imaginima

Hawaiian Electric Industries, Inc. (NYSE:HE) is one of the more unique electric utilities in the market. This is because it is more than simply a utility as it also owns one of the largest banks in Hawaii. Despite this, the company still enjoys many of the characteristics that we have come to associate with the utility sector, such as generally stable cash flows and a high dividend yield. Indeed, Hawaiian Electric Industries currently yields 3.47%, which is substantially higher than the market as a whole. The banking operation does add a certain degree of volatility that is not present in other utilities, which may explain why the stock is down 6.87% over the past twelve months. This may also be due to the company being isolated in the state of Hawaii as Hawaii is far more dependent on the sometimes fickle tourist industry than many other states. This industry is still struggling from the impacts of the COVID-19 pandemic and may become even worse as the country falls into a recession. Fortunately, Hawaiian Electric Industries should be somewhat insulated from this but its stock still looks incredibly expensive at the current price. As such, it may make some sense to wait and see if it declines further before buying in.

About Hawaiian Electric Industries

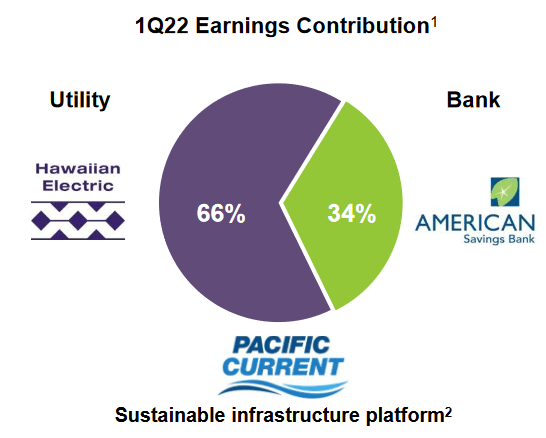

As stated in the introduction, Hawaiian Electric Industries is the largest electric utility in the state of Hawaii. The company is also very unique across the utility sector as it owns one of the largest banks in the state, American Savings Bank. Of the two business units, the electric utility is by far the larger as it alone accounted for 66% of the company’s first-quarter 2022 earnings:

Hawaiian Electric Industries

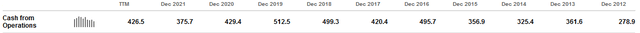

As the utility business is much larger than the bank, we can largely think of Hawaiian Electric Industries as an electric utility with a bank attached. Admittedly, Hawaii may not be the first place that investors think of when purchasing a utility company but there may be a few reasons to consider it, particularly for those investors that are interested in the current environmental, social, and governance investing trend. This is because Hawaii has a climate that lends itself well to the deployment of certain types of renewable energy, especially solar. Hawaiian Electric Industries is in fact being very aggressive at deploying this technology, as we will see throughout the course of this article. Hawaiian Electric Industries also enjoys many of the things that have made utility companies popular among more conservative investors, such as generally stable cash flows. We can see this by looking at the firm’s operating cash flows over time:

The reason for this should be fairly obvious. An electric utility provides a product that is generally considered to be a necessity for our modern way of life. As such, most people will prioritize paying their electric bills ahead of discretionary expenses during times when money gets tight. This is something that could prove to be an advantage as there are a growing number of signs that the United States is heading into a recession. It is doubly important in this case given that the state of Hawaii is highly dependent on its tourist industry and vacations are one of the first things that people tend to cut back on during tough economic times. Fortunately for Hawaiian Electric Industries, it has a monopoly as the company provides electric service to fully 95% of the state’s population so it does not have to worry about competition forcing it to reduce prices and pressuring its cash flows. Thus, the company should be able to maintain its financial performance even given such a poor macroeconomic outlook.

