diluted in $/share | 11.57 | 7.19 | 8.15 | 8.29 | 5.40 |

| Operating cash flow in $ Million | 5,845 | 2,045 | 4,096 | 3,170 | 1,512 |

| CapEx in $ Million | 417 | 463 | 417 | 265 | 170 |

| Free Cash Flow in $ Million | 5,428 | 1,582 | 3,679 | 2,905 | 1,342 |

| Total Cash $ Billion | 5.392 | 3.969 | 4.862 | 5.521 | 5,075 |

| Total L.T. Debt (incl. current) in $ Billion | 12.88 | 11.58 | 9.24 | 11.42 | 11.32 |

| Dividend per share in $ | 0.98 | 0.98 | 1.02 | 1.02 | 1.02 |

| Shares Outstanding (Diluted) in Million | 404 | 390 | 381 | 369 | 358 |

| Oil, N.G. & Ethanol Production | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

| Throughput volume in K Bop/d | 2,962 | 3,005 | 3,042 | 2,930 | 2,969 |

| Ethanol in K gallon p/d | 3,861 | 3,498 | 4,062 | 4,183 | 4,443 |

| Brent price ($/b) | 111.69 | 97.59 | 88.81 | 82.20 | 77.98 |

| WTI price ($/b) | 108.66 | 91.76 | 82.85 | 76.11 | 73.76 |

| Natural gas price ($/MM Btu) | 7.23 | 7.31 | 4.46 | 2.25 | 2.00 |

Source: VLO PR.

Revenues, Earnings Details, Free Cash Flow, Throughput Volume, Ethanol Production, And Margins

1 – Revenues were $34.51 billion in 2Q23

VLO Quarterly Revenue History (Fun Trading)

Valero Energy’s revenue for the second quarter was $34.51 billion. The company posted a quarterly income of $5.40 per diluted share, compared to $11.57 last year.

VLO reported adjusted net income attributable to Valero stockholders of $5.40 per share, versus $11.36 last year.

The total cost of sales rose to $31.53 Billion from $45.16 billion last year. Net Cash from operating activities was $1.51 billion in the second quarter of 2023 versus $5.85 billion last year.

The Better-than-expected quarterly earnings were primarily due to improved renewable diesel sales volumes and a decline in total sales costs. However, a lower refining margin per throughput barrel partially neutralized this positive effect.

Review of the different segments:

- The refining segment: Adjusted Operating Income was $2,433 million, down significantly from $6,122 million in the year-ago quarter. A lower refining margin per Barrel of throughput impacted the segment.

- The Ethanol segment: Valero declared an adjusted operating profit of $128 million, up from $79 million in the year-ago quarter. It was due to higher ethanol production volumes.

- The Renewable Diesel segment, which consists of the Diamond Green Diesel joint venture (DGD), increased to $440 million from $152 million in the year-ago quarter. Renewable diesel sales volumes increased to 4,400 thousand gallons per day, significantly up from 2,182 thousand gallons per day a year ago.

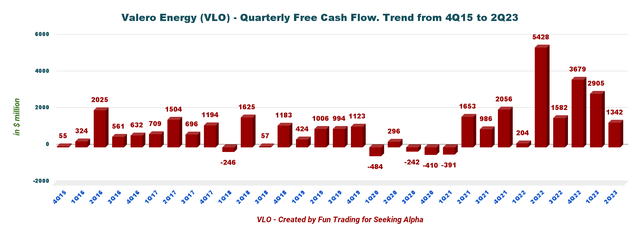

2 – Free cash flow in 2Q23 was $1,342 million.

VLO Quarterly Free Cash Flow History (Fun Trading)

Note: The generic free cash flow is the Cash from operating activities minus CapEx.

VLO had a trailing 12-month ttm free cash flow of $9,508 million. Free cash flow for the second quarter is $1,342 million, significantly down sequentially.

The quarterly dividend stayed at $1.02 per share.

Also, $951 million worth of VLO shares were purchased, or approximately 8.4 million shares of common stock in 2Q23.

The second-quarter CapEx was $170 million, with Cash from Operations of $1,512 million.

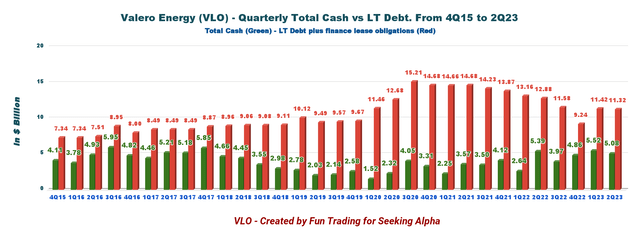

3 – Net debt increased to $6.25 billion as of June 30, 2023

VLO Quarterly Cash versus Debt History (Fun Trading)

Valero Energy had total Cash of $5,075 million in 2Q23, down from $5,392 million last year. Total debt was $11,323 million ( including total lease obligations) compared to $12,880 million last year.

