Maja Hitij/Getty Images News

Elon Musk is an enigma. There are some who say he’s a conman of epic proportions. There are others who say he is changing the world for the better. I don’t know what to make of Elon Musk, to be perfectly honest. But I do think that he is a smart man who is very good at making himself money. After taking a 9.2% ownership stake in Twitter (NYSE:TWTR), Musk has become the largest shareholder of one of the most popular social media platforms in the world.

This week has completely changed my personal view of Twitter as an investment and potentially even as a consumer. Not only has Musk now taken a large ownership stake in the company, but Tuesday morning it was announced that Musk is getting a seat on the board of directors. This means that Musk is the largest investor, is on the board of directors, and has a top 10 following on the platform itself. You could argue Elon Musk is now the most powerful influence on what happens with Twitter going forward. Even more so than the company’s own CEO Parag Agrawal.

Musk’s Voice Matters

Elon Musk has over 80 million followers on Twitter. This puts him at number 8 on the list of top accounts by total followers now that Donald Trump and Ariana Grande are no longer on the platform.

| Rank | Account Owner | Followers(millions) |

| 1 | Barack Obama | 131.3 |

| 2 | Justin Bieber | 114.3 |

| 3 | Katy Perry | 108.8 |

| 4 | Rihanna | 105.9 |

| 5 | Cristiano Ronaldo | 98.7 |

| 6 | Taylor Swift | 90.4 |

| — | Donald Trump | 88.8 |

| — | Ariana Grande | 85.3 |

| 7 | Lady Gaga | 84.4 |

| 8 | Elon Musk | 80.5 |

| 9 | Narendra Modi | 77.6 |

| 10 | Ellen DeGeneres | 77.5 |

Source: Wikipedia, data as of March 1, 2022

With such a massive following, what Musk says and does on the Twitter platform has influence. Beyond that, sampling Musk’s massive base of followers is a very good way to get market research at virtually no expense whatsoever. On March 25th, Musk asked his following this:

Free speech is essential to a functioning democracy. Do you believe Twitter rigorously adheres to this principle?

Voters were given the option to say either yes or no. Over 2 million Twitter users voted. 70.4% answered “no.” That is a clear indication that Twitter might have a problem. But problems usually present opportunities as well. Even though there have been numerous competitors who have entered the social media landscape with the promise of offering a free speech alternative to Twitter, none of the them have been able to capitalize on the market appetite for less social media censorship. I’m speculating, but I imagine Musk has taken note of the failed launches and the fragmentation.

Competitor Window Closing?

Others have made the case that Twitter may prove value as a meme stock. I think Logan Kane’s article from Monday makes good points and that’s a thesis worth considering. I’m going to come at this from a very different angle though. I have a more consumer-focused perspective on Twitter because I personally deleted my Twitter account last January and have been trying out alternatives ever since. As Twitter investors are likely aware, there hasn’t been a legitimate heir to Twitter from any competing microblog platform. Nobody has seized the opportunity that has been presented by user angst from Twitter’s platform policies.

| Platform | Total Visits (Jan22) |

| 6,500,000,000 | |

| Gab | 18,200,000 |

| GETTR | 10,000,000 |

| Parler | 1,800,000 |

| Minds | 1,100,000 |

Source: Similarweb.com

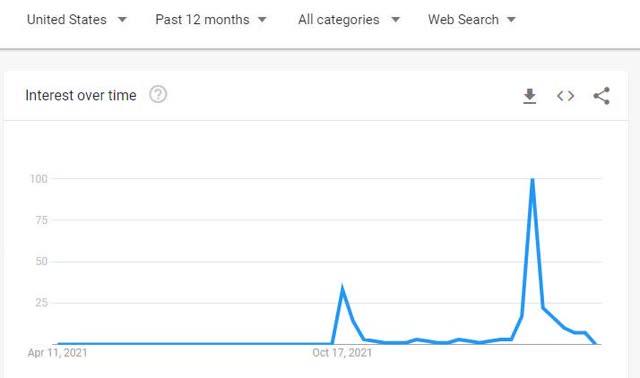

The fledgling Twitter competitors that claim to be proponents of free speech have been harmed by fragmentation, botched launches, big tech collusion, and shady user counts. Given that, the timing of Musk’s activity with Twitter is interesting. If there was any belief that Donald Trump’s Truth Social would catapult into a sizeable Twitter alternative, the rollout of that platform has probably been detrimental enough to seriously damage that thinking. That launch has been so bad, that there’s even speculation that the planned merger with Digital World Acquisition Corp. (DWAC) could be in trouble. Consumer interest in the app seems to have plummeted as well. After a spike in Google search data around the time of the platform’s launch, search term “Truth Social” has been showing big declines in interest ever since.

