Vittorio Zunino Celotto

V.F. Corp. (NYSE:VFC) is a leading apparel company. It takes a conglomerate approach to the industry, owning more than a dozen different brands. In doing so, historically, it has been able to ride out industry volatility and economic down cycles due to the variety of different product styles, price points, and consumer demographics that it serves.

VF Corp also makes a habit of acquiring brands at relative low points, when they are either still small or undergoing current challenges. VF Corp builds brands up and then occasionally monetizes them through a sale or spin-off. This approach has been highly successful for shareholders. A $10,000 investment in 1992 would be worth $100,000 today, and that’s even after the stock’s brutal decline over the past year.

To give one example of VF’s capabilities, consider the North Face. VF acquired it in the year 2000, when it was generating $200 million per year in revenues. Now, the brand is set to generate $3.3 billion of revenues this year. That’s fifteen-fold top-line growth for North Face in 22 years under VF’s ownership.

The company is generous in returning cash to shareholders as well. The company announced a dividend increase on Wednesday, in conjunction with its Q3 earnings report. With this dividend increase, VF Corp has now increased its dividend for 50 consecutive years, making it America’s newest Dividend King. Over the past 10 years, VF has increased its dividend at a solid 11% annualized rate. While current dividend increases are much slower given the trying economic conditions, the hikes are continuing.

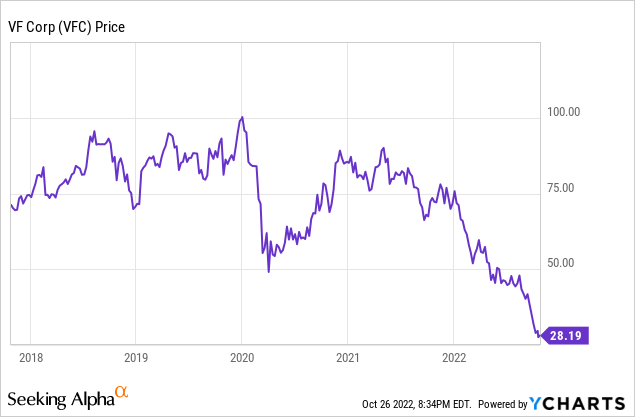

Despite VF’s tremendous operating and dividend record, investors currently are not extending the company any benefit of the doubt. Shares have plummeted this year, losing nearly two-thirds of their value in 2022 alone and almost 75% since the all-time high:

Even from the depths of the March 2020 lows, VF Corp is now down by almost another 50%.

Judging by this disastrous stock price chart, you’d be forgiven for thinking that VF Corp’s business must be in a state of abject ruin. And yet, when you look at the quarterly earnings report, things aren’t nearly as bad as the stock price would indicate.

Q2 Earnings Results

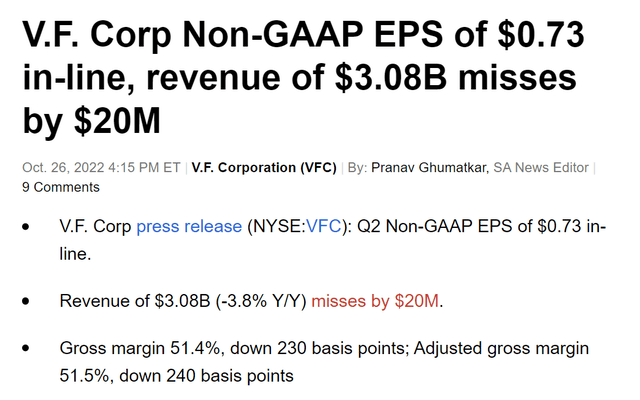

Here are the headline figures from VF’s latest earnings report (note that the company uses a non-standard reporting year, so figures are for Q2 of fiscal year 2023):

VF Earnings (Seeking Alpha)

These results simply aren’t what you’d expect to see for a company whose stock is down close to 70%. Earnings were right where analysts had expected. Revenues were off 4% year-over-year, missing analyst consensus fractionally. Of note, revenues were actually up in constant currency, the entirety of the revenue decline was due to the strong dollar rather than from an actual drop in units or prices.

Margins fell moderately, but this was nothing worse than you’d expect given the similar pressures we’ve seen across the apparel industry.

VF Corp has a significant business presence in China, where the pandemic and travel restrictions have limited economic activity much longer than in other markets. VF’s overall sales continue to remain soft due to weakness in the Chinese market.

It’s possible that this sales overhang will become a permanent slowdown; perhaps China’s economy and/or political situation has materially turned for the worse. If that is the case, however, other American consumer brands with a strong presence in China, such as Apple (AAPL) and Starbucks (SBUX), should probably be down a lot more as well. I don’t discount the possibility that VF Corp’s China business will face a permanent slowdown, but I don’t believe that alone justifies a $28 VFC stock price. Finally, on the China topic, VF sales were only down 10% there this quarter, which is still bad, but is much improved from the minus 30% performance a quarter ago.

