bluebay2014

Introduction

V.F. Corporation (NYSE:VFC) and Hanesbrands Inc. (NYSE:HBI) are two fashion and apparel companies that have been caught in a more or less perfect storm over the last three years. While VFC is known to most for its highly regarded Vans, The North Face, Timberland and Dickies brands, Hanesbrands is far less well known, in part because the company focuses on innerwear, but also activewear brands. Still, names like Champion, Hanes, Bonds (Australia), Bali and Wonderbra are quite popular, though less so than VFC’s.

My regular readers know that V.F. Corp. piqued my interest in early 2022 after the stock finally blew off some steam following its apparent overvaluation. Still, I concluded that VFC was not worth considering due to its problems – largely negated at the time – in the mid-$60s. In a later follow-up analysis, when the stock was in the mid-$40s, I was still put off by its effectively zero long-term free cash flow growth, improvable working capital management, and rising SG&A expenses. Finally, I commented on management’s Investor Day presentation held in September. While the presentation contained a lot of superficial language, I thought that the outlined plan was too optimistic to be a complete pipe dream.

If VFC is considered “deep value”, HBI could be seen as “deeper value” (or “deeper trouble”?), as is underscored by its current 10% higher dividend yield of 7.5% versus 6.8%. Same as VFC, HBI is plagued by operational problems, and its balance sheet is also of rather low quality. At the time of writing, both stocks are still down about 55% from their respective 52-week highs.

In this analysis, I will discuss the possibility of a dividend cut at both companies, in an effort to play “devil’s advocate” – a position that always helps me in establishing a solid long thesis. Finally, before putting money on the table, investors should ask themselves if they can live with the potential downside. It’s all too easy to get into a currently high-yielding stock with low valuation multiples. Also, recency bias is one we should remind ourselves of regularly. Given that both companies are significantly leveraged and thus entering a recession in pretty bad shape, the near-term outlook will be the primary focus of the analysis. Finally, I would like to touch on the key points to watch for in the upcoming earnings releases.

V.F Corp. – Weighing The Possibility Of Being A Yield Trap

VFC owns very strong and widely recognized fashion brands – no question about it. In fact, the company’s diversified portfolio is one reason why I would definitely prefer the stock over competitors with only one brand. The fashion industry is extremely dynamic, and bad management decisions can be fatal for companies with too concentrated a portfolio. In this respect, it is quite reassuring that revenues are rather balanced, but of course Vans remains the main revenue driver for VFC (Figure 1).

Figure 1: Brand segment revenues of V.F. Corp. [VFC] for fiscal 2022, ended March 2022 (own work, based on the company’s fiscal 2022 10-K)![Brand segment revenues of V.F. Corp. [VFC] for fiscal 2022, ended March 2022](https://static.seekingalpha.com/uploads/2023/1/28/49694823-1674935795096332.png)

VFC’s five-year average operating margin of 11% is improvable, as it has declined from around 14% since the early 2010s. Over the past decade, gross margin has increased from about 47% to nearly 55% in fiscal 2022, suggesting management is leveraging the right brands but not controlling SG&A costs well.

As a dividend investor, I keep a close eye on cash flow. Ultimately, dividends must be paid from operating cash flow, and borrowing can only be sustained for so long. So, it is disappointing to see that VFC has not been able to grow its free cash flow (FCF) over the past decade, as I discussed in my earlier articles. FCF has actually declined somewhat, but it is important to remember that VFC has been fighting windmills in recent years (lockdowns, supply chain disruptions, inflationary pressures). I have at least partially accounted for these issues by normalizing working capital movements in my free cash flow estimate, but the lack of growth is concerning. Calling VFC’s FCF stagnant or declining may be considered somewhat unfair given that VFC spun off its jeans business as Kontoor Brands (KTB) in a 1-for-7 transaction in 2019. At the same time, one could argue that as a holding company, acquiring promising assets and divesting underperforming ones is a key priority. In this context, the high price paid for Supreme is of course disappointing (price-to-sales ratio of 3.7), and therefore the recently announced impairment charge is not surprising. Putting normalized FCF in relation to sales – which I think is a fairly unbiased way of looking at the company’s long-term track record – the lackluster performance can be confirmed by the decline in free cash flow margin from about 8% to 9% to only about 6% to 7% in recent years. Of course, the strong dollar hasn’t helped either, given VFC’s exposure to international markets (about 48% of fiscal 2022 revenues).

