gorodenkoff/iStock via Getty Images

To clients and friends of Vailshire Partners LP hedge fund:

- The Fed is tightening into an economic slowdown… buckle up

- “Demand destruction” is working, but at what cost to humanity?

- Vailshire Partners LP’s proprietary trading system is working quite well, even in this difficult macroeconomic environment

Performance Review

Economic Slowdown and Fed Tightening Roil Markets

Sticky high inflation and ongoing low unemployment have the Federal Reserve in a highly hawkish stance. And, historically-speaking, when the Fed tightens into an economic slowdown, risk assets always decline.

In light of these conditions, it should be no surprise that Vailshire’s proprietary trading system has been leaning strongly bearish since early January. As the fund manager and designer of the trading system, I finally relented in mid-June and sold all of our “hold forever” equities… trusting its emotion-free, quantitative approach to generating alpha!

Although the “hold forever” stocks were (and are) wonderful companies that should perform solidly throughout the current decade of stagflation, their strongly bearish price action continued to weigh down the performance of Vailshire Partners LP. Selling them allows our fund to flow with the momentum and (ideally) make profits, regardless of market direction and macroeconomic landscape.

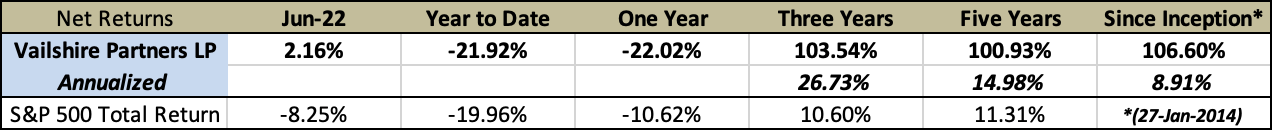

In June of 2022, Vailshire Partners LP holdings returned +2.16% (see table below), compared with a -8.25% total return for the S&P 500. This equates to a whopping 10.41% outperformance in one month. Needless to say, I am optimistic about our performance in the coming quarters and years, as the effects of our new trading system take hold in earnest.

The annualized returns of Vailshire Partners LP over the past three- and five-years–measuring +26.73% and +14.98%, respectively–continue to outperform the S&P 500 by a sizable margin (+10.60% and +11.31%, respectively).

Combining my qualitative, well-researched macroeconomic views with quantitative momentum and volatility-based trading strategies should prove to be a genuine strategic advantage for my treasured Vailshire co-investors and LPs.

Current Market Conditions

As alluded to above, the Federal Reserve has painted itself into a difficult corner. The past decade of seemingly unending quantitative easing and stock market gains has come to a painful end… and has brought serious consequences with it.

Monetary debasement is all fun and games while the prices of our stocks, bonds, and real estate constantly move up and to the right. But when material inflation occurs across the entire spectrum of the goods and services affecting everyday Americans–from high grocery bills and gas prices to unaffordable rent, healthcare, and education costs–people start to get disgruntled… and worried… and sometimes violent.

To “fix” this difficult situation of sticky high inflation, where our country’s demand is currently greater than its underlying supply, the Fed has decided to initiate Operation Demand Destruction. By rapidly raising short-term interest rates and withdrawing liquidity from the system, businesses will have a difficult time operating at a profit. Solid companies will survive, but will likely cease hiring new applicants. Moderate and below-average businesses will need to terminate a significant percentage of their workforce to stay afloat… or they may simply collapse under the financial strain.

The resultant Fed-induced slowing of businesses will continue to drag down earnings, which should further drive down the stock markets. The worst companies will no longer be able to pay or refinance their debt obligations, and will cease operating. As a result, unemployment will rise and America’s “wealth effect” will rapidly diminish. Fewer investments will be made and less goods will be purchased, which will have the “happy” effect of lowering prices and driving down inflation.

This–also called a “recession”–is what the Federal Reserve wants… and it will get it.

This is unfortunate.

I am of the opinion that the solution (“demand destruction”) is not worth the costs to humanity. But instead of complaining about the Fed’s methodology, my goal is to help Vailshire clients successfully navigate this decade’s myriad challenges and emerge in a better position on the other side.

