SDI Productions/E+ via Getty Images

Introduction

V.F. Corp. (NYSE:VFC) sells well-known brands such as Vans, The North Face, Timberland, and Dickies. These four strong brands brought in about $2,613 million in the second quarter of FY23, about 85% of total sales. The North Face brand is growing strongly, while the popularity of Vans and Dickies declined sharply. The company has been plagued by high inflation, low consumer spending and Covid restrictions in China.

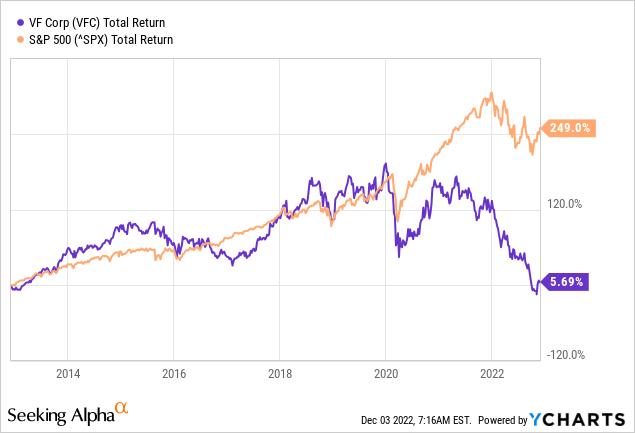

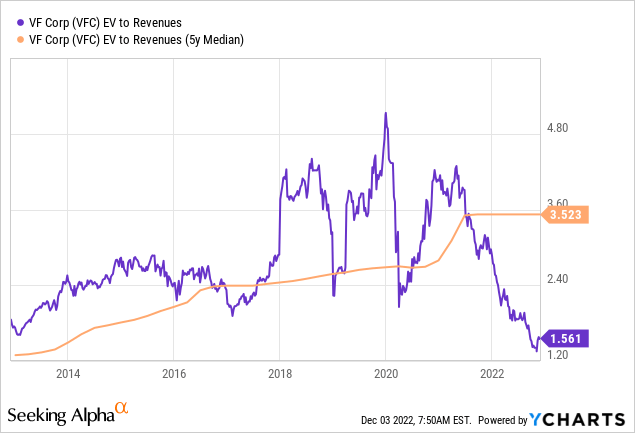

The stock price has fallen sharply from $90 in 2021 to $33 currently. The sharp decline looks attractive to buy the stock cheaply. Still, the outlook is not rosy (yet). Share valuation looks favorable as the EV to Sales Chart shows, but earnings estimates are still very negative.

Increased interest rates, low consumer confidence and the unfavorable yield spread make the stock not a buy for now.

Earnings Came In Weak

Results for the second quarter of fiscal 2023 were weak, with sales down 4%, with the four major brands down 5%. The North Face brand grew strongly with sales up 8% year over year, but Vans sales fell 13% year over year. Sales of both brands totaled $2B in the quarter (66% of total revenue). GAAP earnings per share came in at a loss of -$0.31 per share. Still, the company paid $388 million in dividends during the quarter.

The outlook for fiscal year 2023 is very bleak, as free cash flow is expected to be only $670 million. This outlook assumes that there are no Covid lockdowns and that global inflation and consumer confidence do not deteriorate significantly.

The downward earnings revision is mainly related to the negative effects of currency fluctuations, increased inventories and increased promotional activities in the market.

One bright spot is that raw material suppliers in China are currently operational. V.F. experienced product delays in the first quarter due to the 8-week lockdown in China. Production and assembly suppliers have returned to normal levels and V.F. is working strategically with those suppliers to minimize disruption.

At its peak, 7% of Chinese stores were closed during the quarter, but by the end of the quarter only 4% of stores were closed. Currently, Covid is heating up again and currently 7% of stores are closed again. APAC brought in $467 million in revenue in the quarter, about 15% of total revenue at risk due to Covid restrictions.

Operating margin will be further pressured by the Covid measure, high inflation, high costs and a stronger dollar. Retail is a volatile sector and profitability is highly dependent on consumer confidence. Consumer confidence falls to its lowest level since July. Since the yield spread is deep in the red, I do not expect strong earnings growth in the next 2-3 years as a recession is looming.