VFC has operational problems, and they are nothing new (except to those who focus on adjusted per-share metrics). This is also reflected in the company’s balance sheet. Net debt, including operating leases, has doubled over the past decade, limiting the company’s ability to pursue acquisitions and also making it increasingly dependent on lenders. The pandemic has done anything but improve the situation, and management’s decision to acquire Supreme at the end of 2020 prompted rating agency Moody’s to put the A3 senior unsecured rating on review for downgrade. A few months later, the agency lowered VFC’s rating by one notch to Baa1 (BBB+ S&P equivalent) with a stable outlook. The stable outlook was revised to negative in October 2022, citing “weaker than expected near term operating performance expectations, increasingly challenging operating environment as well as its higher than expected debt levels”.

There’s a lot not to like about VFC, of course, but it’s fair to say that all of these problems are very visible today. I’d rather invest in a company when its problems are highly visible and reflected in its stock price than pay big bucks for a pig that’s only been made up in lipstick. At $30, VFC trades at a price-to-earnings (P/E) ratio of 13, according to FAST Graphs (Figure 2). Given the company’s current weak fundamentals and inherently high operating leverage, VFC might appear cheaper than it actually is. However, I think the valuation is acceptable given the growth potential of its key brands (Vans and The North Face), both in terms of current sales (which are still very low compared to competitors like Nike (NKE) or adidas (OTCQX:ADDYY)) and expected operational improvements (particularly digitalization efforts, as outlined in the presentation mentioned above). I believe that it all boils down to management’s ability to successfully navigate this challenging environment with a rather weak balance sheet.

Figure 2: FAST Graphs chart of V.F. Corp. stock [VFC] (obtained with permission from www.fastgraphs.com)![FAST Graphs chart of V.F. Corp. stock [VFC]](https://static.seekingalpha.com/uploads/2023/1/27/49694823-16748277838287227.png)

Obviously, a recession will further deteriorate VFC’s fundamentals, and Mr. Market seems to be telling us that this is the baseline expectation going forward. A dividend yield of nearly 7% suggests a fear of a cut. Granted, VFC is on its way to become a dividend king, but that should not be taken as a guarantee. Considering debt covenants (p. 33 f., fiscal 2022 10-K) and further deteriorating fundamentals in a recession, investors should strongly consider the risk of a dividend cut. After all, the company paid out $773 million in dividends to shareholders in fiscal 2022 – more than free cash flow, even after adjusting for the very unfavorable increase in inventories that year. Actual FCF was only about $540 million, even excluding stock-based compensation expense.

On the other hand, keep in mind that VFC’s weighted average interest rate (WAIR) is surprisingly low at just 2.3% (p. 31, fiscal 2023 10-Q2) thanks to refinancing transactions at very favorable rates in early 2020. The company also maintains a $2.25 billion revolving line of credit, of which approximately $1.7 billion was drawn down at the end of the second quarter (p. 39, fiscal 2023 10-Q2), in part due to the April 2022 redemption of the 2.05% 2022 Notes.

As a result, VFC’s maturity profile looks anything but reassuring (Figure 3). However, it should be noted that the revolving facility expires in 2026, but the amount currently outstanding is classified as a current liability – so things look worse than they are.

Figure 3: Debt maturity profile of V.F. Corp. [VFC], taking into account the repayment of the 2.05% 2022 notes, drawn revolver and long-term debt at the end of the second quarter of fiscal 2023 (own work, based on the company’s fiscal 2022 10-K and the fiscal 2023 10-Q2)![Debt maturity profile of V.F. Corp. [VFC], taking into account the repayment of the 2.05% 2022 notes, drawn revolver and long-term debt at the end of the second quarter of fiscal 2023](https://static.seekingalpha.com/uploads/2023/1/27/49694823-16748281705567725.png)

Nevertheless, the company will definitely need to refinance the 0.625% Euro Notes due 2023 (€850 million outstanding) and most certainly the 2.4% Notes due 2025 ($750 million outstanding). VFC’s debt servicing ability will weaken but remain manageable – assuming, of course, that interest rates do not rise much higher. A hypothetical refinancing of the 2023 and 2025 Notes at a 200 basis point premium – which does not seem unrealistic – would increase VFC’s WAIR by 54 basis points. A refinancing premium of 400 basis points, which I can imagine would occur if VFC’s debt were downgraded to junk status, would result in a WAIR of 3.4%. This implies an interest burden of about $200 million per year, and if VFC’s free cash flow does not improve significantly over the next few years, a dividend cut will be necessary. In this context, the need for a long-term refinancing of the 2.05% Notes 2022 at some point (which are currently refinanced on a short-term basis via the revolving line of credit) should also be considered. Selling underperforming business units would certainly be helpful (VFC has already considered the sale of Jansport), but would likely achieve below-average transaction values against the backdrop of a widely expected economic downturn.

