Inna Tarasenko/iStock via Getty Images

Investment Thesis

In spite of supply concerns and potentially higher cocoa prices as a result of the ongoing situation in Ukraine, I take the view that Lindt & Sprungli (OTCPK:LDSVF) could see further long-term upside as a result of strong cash flow management and a rebound in sales.

In a previous article back in July, I made the argument that Lindt & Sprungli could see a significant rebound in earnings growth as tourism and mobility start to reach pre-pandemic levels once again.

However, I also cautioned that earnings growth would likely need to be higher than average to justify further price increases.

Since July, the stock has been on the up – albeit with strong volatility since the beginning of this year:

The purpose of this article is to determine why the stock has seen such a big jump in price, and whether we can expect further growth from here.

Performance

Taking a look at the company’s cash flow statement over the past five years – we have seen steady growth in operating cash flow as a whole, along with a slight rise in the operating cash flow to total assets ratio.

| Year | 2017 | 2018 | 2019 | 2020 | 2021 |

| Operating cash flow | 591 | 651.6 | 830.9 | 787.6 | 826.8 |

| Total assets | 6975.6 | 7249.8 | 8040.8 | 8051 | 8956.1 |

| Operating cash flow to total assets ratio | 8.47% | 8.99% | 10.33% | 9.78% |

9.23% |

Source: Operating cash flow and total assets figures sourced from Lindt & Sprungli Annual Report 2021. Operating cash flow to total assets ratio calculated by author.

This indicates that the amount of cash flow generated as a percentage of assets owned has remained stable (or increased slightly in this case). The fact that the company was able to maintain this ratio during the pandemic is encouraging, as it indicates that cash flow did not come under pressure as a result of downward pressure on sales growth during the pandemic.

In spite of negative sales growth in 2020, growth across Europe, North America and the rest of the world rebounded strongly in the double-digits last year – up by 13.8%, 10.7% and 19.7% respectively.

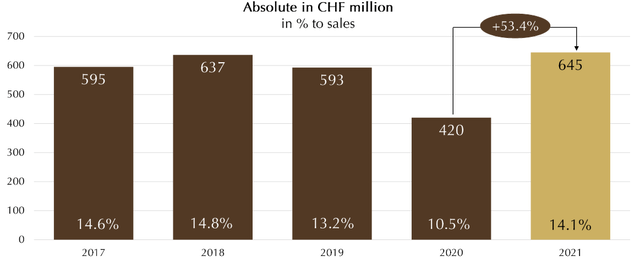

Moreover, operating profit also rebounded in 2021 to a five-year high, outpacing that seen pre-pandemic:

Lindt & Sprungli Financial Year 2021

Moreover, given that earnings rebounded to 2019 levels last year, the company looks like it is in a good position to sustain the current price range over the longer term, provided we continue to see growth in earnings going forward. There is the risk that sales growth might saturate in the short to medium term now that activity has bounced back after COVID.

Looking Forward

The ongoing situation between Russia and Ukraine has invariably had an impact on food prices. With a substantial portion of the world’s wheat coming from Ukraine, prices have risen substantially.

Insofar as how this can be expected to impact the cocoa market, the International Cocoa Organization outlines that the broader situation could impact cocoa demand to a degree.

For instance, as fertilizer is an important component of cocoa production, already high fertilizer prices are set to jump even higher as a result of the Russia-Ukraine situation. This would lead to significantly higher production costs for Lindt & Sprungli and threaten to affect profitability.

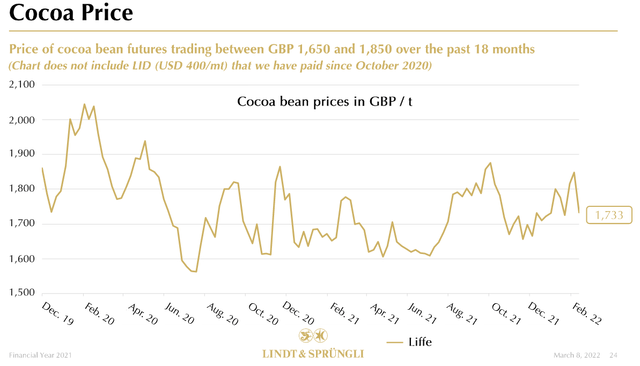

On the other hand, cocoa bean prices still remain below the highs we had seen at the end of 2019, in spite of a rise in the past year:

Lindt & Sprungli: Financial Year 2021

Moreover, the fact that Lindt & Sprungli caters to the luxury end of the market means customers are less likely to be price sensitive – particularly as demand has risen once again with reopening of stores and lifting of restrictions.

The main way that Lindt could be affected by the ongoing situation is in terms of potential shortages of production, supply to meet demand. For instance, the second half of 2021 saw shortages not only in chocolate production, but in labour and packaging as well. With COVID-19 continuing to lead to a number of staff shortages globally, as well as shortages of other raw materials, Lindt could see a situation whereby demand continues to rise to pre-pandemic levels, but the company cannot ramp up production quickly enough to meet such demand in the short to medium term.

Conclusion

To conclude, Lindt & Sprungli has shown resilient performance in a challenging global environment.

In the short to medium term, the stock could see some downside or volatility as food prices continue to be affected by the situation in Ukraine. However, I take the view that with demand set to rebound further post-pandemic, the stock should continue to see upside over the longer-term.

Be the first to comment