zhangxiaomin/iStock via Getty Images

Summary

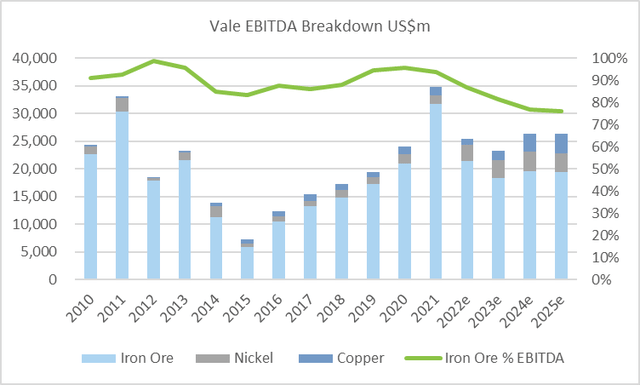

Vale (NYSE:VALE) is predominantly an iron ore exporter with 80% of EBITDA derived from sales to China. Its share price, as well as peers Rio Tinto (RIO) and BHP (BHP), oscillate with China’s iron ore spot prices and news flow surrounding steel demand, residential and infrastructure construction. In my view, the scenario does not point to increased steel/iron ore demand as China begins to ween off construction led GDP growth. However, my sensitivity analysis suggests that Vale’s current valuation incorporates an iron ore price of US$70 per ton (vs US$119 current), which suggests the stock is discounting a significant decline environment and poor medium term upside potential.

Vale EBITDA Breakdown (Created by author with data from Vale)

Chines Steel and Iron Ore Market

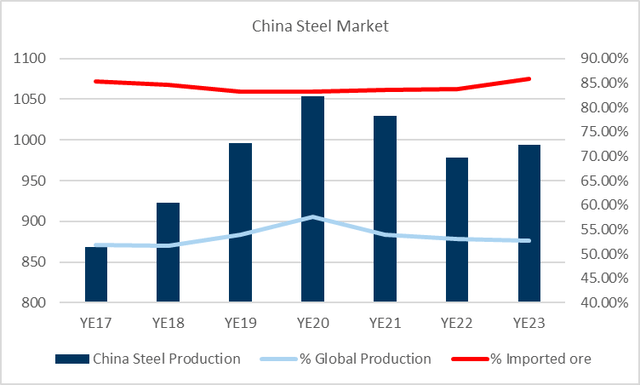

China is the largest steel producer in the world, its over 1bn tons of capacity represents 55% of global supply. At the same time China consumes 1.3bn tons of iron ore, 80% is imported and is known as the seaborne trade. Iron ore is the basic ingredient in steel manufacturing and about 1.4 tons of iron ore makes 1 ton of steel depending on the grade. The grade or purity of the iron ore increases the quality of the end steel product and thus higher grades have higher prices. Vale provides about 30% of China’s imports (the rest come from Australia) from mines in Brazil, predominantly high grades from Carajas (Amazon).

China Steel and Iron Ore Market (Created by author with data from Vale and Tradingeconomic.cl)

There are two basic steel products, long steel and flat steel. Long (I beams and rebar) is used in construction and accounts for 50% of total production, while 35% of total production is destined for residential construction. In many other markets long steel is produced with scrap steel given the lower finished quality requirements. However, in the Chines market there is not enough scrap to meet long (construction) steel demand. Flat steel is used in durable products manufacturing i.e. autos, machinery etc. which may require further transformation into stainless steel and other alloys.

Three Red Lines and the End of Rampant Construction

According to sources such as Goldman Sachs, Morgan Stanley, Woodmac and SP Platts, steel demand in China as well as the rest of the world, is headed into stagnation if not a decline. The reasons are varied, such as a general global macro slowdown, but more importantly the end of rampant residential construction (35% of steel output) in China. The CCP (Chines Communist Party) mandated this slowdown in 2020 with its Three Red Lines regulation aimed at curtailing homebuilder leverage, this eventually led to the ongoing liquidity crises in the sector and reduced construction activity. The rationale for this policy is that China had over built and in so doing distorted land prices, that led to home price unaffordability as well as a mis allocation of capital. Residential construction accounted for over 25% of GDP and was largely funded by the state banks, thus this sector crowded out and took capital from more productive sectors such as tech, health and manufacturing. The residential construction sector has probably hit its apex and along with its steel production and iron demand.

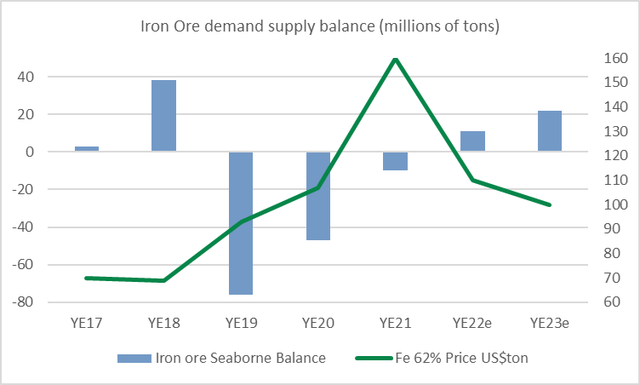

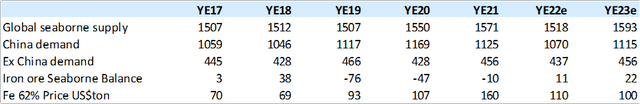

Iron Ore Demand Balance Shifting

The consensus forecasts that China iron ore demand will flat line (optimistically) while seaborne supply increases and drives the market to a modest over supply, impacting prices. As seen in the chart below even small surpluses or deficits can impact prices. Commodities trade on a physical supply /demand equation, adjusted for real time logistics. This makes them volatile, a steel mill cannot stop production or “temporarily” shut off its furnace, it needs to buy raw materials.

Iron Ore market moving to surplus. (Created by author with data from Vale, Macwood and GS.)

Global Seaborne Iron Ore Balance (Created by author with data from Vale, Macwood and GS)

Sensitivity Analysis: Vale Priced at US$70/ton

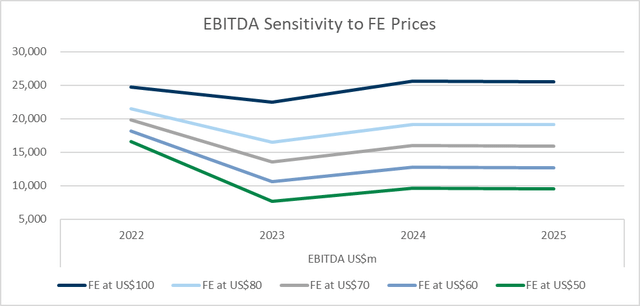

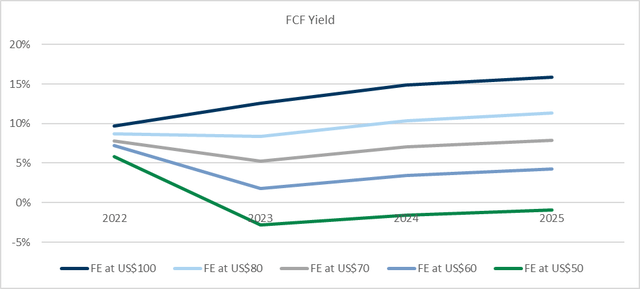

The extent and duration of this steel demand reduction and subsequent iron ore price impact is difficult to estimate. I though it more valuable to provide a sensitivity analysis to a wide range of iron ore prices. In this exercise I kept Vale’s nickel and copper prices flat and eliminated dividend payments to focus cash flow on net debt reduction.

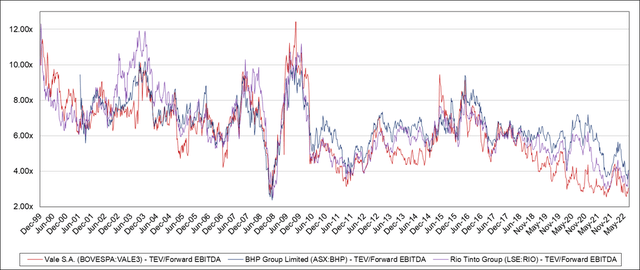

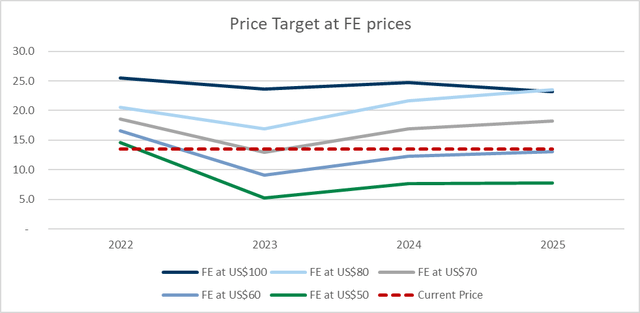

Mining stock prices are correlated with underlying commodity spot prices on a day-to-day trading bases despite medium term fundamentals. This has resulted in a lower risk tolerance from investors that value mining and commodity companies on lower multiples or a higher risk discount. I used a 5x EV/EBITDA target multiple to arrive at Vale’s fair equity value. This is in line with the 5x average in the last 10yrs and below the 6x average since YE2000.

Vale, RIO and BHP EV/EBITDA fwd valuations (Created by author with data from Capital IQ)

At US$70ton the fair equity value is US$13.5 or close to the current price. This suggest the market is discounting or expecting iron ore prices to fall sharply. This iron ore price level has not been seen since YE16 when the seaborne market was in surplus and does not account for inflation or steel price escalation costs. At US$50ton Vale would see negative free cash flow and the stock could collapse by 50%. At a price of US$100ton forever, the stock has 50% upside. The current iron ore cost curve is below US$65 ton for more than 85% of global production with Vale at under US$50 including shipping costs. While this does not mean prices can’t fall below US$65 it does make lower levels less sustainable in my view.

EBITDA at different iron ore prices (Created by author with data from Vale)

Vale Share Price Target at different iron ore prices (Created by author with data from Vale)

FCF yield at different iron ore prices (Created by author with data from Vale)

Conclusion: Vale Needs to Diversify into EV Metals

Vale faces iron ore price pressure as China steel demand declines, which has been mandated by the CCP in the 3 red lines doctrine. While the market has greatly discounted this scenario, an upside to iron ore prices seems allusive and Vale’s growth prospects look poor, making it a potential value trap. Vale has cheap consensus valuations but weak commodity fundamentals that make it difficult for the market to buy into. If Vale can use its still formidable cash flow to acquire or build capacity in the EV metal sector, nickel, copper, cobalt and even lithium, the market view may change.

Be the first to comment