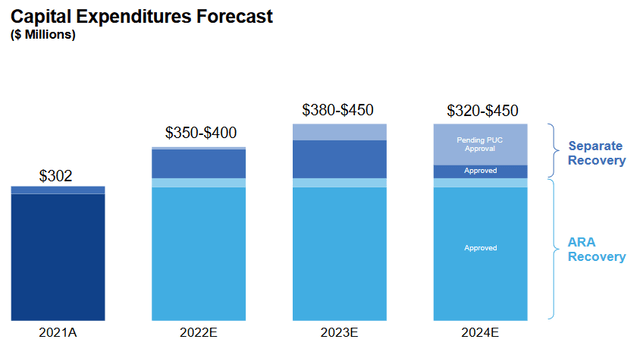

As investors, we are not only interested in stability, we want to see growth. Unfortunately for Hawaiian Electric Industries, it is confined to the island state so its ability to grow by adding new customers is quite limited. Fortunately, though, the company does have a few other options. One of these options is to grow its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the rate base allows the company to increase the prices that it charges its customers in order to earn that rate of return. The usual way for the company to grow its rate base is by investing money into upgrading, modernizing, and possibly even expanding its utility infrastructure. Hawaiian Electric Industries is doing exactly this and has stated that it plans to invest more than $1.6 billion into this project over the 2021 to 2024 period:

The company has stated that this capital spending program should grow the earnings of the electric utility at a 5% compound annual growth rate over the 2022 to 2024 period, which is reasonable for an electric utility as it is in line with many of its peers. However, it is important to keep in mind that a significant proportion of Hawaiian Electric Industries’ earnings come from the banking arm so we need to be very careful about drawing any conclusions from this figure in isolation. We will discuss the bank in more detail later.

One of the biggest areas in which Hawaiian Electric Industries is investing in is renewable energy, which is part of its goal to reduce carbon emissions by 70% by 2030 and achieve net-zero emissions or better by 2045. This is, admittedly, one of the more aggressive carbon-reduction goals in the industry, but it does make sense considering the high cost of fossil fuels in Hawaii and the state’s reputation of being an untouched paradise.

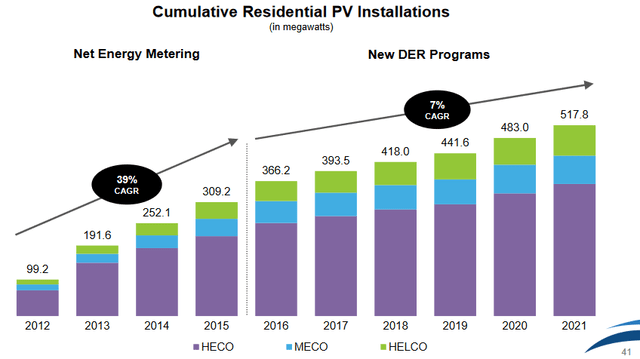

While the company is using common techniques such as retiring coal-fired power plants, it is also pursuing some less orthodox methods. Chief among these is the deployment of rooftop solar panels throughout its service area. As I pointed out in a previous article, rooftop solar panels are generally a very poor solution to reducing carbon emissions compared to using utility-scale wind and solar plants. However, they may make some sense in Hawaii. This is because the problem with rooftop solar panels is that they are generally not going to be at an optimal angle to generate electricity, which substantially reduces their performance compared to the movable panels that are found in utility-scale solar plants. This is less of a problem in Hawaii, as the state’s proximity to the equator greatly expands the optimal angles and thus improves their performance. This may be one of the factors that have allowed Hawaiian Electric Industries to be one of the fastest-growing installers of rooftop solar panels in the United States.

Approximately 21% of the company’s customers have rooftop solar panels installed on their homes. This is a higher percentage than any other utility in the nation. The company has been working on expanding its rooftop solar installations for many years and has managed to achieve a 7% compound annual growth rate over the 2016 to 2021 period:

This is not the only strategy that Hawaiian Electric Industries is using to increase the use of renewable energy across its service area. The company is also constructing utility-scale solar plants, including a massive one-gigawatt solar plant that is currently under development. The company’s leadership in the deployment of solar power is something that may appeal to the managers and investors of the various environmental, social, and governance funds that have amassed a considerable amount of assets in recent years. When we consider the size of these funds, any buying pressure from these funds could drive the company’s stock price up. In addition, if the funds start buying on any dips then it could essentially put a floor under the stock price. Any investor should be able to appreciate either of these things.