Dividend Growth Stalled

V.F. Corporation distributes a dividend of $2.04 per share, a nice dividend yield of about 6% currently. Dividend per share growth has slowed considerably over the past year, in 2021 the dividend per share increased only 2% compared to 15% for 2016. In their recent earnings report, V.F. raises the dividend per share by only 2% YoY. The company stopped growing.

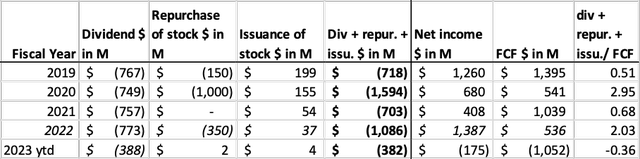

Even though cash flow before dividends has remained virtually unchanged in recent years, the increase in dividends per share comes mainly from share repurchases. In fiscal 2020, the company bought back its own shares for a high $1B; in fiscal 2022, only $350M. In both years, the share repurchases were so large compared to cash flows that they could not be covered by its free cash flow, so the company returned cash from its balance sheet to their shareholders.

VF cash flow highlights (SEC and author’s own calculation)

Looking ahead, I do not expect further share repurchases. Still, there is about $2.5B left under the current share repurchase authorization. Free cash flow is strongly negative at -$1B, and their net cash position of -$5.5B does not make it any better. The downward revision of free cash flow to $670 million for fiscal year 2023 makes it unlikely that V.F. will repurchase shares anytime soon. The dividend payout is already around $760M, so the company is paying additional cash from its balance sheet to its shareholders.

Valuation

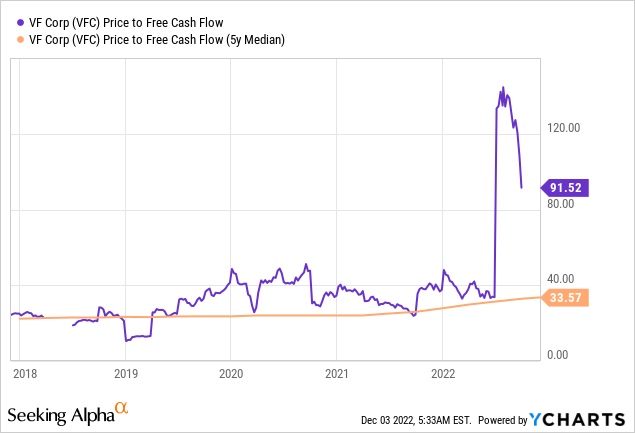

Valuation metrics peak due to low earnings and free cash flow. For a retail company, I prefer price to free cash flow ratio. The ratio of EV to free cash flow is currently heavily skewed for V.F. because of high net debt.

The price to free cash flow ratio of 91 is very high compared to an average value of 34. Looking ahead, V.F. expects free cash flow of $670 for fiscal 2023. With a market capitalization of $12,910M, the forward Price to Free Cash Flow ratio is 19, and the forward EV to free cash flow ratio concerns 28. These are very high ratios, a strong premium is paid for a retail company. The stock is overvalued for now and fiscal 2023.

Profit and free cash flow estimates do not look rosy, but with normal levels of inflation, positive consumer confidence and no Covid disruptions, the strong profit margin could return. This makes it interesting to also look at the enterprise value to sales chart.

In the chart we see that the enterprise value to sales ratio is historically low: 1.6. The five-year average is 3.5. Based on this chart, the stock seems undervalued. But as long as V.F. makes a loss, the enterprise value increases because the amount of cash on the balance sheet decreases. I also see no reason (yet) for positivity in the near future regarding their earnings estimates.

Final Remark

V.F. describes in its recent earnings report that it revised earnings downward for fiscal year 2023 due to the appreciation of the dollar, higher inventory levels and increased promotional activities.

Further appreciation of the dollar is unfavorable for V.F.’s earnings. Although the dollar has risen sharply due to higher interest rates, I expect the value of the dollar to rise further in fiscal year 2023 because the Fed has indicated it will raise interest rates to 5% to reduce the level of inflation. For 2024, I expect inflation to return to normal levels because oil prices are currently in a declining market.

V.F. earnings have been revised downward, free cash flow is deep in the red, consumer confidence is at its lowest level since July, the yield spread is negative and therefore I see no reason to give the stock a buy rating in the near future.

Be the first to comment