Other events, such as the U.S. Tax Court ruling in favor of the IRS in January 2022, are also not helpful. In October 2022, VFC was required to pay nearly $900 million in taxes and interest disputed in connection with its 2011 acquisition of Timberland (p. 21 and p. 28, fiscal 2023 10-Q2). Because management believes that the opinion was in error, it has recorded a tax receivable.

Overall, a dividend cut of about 50% would increase the company’s headroom enormously. In this way, and assuming that $750 million in annual FCF is a realistic near-term expectation, the company would have about $300 million to $350 million left over and could pay down some of the $1.7 billion currently being drawn on the revolver, thereby potentially avoiding refinancing the 2.05% 2022 Notes. This would certainly bolster the financial flexibility the company would definitely need in a recession. Of course, the announcement of a 2% dividend increase in October 2022 can be interpreted as a sign of management’s confidence in the business, but at the same time, the effective immediate retirement of CEO Steven Rendle in December leaves a bad aftertaste (p. 1, 8-K of Dec. 2, 2022).

VFC will report third quarter fiscal 2023 results on Feb. 7 after the bell. I am not interested in investing in the stock at this time, but if I were, I would try to answer the following questions or look for the following information after the conference call:

- How are the segments developing operationally, are there signs of a return to growth? I would watch for sandbagging expressions that might indicate a slower return to growth than previously anticipated.

- Has a permanent CEO been announced? If so, what is his/her background?

- Has management given an update on the situation in China, one of the key growth drivers?

- Is there any suspicious wording in the conference call regarding the dividend?

- Are there any signs of suspicious wording in the conference call regarding the dividend?

- When comparing the Q3 cash flow statement to the Q2 statement for the first six months of fiscal 2023, is there evidence of a mean reversion in working capital? Did markdowns play a role?

- Has the free cash flow guidance changed from the Investor Day presentation?

- Is there any news regarding the tax issue? After all, the $900 million tax receivable could be a significant tailwind.

- Is there any news regarding the previously considered sale of the Jansport brand, which is reportedly worth around $500 million (likely pre-tax)?

- I would also pay close attention to actions and/or statements from rating agencies like Moody’s or S&P after the conference call.

- I would not over-interpret improved sales guidance given the somewhat weaker dollar. In terms of full-year results to be announced later this year, I would also review the development of key foreign currencies to get an idea of any headwinds or tailwinds.

Hanesbrands Inc. – Deeper Value Or Deeper Trouble?

Hanesbrands’ share price formed a double top in 2015 and has known only one direction since then – down. Since the all-time high, investors have seen their invested capital shrink by 75%, not even taking into account the significant opportunity cost. Hanesbrands’ struggle has been dragging on for some time now, and it is easy to understand how the pandemic and associated headwinds have only exacerbated an already difficult operating backdrop.

The company is the market leader in basic innerwear in several countries – underwear brands are quite durable due to their low cost in dollars terms and the trust and comfort undeniably associated with top brands like those own by Hanesbrands. Figure 4 shows brand segment sales for 2021 as reported in the 10-K, and shows that the company is far less exposed to international markets than VFC.

Figure 4: 2021 brand segment revenues of Hanesbrands Inc. [HBI] (own work, based on the company’s 2021 10-K)![2021 brand segment revenues of Hanesbrands Inc. [HBI]](https://static.seekingalpha.com/uploads/2023/1/28/49694823-167493583151155.png)

HBI’s five-year average operating margin of 10% seems very positive to me, especially compared to VFC and considering less popular brands. Moreover, HBI’s operating margin has remained largely stable over the past decade, with the exception of 2020, of course (e.g., 11% in 2013 and 2014, 10% in 2015). HBI’s return on invested capital (ROIC) is also generally above the weighted average cost of capital, which is definitely not a given in this sector. Its free cash flow margin of around 11% in the earlier 2010s declined to around 8% in later years, and this is in part attributable to working capital management, e.g., a rather weak accounts receivable management as indicated by increasing days sales outstanding. In contrast to many larger companies, HBI’s days payables outstanding have remained fairly stable over the last ten years, which also indicates room for improvement. The fact that inventory days have not increased over the past decade suggests that the acquired businesses are well integrated and that inventories at HBI are soundly managed – again, not a given in this sector.