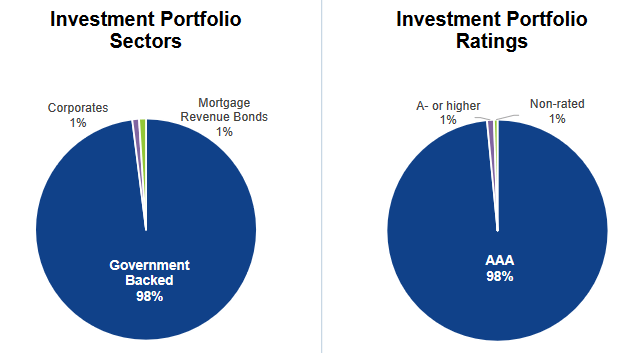

In general, banks are considered to be much less stable financially than utility companies, which is a belief that may be a remnant of the financial crisis back in 2008. As such, we may assume that the fact that Hawaiian Electric Industries derives about a third of its profits from its banking operation might be considered to increase the company’s risks. However, we have already seen that the company does enjoy remarkably consistent cash flows over time. This is partly because this bank is using a much less risky business model than many other banks do. First and foremost, the bank’s investment portfolio is almost entirely invested in investment-grade bonds that are backed by governments:

Hawaiian Electric Industries

Although government bonds tend to have comparatively low yields, they are also generally considered to be free of default risk. The recent increase in interest rates has certainly caused the market value of these securities to decline but this is only a problem if the bank tries to sell them prior to maturity. As long as it simply holds them to maturity, it will still get the full principal and interest bank. That is the strategy that the company’s banking operation attempts to use. The American Savings Bank is not engaging in the highly levered and riskier operations that have gotten other banks into financial trouble in the past.

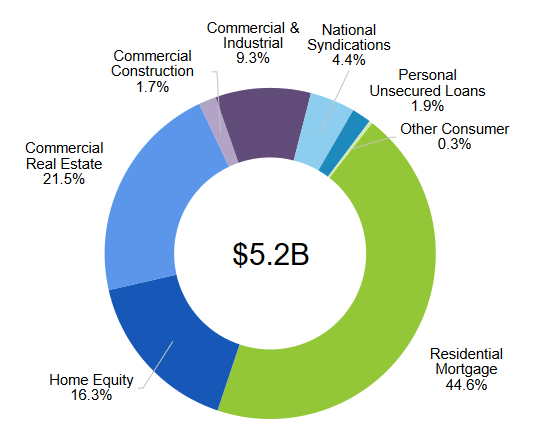

In addition to investing in incredibly safe government bonds, the bank extends mortgages to purchase real estate across the state of Hawaii. It makes loans to purchase both residential and commercial properties and is fairly well diversified among the various types:

Hawaiian Electric Industries

The nice thing here is that the bank is entirely funding its mortgages by relying on deposits. Indeed, the bank has substantially more deposits than it has outstanding mortgages. This is a much more stable business model than needing to rely on the money markets or capital markets to finance loan issuance because depositors tend to be less fickle and less likely to just move their money elsewhere. This is especially true in Hawaii, which has relatively low immigration and emigration. This lends itself reasonably well to stable real estate values. Overall then, the banking operation is much less risky than one may think. The company is, therefore, able to maintain its utility character despite having a very non-utility business accounting for a substantial proportion of its profits.

Financial Considerations

It is always important to look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a business than equity because debt must be repaid at maturity. As this repayment is usually accomplished by issuing new debt to raise the money to repay the old debt, this can cause a company’s interest expenses to increase following the rollover depending on the market conditions. In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, a decline in cash flows may push the company into financial distress if it has too much debt. Although utilities like Hawaiian Electric Industries typically have remarkably stable cash flows, bankruptcies are certainly not unheard of in the sector so this is still a risk that we should not ignore.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. This ratio also tells us how well the company’s equity can cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of March 31, 2022, Hawaiian Electric Industries had a net debt of $2.3751 billion compared to $2.3379 billion of total equity. This gives the company a net debt-to-equity ratio of 1.02. Here is how that compares to a few of the firm’s peers:

| Company | Net Debt-to-Equity Ratio |

| Hawaiian Electric Industries | 1.02 |

| Otter Tail Corporation (OTTR) | 0.82 |

| DTE Energy (DTE) | 2.08 |

| Eversource Energy (ES) | 1.39 |

| American Electric Power Company (AEP) | 1.54 |

| Avista Corporation (AVA) | 1.13 |

As we can clearly see, Hawaiian Electric Industries has significantly lower leverage than many of its peers. Admittedly, not of these are perfect peers because, as already stated, the company is rather unique in its sector. However, we can still see that it is very conservative with its financial structure. This is something that we should appreciate as it should represent a lower risk than the firm’s peers have. Overall, there is nothing to worry about here.

Dividend Analysis

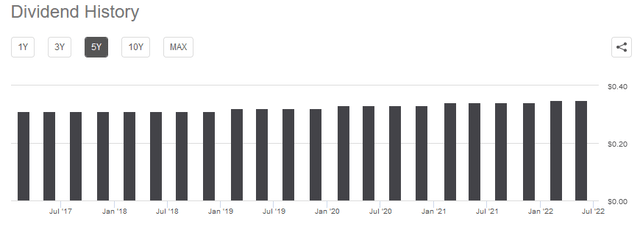

One of the biggest reasons that many investors purchase shares of utility companies like Hawaiian Electric Industries is because of the relatively high yields that they tend to possess. Indeed, Hawaiian Electric Industries boasts a 3.47% yield at the current price, which is substantially higher than the 1.52% yield of the S&P 500 index (SPY). In addition to this, the company has a history of raising its dividend annually:

This is something that is quite nice to see in inflationary times like what we are facing today. This is because inflation is consistently reducing the number of goods and services that we can purchase with the dividend that we receive from the company. The fact that it increases the amount of money that gives us every year helps offset this effect and maintain our standard of living. As is always the case though, we need to examine if the company can actually afford its dividend. After all, we do not want it to be forced to reverse course and cut the dividend since that will reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we judge a company’s ability to pay its dividend is by looking at its free cash flow. Free cash flow is the money that is left over from its ordinary operations after the firm pays all its bills and makes all necessary capital expenditures. Thus, this is the money that is available to do things like pay off debt, buy back stock, or pay a dividend. In the trailing twelve-month period ending March 31, 2022, Hawaiian Electric Industries achieved a levered free cash flow of $242.3 million. However, the company only paid out $149.8 million in dividends. Thus, it easily covered its dividend and had money left over for other things, such as buying back stock. Hawaiian Electric Industries bought back $3.1 million of its own common equity in the period but it also issued more debt than it repaid. Overall though, the company’s net debt is almost identical to what it was at the same time last year so we do see the stability that I mentioned numerous times throughout this article. Overall, the company’s dividend does appear to be affordable and it is unlikely to need to cut it.

Valuation

It is critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like Hawaiian Electric Industries, one method that we can use to value it is by looking at its price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A ratio below 1.0 is a sign that the stock may be undervalued based on its forward earnings growth and vice versa. However, there are remarkably few stocks whose ratios are that low in today’s overheated market, particularly in low-growth sectors. Thus, it makes the most sense to compare Hawaiian Electric Industries to its peer group in order to see which has the most attractive relative valuation.

According to Zacks Investment Research, Hawaiian Electric Industries will grow its earnings per share at a 3.18% rate over the next three to five years. That gives the company a price-to-earnings growth ratio of 5.71 at the current stock price. Here is how that compares to the company’s peers:

| Company | PEG Ratio |

| Hawaiian Electric Industries | 5.71 |

| Otter Tail Corporation | N/A |

| DTE Energy | 3.43 |

| Eversource Energy | 3.29 |

| American Electric Power Company | 3.03 |

| Avista Corporation | 3.58 |

This is unfortunately the area where Hawaiian Electric Industries begins to lose a great deal of its shine. As we can clearly see, the company looks very expensive relative to the other firms in its peer group. This is despite the generally steep decline in the stock price that we have seen in the stock price over the past year. There could be a few reasons for this, including investors and funds purchasing the stock for its renewable credentials. If true, this could certainly give validation to the thesis that I outlined earlier. However, the high price does mean that investors may want to be cautious before buying the company’s shares as it may decline further as we enter into a recession. That could provide a better buying opportunity.

Conclusion

In conclusion, Hawaiian Electric Industries certainly has a lot to offer to investors that can get over its rather unique business structure. The company boasts remarkably stable cash flows, a high yield, and very strong renewable credentials. It also has one of the strongest balance sheets in the industry, which is always a plus for risk-averse buyers. Unfortunately, its valuation is hardly a selling point as the stock is remarkably expensive compared to some of its peers. We could see a decline in the stock price as the country enters into a recession though, so it is certainly worth keeping on the radar to accumulate on dips.

Be the first to comment