sakkmesterke/iStock via Getty Images

Thesis

FLEX LNG (NYSE:FLNG) is an excellent company with long-tailwinds and current catalysts that can propel the stock in the near-term. I believe Flex’s long-term growth will be driven by continued adoption and consumption of natural gas, the attractive age and efficiency of their fleet, and management’s ability to optimize their balance sheet, margins, and return cash to shareholders.

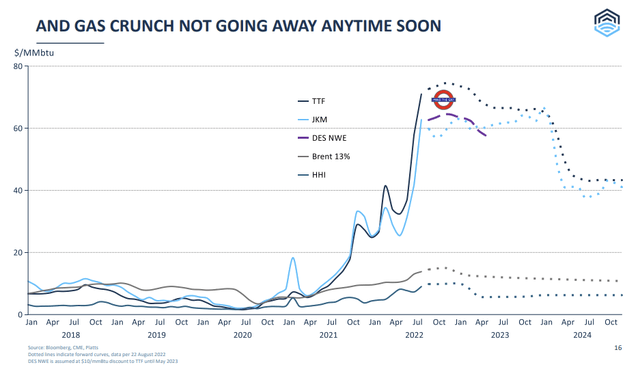

Currently, high natural gas prices and spot carrier prices support greater margins and earnings power for the company. I believe the European energy crisis will keep natural gas demand propped up which will also support demand for marine transportation of liquefied natural gas if Russian pipelines into Europe remain offline. Alongside the energy crisis driving earnings power, we’re entering the strongest seasonality period for the company with winter on the horizon.

The combination of current business momentum may provide the margin of safety as a bonus for a company set up for long-term success.

Business & Industry Overview

Industry

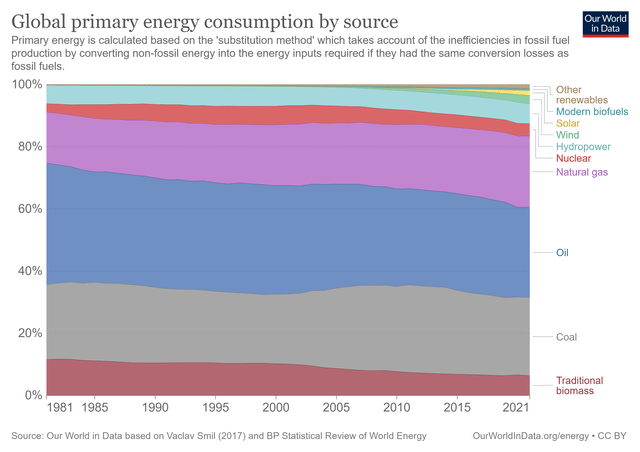

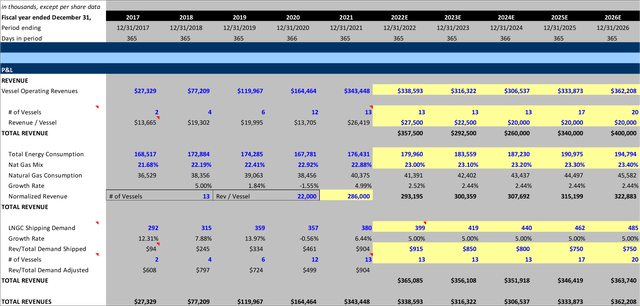

Natural gas is a fossil fuel and can be burned for heating, cooking, and electricity generation. Over the last 3 decades, natural gas has grown from being 16.41% of the global energy mix to 22.88% today.

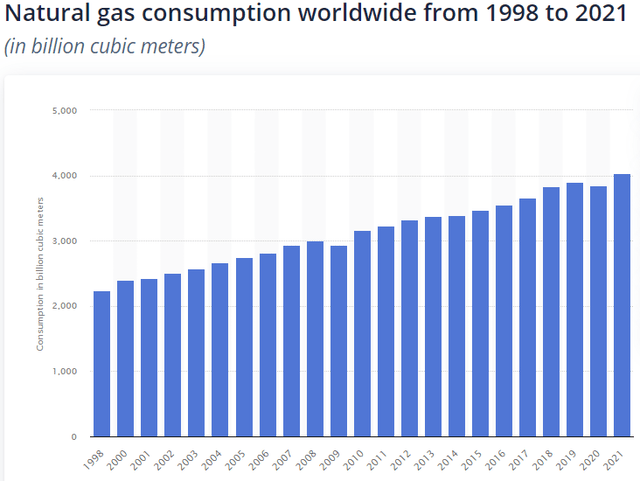

Over that same time period, total natural gas consumption has grown from annual usage of 14,396 terawatt-hours to over 40,375; a 2.61% annual growth rate.

While natural gas plays a very important role in the global energy landscape, liquefied natural gas is a key part in how it can be transported more economically. Natural gas turns to its more dense liquid form at -260 degrees F, resulting in a 600x reduction in volume. With transportation more feasible because of this 600x efficiency, natural gas marine transport has become viable and has grown in adoption over time. Since 2000, LNG marine carrier shipping has grown from 114 million tons to 380 million tons last year, a 5.9% CAGR.

Business

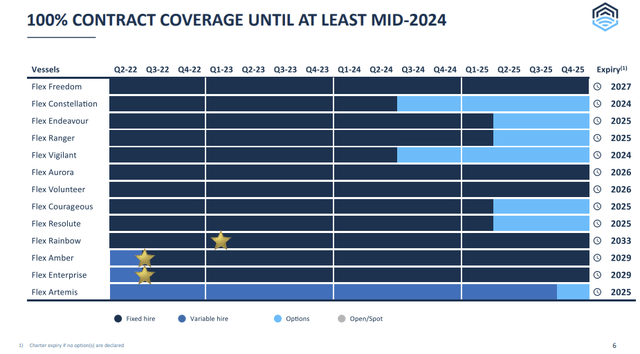

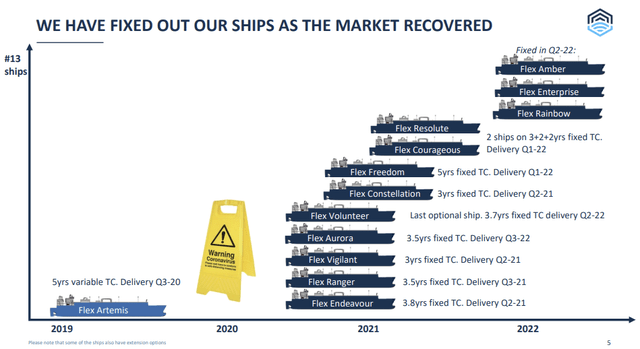

FLEX LNG currently operates 13 state-of-the-art vessels with an average fleet age of 2.6 years (as of 6.30.2022). Flex operates its fleet within spot market charters (short-term contracts) and longer-term fixed contracts with customers. These contract values (transportation prices) can vary depending on the supply and demand characteristics of the natural gas market. Because of their global reach and numerous factors that influence transportation costs & energy prices, it is vital for Flex to run its business with high efficiency in my opinion. With the currently elevated transport prices, Flex’s management has locked in 12/13 vessels to long-term contracts in order to avoid short-term price volatility and ‘lock in gains’:

Thesis Support

Long-Term Drivers

Natural gas has increased its share of the global energy consumption mix because of its efficiency, affordability, and relative sustainability (I attached links to papers supporting each individual claim for those interested). While reduced natural gas affordability may lead to potential demand reductions, I believe the current adoption of natural gas and efficiency will outweigh switching costs in the foreseeable future. With price increases correlated with higher earnings potential for Flex, limited demand destruction would be highly accretive to earnings. As a long-term driver for the top-line, global natural gas consumption continues to grow at a steady pace:

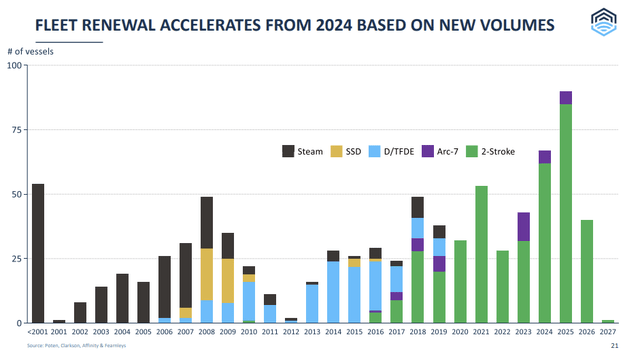

On top of overall growth in the commodity being transported, Flex is very attractive from an industry-specific standpoint because of its average fleet age. Currently, Flex has 13 state-of-the-art vessels with an average boat age of 2.6 years. LNGCs (LNG Carriers) have transformed from steam-powered engines to much more efficient 2-stroke diesel today. With a young and efficient fleet, customers are much more likely to choose their standard-size modern vessels for transportation. This trend is clearly reflected in the types of boats being renewed for transportation contracts:

FLEX LNG Investor Presentation

With 100 steam vessel contracts set to expire by 2027, the young fleet age tailwind may be relevant for at least the next 5 years.

