Justin Sullivan/Getty Images News

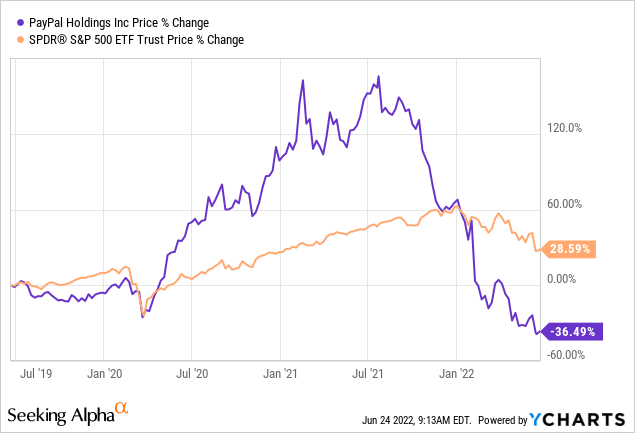

We analyzed PayPal (NASDAQ:NASDAQ:PYPL) in March and predicted a downturn in its stock price due to congestion in the digital payments space and PayPal’s sensitivity to contractionary economic policies. After a more than a 30% drawdown, we’d like to re-affirm our strong sell rating on PayPal stock as we don’t believe the asset’s risk/return profile is aligned to prosper. Furthermore, we’ve discovered a few idiosyncrasies that we’re concerned about.

Operational Review

Transactional Update

During this year’s first financial quarter, PayPal’s active accounts grew by 9%, its payment transactions per active account grew by 11% and its total payment volume increased by 13%.

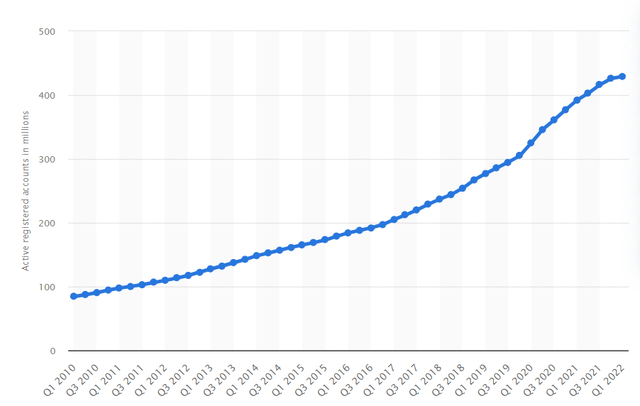

Although the firm’s still experiencing growth, it’s slowed down considerably, as illustrated by its account growth chart below. Investors need to remember that a stock’s price growth is essentially a function of the growth in its key influencing variables. Thus, the stock’s price could decline if growth rates continue to soften.

Furthermore, much of PayPal’s business derives from its merchants. Many small- to medium-sized merchants might struggle if we’re to enter a challenging economic period. To elaborate, we see companies with market strongholds outprice the smaller players whenever the economy contracts. Thus, any cyclical economic downturn could result in a decline in merchant-based income.

Buy Now Pay Later

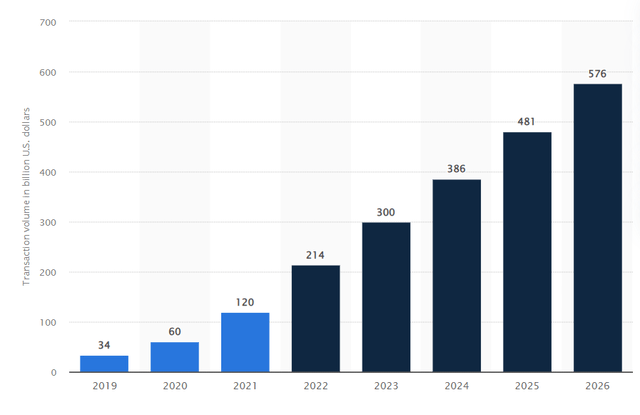

The chart below conveys the market size for buy now pay later, otherwise known as BNPL. The market’s set to grow at an assumed compound annual growth rate worth 22.4% until 2031, which excites many investors. However, we need to consider cyclicality of the debt market.

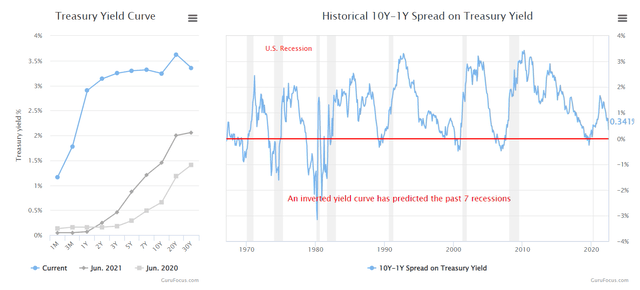

The chart that I added after the BNPL histogram is the U.S. treasury yield curve, which is the implied interest rates for the United States. I believe that as rates move higher, we’ll see a decline in high-yielding BNPL activity and the focus will shift towards the investment-grade side of the debt market (lower yield). I say this because spending power will likely continue to wane with resilient push inflation, and growing labor market challenges will rise as the economy contracts under higher interest rates (and a possible recession). In a nutshell, I’m not saying that BNPL isn’t a lucrative concept but rather that it could be faced with a bump in the road.

PayPal’s BNPL segment attracts 22 million of its users that get provided with financing between APRs of 0-29.99%. I don’t think it will be beneficial to the company until the economy stabilizes again.

Company Growth Rates

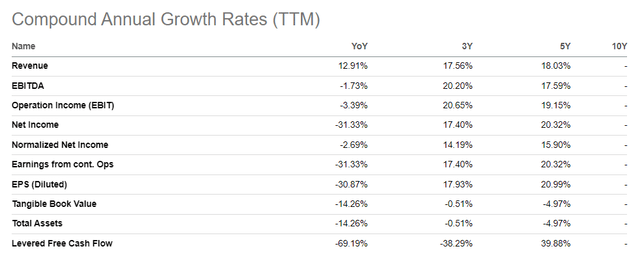

Retrospective growth rates imply that PayPal’s intrinsic value is slowing down significantly. During the past year, the firm hasn’t only struggled with margin compression, but its top-line growth has started growing less rapidly. We believe that it could be due to matters discussed in our previous report, which included industry lifespans and competitiveness. Although I believe we’ll see PayPal’s margins compress, it’s unlikely that it will scale its revenue back to the growth we saw in 2020 and 2021.

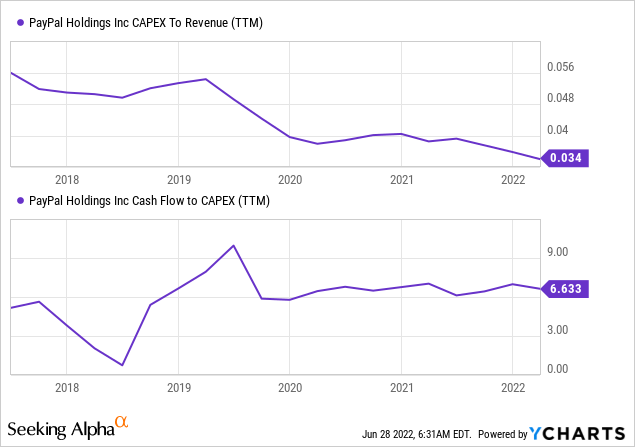

I studied the firm’s capital expenditure metrics to gather a parsimonious overview of PayPal’s future growth prospects. The key metrics imply that PayPal’s growth could stagnate as its CapEx has receded by 0.34% in the past year. Moreover, the firm’s cash flows are depreciating relative to the already negative growth in CapEx, meaning that we likely won’t see PayPal scale its current growth initiatives anytime soon.

Quantitative Risk Analysis

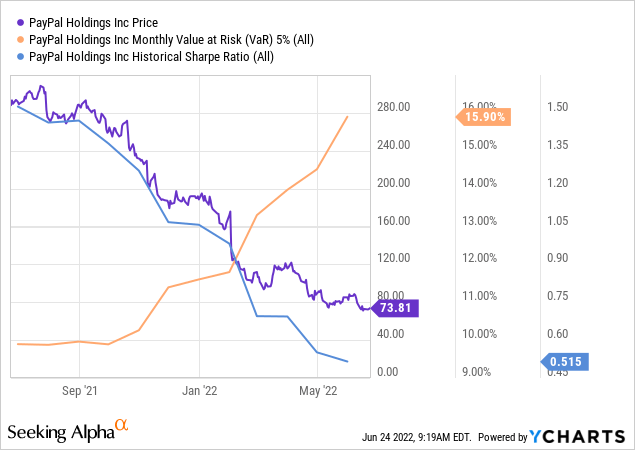

PayPal stock doesn’t stack up well from a quantitative risk vantage point. Firstly, let’s look at its Sharpe Ratio. A stock with a Sharpe Ratio below 1.00, is usually considered poor value for money as its excess returns versus total market risk isn’t well aligned.

Furthermore, the stock has a 5% monthly Value at Risk of 15.90%, implying that we can only have 95% confidence that its price will not collapse by more than 15.90% in its worst month. Thus, considering we’re in a bear market, it’s not a risk worth taking.

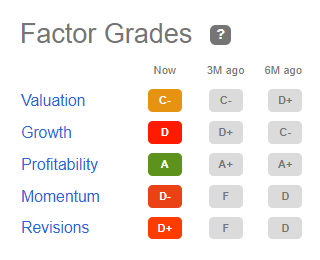

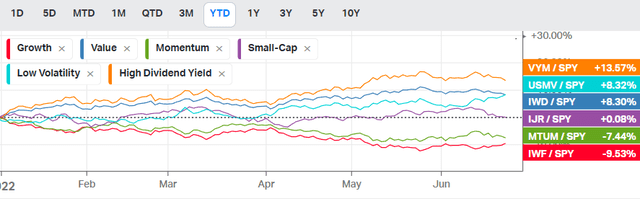

A critical matter to consider when it comes to the financial markets is factor performance. Factor performance refers to categorial stock performance relative to the macroeconomic climate. The concept was established by Eugene Fama and Kenneth French, which others later developed. In essence, factors can be divided into value, growth, quality (or profitability), momentum, and earnings (or revisions).

For instance, PayPal can be considered a quality stock as it exhibits an “A level” profitability factor on Seeking Alpha. However, PayPal isn’t a growth or a value stock as it has C and D grades for the respective factors.

Seeking Alpha

The chart below shows the year-to-date performance of different factor segmented stocks relative to the S&P 500. It’s clear that investors have either bought into dividend stocks to fight inflation or opted for value stocks to “buy the dip”. In addition, investors have opted for low-volatility stocks to protect themselves against the downside. Nevertheless, PayPal stock doesn’t tick any of those boxes and isn’t conducive to the current market environment.

An Argument For Upside

There could be an argument that PayPal has reached its temporary bottom. For instance, the stock’s recently been added to the Russell 1000 Value index. In addition, PayPal’s trading at a normalized price to cash flow and price to sales discounts worth 64.89% and 60.60%, respectively, adding substance to an argument that the stock could be oversold.

Furthermore, PayPal owns subsidiaries with promising growth prospects. These subsidiaries integrate vertically and horizontally into PayPal’s business model, allowing for critical synergies. I personally like Honey Science Corp., which is a discount-seeking e-commerce tool.

Concluding Thoughts

Although an argument can be made that PayPal is oversold, we don’t think the market’s supportive of a recovery in PayPal’s stock price. The economy will likely slow the company’s transactional volume and BNPL segment. Furthermore, PayPal’s growth rates have softened significantly, and an analysis of the stock’s quantitative risk suggests that more downside is ahead.

Be the first to comment