While the ten-year compound annual sales growth rate (CAGR) is quite solid at 3.2%, sales declined 4% on a three-year comparable basis. Clearly, supply chain issues and inflationary pressures are also taking their toll. Nevertheless, I believe Hanesbrands is quite well positioned in this context, as it operates its own production facilities and has strong leverage with dedicated manufacturers. In 2021, management announced a plan to rejuvenate Champion, bolster operating profitability, and return to growth in the innerwear segment. Like VFC, Hanesbrands wants to improve its digital marketing capabilities and customer-centric analytics.

If it were just these headwinds, I think Hanesbrands would be a clear investment case, but admittedly the valuation would be nowhere where it is today (Figure 5). At a price-to-earnings ratio of about 8, the stock looks like a bargain. HBI’s long-term normalized free cash flow is quite volatile (Figure 6), and the company will actually burn cash in 2022, but is expected to return to positive free cash flow in 2023 as it frees up working capital.

Figure 5: FAST Graphs chart of Hanesbrands stock [HBI] (obtained with permission from www.fastgraphs.com) Figure 6: Hanesbrands’ [HBI] normalized free cash flow (own work, based on the company’s 2010 to 2021 10-Ks, the 2022 10-Q3 and my estimate for 2022)![FAST Graphs chart of Hanesbrands stock [HBI]](https://static.seekingalpha.com/uploads/2023/1/27/49694823-16748279263255746.png)

![Hanesbrands' [HBI] normalized free cash flow](https://static.seekingalpha.com/uploads/2023/1/28/49694823-16749338015996609.png)

All this sounds fixable, but investors are obviously unsettled by the current negative free cash flow in light of the high debt load. The company acquired Knights in 2015, Champion Europe and Hanes Australasia in 2016, Alternative Apparel in 2017, and Bras N Things in 2018, which explains the increase in debt over the years (Figure 7).

Figure 7: Historical development of net debt at Hanesbrands’ [HBI] (own work, based on the company’s 2012 to 2021 10-Ks and the 2022 10-Q3)![Historical development of net debt at Hanesbrands' [HBI]](https://static.seekingalpha.com/uploads/2023/1/27/49694823-1674827975719284.png)

However, it should also be taken into account that management made relatively large share buybacks in the same years it acquired the above-mentioned companies (Figure 8), which further weighed on the balance sheet. Granted, the buybacks in 2020 were opportunistic, but I consider them too risky in light of the still significant debt burden (compare Figure 7).

Figure 8: Share repurchases at Hanesbrands’ [HBI], compared to the share price of HBI (own work, based on the company’s 2012 to 2021 10-Ks and the daily closing price of HBI)![Share repurchases at Hanesbrands' [HBI], compared to the share price of HBI](https://static.seekingalpha.com/uploads/2023/1/27/49694823-16748280200548158.png)

I believe that the $585 million inventory write-down charge taken in 2020 (p. F-9, 2021 10-K) is a very good example of the highly dynamic nature of the fashion and apparel business, which underscores the importance of a solid balance sheet. In this context, small brick & mortar retailer Cato Corp. (CATO), with a market cap of $200 million, serves as a positive example. CEO John Cato, who owns nearly 50% of the combined voting rights, ensures that the company operates on the back of a very solid balance sheet that allows it to weather difficult situations very well. At the end of the third quarter of 2022, the company reported cash and short-term investments of $146 million and no debt. I followed Cato throughout 2020 and found it remarkable that a company of this size made it through the year unscathed and was even able to reinstate its dividend in May 2021. Even more, management was able to act opportunistically, buying back shares for $20 million and $22 million in 2020 and 2021, respectively.

Turning back to Hanesbrands, at the end of Q3 2022, the company reported it had $13.5 million of borrowing capacity left under its accounts receivable securitization (ARS) borrowing facility, and $36.1 million from international credit facilities. The company was in compliance with all debt covenants (see p. 15 f. 2022 10-Q3) and declared a regular quarterly dividend in November, which was paid in December. However, it should not be forgotten that the company recently amended its credit agreement to allow more flexibility (see Q3 2022 earnings call transcript).

