Funtap

What started out as a great day for the major market averages with further confirmation that the rate of inflation is decelerating ended with less enthusiasm, as headlines hit the tape that missiles landed in a Polish town across the Ukraine border, killing two people. The obvious concern was that these were Russian, which could escalate the conflict, but President Biden indicated overnight that they were from Ukrainian air defenses. This unfortunate event should not be market-moving. In other news, retailers Walmart and Home Depot reported impressive results that lifted the share prices of most retailers yesterday, but Target’s disappointment this morning is reversing some of those gains.

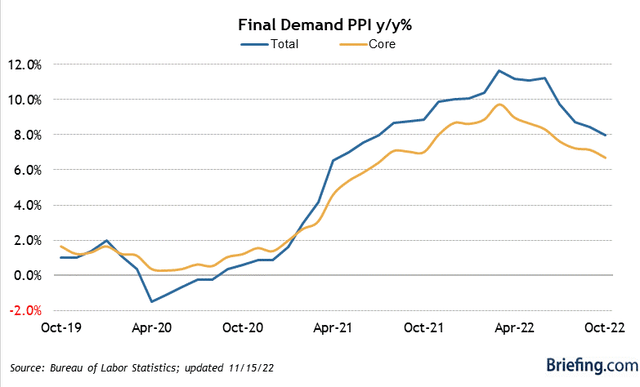

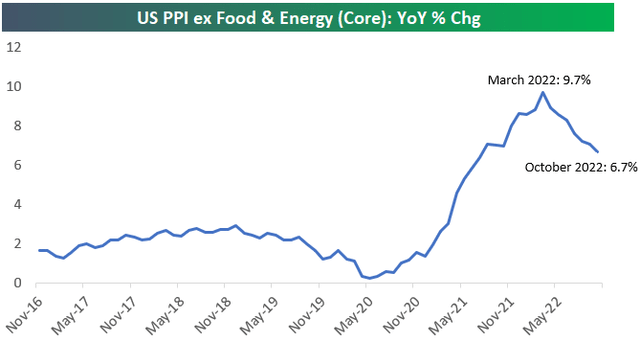

Producer prices lead consumer prices, which is why yesterday’s report was so important. The overall Producer Price Index was up just 0.2% in October, compared to the 0.5% expected, while the core rate was unchanged on a monthly basis for the first time in two years. Expectations were for a 0.4% increase. Additionally, September’s overall and core increases were downwardly revised. This brought the overall year-over-year rate down from 8.4% to 8%, while the core rate fell from 7.1% to 6.7%. Also notable in the details of this report is that processed goods for intermediate demand, declined 0.2%, while unprocessed goods fell 11.7%. There is disinflation in the pipeline.

Meanwhile, the consensus on Wall Street is warning that we should not view one good monthly number as a trend, but I think the trend has been well established, and it points definitively downward. The core PPI peaked in March of this year at 9.7%, which was the month in which the Fed decided it might be a good time to start raising interest rates from near zero. Seven months later, the core PPI has fallen three percentage points in what is clearly and unmistakably a trend in the right direction.

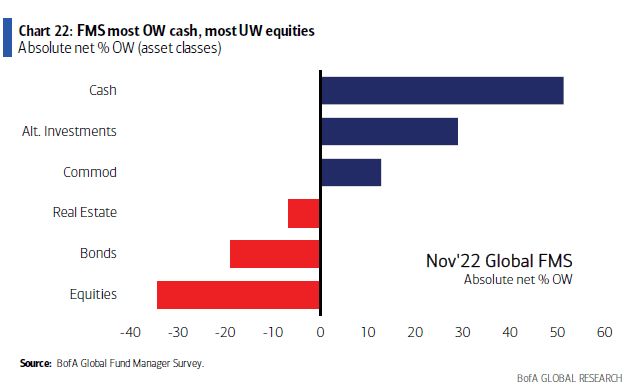

This is why interest rates are falling, and the dollar is in decline, which are both driving stock prices higher. The market sees less aggressive monetary policy with a lower peak fed funds rate one year from now. This is why I have been asserting that the Fed should be done raising interest rates at its December meeting. Investors have clearly not caught on yet, as Bank of America’s latest fund manager survey shows institutional investors are hugely overweight cash and underweight stocks, which helps explain why there has been a scramble to increase exposure to the stock market as it rallies into year-end with a triple tailwind. November begins the seasonally strongest six-month period of every year, which is further fueled this year by the bullish precedents of post-midterm election performance and the third year of the presidential cycle. A little good news should go a long way in the near term with sentiment as poor as it is today.

Bloomberg

The Technical Picture

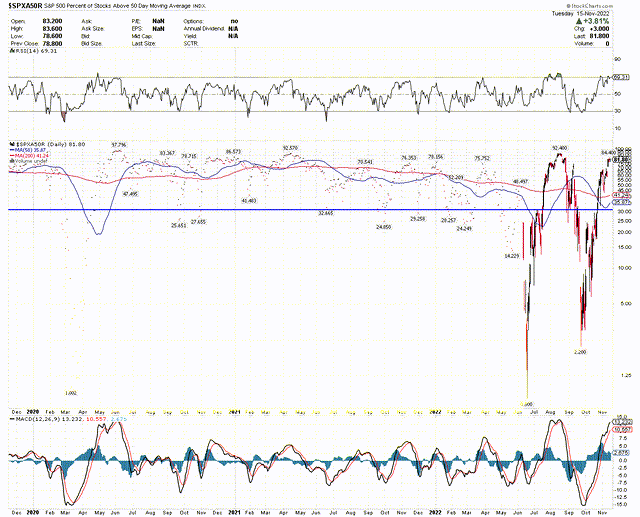

My near-term optimism can’t ignore that we are now very close to overhead resistance for the S&P 500 at its 200-day moving average at a time when short-term technical indicators are getting stretched. One of my favorites, the percentage of stocks in the index trading above their 50-day moving average, is now at 82%. This is at a level where it typically peaks, but it has made moves into the mid-90s. It is not far from where it peaked in August, so the bottom line is that some caution is warranted here.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment