xeni4ka

The Argentinian Lithium Belt

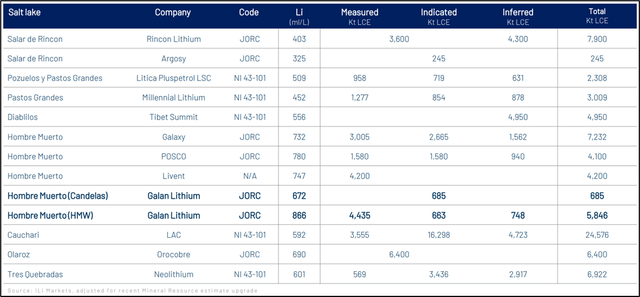

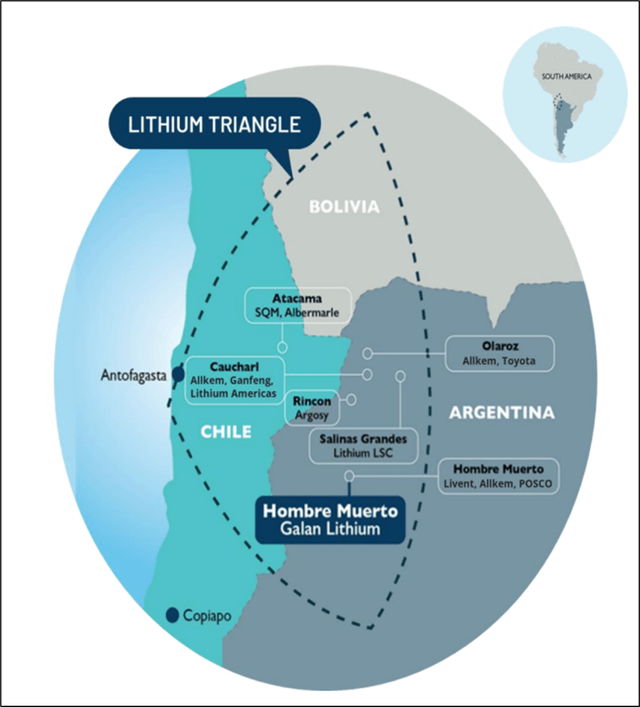

Argentina really is elephant country when it comes to world class battery mineral developments. The Latin American country showcases some of the most compelling projects, holding the world’s largest reserves, with roughly 40% coming from the Atacama and Hombre Muerto areas.

It’s an enviable prospect for Australian mining junior, Galan Lithium (OTCPK:GLNLF) – a world class location with high grade, low impurity brine assets, appealing project economics, and a buoyant commodities environment.

The line-up of lithium miners investing in the area is equally impressive, with the likes of Livent (LTHM), Alkem and Posco (PKX) all reaching deep into their pockets to swiftly sanction development projects. Indeed, the crucial battery ingredient has upside written all over it. That’s also why I remain bullish on Galan Lithium.

Galan Lithium retains some of the most attractive lithium assets in Argentina’s prolific lithium triangle.

Lithium, whose production is derived from brine and hard rock deposits, is a central component of the EV battery revolution. Hard rock operations characteristically command costs half the equivalent of higher value-add brine plays with margins, project economics and cost structures all being discretely different.

Yet despite higher cash outlays for brine deposits, it’s that part of the value chain posting higher margin premiums. The value differential is encouraging hard rock producers to invest more meaningfully in world class brine assets, spelling risk for the Hombre Muerto West development as it tries to front run neighboring projects.

Hard rock operations follow conventional mining processes with ore being extracted before concentration via crushing, and a series of transformation steps to produce a concentrate. Spodumene is the end-product in hard rock mining operations. It is marketed and distributed to lithium hydroxide or carbonate conversion plants which finalize conversion into lithium chemical products.

It’s these complex industrial carbonate conversion processes which capture the more lucrative part of the value chain, encouraging miners to invest in downstream conversion activities. This characteristic alone may provide indications of the future, with miners perchance being more concentrated and catching a more extensive part of the value chain.

Hombre Muerto West project lies slap-bang in the middle of Argentina’s prolific lithium triangle.

Company Introduction

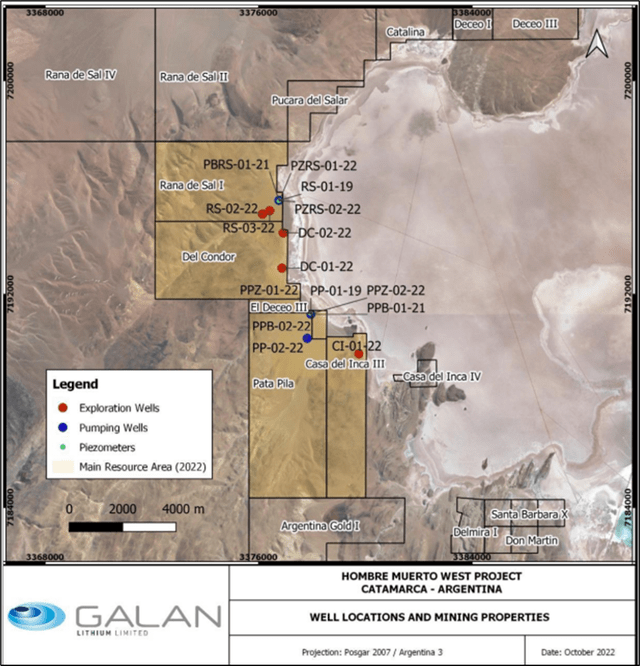

Galan Lithium is an Australian lithium mining junior with speculative but possibly extremely lucrative mineral developments. Its flagship Hombre Muerto West asset, made up of several concessions, covers approximately 11,600 hectares in Argentina’s Catamarca province.

Its Candelas play is a 24,072-hectare bolt-on located in the same province and providing significant upside development optionality. Back home in Australia, the company has interests in the Greenbushes South lithium development.

The company provides investors a speculative bet on continued lithium upside matched by the prospects of asset carve-outs, strategic divestments, or a wholesale marketing of the business as a viable acquisition.

It’s risky – with no revenues, big development costs, and an increasingly challenging macro-economic environment but some safeguards are provided such as commodity price buoyancy, a Fed likely to progressively ease-off monetary tightening, and a dollar that is likely to soften accordingly.

The management team is a mix of Argentinian and Australian mining veterans, with significant alignment with shareholder interests through the sizable equity holdings by insiders.

The A $469M lithium junior boasts strong alignment between directors & other equity holders with 17% of float being held by top management.

The company posts a market capitalization of A $469M and 3 interesting early-stage projects. It holds about A $53M in cash & marketable securities, with plant, property & equipment now valued at A $35M.

The company has little in the way of debt, but this is likely to change as project developments mature. To date, most of the cash has been raised by common stock issuances – in FY 2021, the organization issued stock to the value of A $18.2M. In FY 2022, this increased measurably to an additional A $53.9M. Difficult credit markets and a distortion between credit market yields and equity market risk premiums perhaps explains some of this.

In any case, given the difficult credit markets, it can be assumed the company will return to equity markets to raise additional cash during 2023 as its projects get off the ground. For the strategic investor interested in lithium exposure, these may be prudent entry points.

The Hombre Muerto Project

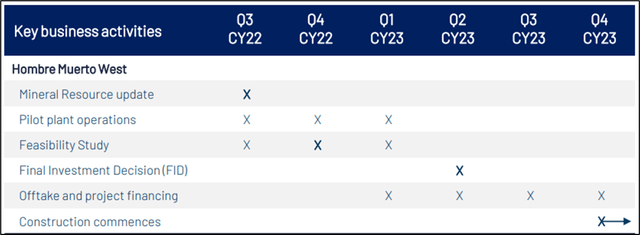

Any positioning in Galan Lithium is a wholesale bet on Hombre Muerto West getting off the ground. The high grade, low impurity brine deposit presently has a resource just South of 6Mt of lithium carbonate equivalent @ 866mg/ liter with a definitive feasibility study penned in for early 2023.

Current indications support an additional scaling up of original pilot pumping station to 4ktpa of lithium carbonate equivalent. The feasibility study completion, expected sometime early 2023, will be a make-or-break moment for the project. If the project goes ahead, first lithium concentrate is expected sometime in 2024, with lithium carbonate production occurring a year later.

Galan’s Hombre Muerto play has had mineral resource estimations boosted 2.5X to 5.8Mt contained lithium carbonate equivalent @ 866mg/l.

The project is anticipated to have a 40-year life of mine with steady state lithium carbonate production around 20kt per year. The project implies a long-term lithium carbonate price of US $18,594 per ton with expected cash costs of production around US $3,518.

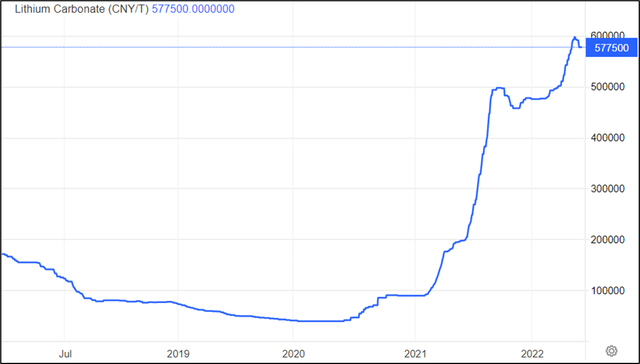

Lithium Carbonate prices per ton have literally mooned over the past couple of years with current rates closer to $82,000/t – far in excess of the baseline revenue assumptions ($18,594/t) for the HMW project.

Project Economics

The sticker price on the Hombre Muerto Project is US $439M with a post-tax net present value of US $1.3B, an IRR of 33% and a payback period in less than 3 years. Some project de-risking has already taken place with the HMW pilot plant operations already commencing.

To put some perspective on these project economics, I invite you to read my review of Liontown Resources (OTCPK:LINRF) Kathleen Valley project in Australia. Granted, there are huge differences in project profile with Kathleen Valley being a large-scale hard rock spodumene operation.

Yet given the fact that brine deposits generally command higher margins, it could well mean that Galan Lithium management has been extremely conservative, particularly with its NPV values.

Final investment decision for HMW should occur before mid-2023.

The Candelas Project, which complements the firm’s Latin American assets, posts smaller production (14kt/ year) and a shorter life of mine (25 years). The project may allow significant long-term cost synergies once Hombre Muerto West is up and running.

Valuation & Risk

The main risk regarding Galan Lithium presently is project financing. If HMW goes ahead, somewhere around $450M in capital costs will be required with investors possibly less inclined to pour money into risky speculative projects in faraway jurisdictions amidst increased global volatility.

Argentina comes heaped with country risk, with the country having a track record of inflationary busts, big sovereign leverage, and expropriation of private assets when it suited a political narrative.

Given most of Galan Lithium’s cash flows will come from Argentina, macro-aspects linked to debt ratings, inflationary exposure and country risk need to be gauged accordingly. Debt markets are presently difficult to navigate, with the most likely outcome being continued equity raises. This will be dilutive for any current equity holder.

Key Takeaways

Galan Lithium presents some compelling upside. It’s an Australian mining junior looking to develop prolific lithium brine deposits in one of the world’s biggest battery mineral producing areas. The company has cleverly positioned itself on the most lucrative side of the lithium value chain and taken on an experienced leadership team with strongly aligned interests through insider holdings.

The company has taken a very conservative approach to what lithium prices will be, providing some shielding to other project assumptions. With the area primed for additional investment upside, keep an eye on Galan Lithium, either as a standalone lithium miner, or a potential takeover target for a bigger firm looking for battery mineral exposure without having to do any of the preliminary ground work.

Be the first to comment