BeyondImages

Thesis

Vale S.A.’s (NYSE:VALE) stock has outperformed the S&P 500 (SPX) (SP500) significantly since our previous update in early October. Accordingly, VALE posted a price gain of nearly 22% relative to SPX’s 11% uptick.

The outperformance likely stunned the bears, considering that Wall Street analysts turned even more pessimistic after its FQ3 earnings release in late October. It also coincided with the initial aftermath of China’s CPC 20th Party Congress in which Chinese President Xi Jinping doubled down on his “dynamic COVID zero” policy.

Therefore, even Vale’s management was likely taken by surprise as it highlighted its disappointment in its earnings call commentary. However, in just over a month, China has progressively eased its zero COVID restrictions, with major provincial capital cities accelerating their loosening of curbs.

As such, China watchers have revised their reopening forecasts, with the consensus suggesting that China could exit its zero COVID restrictions by Q2’23.

Hence, the recent outperformance of VALE shouldn’t be surprising. Notably, VALE bottomed out in September, well ahead of China’s recent easing moves. Thus, buyers already returned nearly three months ago to start accumulating. However, the decisive moves to demolish the bears only started in November, as VALE bulls forced a series of upward surges, lifting its performance sharply.

Given VALE’s recent recovery, we assessed its valuation as more well-balanced. However, its price action is also overbought and, in our opinion, has likely overstated the recovery in iron ore futures (TIOC:COM).

As such, we believe investors looking to add exposure should remain patient and wait for a pullback first to digest its recent recovery.

Revising from Buy to Hold for now.

VALE: Easy Money Has Likely Been Made

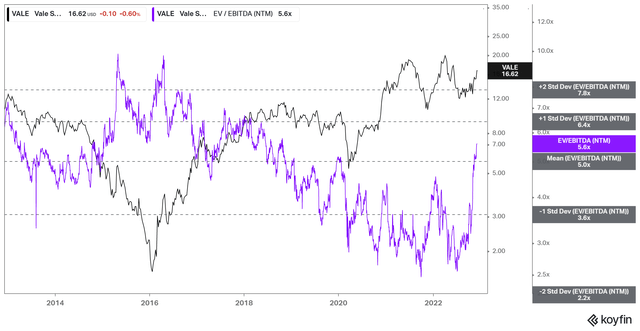

VALE NTM EBITDA multiples valuation trend (koyfin)

With the remarkable recovery from its September lows, VALE’s NTM EBITDA multiples have normalized toward its 10Y average. Notwithstanding, the significant revisions in its NTM earnings estimates by Street analysts after its Q3 card also lifted its valuation.

As such, it corroborates our previous article explaining why the market didn’t re-rate VALE higher earlier in the year. The market had correctly anticipated that the Street could be “forced” to cut its earnings estimates, given worsening macros and elevated inflation levels and energy costs.

While we think the downward revisions should place Vale in a better position to outperform the Street’s consensus moving ahead, we deduce the reward/risk balance is less favorable at the current levels.

But China Could Proffer A Pleasant Surprise

Despite that, we believe Street analysts have likely not reflected the boost to China’s property market recovery and its 2023/24 GDP forecasts as China eases its COVID restrictions.

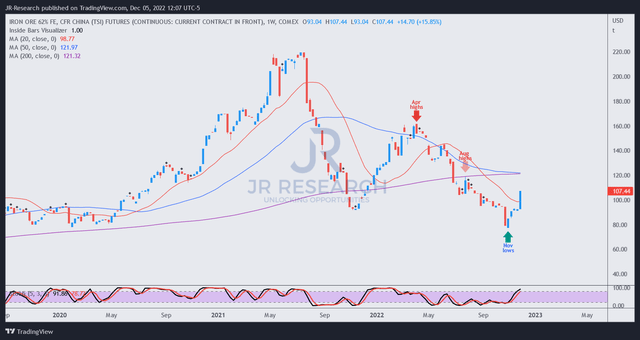

Iron ore 62% Fe futures price chart (weekly) (TradingView)

While iron ore futures have surged from their November lows, reflecting the optimism in China’s recent easing moves, they remain well below their April and August highs.

Therefore, we believe there’s significant potential for TIOC to sustain its recovery if China could reopen with more urgency, lifting its GDP growth projections for 2023.

Notably, Chinese economists have called out to policymakers to accelerate China’s reopening and set a GDP growth target higher than 5% for 2023 “to send a strong signal that boosting [the] economy is a priority for the government.”

Accordingly, it’s higher than the revised growth projections per consensus right after the National Congress, as economists dwelled over China’s zero COVID restrictions.

As such, we believe China could provide a significant boost for VALE in the near medium term if the market anticipates an accelerated reopening phase.

Is VALE Stock A Buy, Sell, Or Hold?

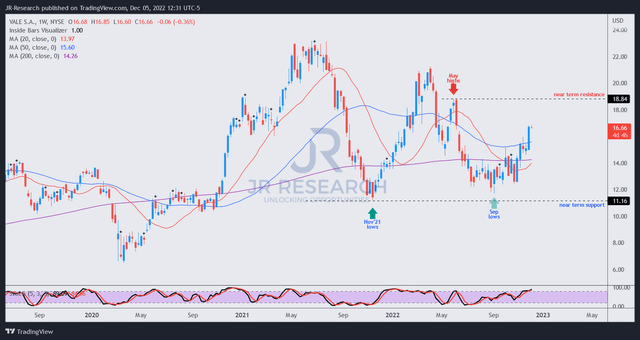

VALE price chart (weekly) (TradingView)

VALE has recovered remarkably from its September lows but remains a distance from its May highs.

However, we assess that a material re-rating toward its May highs is unlikely for now, as the market remains tentative over worsening global macro headwinds. Also, we believe that the near-term optimism over China’s recent easing of its COVID curbs has likely been reflected.

As such, we believe a pullback is looking increasingly likely, which should help improve investors’ reward/risk as they look to partake in China’s economic recovery moving ahead.

Revising from Buy to Hold for now.

Be the first to comment