3Q 2022 Investment Strategy

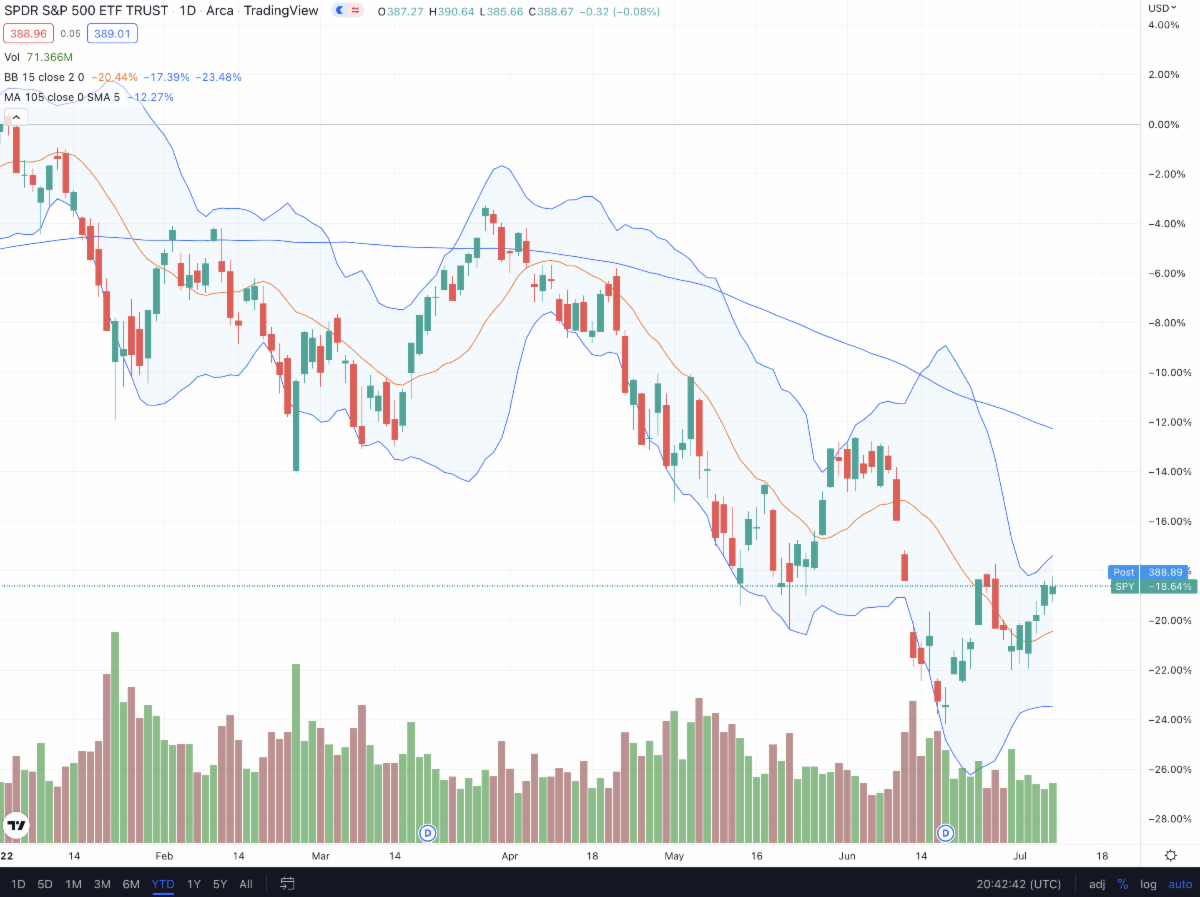

The momentum of the US stock markets has been unequivocally bearish throughout the first half of 2022.

As shown by the adjacent chart, despite an impressive rally since the start of July, the S&P 500 is still down nearly -19% so far in 2022. The tech-heavy #NASDAQ is down over -26%. And Bitcoin, which is simply better money for the world, remains down an eye-watering -54%!

Until the currently atrocious macroeconomic conditions change, I am of the strong opinion that it is unwise to fight the heavily bearish momentum across risk assets.

Vailshire’s proprietary trading system agrees!

Until momentum decidedly shifts, we will remain heavily short technology, growth, and innovation stocks, the majority of which are included in the NASDAQ index ETF.

While we still hold a core allocation to spot bitcoin in the fund, we are hedging this position by being short BTC futures. The hedge will remain in place until momentum has shifted positively for bitcoin.

Another hedge that I occasionally use is to be long volatility during times of unusual complacency. We are in such a period now, as stocks have rallied hard since the beginning of July. When stocks decline precipitously, volatility spikes, and this short-term long volatility position performs exceedingly well as a hedge.

Finally, and somewhat surprising to some, Chinese equities look to be starting a new bull market after 1-2 years of bearish behavior and wild unpopularity. Our fund currently holds a 3-4% stake in a single Chinese public equity that is up approximately 14% since we added it to our portfolio. It will likely remain in place until it hits its trailing stop loss, which may not occur for quite some time.

To conclude, the current economic conditions and Federal Reserve’s actions bode poorly for most risk assets over the coming months. Thankfully, Vailshire’s proprietary trading system is up for the task of generating alpha over the long term for our clients, regardless of market direction.

I am honored by the trust my LPs have placed in me to make wise investment decisions throughout this tumultuous decade… and I take this responsibility very seriously. If you are reading this and you are already a part of the Vailshire family: thank you.

For current non-clients: If you would like to discuss what Vailshire’s innovative investment strategies can do for you and your family, please do not hesitate to reach out to me personally via email (jeff@vailshire.com). This is not a solicitation to invest but, rather, an invitation to inquire more.

Living well and investing wisely with you,

Jeff Ross

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment