dnaveh/iStock Editorial via Getty Images

Introduction

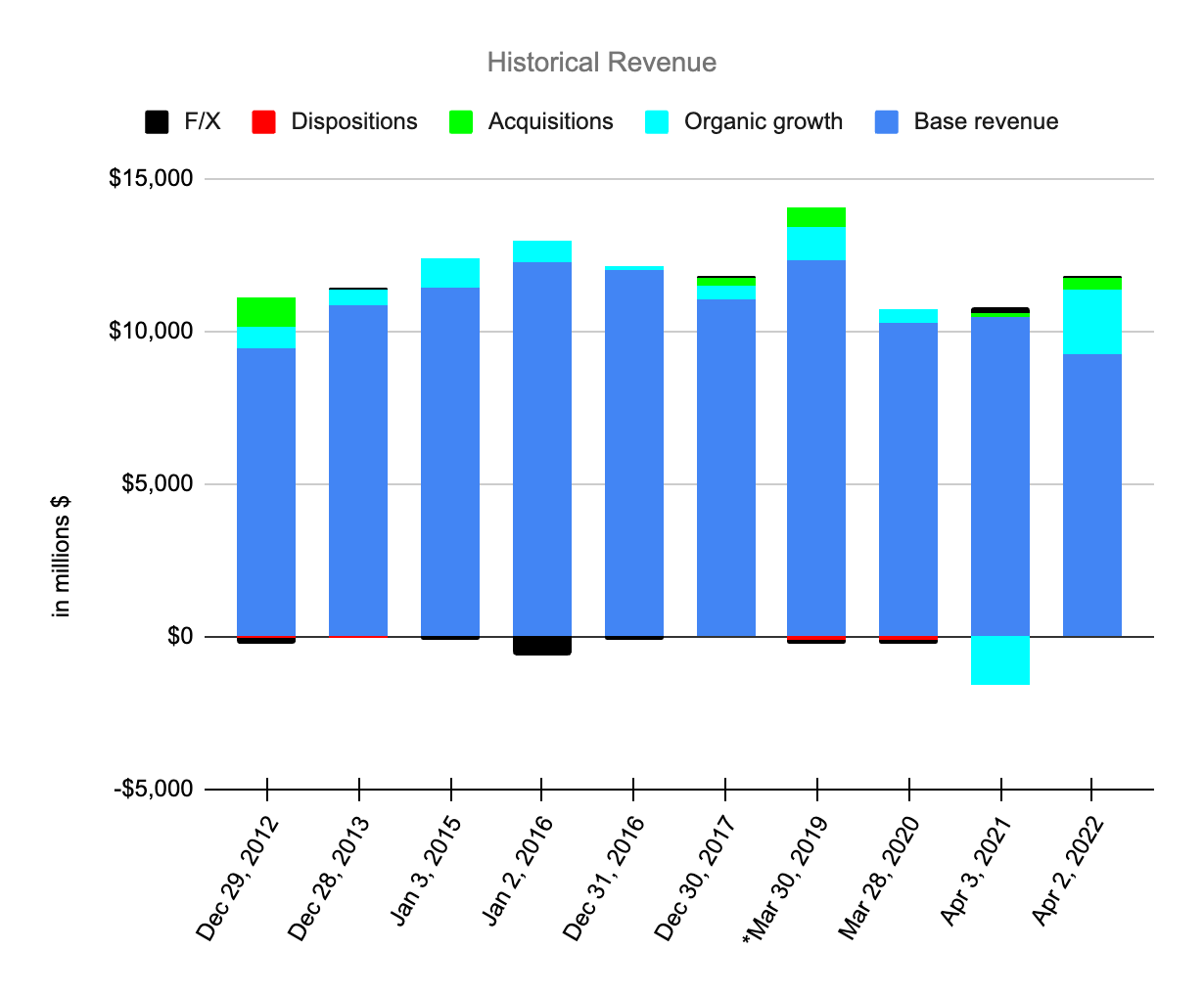

My thesis is that revenue growth has been underwhelming at V.F. Corporation (NYSE:VFC) for the last decade. Looking at the 10-K from 10 years and 3 months ago, we see revenue of $9.5 billion for the period through December 2011. Moving forward, the latest 10-K through April 2, 2022 shows revenue of just $11.8 billion.

