Andressa Anholete/Getty Images News

Iron ore price hit a two-week low yesterday ahead of a widely expected interest rate hike from the U.S. Federal Reserve. We got the interest hike, and the market is now taking the idea that Powell will keep raising rates to combat inflation through a slowdown more seriously. As bad as that sounds, keep in mind that iron ore rarely ever got to current “lows” between 2015 and 2019:

iron ore prices historical (Trading Economics)

Brazilian presidential elections are coming up next month, and Lula looks like he has a ~70% chance of taking it down (I’m deriving these odds from betting sites so take it for what it’s worth). He’s floated some creative mining royalty ideas on the campaign trail which may have put some pressure on Vale (NYSE:VALE) as well.

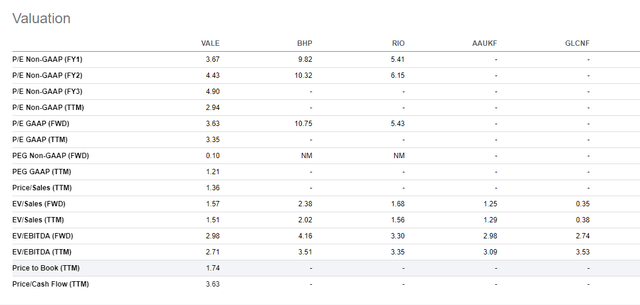

In terms of valuation, Vale S.A. still looks very cheap to me. I readily acknowledge the recession risk on continued rate increases. I agree that could bring down iron ore prices and EBITDA/earnings to a magnified extent due to operating leverage. Yet, 3.63x forward earnings or 2.71x EV/EBITDA remains quite attractive. Peers like BHP Group Limited (BHP) and Rio Tinto (RIO) are subject to the same risk but trade at slightly higher multiples (arguably low multiples as I argue here).

Vale valuations (Seekingalpha.com)

Meanwhile, Vale bought back 100 million+ shares in the last two months and they have an aggressive policy in place. Per the CEO on the most recent earnings call:

Last quarter, we announced the third buyback program for up to 500 million shares. We executed close to 22% of this program in a little more than two months. After the completion of the third buyback program, you will have repurchased almost 20% of the company’s outstanding shares. This means that we are concentrating future earnings on a per share basis by 25%. We view this as a form of growth without pressuring the supply side and carrying a lower execution risk.

The company is also committed to paying a dividend equal to 50% of cash flow. Commodities are under pressure on recession fears. I get that recession will materialize if the Fed keeps it up. At the same time, I’m not fully convinced a recession translates into deep commodity slumps as we’ve seen after the GFC and recent slowdowns.

I do acknowledge China won’t be growing as explosively. Yet even modest growth on what’s now a huge economy (2nd largest GDP in the world) still requires massive absolute growth in commodity supply.

Mature economies like the U.S. and the combined Euro area are on a multi-decade path to transition from fossil-fueled economies to renewable-fueled economies. This transition requires massive amounts of commodities to supply materials required to adapt grids and manufacture windmills, solar panels, electric vehicles, and hydrogen installations. In general, renewable power sources and electric vehicles require much more copper than their fossil-fueled predecessors. The infrastructure build-out means a frontloading of material investment with the payoff following as emissions-free energy is generated over the decades afterward.

Vale management believes it is valued as a mature low, growth iron ore business. But it sees quite a bit of potential in its base metal properties that are valuable to the energy transition. Nickel is a metal that’s particularly useful to EV-makers in batteries. Elon Musk has been more or less begging miners to up their nickel investments. Tesla (TSLA) recently signed a supply deal with Vale for Nickel from its Canadian operations.

There’s even some talk of separating the future-oriented base metals business from the iron ore operations but I believe it is very unlikely Vale will pull the trigger on that. The President of Finance and Investor Relations answered as follows to a question about an IPO of the metals division:

…So, on the potential transaction, we haven’t decided that as Eduardo said if it’s an IPO, non-IPO, but I think fundamentally what we are trying to achieve here is a more dedicated governance for base metals which we see a lot of merits for. We also want to make sure we create occurrence for growth. This business is very different from iron ore. We have a lot of growth in iron ore by resuming our capacity with limited CapEx. But as I think you pointed out, we are cash story. Today, we appreciate that. And we are happy with that, and we continue to pursue that strategy. But base metals is different, it’s a growth business. There’s tremendous amount of momentum for EV transition, for electrification of the world, so all of that calls for different strategy.

And we believe it would make sense to have occurrence that could support an accelerated growth strategy there. The final format we’ll see, but that’s how we are thinking about, and that’s what we should expect us to pursue. Certainly the market today is not appreciative of a transaction, but we’ll continue to look into that and bring that to you guys once we feel good about it. On the divestment MRN is the one we’ve said publicly. And it’s quite frankly the last one. So we could continue to look for ways to optimize the portfolio on the margin. But I think we can certainly say we’ve done most of the reshaping that we wanted to do at this point.

This suggests there is a non-zero chance of IPO’ing or spinning-off a base metals segment. The CEO then kind of threw cold water on that prospect (emphasis mine):

And just to compliment your points. It’s like a growth call and a youth call, but probably never going to let go the base metal business. Okay. If we want to bring partners, even its private, even if we go public, it’s going to be a Vale’s and it’s going to be a growth goal, raise currency, nobody has this front end commodities like we do. It’s a matter of, because we believe better governance, we believe better partners would help us grow, but we don’t want to lose our growth, of course, there’s a huge amount of opportunities in the electric world, the transition – the energy transition world.

In my view, the market is punishing some metals businesses way too hard for a potential recession. Vale’s share price may already (partially) bake in a Lula victory while any detrimental policies are still far away. In addition, these policies also tend to dissuade competition. I agree it will likely come, but the backdrop is different, and Vale is in very good shape with $8 billion in net debt (about double on a gross basis) and $24 billion of EBITDA. The multiples will likely expand as what’s likely a peak-EBITDA contracts some. However, the business is throwing off cash and aggressively buying back shares. I explained how I’m trying to benefit from the large buyback program in my previous Vale article although that hasn’t worked out so far. I continue to be long Vale believing its longer-term prospects aren’t reflected in the current share price.

Be the first to comment