AsiaVision

Shares in Hims & Hers (NYSE:HIMS) have fallen more than 80%, from their all-time high in February 2021. HIMS was well overvalued at its all-time high, but that big drop was also driven by the highest inflation in decades and ever-rising interest rates. As a result, investors started selling all high-growth companies. But HIMS does not belong to a group of companies that tend not to live up to expectations these days. On the contrary, the management of the company is showing genuine progress, and HIMS continues to grow at a rapid rate. The company has really high margins and a very strong balance sheet. The valuation of the company right now is very cheap. I think Hims & Hers can bring significant returns to long-term investors.

What Is Hims & Hers Health?

Hims & Hers is a telehealth company that sells various drugs online that solve problems such as hair loss, depression, skin-related issues, and many more. The company was founded in November 2017, by current CEO Andrew Dudum. He owns 9.6% of the entire company, which is something I personally am very happy to see.

Now let’s focus on how Hims & Hers actually work. First, patients receive free online consultations from a licensed healthcare professional. Patients answer a few simple questions about their condition. Secondly, patients will receive the recommended treatment prescription, following consultation. After that, patients will choose to make a one-time purchase or subscription plan. Most customers choose the subscription plan as 90% of HIMS sales are recurring and this is another big advantage the company has.

And lastly, they will be able to receive ongoing care from licensed providers, either via video calls or messages. As you can see, this whole process is very simple, as opposed to the traditional medical system. Overall, over 7.2 million medical consultations have been carried out on Hims & Hers since its launch.

The company is very focused on ensuring that the customer has the most comfortable and best possible experience. This is also one of the reasons why I think HIMS is growing so fast.

The Market Opportunity Is Massive

Before we focus on the market opportunity that HIMS has, which is really huge, I would like to tell you why HIMS is so useful. The whole problem lies in the current medical system. It’s very outdated, uncomfortable, and most importantly, expensive.

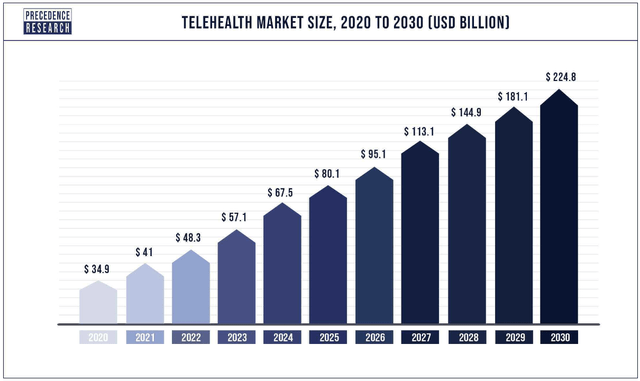

Hims & Hers solves all these problems. That’s probably why customers seem to love the company so much. It appears there is a really big opportunity for HIMS. The current telehealth market size by Precedence Research in 2022 is $48.3 billion.

Over the next 8 years, the telehealth market size is estimated to be over $224 billion. This is more than 4.6 times the expected market increase over the next 8 years. As you can see, the market opportunity for Hims & Hers is really huge.

Telehealth Market Size 2020 To 2030 (Precedence Research )

Financials

Now let’s look at the financials of the company.

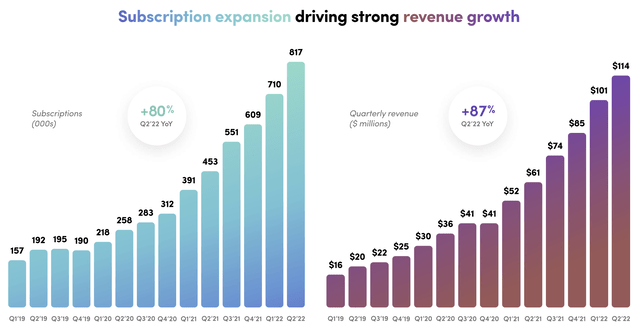

In the second quarter of this year, the company had sales of $113.56 million, an increase of 87.1% YoY. That’s really extremely fast revenue growth. Gross margins were 76.8% but the company lost $19.68 million in Net Income. Hims & Hers is currently loss-making, but it has a very strong balance sheet, so it’s financially perfectly fine in my opinion.

To grow this fast, a company usually has to spend not small amounts on marketing. In Q2 2022 it was specifically $60.49 million. That represents about 53% of sales this quarter. That’s a pretty intimidating number at first, but we have to recognize the fact that once HIMS gets its customers, most choose a subscription plan for the drugs it buys and that’s why customers can take away a given plan for many years to come, so I think HIMS spending this much on S&M will pay off in the long run.

As for the balance sheet, as I mentioned earlier, that is really very strong. The company had $194.98 million in cash and $379.97 in total assets in Q2 2022. HIMS currently has no long-term debt and has only $60.91 in total liabilities. That means if the company’s management wanted to, they could pay all the company’s liabilities tomorrow, and Hims & Hers would still have $134 million in cash. The company just has a very strong balance sheet. HIMS has $319 million in total equity, and with the current market capitalization of $905 million, P/B is only 2.8x, which is really low. The current ratio stands at 4.14x and overall HIMS appears financially very well off.

Hims & Hers And Growth

Now let’s look at how fast the company has grown in the past few years and what strategies it’s going to use for further growth. From FY 2018 to FY 2021, HIMS grew at a 117% CAGR. Growth is not expected to increase as quick in 2022, as expected sales growth this year is 76.5%. In Q2 2022 the company had 817k subscriptions, which is a growth of 80% YoY.