When evaluating businesses, I like to look at their revenue history from the last 10 or 11 years as one of the considerations as to what revenue growth may look like in the future.

The Numbers

Looking at the last 10 years, revenue is almost flat despite acquisitions of notable companies like Williamson-Dickie and Supreme:

V.F. Corporation Revenue (Author’s spreadsheet)

*The period through March 2019 includes an extra 3 months while the period through March 2020 starts with just a 12 month base.

Timberland was acquired in September 2011 and it boosted revenue significantly for the period ending December 2012.

The Williamson-Dickie acquisition added revenue of $471.9 million for the period through March 2019.

The Supreme acquisition increased revenue for the period through April 2022 by $438.5 million.

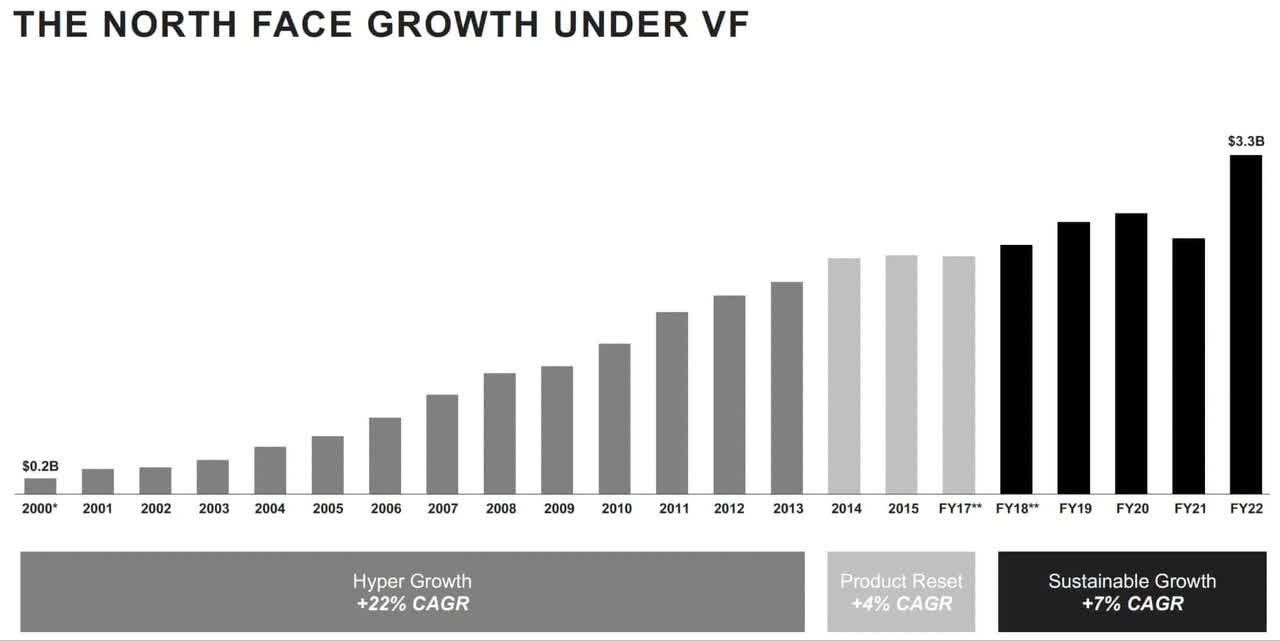

The North Face is one of the brands owned by V.F. Corporation which shows that revenue growth has been modest most of the last decade. Their revenue growth was impressive from 2000 to 2013 when the CAGR was 22%. However, the CAGR was only 4% from 2014 to FY17 and it was only 7% from FY18 to FY22 per a slide from the 2022 Investor Day:

North Face Revenue (2022 Investor Day)

The Billion Dollar Brand Club book by Lawrence Ingrassia talks about the fact that incumbent brands must fight harder than ever against new brands that can grow quickly online. The book mentioned that companies like Stitch Fix can create complications for existing brands:

And while the company initially sold apparel and accessories made by others, its data scientists in 2017 started designing “Stitch Fix exclusive brand” items by combining different style characteristics from popular clothing. In-house designers create these “Hybrid Designs” by taking ideas generated by artificial intelligence about the kinds of clothing its customers might like.

[ Billion Dollar Brand Club Kindle Location: 1,483]

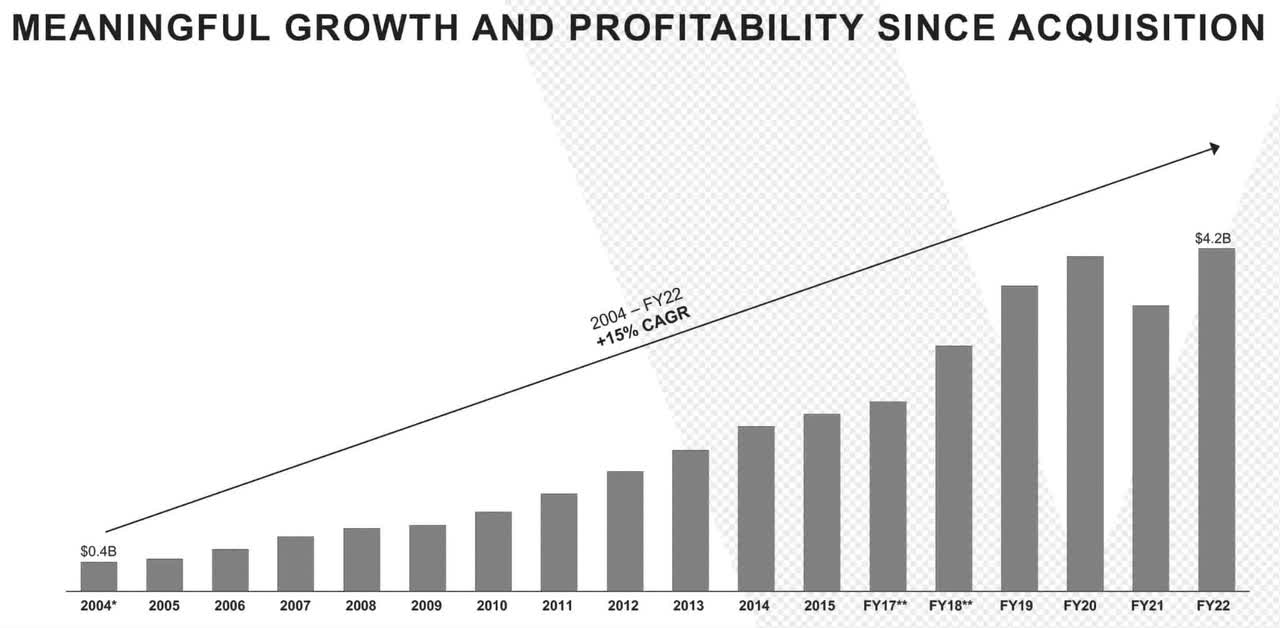

The nice revenue growth at Vans over the years has assuaged the frustrations felt from under-performing brands. However, even Vans has shown signs of slowing down recently:

Vans Revenue (2022 Investor Day)

Valuation

The latest 10-K for V.F. Corporation through April 2nd shows operating income of $1.6 billion.