Search term “Truth Social” (Google Trends)

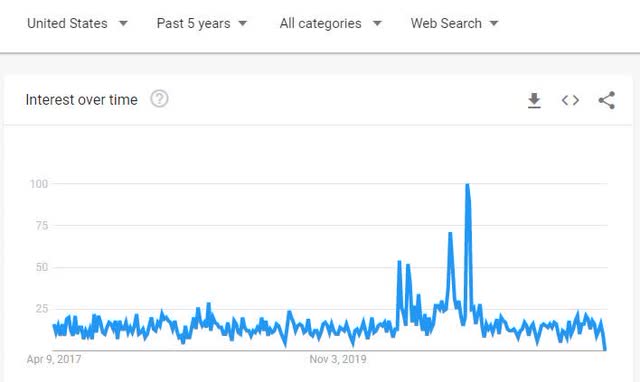

This does not seem to be exclusive to Truth Social either. Broadly, the platforms that are marketing themselves as free speech competitors are also potentially facing declining interest. Consider that “Twitter alternative” as a search term has also failed to gain any real steam after the interest peaked last February.

Search term “Twitter Alternative” (Google Trends)

The user experience edge that Twitter has shouldn’t be discounted either. Based off both average site duration and bounce rate, Twitter’s users are far more engaged with the platform than most of the competition, according to Similarweb. And some of the Twitter alternative platforms have seen larger drops in usage from December to January than Twitter has.

| Platform | Site Duration | Visits Mo/Mo | Bounce Rate |

| 10:41 | -7.3% | 31.8% | |

| Gab | 9:15 | -2.7% | 39.7% |

| GETTR | 7:10 | -42.1% | 42.4% |

| Parler | 3:33 | -4.7% | 59.5% |

| Minds | 5:28 | -19.5% | 37.9% |

Source: Similarweb.com, January 2022 data

I can share I’ve personally been trying to find a platform that provides a similar level of enjoyment that Twitter once gave me but that also balances what I want out of a company from a social and philosophical perspective. While there is one platform that is my clear favorite of the Twitter alternatives, I’d certainly consider starting over with Twitter if I had faith in the company’s commitment to allowing real discourse. For that reason, I find the developments regarding Elon Musk and Twitter to be very interesting.

Technical View

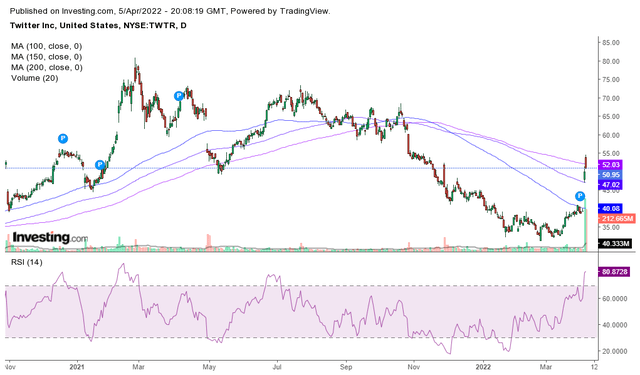

All of these points aside, I have not entered a long position as of article submission. The reason for that is because I believe the price action has probably gotten way ahead of itself after the last two sessions.

Twitter 4/5/22 Close (Investing.com)

After two back to back days with volume more than 20 times ahead of where the 20-day average was after Friday’s session, the RSI-14 on Twitter’s daily chart is now above 80. That’s very overbought. After opening above it, shares closed back below the 200-day moving average near the low of the day. I’d like to see the stock calm down before I entertain a long entry.

Conclusion

It seems the most pragmatic way to have a top social media platform that will legitimately commit to protecting an individual’s right to share their ideas is by changing Twitter through investor activism and corporate governance rather than by trying to build a new platform from scratch. Whether Elon Musk is seeing interest in Twitter’s competition dwindle or he’s just trying to fix a platform that he values greatly as a user, I won’t speculate. But I think he’s made an incredibly interesting move by taking the stake that he has. As a consumer, I genuinely hope that he can influence change at Twitter. As a potential investor, I’m definitely keeping my eye on some key levels going forward and I wouldn’t rule out going long in the weeks ahead.

One More Thing

I’m really excited to share that I’ll be launching a Marketplace service right here on Seeking Alpha called Heretic Speculator PRO very soon. As we get closer to the launch, I’ll be able to get into more of the details about the service and the value proposition for subscribers. Make sure you follow me so you don’t miss what’s coming!

Be the first to comment