I believe the most important long-term driver for Flex is its management team. Being so tied to the commodity market, operating efficiencies are key in my opinion. Starting at the top level, Flex is domiciled in Bermuda with an average effective tax rate (completely tied to business in foreign countries) of less than 0.50%. Management also expanded their fleet when newbuild costs were relatively low and focused on only housing the most modern ships attractive to customers. While management’s timing with building their fleet was excellent in hindsight, they have not been too quick to expand in today’s environment where the business may be over earning and new build costs are at record highs. Instead, management has fixed out contracts long-term while natural gas prices and spot contract values are at relative highs in order to reduce potential volatility:

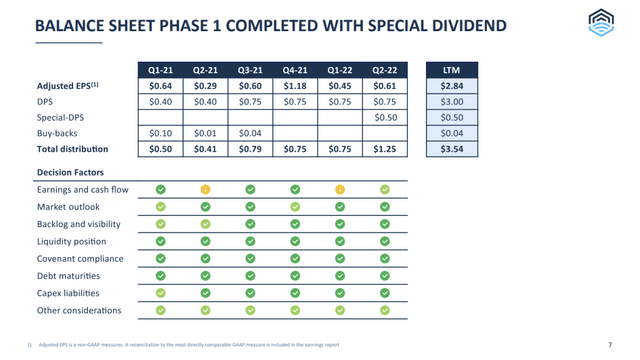

Being a highly leveraged business to fund the vessel costs, Management has also focused extensively on refinancing debt facilities and has successfully brought down interest costs as a % of sales significantly since 2018. By tactically improving cash flow margins, Management recognizes the volatility of the business and returns ample amounts of cash to shareholders without hurting liquidity, in my opinion. They do this by measuring different decision factors and then determining payouts depending on the current cash flow health:

Lastly, management’s stock packages account for ~90% of total compensation meaning their interests are very aligned with shareholders.

Risks

Customer Concentration

Flex customers are producers of LNG products including national, major, and other independent energy companies. In 2021, Flex had just 4 customers accounting for 66.1% of revenues representing a lack of customer diversity. A loss of customers could be a huge blow if Flex cannot secure a new charter agreement.

A mitigant to this risk is that Flex has locked up 12/13 ships to long-term charter agreements and demand remains elevated in spot markets.

High Correlation

Both the LNG commodity markets and the spot charter markets are very volatile and can lead to massive moves in Flex’s stock price. Not only is general volatility an issue, but spot markets can decline to the point where Flex is unable to charter vessels at a profit. This may lead to the inability to service debt or return cash to shareholders putting immense pressure on equity returns. While the correlation their business has to the aggregated natural gas market has been excellent since COVID, it may work adversely in the future:

The major mitigant to this risk is fixed contracts. Management has navigated post-COVID conditions very well in my opinion by locking in long-term charters at elevated prices to bolster future earnings.

Financials

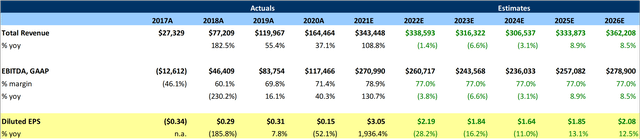

Below I’ve showcased my revenue projections through FY ’25, my model highlights, price targets, and risk cases. If you want more color on my projections please reach out:

Revenue Projections

Model Highlights

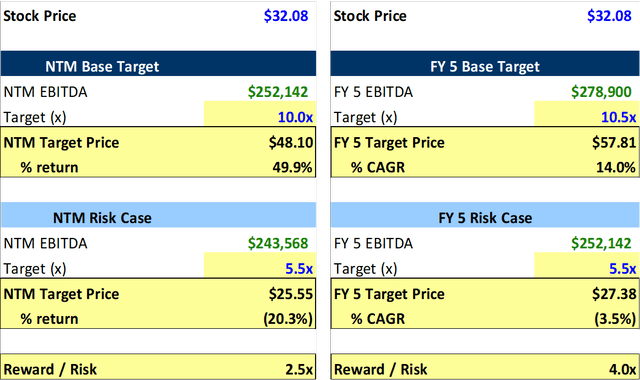

Reward / Risk

Summary

One of the most important questions with this business currently is how much are the key drivers priced in. While there are both long-term and short-term catalysts supporting the stock, FLNG has already ripped ~50% this year compared to the Vanguard World Stock Index (VT) down over 20%.

Even with the stock price elevated this year relative to the broad market, I still believe there is more room for earnings and multiple expansion given the current state of the energy crisis and seasonality benefits. Long-term, Flex is run by an excellent management team focused on operating efficiencies, sustainable growth, and returning cash to shareholders. At its current NTM EV/EBITDA multiple of 10.9x, I believe the bull case I’ve highlighted outweighs the risk case over the next twelve months and years after, especially after accounting for potential dividend payouts.

Be the first to comment