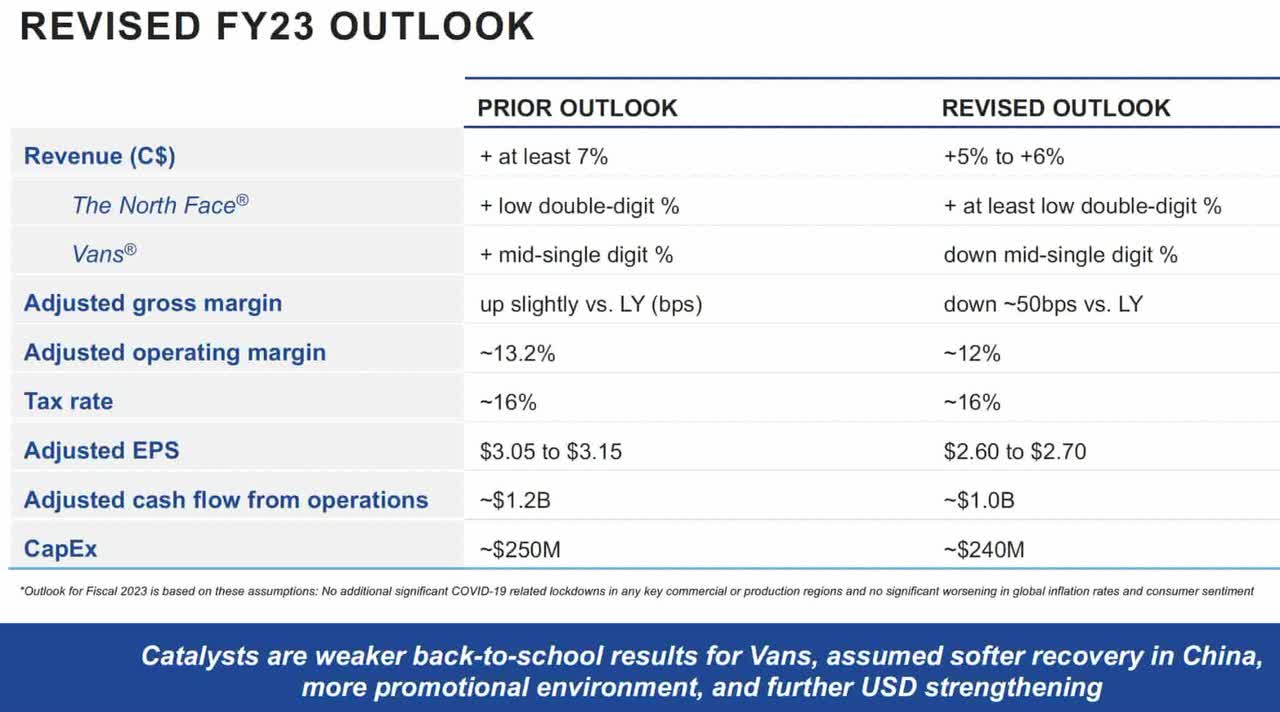

The adjusted FY23 outlook in the 2022 Investor Day presentation shows adjusted operating cash flow of about $1 billion and capex of nearly a quarter of a billion:

FY23 Outlook (2022 Investor Day)

Management defines free cash flow (“FCF”) as cash from operations less capital expenditures and software purchases. Management thinks they’ll generate cumulative FCF of $5.5 billion from FY23 to FY27. Given the guidance above, FY23 FCF should be about $0.75 billion which leaves about $4.75 billion for FY24 to FY27, meaning the average for each of those 4 years should be nearly $1.2 billion:

FY27 Targets (2022 Investor Day)

One of the slides from the 2022 Investor Day points out that Supreme is scarce:

Supreme Model (2022 Investor Day)