The company said in the press release:

Valero ended the second quarter of 2023 with $9.0 billion of total debt, $2.3 billion of finance lease obligations and $5.1 billion of cash and cash equivalents. The debt to capitalization ratio, net of cash and cash equivalents, was 18 percent as of June 30, 2023.

4 – Throughput and ethanol production in 2Q23

VLO Quarterly Refining Throughput and Ethanol Production History (Fun Trading)

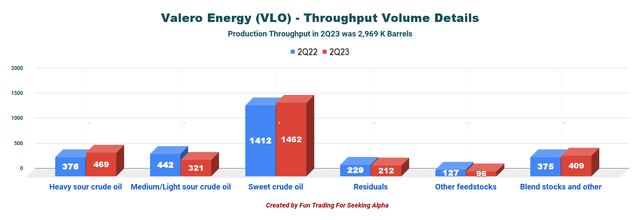

Refining throughput volumes were 2,969K barrels per day for the second quarter, up from 2,962K barrels per day last year. The graph below shows that sweet crude oil is the most critical segment.

VLO Throughput per segment (Fun Trading)

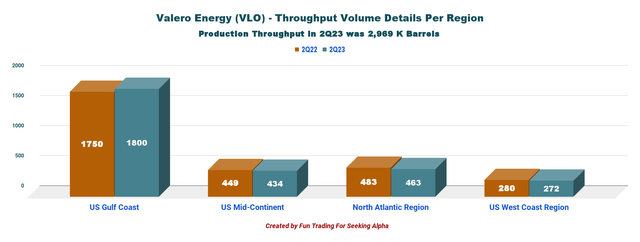

The U.S. Gulf Coast provided approximately 60.6% of the total throughput volume 2Q23.

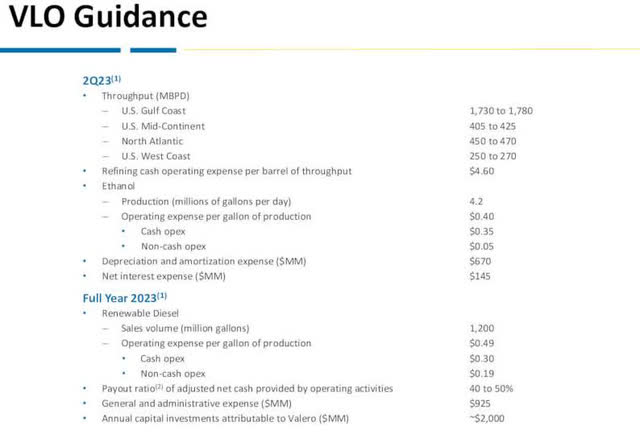

VLO Quarterly Throughput per Region (Fun Trading) VLO Quarterly Brent and WTI Prices History (Fun Trading) VLO 2023 Guidance (VLO Presentation)

Technical Analysis (Short-Term) And Commentary

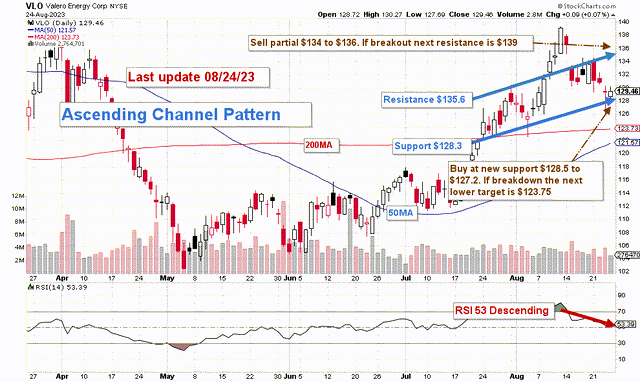

VLO TA Chart Short-Term (Fun Trading StockCharts)

Note: The chart has been adjusted for the dividend.

VLO forms an ascending channel pattern, with resistance at $135.6 and support at $128.3. RSI shows 53/descending, implying a possible breakdown in Q4.

Ascending channel patterns or rising channels are short-term bullish in that a stock moves higher within an ascending channel, but these patterns often form within longer-term downtrends as continuation patterns. The ascending channel pattern is often followed by lower prices, but only after a downside penetration of the lower trend line.

I regularly promote keeping a core long-term position and using about 40%-60% to trade LIFO while waiting for a higher final price target for your core position that you may keep as a well-secured dividend provider.

Thus, the trading strategy is to sell about 40%-50% between $134 and $136 with possible higher resistance at $139 and wait for a retracement between $128.5 and $127.2 with possible lower support at $123.75.

Valero Energy Corporation stock is highly correlated to the oil demand in the USA and will likely face some wild swings in the remainder of 2023. Thus, trading half of your position using TA charts and patterns will be highly beneficial.

Warning: The T.A. chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the T.A. chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Be the first to comment