What offset the weak performance out of China? Surprisingly enough, Europe came through in a big way. VF Corp reported double-digit sales growth in France, Spain, Italy, and Germany this quarter. That’s particularly impressive given how weak the European consumer and economic backdrop is perceived to be at the moment.

Turning from geography to brands, Vans continues to be VF’s weak point. Vans’ North American sales fell 11% on the quarter, and management is guiding to high single-digit declines for the full-year as it works through excess inventory and repositioning the brand with consumers.

On the flip side of the coin, Timberland grew by an acceptable 3% for the quarter, while North Face sales surged 14% higher. This speaks to VF’s diversified approach. It tends to always be able to succeed with some product line in some market, offsetting inevitable weakness in others.

For skeptics looking at the bad side of this Q2 report, there were several items of interest. VF Corp trimmed midpoint earnings guidance for 2023 to $2.45 from the prior $2.65. This isn’t a huge cut given the macroeconomic backdrop, but it still stings and justifies some share price weakness.

Digging deeper into the numbers, inventories were up 58% versus last year excluding some in-transit shipments that are part of a supply chain financing program. 58% inventory growth sounds really bad in isolation. However, VF Corp had too little inventory at times last year due to unusually strong consumer demand for certain product lines, so a big chunk of this build was replenishing stock rather than ending up with unwanted goods. That said, for some brands, particularly Vans, inventory is now starting to accumulate, and VF may have to use pricing to manage the situation.

To reiterate, this wasn’t a particularly good Q2 earnings report. On the other hand, going into this earnings report, VFC stock was down 62% year-to-date and 21% over the past month alone. It’d be fair to say expectations were very low, and these numbers certainly could have been worse.

The North Face results are legitimately impressive. Overall, maintaining essentially flat revenues while comparing against last year isn’t bad either. As long as consumer demand is still there for the products, I have confidence that management can work out profit margin and inventory issues in due time.

VFC Stock Verdict

People that bought VFC stock at $100 a few years ago had to underwrite a very optimistic scenario for the math on that purchase to make sense. I totally understand why shares aren’t anywhere near their prior highs. Even last year’s $80 price is rather optimistic, as that assumed a low-to-mid 20s P/E multiple on top of above-trend earnings. For a cyclical apparel company, it’s not surprising that the market is selling aggressively at the first sign of economic trouble.

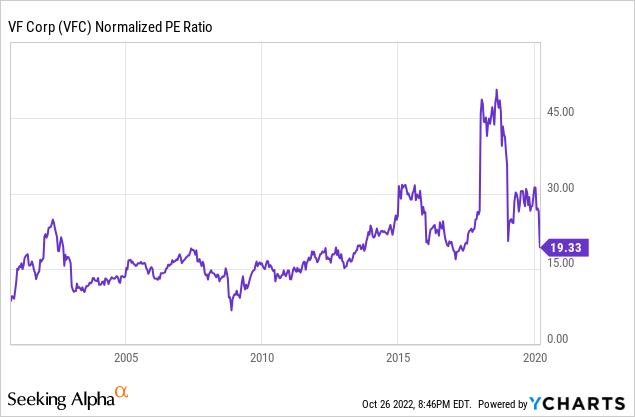

At this point, however, the pendulum has swung much too far in the other direction. At this point, we’re barely paying 11x trough earnings for VF Corp.

Between 2000 and 2020 (before the pandemic messed up the numbers) VF Corp traditionally traded around a 15x P/E multiple. The only time it got down to 11x earnings — where it is today — was during the financial crisis. And shares traded above 20x earnings on several occasions:

As the chart shows, historically, VF Corp traded closer to 15 times earnings than the 25 for most of its history; the elevated valuation we saw in the last few years probably isn’t sustainable.

Still, once VF Corp gets back to a more normalized profit margin, look for earnings per share in the neighborhood of $3.50 per year. That supports a $53 share price at a 15x P/E multiple, offering nearly a double versus today’s stock price. In the interim, we get to collect the 7% dividend yield.

Can things get worse from here before they get better? Sure. The Federal Reserve’s tightening campaign could lead to a significant recession before the inflation situation is fully resolved. On the plus side, perhaps we’re closer to turning the corner than people expect. In any case, consumer spending is still reasonably strong, and VF Corp’s revenues are holding in there.

Margin pressures have taken their toll, but that’s an industry-wide problem and hardly anything specific to VF’s operations. VF has raised its dividend 50 years in a row and just gave us another hike on Wednesday. Shareholders have been treated well, and the leadership team has done an amazing job managing the enterprise through previous economic volatility. Two VF Corp directors have purchased shares recently as well, suggesting that insiders see value in the company during this decline. Adding it all together, I believe reward considerably outweighs risk at this price point.

Be the first to comment