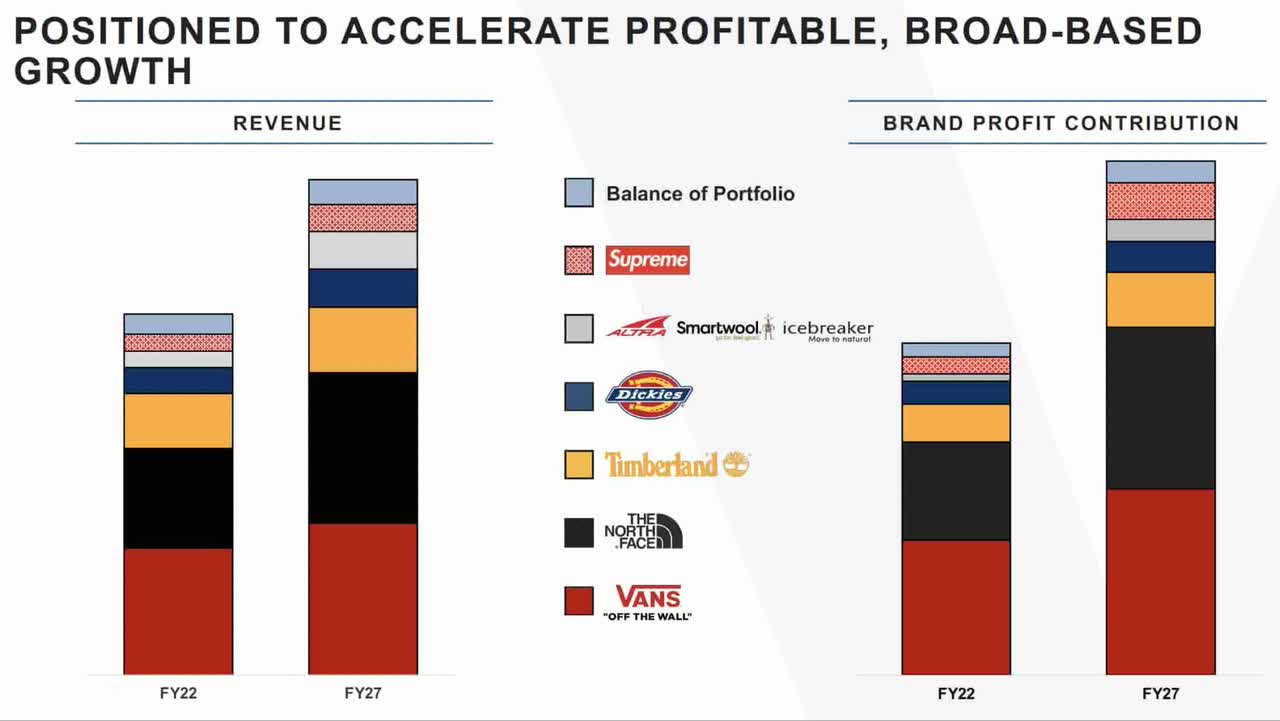

Supreme’s profit contribution is expected to increase prodigiously by FY27 and I don’t think this is consistent with the “scarce” slide we saw about them above. If Supreme becomes ubiquitous like Vans then the brand won’t be as prestigious as it is now:

Brand Profit Contribution (2022 Investor Day)

P/E ratios have to come down as interest rates keep rising. Revenue growth has been extremely limited over the last decade. The plan to rely heavily on Supreme for increased profits could diminish the brand. Putting these considerations together, I don’t think a high valuation multiple is warranted. I think it’s reasonable for the enterprise value (“EV”) to be about 10 to 11 times operating income or around $16 to $17.5 billion.

The July 2nd 10-Q shows 388,494,512 shares outstanding as of July 30th. Multiplying this by the September 29th share price of $29.91 gives us a market cap of $11.6 billion. The enterprise value is about $5.8 billion higher than market cap due to long-term debt of $4,468 million plus long-term leases of $1,006 plus short-term debt of $828 million less cash and equivalents of $528 million. Today’s enterprise value is near the upper end of my valuation range and I don’t think the stock is a screaming buy right now.

Be the first to comment