The elephant in the room is the $1.4 billion in debt due in 2024 (4.625% and 3.5% Notes due in May and June, respectively). Using the data published in the 2022 10-Q3 (illustrated in Figure 9), Hanesbrands’ current weighted average interest rate (WAIR) was 4.4% at the end of Q3. Refinancing the debt at a 200 basis point premium would result in a WAIR of 5.1%, and a 400 basis point premium would result in a WAIR of 5.8%.

Figure 9: Debt maturity profile of Hanesbrands Inc. [HBI], taking into account the term loan, accounts receivable facility and revolving loan facility as of Q3 2022 (own work, based on the company’s 2022 10-Q3)![Debt maturity profile of Hanesbrands Inc. [HBI], taking into account the term loan, accounts receivable facility and revolving loan facility as of Q3 2022](https://static.seekingalpha.com/uploads/2023/1/27/49694823-16748280583880022.png)

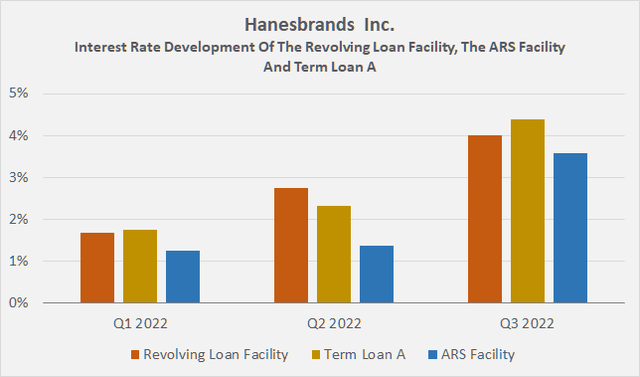

At the same time, it is important to remember that Hanesbrands’ revolving loan facility ($430 million at the end of Q3 2022, expires 2026), the term loan ($981 million) and the ARS facility ($212 million) will most likely continue to weigh on the company’s headroom (Figure 10). All of this likely contributed to the decision to change Hanesbrands’ outlook to negative (from previously Ba2 with a stable outlook) and downgrade the short-term rating to SGL-3 from SGL (Speculative Grade Liquidity).

Figure 10: Interest rate development of the revolving loan facility, the ARS facility and term loan A, as of Q3 2022 (own work, based on the company’s 2022 10-Q1, 10-Q2, and 10-Q3)

Taken together, based on current debt levels, Hanesbrands needs to spend about $170 million per year on interest expense, which increases to $198 million in the 200 basis point stress scenario and $226 million in the 400 basis point stress scenario. While these are substantial numbers, I don’t think Hanesbrands’ situation is overly desperate, given that the baseline free cash flow before interest is about $650 million to $700 million, which of course assumes a significant decline in working capital in 2023.

Obviously, Hanesbrands’ management has played pretty risky in recent years, and if I were a long-term shareholder, I would have much preferred to see the company forgo share buybacks between 2015 and 2017 and instead spend the $1.1 billion on strengthening the balance sheet. It is disappointing to see the management of a company with over 100 years of history focus on short-term results. Nevertheless, I don’t believe the company is in deep trouble, even with debt refinancing at very unfavorable interest rates. Assuming that management is able to free up significant working capital in 2023 and that the “Full Potential” plan starts to take effect soon, the company should even be able to continue paying the dividend. Of course, this assumes that the widely expected recession will be rather moderate.

Hanesbrands will announce its annual results on February 2, 2023 before the stock market opens. If I were interested in investing in Hanesbrands stock, I would try to answer the following questions after the earnings call:

- How are the segments performing operationally? Is there a return to growth in sight? Are there tangible signs that management’s plan is beginning to take hold?

- How severe is the anticipated decline in gross margin, and are there any concrete signs that the pressure on gross margin will ease in 2023? However, I would keep the previous earnings call in mind, as management has already announced that the impact will only be visible in the income statement with a delay of two to three quarters.

- How did the interest rates on the revolving loan facility, the term loan, and the ARS facility develop in the fourth quarter of 2022 and did management provide an outlook in this context?

- Are there specific plans for the refinancing of the 2024 Notes?

- Is there any suspicious wording in the conference call regarding the dividend?

- When comparing the full year cash flow statement to the Q3 statement for the first nine months of 2022, does it show a mean reversion in working capital, or at least a trend? Did markdowns play a role?

- I would also pay close attention to the actions and/or statements of rating agencies such as Moody’s or S&P after the conference call.

Thank you very much for taking the time to read my article. How did you like it, my style of presentation, the level of detail? If there is anything you’d like me to improve or expand upon in future articles, do let me know in the comments section below.

Be the first to comment