The company will use 4 major strategies to continue to grow rapidly. The first is to continue to attract more customers. The simplicity and financial availability of the company’s platform attract many customers, and HIMS wants to continue to improve its platform and thus attract other customers.

As a further strategy, there is growth within the existing customer base. HIMS has relatively young customers, most of the company’s customers are millennials. As young HIMS customers are currently gradually getting older, they will likely experience health problems as they age. HIMS intends to grow with customers and wants to gradually find solutions to these future problems, in the form of new medicines and treatments.

As another strategy for the company’s growth, there is category expansion into new chronic conditions. According to the Centers for Disease Control and Prevention, 6 out of 10 individuals in America currently suffer from a chronic condition a four out of every ten individuals suffer from two or more chronic conditions. This is for example sleep disorders, infertility, weight loss, diabetes, and more, which represent a great opportunity for the further growth of Hims & Hers.

As an additional opportunity for growth, there is an expansion into new geographical areas. Currently, Hims & Hers is only in the United States and the UK, where the platform was launched in 2021. The company plans to expand to countries such as China, India, Japan, Germany, and many others. Expanding into new geographical areas is, in my opinion, a huge opportunity for the company. Overall Hims & Hers has plenty of opportunities for further growth.

Subscriptions (Hims Q2 2022 Investor Presentation)

Moat

Let’s take a look at the competitive advantage of Hims & Hers. The company’s moat is that the entire healing process takes place from the comfort of the customer’s home. This saves the customer a lot of time. Overall, HIMS is a good deal more affordable than most doctors. The company also has a very high NPS of 65 compared to the average health provider who has an average NPS of 9. Hims & Hers also has 2 apps. First named “hims” is the #20 most popular app in the medical category on the App Store, where it has 4.8 out of 5 stars, and over 5,300 ratings there. The second named “hers” also has 4.8 out of 5 stars and over 540 ratings.

Overall, these apps are very popular with the company. In my opinion, the company also has network effects moat. HIMS has over 13 retail partners including Target (TGT), Revolve (RVLV), Walgreens (WBA), Amazon (AMZN), CVS (CVS), Walmart (WMT), and many more. That the customer sees Hims & Hers products in these large retailers only continues to increase brand awareness of Hims & Hers. The company also has over 7 healthcare partners. Personally, I think the moat of HIMS is currently strong.

Valuation

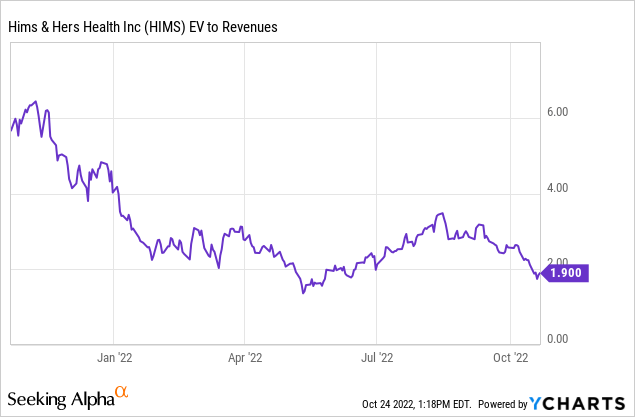

Now, I’d like to focus on the company’s current valuation, because I think it’s really cheap right now. At the company’s all-time high in February 2021, HIMS was trading at 36x EV/Revenues. A year and a half later, the company trades at a ridiculous EV/Revenues multiple of 1.9x. That’s a really big jump, in such a short space of time. Price/Gross Profit is currently only 3.2x.

Thanks to the expected rapid growth in sales, HIMS is currently trading at NTM EV/Revenues of 1.3x. That’s very cheap indeed. HIMS is one of the cheapest fast-growing companies I know right now. The company’s stock can multiply from its current price, and it still wouldn’t be very expensive in my opinion.

That’s what I’m so attracted to about HIMS. In 2025, the company is likely to become profitable as expected by analysts and this is likely to spark a lot of investors’ interest in the company, as a lot of them are not looking at non-profitable companies at all due to the current macroeconomic situation. Overall, in my opinion, HIMS valuation is very cheap right now.

Risks

Of course, Hims & Hers has several risks to consider before purchasing. The first is the company’s current record of unprofitability already mentioned. This always poses a risk, especially in the current macroeconomic situation. Thanks to the company’s strong balance sheet, however, I think this risk is greatly reduced.

Currently, the biggest risk for Hims & Hers is the competition. While HIMS does not currently have a competitor doing exactly what HIMS does, the company has many competitors in the telehealth industry. Personally, I think that the company is coping well with the competition so far, but it is necessary to monitor if this will continue to be the case in the future and that the management will continue to improve its platform.

These are the two main risks that Hims & Hers currently has and investors should be aware of them and closely monitor them in the future.

Conclusion

Hims & Hers is a high-growth company with a platform that customers seem to love. The valuation of HIMS is currently very cheap and the company has a very strong balance sheet. The management of the company has done a great job in the past few years, and the market opportunity the company has is huge, in my opinion.

Despite a few risks, I think that if management meets current expectations, HIMS can deliver solid returns to long-term investors, possibly even in the hundreds of percent.

Be the first to comment